Amsterdam Stock Index Plunges: Over 4% Drop To Year-Low

Table of Contents

Causes of the Amsterdam Stock Index Plunge

Several interconnected factors contributed to the substantial drop in the Amsterdam Stock Index (AEX). Understanding these causes is vital for investors and market analysts alike.

Global Economic Uncertainty

The current global economic climate is characterized by significant uncertainty, significantly impacting the AEX.

- Rising Inflation and Recessionary Fears: Persistently high inflation rates in many countries are fueling fears of a global recession. Central banks are aggressively raising interest rates to combat inflation, but this action risks slowing economic growth and potentially triggering a recession. This uncertainty creates a negative sentiment in the market.

- Geopolitical Tensions and Supply Chain Disruptions: The ongoing war in Ukraine continues to disrupt global supply chains, leading to energy price volatility and impacting the availability of crucial goods. This instability contributes to economic uncertainty and negatively impacts investor confidence, leading to sell-offs in the stock market, including the AEX.

- Increased Interest Rates: The actions of central banks worldwide to increase interest rates to curb inflation are impacting market sentiment. Higher interest rates increase borrowing costs for businesses, potentially slowing investment and economic activity.

Sector-Specific Weakness

The AEX's decline wasn't uniform across all sectors. Certain industries experienced more significant drops than others.

- Energy Sector Slump: The energy sector within the AEX saw particularly sharp declines. Fluctuations in global energy prices, driven by geopolitical events and supply chain issues, heavily impacted energy companies' stock valuations. For example, [insert specific example of an energy company listed on AEX and its percentage drop].

- Technology Sector Underperformance: The technology sector also underperformed, mirroring trends in global tech markets. Concerns about slowing growth and increased competition contributed to the downward pressure on tech stocks listed on the AEX. [insert specific example of a tech company listed on AEX and its percentage drop].

Investor Sentiment and Market Volatility

Negative investor sentiment played a crucial role in exacerbating the AEX's decline.

- Panic Selling: The combination of global uncertainties and sector-specific weaknesses led to increased panic selling, further driving down the Amsterdam Stock Index. Investors seeking to protect their capital contributed to the downward spiral.

- Increased Market Volatility: The AEX, mirroring broader European market trends, experienced significantly increased volatility. This volatility reflects the uncertainty and nervousness among investors. Indicators like the VIX index (a measure of market volatility) likely showed a significant increase during this period.

Implications for Investors

The sharp drop in the Amsterdam Stock Index has significant implications for investors.

Impact on Portfolio Value

The AEX plunge resulted in substantial losses for investors holding AEX-related assets.

- Portfolio Diversification Crucial: This highlights the critical importance of portfolio diversification to mitigate risk. Investors with heavily concentrated holdings in AEX-listed companies experienced disproportionately large losses.

- Risk Management Strategies: Robust risk management strategies, including stop-loss orders and diversification across different asset classes, are crucial for navigating market volatility.

- Market Monitoring Resources: Investors should utilize reliable resources to monitor market conditions, such as financial news websites, brokerage platforms, and economic data providers.

Trading Strategies in a Volatile Market

The current market volatility necessitates a reassessment of trading strategies.

- Long-Term Perspective: Maintaining a long-term investment perspective is crucial. Panic selling often leads to poor investment decisions.

- Strategic Adjustments: Investors may need to adjust their investment strategies, perhaps shifting towards more defensive assets or delaying significant investment decisions until market conditions stabilize.

- Avoiding Panic Selling: It's vital to avoid impulsive reactions and panic selling. A well-defined investment strategy and risk tolerance are crucial during times of market uncertainty.

Future Outlook for the Amsterdam Stock Index

Predicting the future performance of the AEX is inherently challenging, but analyzing analyst predictions and potential catalysts can offer some insight.

Analyst Predictions and Market Forecasts

Financial analysts offer varying predictions regarding the AEX's future performance.

- Market Recovery Potential: Some analysts anticipate a market recovery driven by factors such as easing inflation, improved global economic conditions, or government interventions. [Cite relevant sources supporting this view].

- Continued Decline Possible: Others predict a continuation of the downward trend, citing persistent global uncertainties and the potential for further economic slowdown. [Cite relevant sources supporting this view].

Potential Recovery Strategies

Several factors could influence the AEX's recovery.

- Government Intervention: Government intervention through fiscal stimulus or policy changes could help bolster the economy and boost investor confidence.

- Central Bank Actions: Central bank actions, including interest rate adjustments or quantitative easing measures, could play a role in stabilizing the market.

- Positive Economic Indicators: Positive economic indicators, such as improved employment data or decreased inflation, could trigger a market rebound.

Conclusion

The Amsterdam Stock Index's dramatic 4% plunge to a year-low underscores the challenges facing the Netherlands' financial markets and the broader global economy. Global uncertainties, sector-specific weaknesses, and heightened market volatility are key contributing factors. Investors need to carefully assess the implications for their portfolios and adapt their strategies accordingly. Understanding the forces driving the Amsterdam Stock Index's performance is paramount for making sound investment decisions.

