Weak Q1 Figures Cause 6% Drop In Kering Share Price

Table of Contents

Detailed Analysis of Kering's Weak Q1 Performance

Kering's underwhelming Q1 2024 results paint a complex picture of challenges within the luxury sector. Several factors contributed to the underperformance compared to both Q1 2023 and internal projections.

-

Lower than Expected Sales in Key Markets: Significant sales declines were reported in key regions, particularly China and parts of Europe. The slowdown in these crucial markets significantly impacted overall revenue. The ongoing economic uncertainty in these regions likely dampened consumer spending on luxury goods.

-

Impact of Supply Chain Disruptions: While supply chain issues have eased somewhat globally, lingering disruptions continue to impact production and delivery timelines, affecting the availability of key products and impacting sales figures. This suggests Kering needs to further diversify and strengthen its supply chain resilience.

-

Changes in Consumer Spending Habits: Shifting consumer preferences and a potential move towards more value-conscious purchasing, even within the luxury sector, may have played a role. This highlights the need for Kering brands to adapt their strategies and offer products that cater to evolving consumer demands.

-

Performance of Individual Brands: While specific sales figures for individual brands haven't been fully disclosed, early reports suggest that even flagship brands like Gucci experienced a slowdown in growth compared to previous quarters. This underscores the need for a more in-depth analysis of individual brand performance to identify areas for improvement. [Insert relevant chart comparing Q1 2024 sales to Q1 2023 sales for key brands].

Comparing Q1 2024 to Q1 2023 reveals a stark contrast, with a noticeable drop in revenue and profit margins across the board. Unexpected factors, such as geopolitical instability and currency fluctuations, may have also contributed to the overall weaker performance.

Impact on Kering's Share Price and Investor Confidence

The 6% drop in Kering's share price immediately following the release of the Q1 results sent shockwaves through the financial markets. Financial news outlets like the Financial Times and Bloomberg reported widespread concern among investors. This sharp decline reflects the market's immediate negative reaction to the unexpected weakness in Kering's Q1 performance.

The impact on investor confidence is significant. The sudden drop suggests a loss of faith in Kering's ability to maintain its growth trajectory, particularly in the face of growing economic headwinds. Several analysts have lowered their price targets for Kering stock, reflecting a cautious outlook for the near future.

-

Short-term vs. long-term effects on the share price: The short-term impact is undeniably negative, but the long-term effects will depend on Kering's ability to implement effective strategies to address the issues highlighted in the Q1 results.

-

Impact on Kering's market capitalization: The share price drop translates into a considerable reduction in Kering's market capitalization, impacting its overall valuation and investor perception.

Kering's Response and Future Outlook

Kering has acknowledged the disappointing Q1 results and outlined a series of strategic initiatives to address the challenges and regain momentum.

-

Planned marketing campaigns or product launches: The company plans to launch several new product lines and ramp up marketing efforts in key markets to reignite consumer interest.

-

Restructuring initiatives: Internal restructuring and operational efficiency improvements are underway to streamline operations and reduce costs.

-

Focus on specific geographical markets: Kering intends to strengthen its presence and tailor its offerings to specific geographical markets to better respond to local consumer preferences.

Kering's management has expressed confidence in the company's long-term prospects, emphasizing the strength of its brands and its commitment to innovation. However, the road to recovery will require significant effort and a clear demonstration of effective strategies to overcome the challenges identified in Q1 2024.

Navigating the Future After Kering's Q1 Share Price Drop

In summary, Kering's weak Q1 performance, resulting in a 6% share price drop, highlights the vulnerability of even leading luxury brands to external factors and evolving consumer behavior. The primary reasons behind this underperformance include weaker-than-expected sales in key markets, lingering supply chain disruptions, and shifting consumer spending habits. Kering's response involves strategic initiatives focused on marketing, restructuring, and targeted geographical market strategies. The long-term impact on Kering’s share price and the luxury goods market remains to be seen, but the company's ability to effectively address these challenges will be crucial.

Stay updated on the latest developments in Kering’s performance and its impact on the luxury market. Follow our blog for further analysis of Kering's share price and Q2 results.

Featured Posts

-

Frankfurt Stock Market Closes Lower Dax Below 24 000 Points

May 24, 2025

Frankfurt Stock Market Closes Lower Dax Below 24 000 Points

May 24, 2025 -

Net Asset Value Nav Explained Amundi Msci All Country World Ucits Etf Usd Acc

May 24, 2025

Net Asset Value Nav Explained Amundi Msci All Country World Ucits Etf Usd Acc

May 24, 2025 -

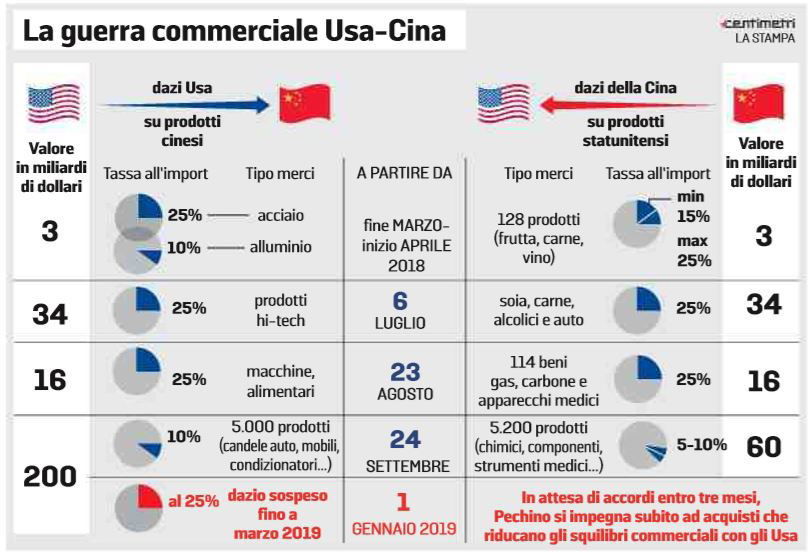

L Impatto Dei Dazi Usa Sui Prezzi Dell Abbigliamento Una Panoramica

May 24, 2025

L Impatto Dei Dazi Usa Sui Prezzi Dell Abbigliamento Una Panoramica

May 24, 2025 -

Brazils Banking Landscape Shifts Brb And Banco Master Merger

May 24, 2025

Brazils Banking Landscape Shifts Brb And Banco Master Merger

May 24, 2025 -

Florida Film Festival Spotting Mia Farrow And Christina Ricci

May 24, 2025

Florida Film Festival Spotting Mia Farrow And Christina Ricci

May 24, 2025

Latest Posts

-

Woody Allen Sexual Abuse Claims Re Examined Following Sean Penns Public Backing

May 24, 2025

Woody Allen Sexual Abuse Claims Re Examined Following Sean Penns Public Backing

May 24, 2025 -

The Sean Penn Dylan Farrow Woody Allen Controversy A Deeper Look

May 24, 2025

The Sean Penn Dylan Farrow Woody Allen Controversy A Deeper Look

May 24, 2025 -

Sean Penn Questions Dylan Farrows Accusations Against Woody Allen

May 24, 2025

Sean Penn Questions Dylan Farrows Accusations Against Woody Allen

May 24, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 24, 2025

Woody Allen Sexual Assault Allegations Sean Penns Doubts

May 24, 2025 -

The Woody Allen Dylan Farrow Case Sean Penns Perspective

May 24, 2025

The Woody Allen Dylan Farrow Case Sean Penns Perspective

May 24, 2025