Amsterdam Stock Market Volatility: 7% Drop At Open Due To Trade War

Table of Contents

The Impact of the Trade War on the Amsterdam Stock Market

The escalating global trade war is a primary driver of the Amsterdam Stock Market's volatility. Increased protectionist measures, tariffs, and sanctions create significant uncertainty, directly impacting investor confidence and leading to market instability. This uncertainty discourages investment and slows economic growth.

-

Increased uncertainty impacting investor confidence: The ongoing trade disputes create a climate of unpredictability, making it difficult for businesses to plan for the future and for investors to make informed decisions. This uncertainty often translates to a reluctance to invest, leading to decreased market activity and price drops.

-

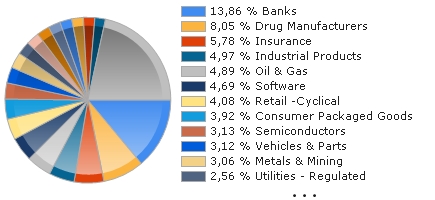

Specific sectors heavily impacted (e.g., technology, export-oriented industries): Companies heavily reliant on international trade, such as those in the technology and export-oriented sectors, are particularly vulnerable. These businesses face higher costs due to tariffs and potential disruptions to their supply chains, directly impacting their profitability and share prices. For example, a significant Dutch exporter of agricultural products might see its stock price decline sharply due to newly imposed tariffs.

-

Analysis of the AEX index's performance in relation to global market trends: The AEX Index, a key indicator of the Amsterdam Stock Exchange's performance, mirrors global trends, particularly reacting strongly to news regarding trade negotiations. Its sharp drop this morning is directly linked to negative global market sentiment fueled by trade war anxieties.

-

Comparison to other European stock markets' reactions to the trade war: While other European markets have also experienced volatility, the 7% drop in Amsterdam suggests a particularly strong sensitivity to trade war anxieties, possibly reflecting the Netherlands' highly export-oriented economy and its significant reliance on international trade.

Analyzing the 7% Drop: Immediate Causes and Contributing Factors

The 7% plunge wasn't solely due to long-term trade war anxieties; immediate factors exacerbated the situation.

-

Overnight news and announcements impacting investor sentiment: Negative news reports concerning trade negotiations overnight likely contributed to the sell-off. Announcements regarding new tariffs or breakdowns in talks can trigger immediate and dramatic market reactions.

-

Reaction to specific economic indicators released before market open: The release of unfavorable economic indicators before the market opened, such as disappointing manufacturing data or a decline in consumer confidence, might have further fueled the sell-off. This creates a negative feedback loop, amplifying existing anxieties.

-

Potential short-selling or panic selling contributing to the sharp decline: Short-selling, where investors bet against a stock's price, can accelerate downward trends. Coupled with panic selling, where investors rush to sell their holdings to minimize potential losses, this can result in a dramatic market drop like the one witnessed today.

Potential Long-Term Consequences for the Dutch Economy

The stock market's volatility poses significant risks to the Dutch economy.

-

Potential impact on GDP growth: A prolonged period of market instability can negatively affect business investment, consumer spending, and overall economic growth, potentially leading to a slowdown in GDP growth.

-

Possible increase in unemployment rates: If businesses struggle due to decreased demand and increased costs, they may resort to layoffs, leading to a rise in unemployment rates.

-

Effects on consumer spending and confidence: Market volatility often erodes consumer confidence, causing people to reduce their spending, further dampening economic activity.

-

The role of government intervention or policy responses: The Dutch government may need to intervene through fiscal or monetary policies to mitigate the negative economic consequences, such as lowering interest rates or implementing stimulus packages.

Strategies for Investors Navigating Amsterdam Stock Market Volatility

Navigating this turbulent period requires prudent investment strategies.

