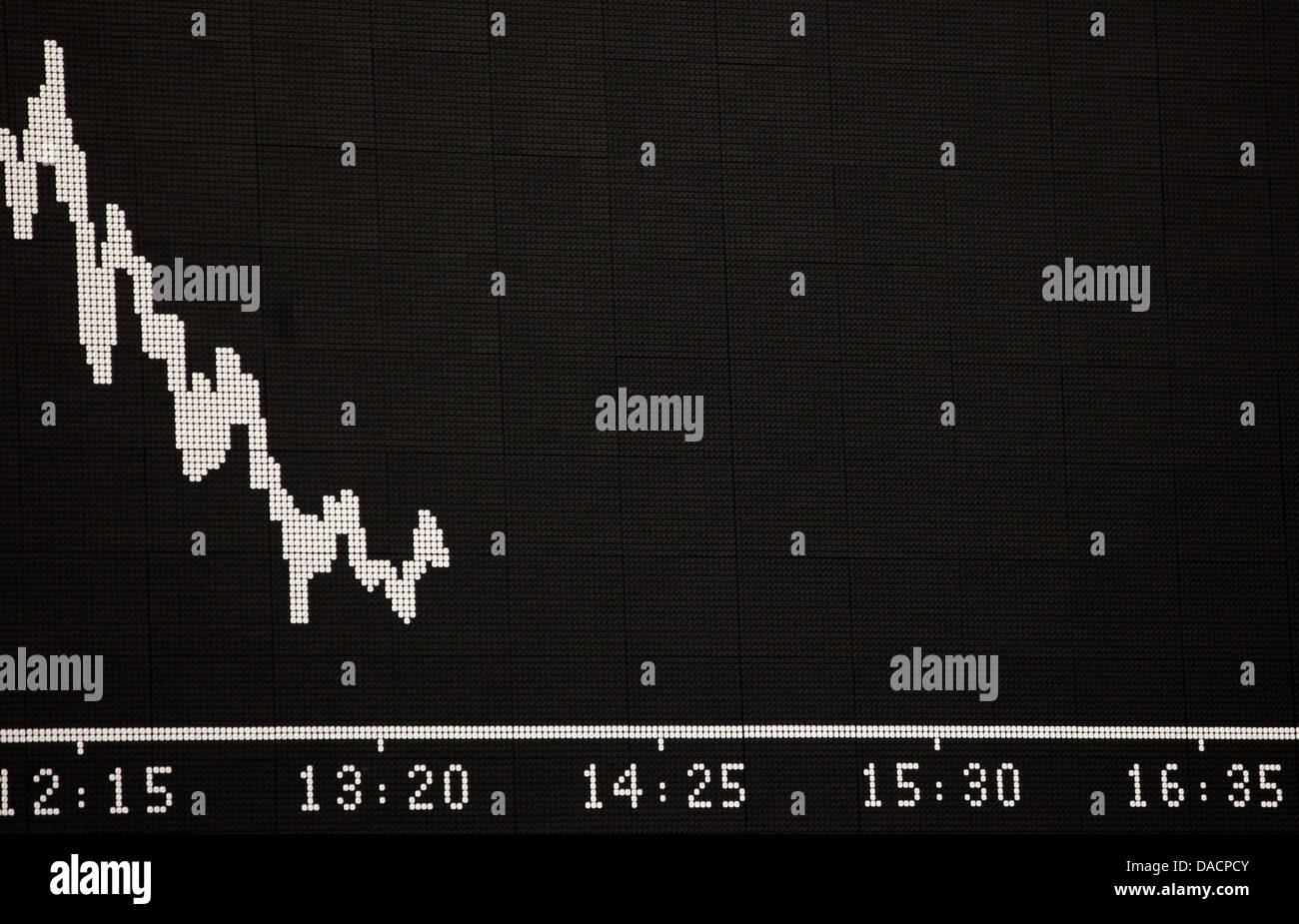

Amsterdam Stock Exchange Plunges: Third Consecutive Day Of Heavy Losses

Table of Contents

The Amsterdam Stock Exchange (AEX) is experiencing a dramatic downturn, suffering heavy losses for the third consecutive day. This unprecedented plunge has sent shockwaves through the market, leaving investors scrambling to understand the causes and potential long-term implications. This article delves into the reasons behind this significant market decline and explores the potential consequences for the Dutch economy and global markets. We will examine the key factors contributing to this crisis and offer insights into what the future may hold for the AEX.

