Should You Buy Apple Stock Now? Wedbush's Take After Price Target Drop

Table of Contents

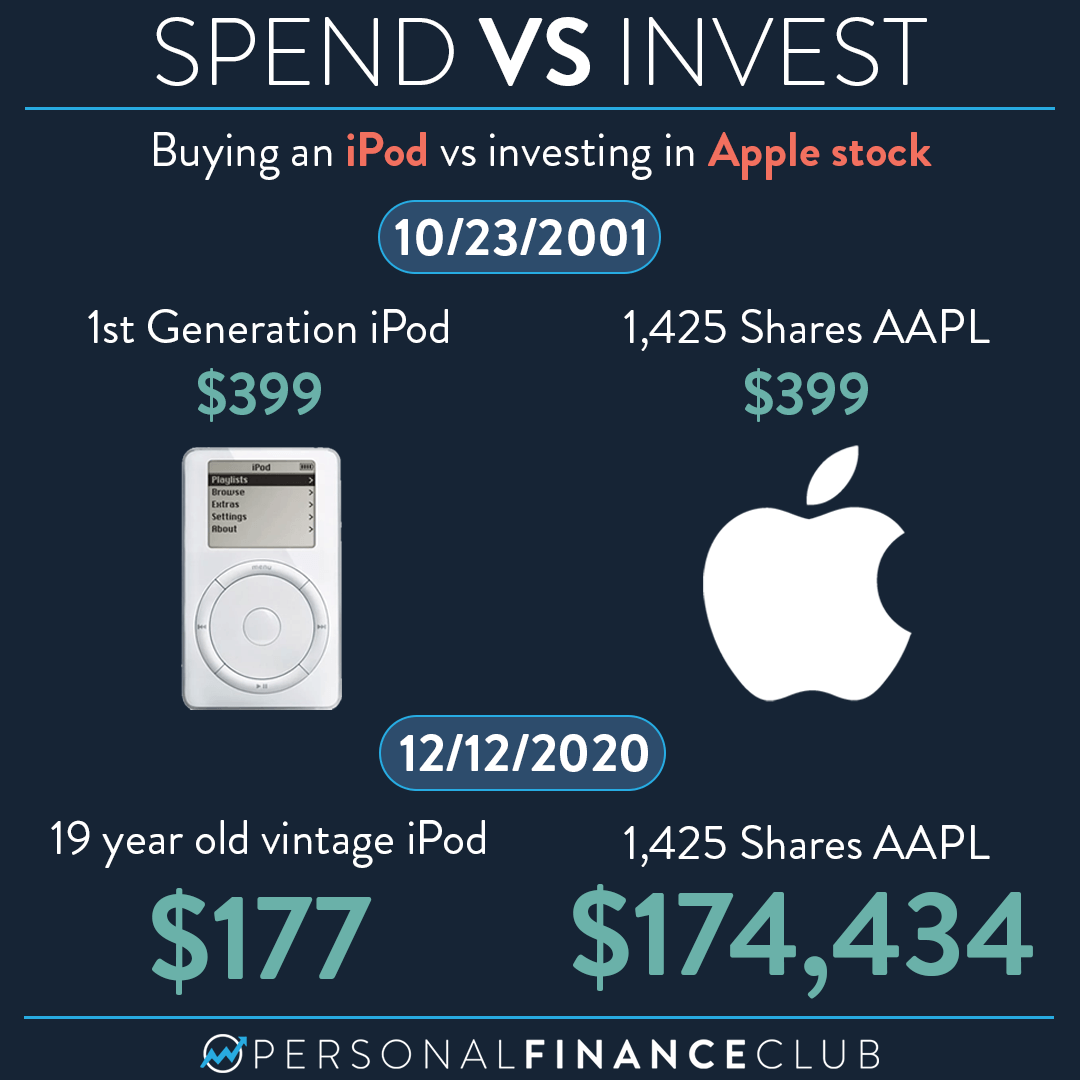

Wedbush's Price Target Revision: A Deep Dive

Wedbush Securities, a prominent investment bank, recently lowered its price target for Apple stock. Previously holding a more bullish outlook, they adjusted their prediction from [Insert Previous Price Target] to [Insert New Price Target]. This represents a [Percentage Change]% decrease.

