Amsterdam Stock Market Suffers 2% Drop: Trump Tariff Fallout

Table of Contents

Impact of Trump Tariffs on Dutch Exports

The Netherlands, with its export-oriented economy, is highly vulnerable to the effects of increased tariffs. Dutch exports, a cornerstone of the nation's economic strength, are facing significant headwinds. Sectors like agriculture, technology, and manufacturing are directly impacted by increased trade barriers and reduced global demand.

-

Agriculture (-5%): The reduced demand for Dutch dairy products and flowers in the US, a key export market, has led to significant losses. Farmers are struggling with surplus produce and decreased profitability, impacting the entire agricultural supply chain.

-

Technology (-3%): Dutch technology companies reliant on importing US components face increased production costs, reducing their competitiveness in the global market. This increased cost of goods sold directly impacts profit margins and bottom lines.

-

Manufacturing (-4%): Higher prices resulting from tariffs make Dutch manufactured goods less competitive internationally. This is leading to decreased sales and potential job losses in the manufacturing sector.

These trade barriers are creating a ripple effect, impacting not just the exporting companies themselves but also related industries and the broader Dutch economy. The overall impact of these trade disputes highlights the interconnected nature of global trade and the vulnerability of export-oriented industries like those in the Netherlands. Keywords: Dutch exports, trade barriers, global trade, economic downturn, export-oriented industries.

Investor Sentiment and Market Volatility

The news surrounding Trump's tariffs has significantly eroded investor confidence in the Amsterdam Stock Market. The resulting market volatility is forcing investors to re-evaluate their portfolios and investment strategies. The increased uncertainty is evident in the increased trading volume and sharp fluctuations in the AEX index.

-

Increased selling pressure on stocks: Investors are increasingly liquidating their holdings, seeking to minimize potential losses.

-

Flight to safety: A significant portion of investors are moving towards less risky assets, such as government bonds, to protect their capital.

-

Uncertainty about future economic prospects: The ongoing trade war creates significant uncertainty, making it difficult for investors to predict future market trends and make informed investment decisions.

This heightened volatility makes both short-term and long-term investment planning challenging. The fluctuating AEX index reflects the anxieties within the market, emphasizing the need for careful risk management and a clear understanding of the evolving economic landscape. Keywords: Investor confidence, market volatility, stock market fluctuations, risk aversion, trading volume.

The Role of the Euro in the Market Decline

The weakening Euro against the US dollar further complicates the situation for Dutch companies. The decreased value of the Euro increases the price of imports from the US in Euro terms, adding to the inflationary pressures caused by the tariffs. This negative effect exacerbates the already difficult conditions faced by Dutch businesses, leading to further losses and impacting their competitiveness in international markets. The potential for further currency fluctuations adds another layer of uncertainty to the already volatile situation, impacting the AEX index even more significantly. Keywords: Euro, US dollar, currency exchange rate, foreign exchange market, currency fluctuations.

Government Response and Potential Mitigation Strategies

The Dutch government is acutely aware of the negative impact of the trade war on the national economy. While direct intervention in international trade disputes is limited, the government is exploring various mitigation strategies to support affected businesses and industries. These strategies may include financial aid packages, targeted economic stimulus measures, and initiatives designed to promote diversification of export markets. Continued engagement in international trade negotiations remains crucial to finding a resolution to these trade disputes and mitigating the long-term economic consequences. Keywords: Government intervention, economic stimulus, financial aid, trade negotiations, policy response.

Conclusion: Navigating the Amsterdam Stock Market Decline

The 2% drop in the Amsterdam Stock Market, primarily caused by the fallout from Trump's tariffs, underscores the significant impact of trade disputes on a globally integrated economy. The agricultural, technological, and manufacturing sectors in the Netherlands have been particularly affected, leading to reduced export revenues, increased costs, and decreased investor confidence. The weakening Euro further exacerbates the situation, creating significant uncertainty for investors and businesses alike. While the Dutch government is actively considering mitigation strategies, navigating this turbulent period requires careful monitoring of market trends and a proactive approach to risk management. Stay informed about the latest developments affecting the Amsterdam Stock Market and adjust your investment strategies accordingly. Keywords: Amsterdam Stock Market, AEX index, trade war, investment strategy, economic outlook, market analysis.

