Amsterdam Exchange Down 2% Following Latest Trump Tariff Announcement

Table of Contents

Immediate Impact on Key Amsterdam Exchange Sectors

The immediate impact of the tariff announcement was acutely felt across various sectors of the Amsterdam Exchange. The uncertainty surrounding international trade triggered a widespread sell-off, impacting investor confidence and market stability.

Technology Sector Decline

The technology sector, a cornerstone of the Amsterdam Exchange, suffered the most significant decline. Increased uncertainty surrounding international trade led to a sell-off in tech stocks. Companies heavily reliant on global supply chains were particularly vulnerable.

- Increased uncertainty: The unpredictable nature of global trade policies created a climate of fear among investors.

- Supply chain disruptions: Companies facing potential delays or increased costs due to tariffs experienced immediate pressure.

- Examples: Consider the impact on companies like ASML Holding (ASML.AS), a major semiconductor equipment manufacturer, and Adyen (ADYEN.AS), a global payment processor, both heavily reliant on global trade. These companies saw significant share price drops following the announcement.

Financial Services Sector Response

The financial services sector also mirrored broader market anxieties, experiencing a downturn. Increased risk aversion among investors significantly impacted investment banking activities and trading volumes.

- Risk aversion: Investors shifted towards safer assets, reducing exposure to riskier investments.

- Reduced trading volumes: The uncertainty led to decreased activity in the financial markets.

- Examples: Institutions like ING Groep (INGA.AS) and ABN AMRO (ABN.AS) witnessed a decrease in trading activity and a subsequent dip in their share prices. The impact on their lending and investment portfolios requires close monitoring.

Energy Sector Volatility

The energy sector exhibited considerable volatility, influenced by both the tariff announcements and broader geopolitical factors. Uncertainty surrounding future energy prices contributed significantly to market fluctuations.

- Price volatility: Fluctuations in oil and gas prices directly impacted the energy sector's performance on the Amsterdam Exchange.

- Geopolitical factors: International relations and energy supply chains contributed to the overall uncertainty.

- Examples: Companies like Shell (RDS.A, RDS.B – though primarily listed elsewhere, their performance on the Amsterdam exchange is relevant) experienced volatility reflecting the global nature of the energy market and its sensitivity to trade disputes.

Investor Sentiment and Market Reaction

Following the tariff announcement, investor confidence plummeted, driving a significant market reaction. Increased market volatility and uncertainty led to risk-averse trading strategies.

- Plummeting confidence: The unexpected nature of the tariff announcement and its potential long-term impact significantly eroded investor confidence.

- Risk-averse trading: Investors moved towards lower-risk assets, contributing to the sell-off in more volatile sectors.

- Market indices: The AEX index, the benchmark index for the Amsterdam Exchange, reflected the overall downturn, providing a clear indicator of market sentiment.

- Expert opinions: Analysts at leading financial institutions, such as Rabobank and ING Economics, offered insights into the situation, predicting varying degrees of short-term and long-term impact on the Amsterdam Exchange.

Potential Long-Term Implications for the Amsterdam Exchange

The long-term effects of these tariffs on the Amsterdam Exchange remain uncertain, with several potential scenarios playing out.

- Continued decline: Prolonged trade tensions could lead to further declines in the market.

- Stabilization: The market could stabilize if trade tensions ease and investor confidence gradually returns.

- Potential recovery: A swift resolution to trade disputes or government intervention could lead to a market rebound.

- Government response: The Dutch government's economic policies and any potential EU-level intervention will significantly influence the market's trajectory. Fiscal stimulus or targeted support for affected industries could play a role in recovery.

Comparison with Other European Exchanges

Comparing the Amsterdam Exchange's performance to other major European exchanges, such as the London Stock Exchange, Frankfurt Stock Exchange, and Euronext Paris, provides valuable context.

- Relative performance: Analyzing the comparative performance against these other exchanges helps determine whether the Amsterdam Exchange was disproportionately affected or if the decline reflected broader European market trends.

- Divergent factors: Identifying factors unique to the Amsterdam Exchange, such as its sector composition or investor base, can help explain any discrepancies in market responses across these exchanges.

Conclusion

The 2% drop in the Amsterdam Exchange following President Trump's tariff announcement highlights the vulnerability of even established markets to global trade policies. The immediate consequences were widespread, impacting key sectors and triggering investor uncertainty. While the long-term implications remain unclear, close monitoring of global economic indicators and government responses is crucial. Understanding the intricacies of the Amsterdam Exchange and its sensitivity to international trade is vital for informed investment decisions. Stay informed on future developments and monitor the Amsterdam Exchange closely to make sound investment decisions in these volatile times.

