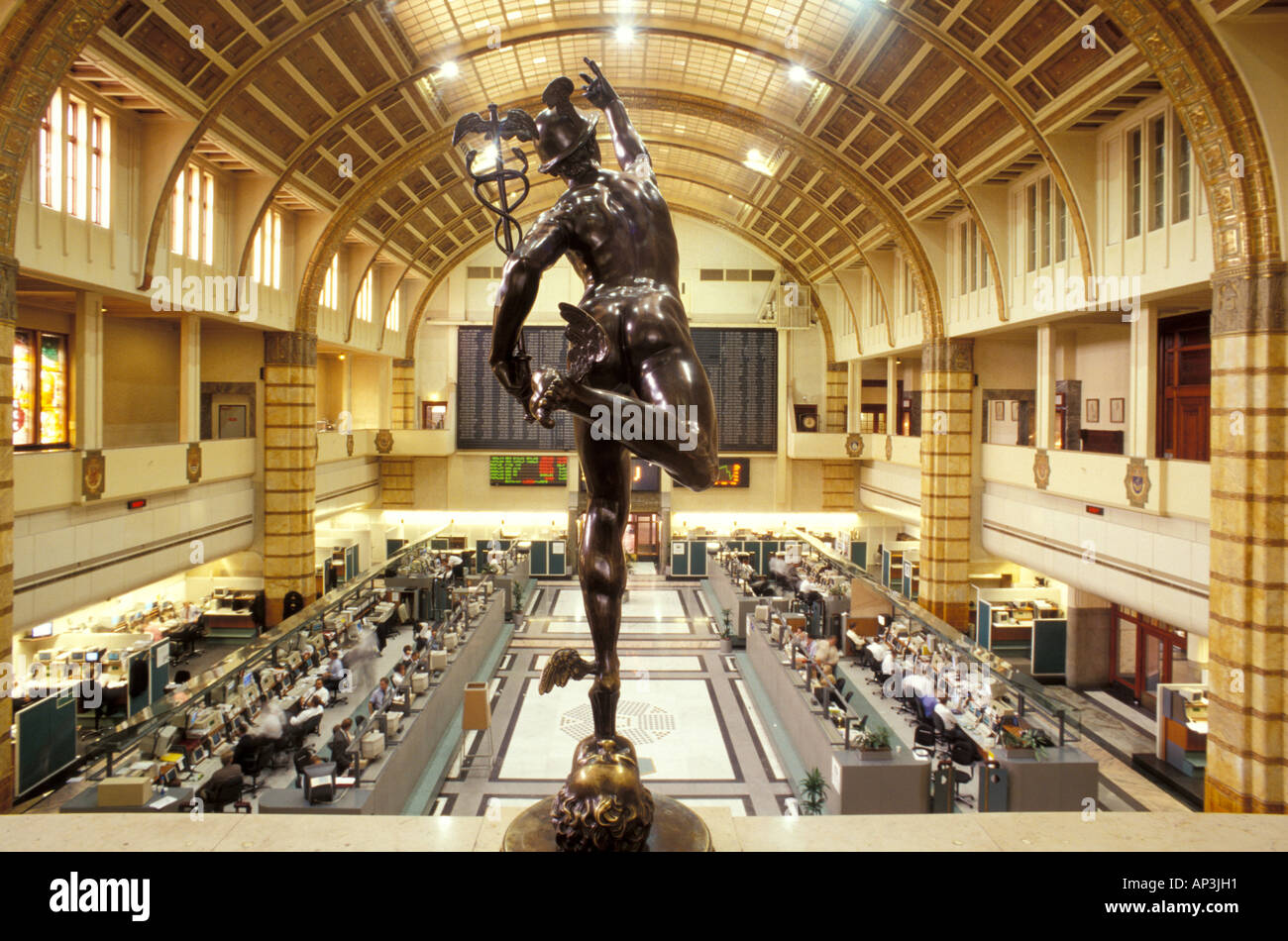

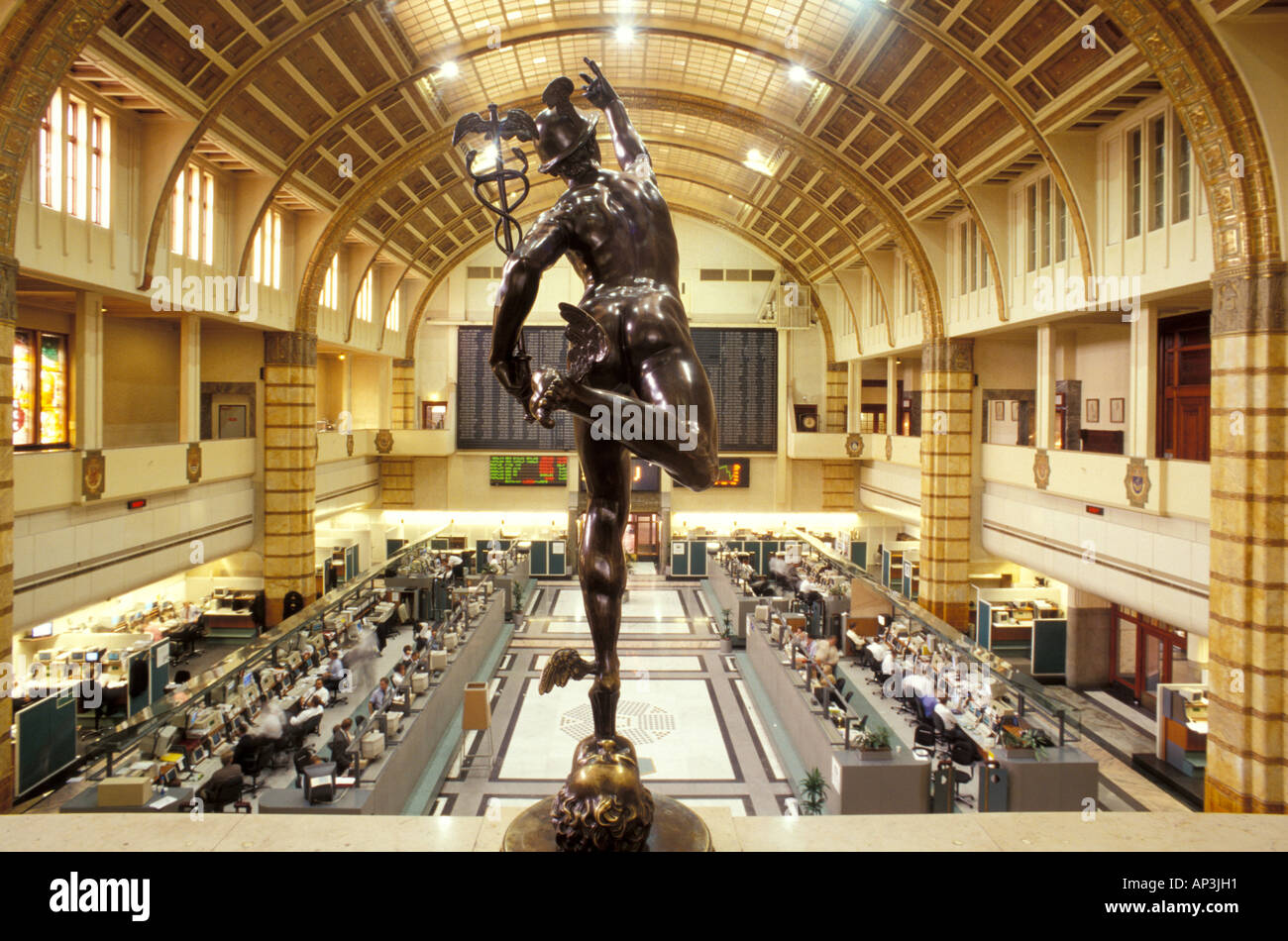

Amsterdam Stock Exchange Plunges: Three Consecutive Days Of Heavy Losses

Table of Contents

Factors Contributing to the Amsterdam Stock Exchange Plunge

The three-day plunge in the AEX index is not an isolated event but rather the culmination of several interconnected factors impacting global and Dutch markets.

Global Economic Slowdown

The global economy is facing headwinds, significantly impacting investor sentiment and contributing to the Amsterdam Stock Exchange plunges. Rising inflation, coupled with aggressive interest rate hikes by central banks worldwide, is creating a challenging environment for businesses and investors. This uncertainty is reflected in decreased consumer spending and weakened international trade, directly affecting Dutch businesses reliant on exports and global supply chains.

- Weakening Euro: The weakening Euro against major currencies further exacerbates the situation, increasing the cost of imports and reducing the competitiveness of Dutch exports.

- Potential Recession: Fears of a looming global recession are fueling risk aversion among investors, leading to capital flight from equities.

- Global Supply Chain Issues: Ongoing disruptions to global supply chains are causing inflationary pressures and impacting business profitability, adding to the downward pressure on the AEX.

Geopolitical Instability

Geopolitical instability, particularly the ongoing war in Ukraine, is a major factor driving market volatility. The conflict has caused significant energy price volatility, directly impacting energy-intensive industries in the Netherlands and increasing uncertainty about future energy supplies and costs.