Call to Action: Stay informed about the evolving situation concerning the Amsterdam Stock Index. Regularly monitor market news, consult with financial advisors, and develop a robust investment strategy to effectively navigate the volatility of the AEX and other global markets. Proactive monitoring and informed decision-making are essential to successfully manage your investments in the face of fluctuations in the Amsterdam Stock Index and the broader market.

Featured Posts

-

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In Het Groen

May 24, 2025

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In Het Groen

May 24, 2025 -

Aex Stijgt Terwijl Amerikaanse Beurzen Dalen Analyse Van De Markttrends

May 24, 2025

Aex Stijgt Terwijl Amerikaanse Beurzen Dalen Analyse Van De Markttrends

May 24, 2025 -

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025 -

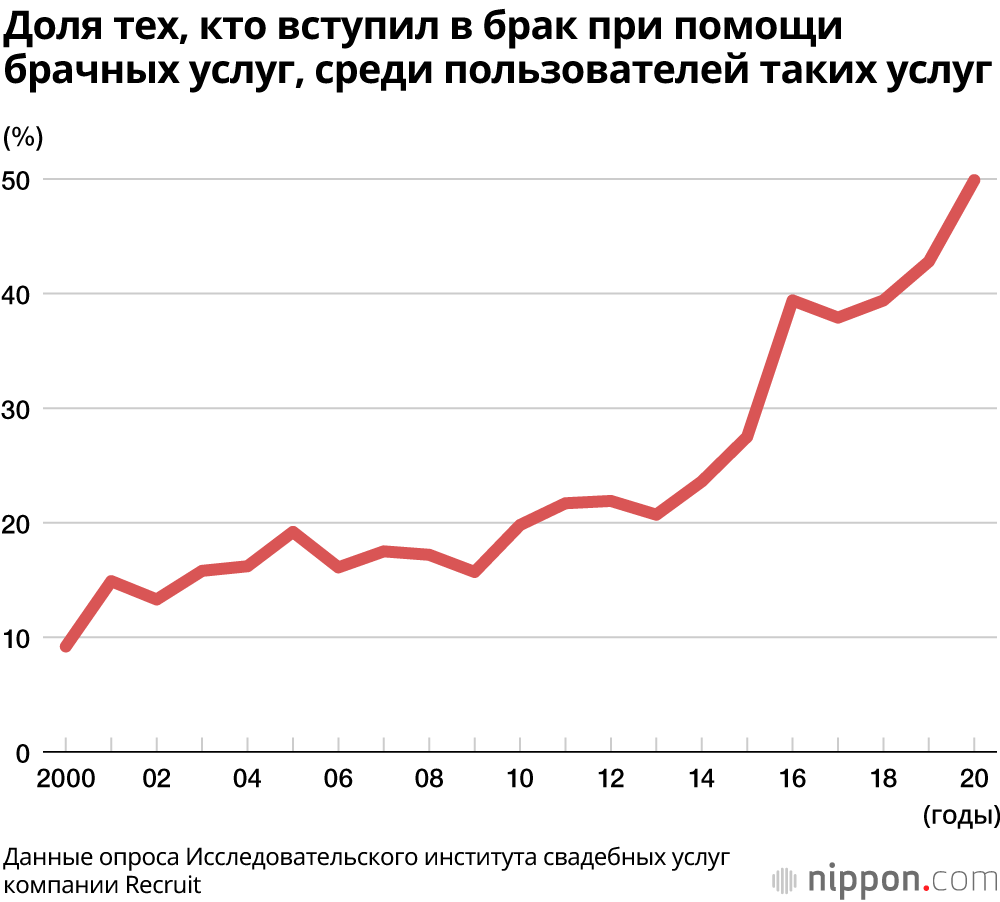

Svadebniy Sezon Na Kharkovschine Rekordnoe Kolichestvo Brakov

May 24, 2025

Svadebniy Sezon Na Kharkovschine Rekordnoe Kolichestvo Brakov

May 24, 2025 -

Escape To The Country Top Destinations For A Relaxing Getaway

May 24, 2025

Escape To The Country Top Destinations For A Relaxing Getaway

May 24, 2025

Latest Posts

-

Sean Penns Recent Public Appearance A Detailed Look At The Controversy

May 24, 2025

Sean Penns Recent Public Appearance A Detailed Look At The Controversy

May 24, 2025 -

The Woody Allen Controversy Sean Penns Endorsement And The Renewed Focus On Sexual Abuse Claims

May 24, 2025

The Woody Allen Controversy Sean Penns Endorsement And The Renewed Focus On Sexual Abuse Claims

May 24, 2025 -

Hollywood Star Sean Penn Makes Bombshell Claims Leaving Fans Horrified

May 24, 2025

Hollywood Star Sean Penn Makes Bombshell Claims Leaving Fans Horrified

May 24, 2025 -

Resurfacing Woody Allen Allegations Sean Penns Support Fuels Debate

May 24, 2025

Resurfacing Woody Allen Allegations Sean Penns Support Fuels Debate

May 24, 2025 -

Sean Penns Appearance Sparks Concern What Happened To The Hollywood Star

May 24, 2025

Sean Penns Appearance Sparks Concern What Happened To The Hollywood Star

May 24, 2025