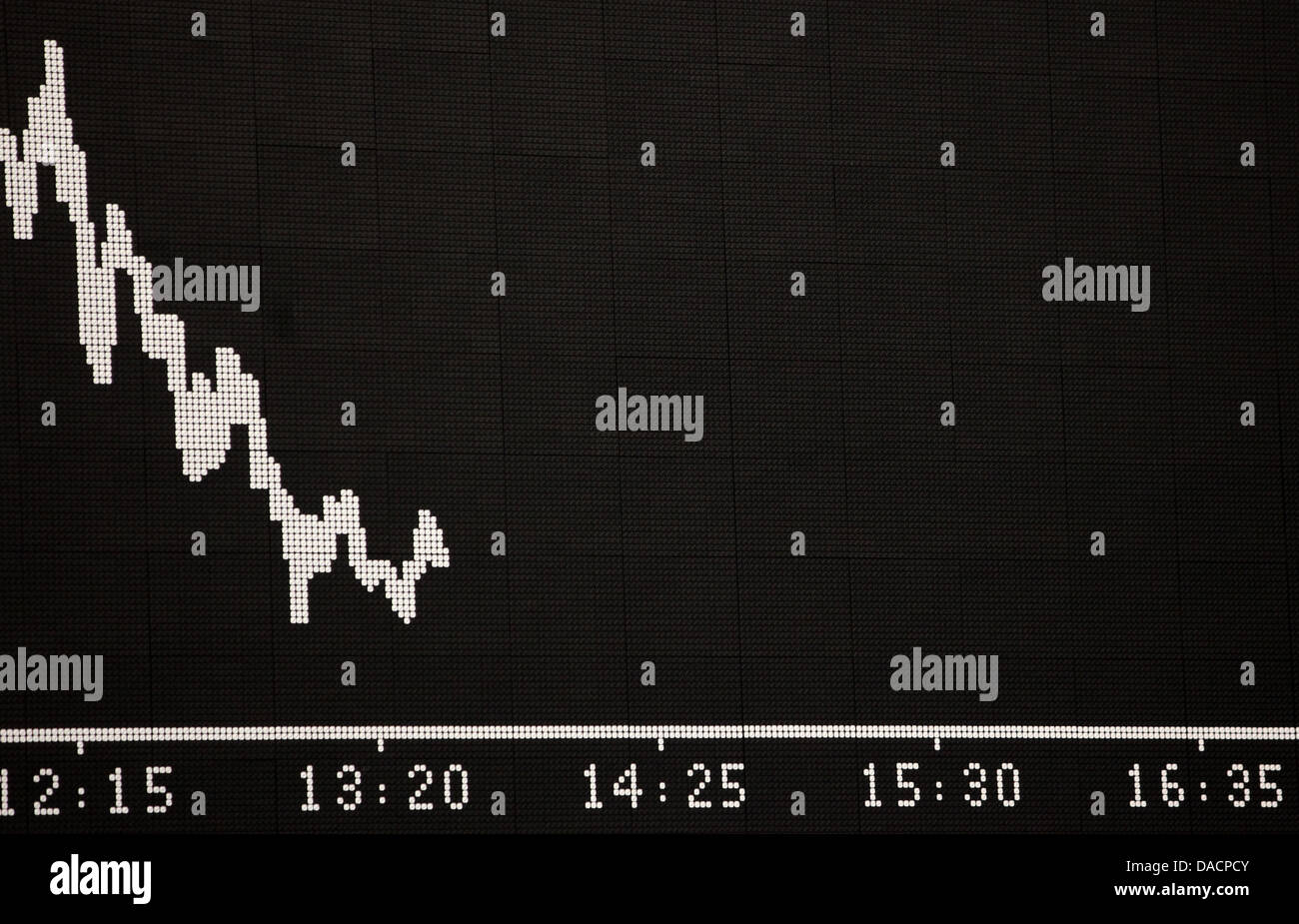

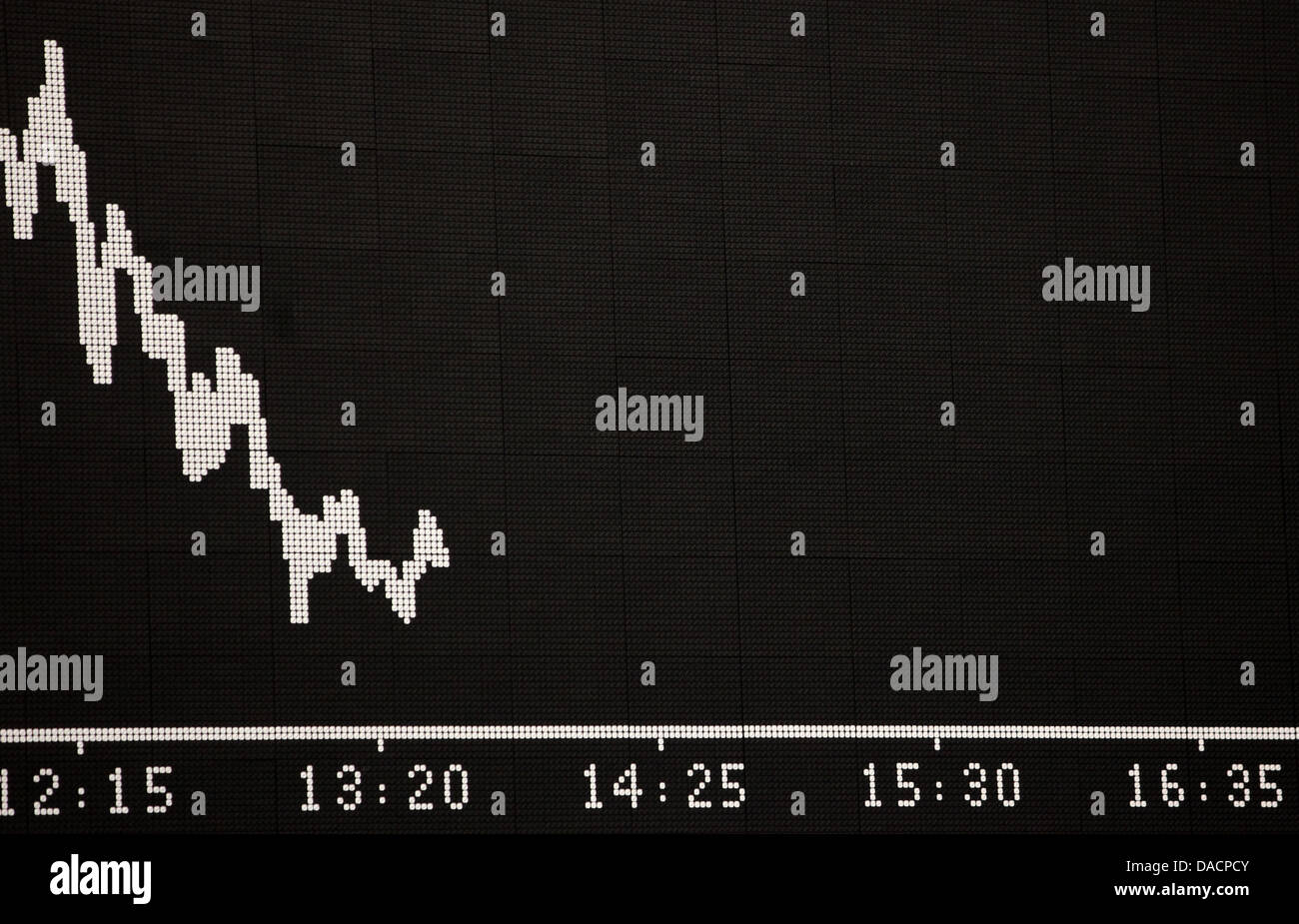

Frankfurt DAX Closes Below 24,000 Amid Market Losses

Table of Contents

Key Factors Contributing to the Frankfurt DAX Decline

Several interconnected factors contributed to the Frankfurt DAX's fall below the 24,000 threshold. Understanding these elements is crucial for navigating the current market volatility.

Global Market Uncertainty

The current global economic climate is marked by significant uncertainty, impacting investor confidence worldwide and consequently, the Frankfurt DAX.

- Rising inflation and interest rate hikes: Central banks globally are aggressively raising interest rates to combat inflation, impacting borrowing costs for businesses and dampening economic growth. This directly affects corporate profitability and investor sentiment.

- Geopolitical tensions: The ongoing war in Ukraine, coupled with escalating tensions in other regions, fuels uncertainty and market volatility. The ripple effects of these conflicts on energy prices and supply chains significantly impact the Frankfurt DAX.

- Weakness in other major global indices: The decline in the Frankfurt DAX mirrors similar downturns observed in other major global indices, such as the Dow Jones and Nasdaq, indicating a broader market correction. This interconnectedness highlights the global nature of financial markets.

- Specific negative news: Recent negative earnings reports from major multinational corporations, coupled with disappointing economic data from key global economies, have further fueled investor anxieties.

Concerns within the German Economy

The German economy, a cornerstone of the Frankfurt DAX, faces several headwinds that contribute to the index's decline.

- Impact of energy prices: Soaring energy prices, largely driven by the geopolitical situation, place a considerable burden on German businesses, increasing production costs and reducing profitability.

- Supply chain disruptions: Ongoing supply chain disruptions continue to hamper German manufacturing, affecting production output and impacting the bottom line for many DAX-listed companies.

- Slowdown in German economic growth: Several economic indicators point towards a slowdown in German economic growth, increasing investor pessimism and leading to a sell-off in the Frankfurt DAX.

- Specific economic indicators: Recent data showing a decline in industrial production, weakening consumer confidence, and rising unemployment in Germany contribute to a negative outlook for the market.