Featured Posts

-

Camunda Con 2025 Unlocking The Power Of Orchestration In Ai And Automation

May 25, 2025

Camunda Con 2025 Unlocking The Power Of Orchestration In Ai And Automation

May 25, 2025 -

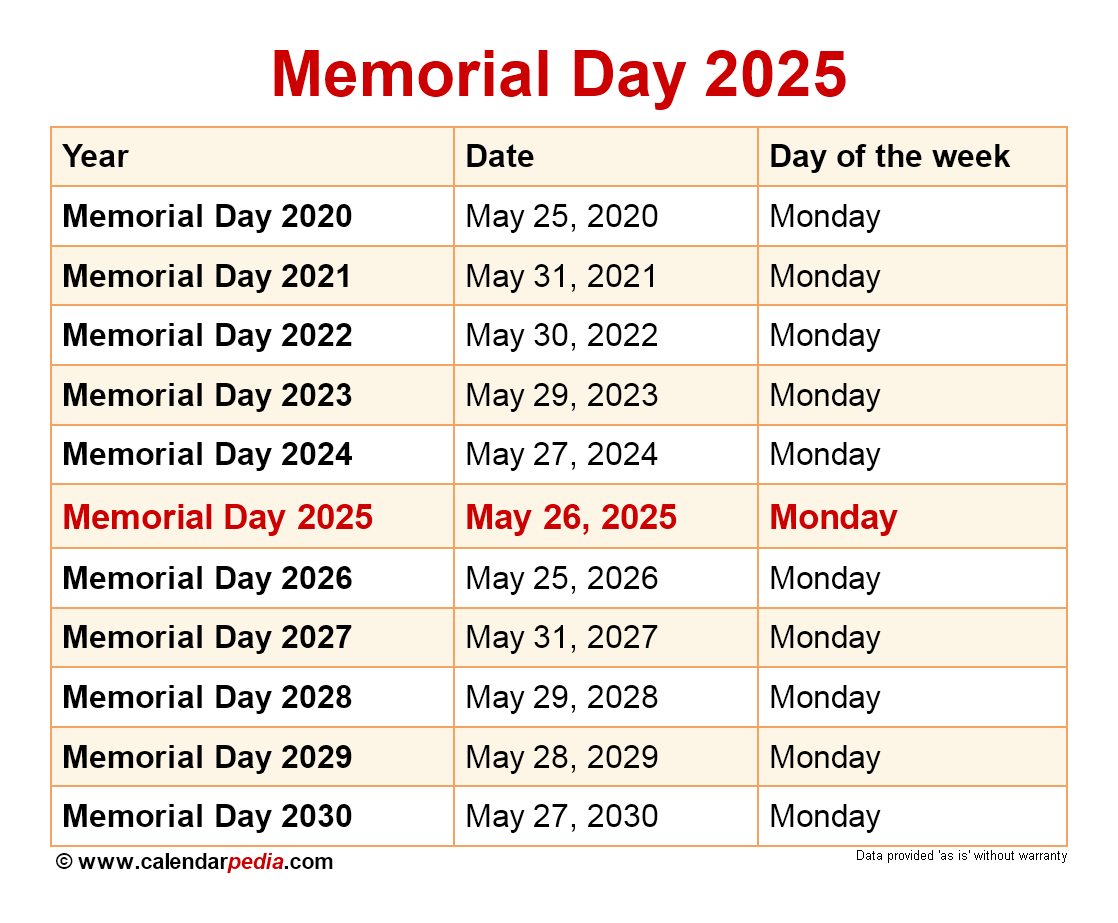

Flying During Memorial Day Weekend 2025 A Guide To Peak Travel Times

May 25, 2025

Flying During Memorial Day Weekend 2025 A Guide To Peak Travel Times

May 25, 2025 -

De Toekomst Van Europese Aandelen In Vergelijking Met Wall Street

May 25, 2025

De Toekomst Van Europese Aandelen In Vergelijking Met Wall Street

May 25, 2025 -

Porsche Investicijos I Elektromobiliu Infrastruktura Europoje

May 25, 2025

Porsche Investicijos I Elektromobiliu Infrastruktura Europoje

May 25, 2025 -

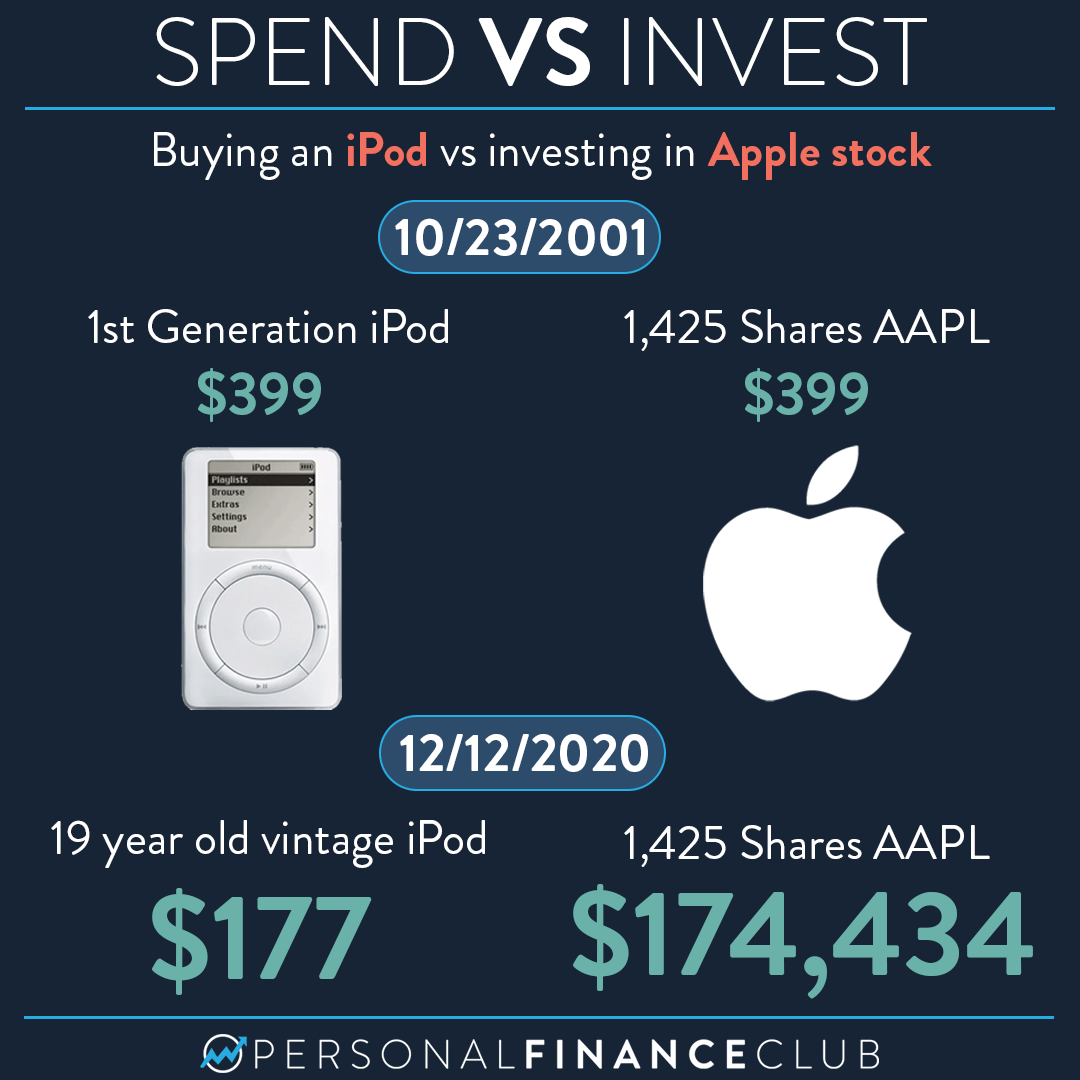

Should You Buy Apple Stock Now Wedbushs Take After Price Target Drop

May 25, 2025

Should You Buy Apple Stock Now Wedbushs Take After Price Target Drop

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025 -

Actress Mia Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 25, 2025

Actress Mia Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 25, 2025 -

Overnight Disasters 17 Celebrities Whose Careers Imploded

May 25, 2025

Overnight Disasters 17 Celebrities Whose Careers Imploded

May 25, 2025 -

From Fame To Shame 17 Celebrity Downfalls

May 25, 2025

From Fame To Shame 17 Celebrity Downfalls

May 25, 2025 -

17 Famous Faces How One Mistake Ruined Their Reputations

May 25, 2025

17 Famous Faces How One Mistake Ruined Their Reputations

May 25, 2025