Featured Posts

-

Analisi Dell Effetto Dei Dazi Di Trump 20 Sul Settore Moda Nike Lululemon E Altri

May 24, 2025

Analisi Dell Effetto Dei Dazi Di Trump 20 Sul Settore Moda Nike Lululemon E Altri

May 24, 2025 -

Nemecke Spolocnosti A Vlna Prepustania Analyza Situacie

May 24, 2025

Nemecke Spolocnosti A Vlna Prepustania Analyza Situacie

May 24, 2025 -

Annie Kilner Spotted Running Errands After Kyle Walkers Evening With Two Women

May 24, 2025

Annie Kilner Spotted Running Errands After Kyle Walkers Evening With Two Women

May 24, 2025 -

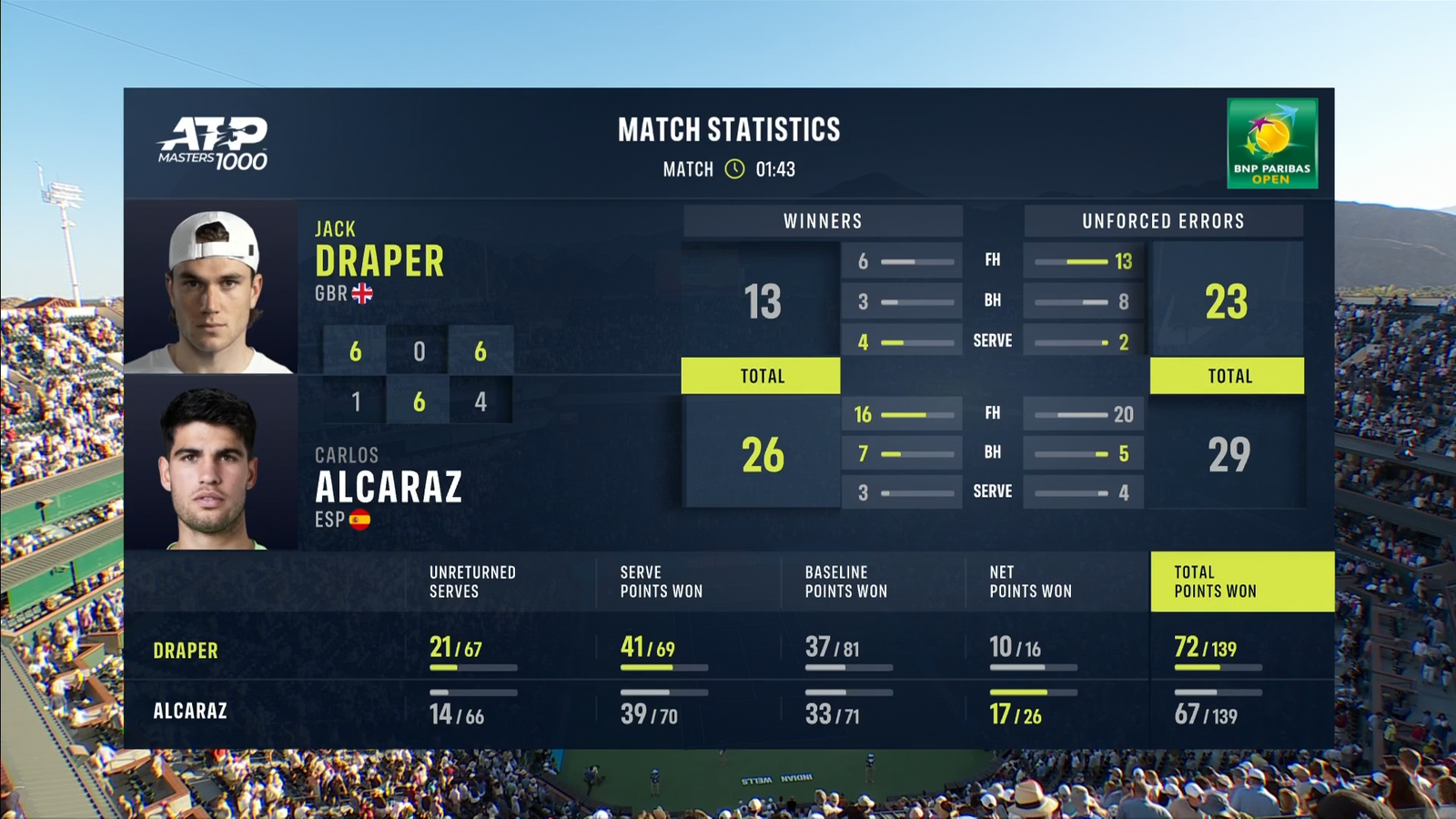

Atp Indian Wells Draper Wins First Masters 1000 Tournament

May 24, 2025

Atp Indian Wells Draper Wins First Masters 1000 Tournament

May 24, 2025 -

Weak Q1 Figures Cause 6 Drop In Kering Share Price

May 24, 2025

Weak Q1 Figures Cause 6 Drop In Kering Share Price

May 24, 2025

Latest Posts

-

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Mia Farrow Demands Trump Be Jailed For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrow Demands Trump Be Jailed For Deporting Venezuelan Gang Members

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation Policy

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation Policy

May 24, 2025 -

Reputation Wreckage 17 Celebrities Whose Careers Ended Abruptly

May 24, 2025

Reputation Wreckage 17 Celebrities Whose Careers Ended Abruptly

May 24, 2025 -

Understanding Frank Sinatras Four Marriages

May 24, 2025

Understanding Frank Sinatras Four Marriages

May 24, 2025