- Impact of Sanctions: International sanctions imposed on Russia have created ripple effects throughout the global economy, disrupting trade and increasing uncertainty.

- Refugee Crisis: The influx of Ukrainian refugees into Europe, including the Netherlands, is placing pressure on social services and potentially impacting economic growth.

- Implications for European Energy Security: The war has highlighted Europe's dependence on Russian energy, raising concerns about long-term energy security and contributing to energy price spikes, directly affecting the AEX.

Specific Sectoral Weakness

The AEX decline isn't uniform across all sectors. Certain industries are disproportionately affected, experiencing sharper losses than others. For example, the technology sector has seen significant declines, mirroring global trends in tech stock valuations. The energy sector, while benefiting from high prices in some areas, is also facing significant uncertainty due to geopolitical risks and energy transition policies. Similarly, the financial sector is also suffering from increased risk aversion and market uncertainty.

- Examples of Underperforming Companies: Specific examples of companies significantly underperforming within these sectors should be named (replace with real examples during publication). Analyzing their individual financial reports and announcements will provide a clearer picture of their specific challenges.

- Market Trends: The underlying market trends affecting these sectors, such as rising interest rates, increased regulation, or changing consumer behavior, should be detailed.

- Earnings Reports: A thorough analysis of recent earnings reports of key companies within affected sectors will illuminate the reasons for their underperformance and contribute to a deeper understanding of the AEX's decline.

Impact and Analysis of the AEX Decline

The three-day plunge in the AEX has had a significant impact on investor sentiment, market confidence, and the broader Dutch economy.

Investor Sentiment and Market Confidence

The sharp decline in the AEX has eroded investor confidence, leading to increased risk aversion and a flight to safety. Investors are moving their money into less volatile assets, like government bonds, further exacerbating the downward pressure on equities.

- Decreased Trading Volume: Market uncertainty often results in decreased trading volume as investors adopt a wait-and-see approach.

- Flight to Safety: Investors are seeking the perceived safety of government bonds and other low-risk investments.

- Increased Risk Aversion: Investors are becoming more cautious and less willing to take on risk, leading to lower demand for equities.

Potential Long-Term Implications

The long-term implications of the AEX decline for the Dutch economy are significant. A prolonged period of low market confidence could lead to reduced investment, slower economic growth, and potential job losses.

- Impact on GDP Growth: A sustained decline in the stock market can negatively impact consumer and business confidence, leading to reduced spending and investment, hindering economic growth.

- Job Losses: Companies struggling with decreased demand and profitability may resort to layoffs, leading to job losses in various sectors.

- Potential Government Interventions: The Dutch government may consider implementing fiscal stimulus packages or other policy measures to boost economic activity and investor confidence.

Conclusion

The Amsterdam Stock Exchange's three-day plunge represents a significant event with potentially far-reaching consequences for the Dutch economy and the European markets. The confluence of a global economic slowdown, geopolitical instability, and specific sectoral weaknesses has created a perfect storm impacting investor confidence and market stability. Understanding the factors contributing to this decline is crucial for investors to navigate the current market uncertainty and make informed decisions. Keeping a close eye on developments in the AEX and global markets is essential for successfully navigating this period of volatility. Stay informed about the Amsterdam Stock Exchange's performance and potential recovery through continued monitoring of market news and analysis. Understanding the dynamics of the Amsterdam Stock Exchange plunges, and similar market events, will empower investors to make better-informed decisions in the future.

Featured Posts

-

French Pms Public Dissent On Macrons Leadership

May 24, 2025

French Pms Public Dissent On Macrons Leadership

May 24, 2025 -

The Undervalued Gems Of News Corp Uncovering Hidden Potential

May 24, 2025

The Undervalued Gems Of News Corp Uncovering Hidden Potential

May 24, 2025 -

Net Asset Value Nav Explained Amundi Msci World Ex Us Ucits Etf Acc

May 24, 2025

Net Asset Value Nav Explained Amundi Msci World Ex Us Ucits Etf Acc

May 24, 2025 -

Esc 2025 Conchita Wurst And Jj Live At Eurovision Village

May 24, 2025

Esc 2025 Conchita Wurst And Jj Live At Eurovision Village

May 24, 2025 -

Gaga And Polansky Couples Arrival At Snl Afterparty

May 24, 2025

Gaga And Polansky Couples Arrival At Snl Afterparty

May 24, 2025

Latest Posts

-

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025 -

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025 -

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025 -

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025 -

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025