The reasoning behind this downgrade, according to Wedbush's official report [Insert Link to Report Here], cites several factors:

- Concerns about iPhone sales: Slower-than-anticipated growth in iPhone sales, potentially driven by macroeconomic headwinds and increased competition.

- Impact of Inflation on Consumer Spending: Weakening consumer spending due to persistent inflation impacting discretionary purchases, including electronics.

- Supply Chain Disruptions: Lingering concerns about global supply chain disruptions impacting production and delivery timelines.

This revision doesn't necessarily signal a complete bearish outlook on Apple. It could simply reflect a more conservative assessment of near-term performance given the current economic climate. However, investors should carefully consider the implications of this change within their overall investment strategy.

Apple's Current Financial Health and Future Prospects

Despite Wedbush's adjusted target, Apple continues to demonstrate strong financial health. Recent quarters have shown impressive revenue generation [Insert Revenue Data], consistent earnings growth [Insert Earnings Data], and a healthy growth rate [Insert Growth Rate Data].

Analyzing Apple's key product lines offers a nuanced picture:

- iPhone: While facing potential headwinds, the iPhone still dominates the smartphone market and continues to generate substantial revenue.

- Services: Apple's services segment (App Store, Apple Music, iCloud, etc.) exhibits robust growth and provides a reliable revenue stream.

- Wearables: Apple Watch and AirPods continue to capture market share and contribute significantly to overall revenue.

- Emerging Technologies: Investments in areas like augmented reality (AR), virtual reality (VR), and autonomous vehicles represent potential future growth drivers.

However, potential risks remain:

- Intense Competition: Competition in the smartphone and tech markets is fierce, with companies like Samsung, Google, and others constantly innovating.

- Geopolitical Uncertainty: Global geopolitical events can impact supply chains and overall market stability.

- Economic Slowdown: A potential recession could significantly impact consumer spending on electronics.

Apple's innovation pipeline, however, offers a counterbalance to these risks. Rumored future product releases and software updates could potentially drive future stock performance.

Alternative Analyst Opinions and Market Sentiment

While Wedbush's revised price target is noteworthy, it's crucial to consider the broader analyst consensus. [Insert information on other analysts’ opinions and their price targets, citing sources]. This provides a more comprehensive understanding of market sentiment toward Apple stock.

Current market indicators, such as trading volume [Insert Data] and price-to-earnings ratio (P/E) [Insert Data], provide further context. [Include relevant charts and graphs here to visually represent the data]. The overall market sentiment appears to be [Insert – positive, negative, or neutral, and justify with supporting data].

Strategies for Investing in Apple Stock (Considering the Price Drop)

Given Wedbush's lowered price target, investors have several options:

- Dollar-Cost Averaging (DCA): Investing a fixed amount regularly, regardless of price fluctuations, can mitigate risk.

- Buying the Dip: Taking advantage of a perceived price drop to purchase more shares.

- Waiting for Further Adjustments: Adopting a wait-and-see approach to observe future price movements.

The best strategy depends on individual risk tolerance and investment goals. It's vital to diversify your portfolio and conduct thorough due diligence before making any investment decisions.

Conclusion: Should You Buy Apple Stock Now? A Final Verdict

Wedbush's price target reduction for Apple stock reflects concerns about near-term performance, particularly regarding iPhone sales and macroeconomic factors. However, Apple's strong financial health, consistent growth in services, and innovative product pipeline offer a counterbalance. There is no definitive "yes" or "no" answer to whether you should buy Apple stock now. The decision hinges on your individual risk tolerance, investment horizon, and thorough understanding of the market dynamics.

Remember, this analysis is for informational purposes only and doesn't constitute financial advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions. Make an informed decision about whether to buy Apple stock today, considering your personal circumstances and risk appetite. Learn more about investing in Apple stock and developing your investment strategy to make the best choice for your financial future.