Causes of the Amsterdam Stock Exchange Plunge

Global Economic Uncertainty

The current market instability isn't isolated to Amsterdam; it reflects broader global economic anxieties. Several interconnected factors contribute to this uncertainty:

-

Rising inflation and interest rates: Persistently high inflation globally has forced central banks, including the European Central Bank, to aggressively raise interest rates. This increases borrowing costs for businesses and consumers, dampening economic activity and impacting investor confidence.

-

Geopolitical instability: The ongoing war in Ukraine, escalating tensions in other regions, and trade disputes continue to fuel uncertainty in the global economy. This geopolitical risk significantly impacts investor sentiment and market stability.

-

The ongoing energy crisis: The energy crisis in Europe, exacerbated by the war in Ukraine, has pushed energy prices to record highs, impacting businesses and consumers across the continent, including the Netherlands. This energy crisis directly impacts the profitability of many Dutch companies.

-

Weakening global growth forecasts: Major international organizations are revising their global growth forecasts downward, reflecting the combined effects of inflation, interest rate hikes, and geopolitical risks. This negative outlook contributes to a pessimistic market sentiment.

-

Specific examples: The recent slowdown in Chinese economic growth, coupled with the ongoing supply chain disruptions, has further added to the global economic uncertainty, impacting the AEX's performance.

Specific Factors Affecting Dutch Companies

Beyond global factors, several specific issues are affecting Dutch companies listed on the AEX, contributing to the recent decline:

-

Performance of major Dutch companies: Several key companies listed on the AEX have reported disappointing earnings or revised their growth forecasts downward, impacting their stock prices and dragging down the overall index.

-

Impact of specific industry sectors: Certain sectors, such as energy, technology, and finance, are particularly vulnerable to the current economic climate. The energy sector, for example, is grappling with high energy costs and regulatory uncertainty. The technology sector is experiencing a slowdown in growth and increased competition.

-

Analysis of individual stock performance: A detailed analysis reveals that the decline isn't uniform across all stocks; some sectors are performing worse than others. This highlights the sector-specific nature of the current crisis.

-

Key underperforming sectors and companies: (Examples of specific companies and sectors should be included here, based on current market data. This will require up-to-date research.)

Investor Sentiment and Market Volatility

Investor sentiment plays a crucial role in market fluctuations. The current situation demonstrates the impact of fear and uncertainty:

-

Analysis of investor behavior and panic selling: Recent days have witnessed increased panic selling, as investors react to the negative news and uncertainty. This amplified the initial decline, creating a self-fulfilling prophecy.

-

The role of algorithmic trading: Algorithmic trading, which uses computer programs to execute trades based on predefined rules, can exacerbate market volatility. In periods of uncertainty, these algorithms can amplify sell-offs, leading to more dramatic price swings.

-

Discussion of decreased investor confidence: The sustained period of losses has eroded investor confidence, leading to a reluctance to invest further in the market. This lack of confidence is a significant factor contributing to the ongoing decline.

-

Impact of news and social media: Negative news and social media commentary can significantly influence investor sentiment. The rapid spread of information, both factual and speculative, can amplify market reactions.

Impact of the Decline on the Dutch Economy

Short-Term Economic Consequences

The AEX plunge has immediate consequences for the Dutch economy:

-

Impact on consumer confidence and spending: Falling stock prices can negatively impact consumer confidence, leading to reduced spending and a slowdown in economic activity.

-

Potential job losses and increased unemployment: Companies facing financial difficulties due to the market downturn may resort to layoffs, leading to increased unemployment.

-

Effect on business investment and growth: The uncertainty surrounding the market is likely to discourage businesses from making significant investments, further hampering economic growth.

-

Immediate effects on various sectors: The impact will vary across sectors, with some sectors more vulnerable than others. For instance, export-oriented businesses may be particularly impacted by reduced global demand.

Long-Term Economic Implications

The long-term implications of this decline are more serious:

-

Potential for a recession in the Netherlands: A prolonged period of market downturn could trigger a recession in the Netherlands, with significant consequences for the entire economy.

-

Impact on government revenue and spending: A recession would reduce government tax revenue and potentially necessitate increased government spending on social programs, straining public finances.