Specific Sectoral Losses

The decline in the Frankfurt DAX wasn't uniform across all sectors. Certain sectors experienced disproportionately higher losses.

- Energy sector: The energy sector, heavily impacted by global price fluctuations and geopolitical uncertainties, witnessed significant losses.

- Automotive sector: The automotive industry, facing challenges related to supply chain disruptions and the transition to electric vehicles, also experienced substantial declines.

- Technology sector: The technology sector, sensitive to interest rate hikes and shifts in investor sentiment, saw notable losses.

- Worst-performing companies: [Insert names of specific companies and their percentage drops. For example: "Volkswagen experienced a 5% drop, while Siemens saw a 3% decline."]

Analysis of the 24,000 Mark Breach

The Frankfurt DAX breaching the 24,000 mark holds significant implications.

Psychological Significance

The 24,000 level represented a key support level for the DAX. Breaking below this level is psychologically significant, often triggering further selling pressure as investors react to the perceived weakness.

Technical Analysis

Technical indicators such as moving averages and the Relative Strength Index (RSI) provide further insights. [Insert details on specific technical indicators and their implications. For example: "The 50-day moving average crossed below the 200-day moving average, a bearish signal indicating a potential continuation of the downtrend."]

Investor Sentiment

The breach has significantly impacted investor sentiment, with many adopting a more cautious approach. This shift in sentiment could lead to further declines in the short term.

- Short-term implications: Increased volatility and potential for further declines are expected in the short term.

- Long-term implications: The long-term impact will depend on the resolution of the underlying economic and geopolitical factors.

Potential Implications and Future Outlook for the Frankfurt DAX

Predicting the future is inherently challenging, but analyzing current trends can provide a perspective on potential outcomes for the Frankfurt DAX.

Short-Term Predictions

The Frankfurt DAX might experience further short-term declines before potentially finding a support level. However, a short-term rebound is also possible depending on market sentiment and any positive economic news.

Long-Term Outlook

The long-term outlook for the Frankfurt DAX remains uncertain, contingent upon several factors, including inflation control, geopolitical stability, and the performance of the German economy.

Investment Strategies

Investors should consider the following strategies:

- Diversification: Diversifying investments across various asset classes can help mitigate risk.

- Risk management: Employing appropriate risk management techniques, such as stop-loss orders, is crucial in volatile markets.

- Long-term perspective: Maintaining a long-term investment horizon can help weather short-term market fluctuations.

Conclusion

The Frankfurt DAX closing below 24,000 reflects a confluence of global and domestic factors, including rising inflation, geopolitical instability, concerns about the German economy, and significant sectoral losses. The breach of this key support level holds significant psychological and technical implications, potentially leading to further short-term volatility. While the long-term outlook remains uncertain, investors should prioritize diversification and risk management strategies. Stay informed about the fluctuations of the Frankfurt DAX and other market indices by regularly checking our website for the latest updates and analysis on the Frankfurt DAX and related market trends. Learn more about managing your investment portfolio amidst Frankfurt DAX volatility.

Featured Posts

-

Mercedes Flaw George Russells Solution

May 25, 2025

Mercedes Flaw George Russells Solution

May 25, 2025 -

Explore The 2025 Porsche Cayenne High Resolution Interior And Exterior Images

May 25, 2025

Explore The 2025 Porsche Cayenne High Resolution Interior And Exterior Images

May 25, 2025 -

Konchita Vurst Prognozi Peremozhtsiv Yevrobachennya 2025 Vid Unian

May 25, 2025

Konchita Vurst Prognozi Peremozhtsiv Yevrobachennya 2025 Vid Unian

May 25, 2025 -

Retail Sales Surge Pushes Back Bank Of Canada Rate Cut

May 25, 2025

Retail Sales Surge Pushes Back Bank Of Canada Rate Cut

May 25, 2025 -

The Angry Elon Effect How It Impacts Tesla

May 25, 2025

The Angry Elon Effect How It Impacts Tesla

May 25, 2025

Latest Posts

-

Chinese Tennis Ace Advances To Wta Italian Open Quarterfinals

May 25, 2025

Chinese Tennis Ace Advances To Wta Italian Open Quarterfinals

May 25, 2025 -

Chinese Tennis Star Reaches Italian Open Quarterfinals

May 25, 2025

Chinese Tennis Star Reaches Italian Open Quarterfinals

May 25, 2025 -

Zheng Qinwens Path To The Italian Open Semifinals A Winning Strategy

May 25, 2025

Zheng Qinwens Path To The Italian Open Semifinals A Winning Strategy

May 25, 2025 -

Zheng Qinwens Semifinal Appearance At The Italian Open Key Moments And Highlights

May 25, 2025

Zheng Qinwens Semifinal Appearance At The Italian Open Key Moments And Highlights

May 25, 2025 -

Italian Open Semifinals Gauff Triumphs Over Zheng In Three Sets

May 25, 2025

Italian Open Semifinals Gauff Triumphs Over Zheng In Three Sets

May 25, 2025