Featured Posts

-

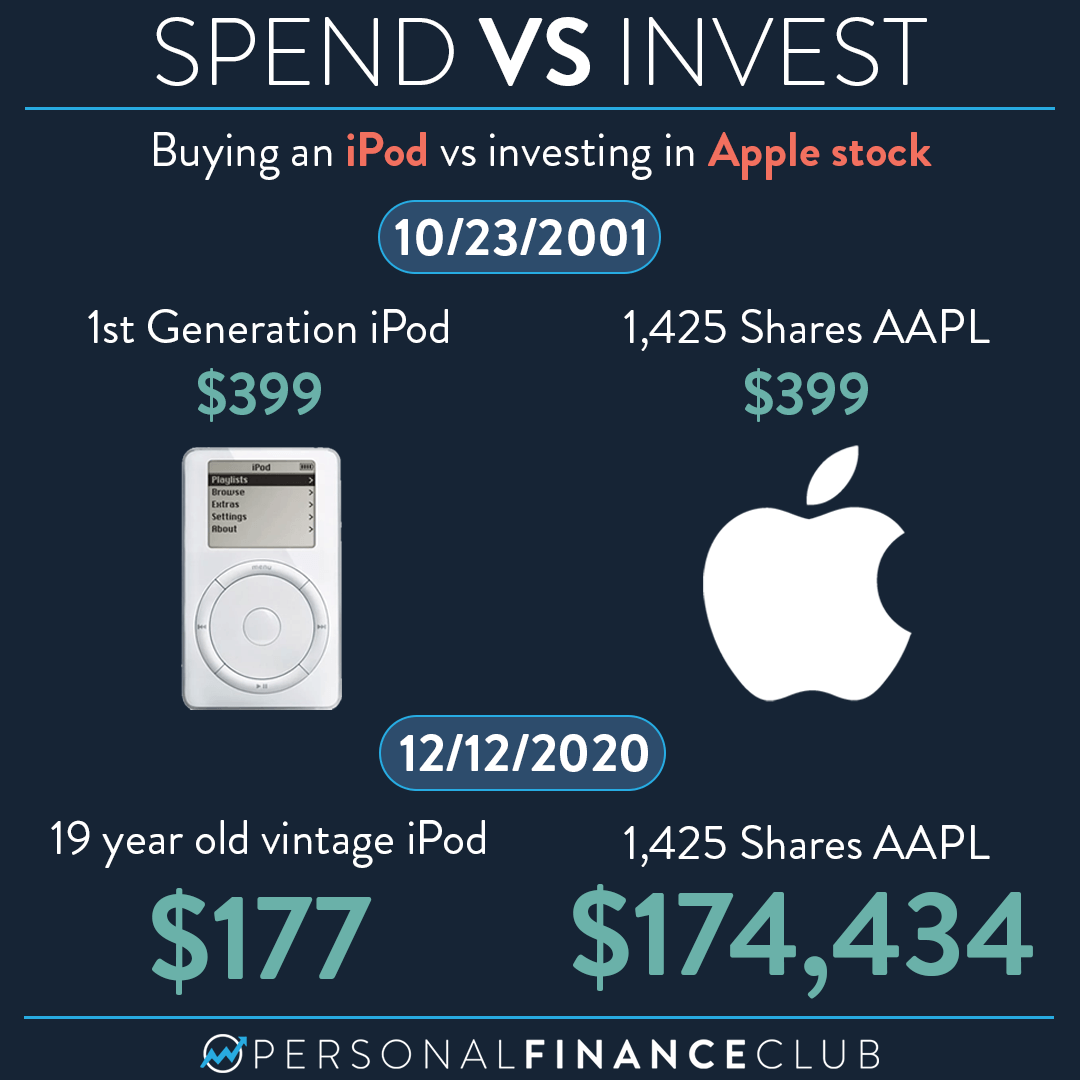

Trumps Campaign Against Top Law Firms Faces Another Defeat

May 25, 2025

Trumps Campaign Against Top Law Firms Faces Another Defeat

May 25, 2025 -

Planning Your Memorial Day Trip The Best And Worst Flight Days In 2025

May 25, 2025

Planning Your Memorial Day Trip The Best And Worst Flight Days In 2025

May 25, 2025 -

Shes Still Waiting By The Phone A Personal Account

May 25, 2025

Shes Still Waiting By The Phone A Personal Account

May 25, 2025 -

Iam Expat Fair Housing Options Financial Advice And Kids Activities

May 25, 2025

Iam Expat Fair Housing Options Financial Advice And Kids Activities

May 25, 2025 -

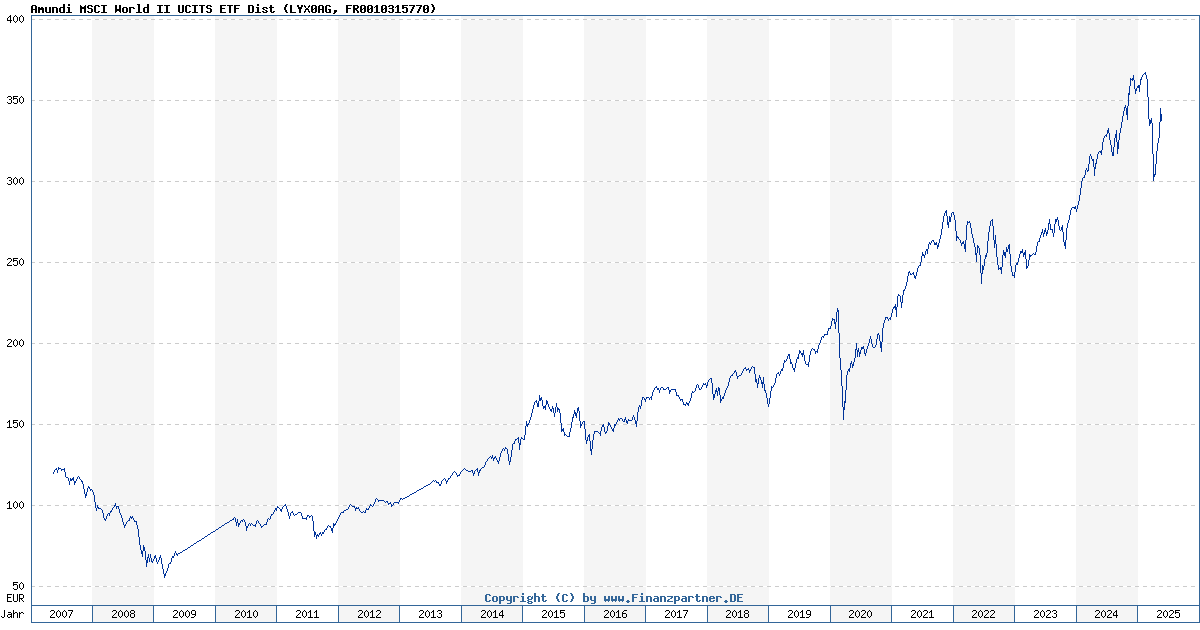

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Deep Dive Into Nav Performance

May 25, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Deep Dive Into Nav Performance

May 25, 2025

Latest Posts

-

Hair Trimmers Used In Attempted Jailbreak Louisiana Inmates Escape Plan

May 25, 2025

Hair Trimmers Used In Attempted Jailbreak Louisiana Inmates Escape Plan

May 25, 2025 -

Black Lives Matter Plaza A Reflection On Protest And Public Space

May 25, 2025

Black Lives Matter Plaza A Reflection On Protest And Public Space

May 25, 2025 -

New Orleans Jailbreak Inmates Allegedly Use Hair Trimmers In Escape Attempt

May 25, 2025

New Orleans Jailbreak Inmates Allegedly Use Hair Trimmers In Escape Attempt

May 25, 2025 -

The Short Lived Black Lives Matter Plaza A Case Study In Political Change

May 25, 2025

The Short Lived Black Lives Matter Plaza A Case Study In Political Change

May 25, 2025 -

Louisiana Inmates Hair Trimmer Escape Attempt New Orleans Jail Break

May 25, 2025

Louisiana Inmates Hair Trimmer Escape Attempt New Orleans Jail Break

May 25, 2025