-

Effect on foreign investment in the Netherlands: The current market instability could deter foreign investors, further weakening the Dutch economy.

-

Potential long-term effects and risks: The longer the market remains depressed, the greater the risk of a deep and prolonged economic downturn.

Potential Recovery Strategies and Outlook

Government Intervention and Support Measures

The Dutch government may consider several measures to mitigate the economic impact:

-

Potential government policies to stimulate economic growth: The government may introduce fiscal stimulus packages, tax cuts, or other measures to boost economic activity.

-

Analysis of the effectiveness of past government interventions: Lessons learned from past economic crises can inform the design and implementation of current policies.

-

Discussion of potential fiscal or monetary policies: A coordinated approach involving both fiscal and monetary policies may be necessary to effectively address the crisis.

-

Possible government actions and their potential impact: The effectiveness of these interventions will depend on the severity and duration of the market downturn.

Market Predictions and Future Outlook

Predicting the future trajectory of the AEX is challenging:

-

Expert opinions and analysis of the market's future trajectory: Market analysts offer varying perspectives on the market's future, with some predicting a rebound and others forecasting further declines.

-

Potential for a market rebound or further decline: The outcome will depend on several factors, including the evolution of the global economy, the response of the Dutch government, and investor sentiment.

-

Discussion of factors that could influence future market performance: Global economic events, political developments, and corporate earnings will all play a significant role in shaping the AEX's future performance.

-

Various market predictions and scenarios: (Include a range of plausible scenarios, supported by expert opinions.)

Conclusion

The Amsterdam Stock Exchange's three-day plunge is a significant event with potentially far-reaching consequences for the Dutch economy and global markets. The causes are complex, involving a combination of global economic uncertainty, specific challenges for Dutch companies, and volatile investor sentiment. Understanding these factors is crucial for navigating this turbulent period.

Call to Action: Stay informed about the evolving situation of the Amsterdam Stock Exchange and its impact on global markets. Continue to monitor news and analysis to make informed decisions regarding your investments. Understanding the intricacies of Amsterdam Stock Exchange plunges is key to successful financial planning.

Featured Posts

-

Kak Zhenyatsya Na Kharkovschine Svadebniy Bum Bolee 600 Brakov Za Mesyats

May 25, 2025

Kak Zhenyatsya Na Kharkovschine Svadebniy Bum Bolee 600 Brakov Za Mesyats

May 25, 2025 -

Annie Kilners Reaction To Kyle Walkers Night Out Poisoning Claims Examined

May 25, 2025

Annie Kilners Reaction To Kyle Walkers Night Out Poisoning Claims Examined

May 25, 2025 -

Relx Trotseert Economische Recessie Met Ai Groeiprognoses Voor 2025

May 25, 2025

Relx Trotseert Economische Recessie Met Ai Groeiprognoses Voor 2025

May 25, 2025 -

Frankfurt Dax Closes Below 24 000 Amid Market Losses

May 25, 2025

Frankfurt Dax Closes Below 24 000 Amid Market Losses

May 25, 2025 -

Lady Gagas Post Snl Celebration With Fiance Michael Polansky

May 25, 2025

Lady Gagas Post Snl Celebration With Fiance Michael Polansky

May 25, 2025

Latest Posts

-

Hair Trimmers Used In Attempted Jailbreak Louisiana Inmates Escape Plan

May 25, 2025

Hair Trimmers Used In Attempted Jailbreak Louisiana Inmates Escape Plan

May 25, 2025 -

Black Lives Matter Plaza A Reflection On Protest And Public Space

May 25, 2025

Black Lives Matter Plaza A Reflection On Protest And Public Space

May 25, 2025 -

New Orleans Jailbreak Inmates Allegedly Use Hair Trimmers In Escape Attempt

May 25, 2025

New Orleans Jailbreak Inmates Allegedly Use Hair Trimmers In Escape Attempt

May 25, 2025 -

The Short Lived Black Lives Matter Plaza A Case Study In Political Change

May 25, 2025

The Short Lived Black Lives Matter Plaza A Case Study In Political Change

May 25, 2025 -

Louisiana Inmates Hair Trimmer Escape Attempt New Orleans Jail Break

May 25, 2025

Louisiana Inmates Hair Trimmer Escape Attempt New Orleans Jail Break

May 25, 2025