-

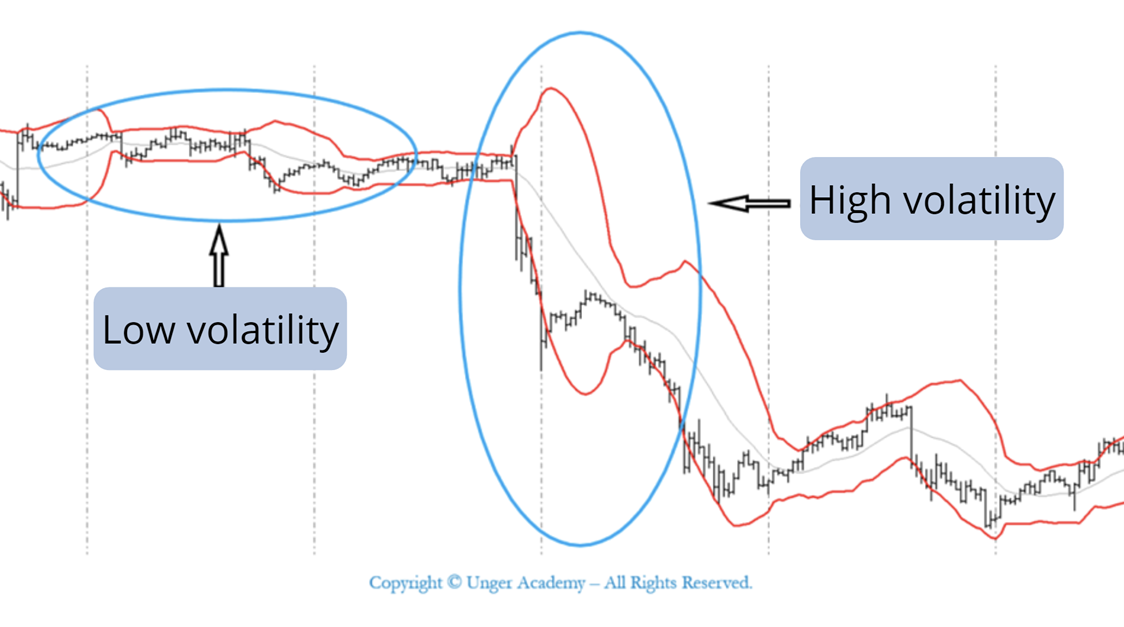

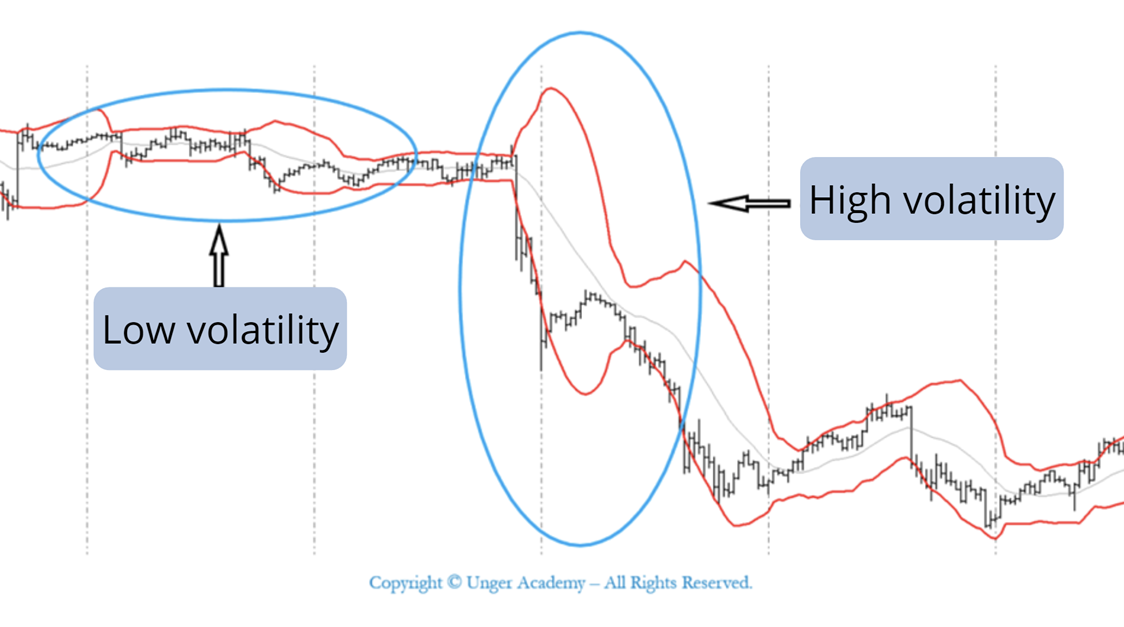

Importance of diversification and risk management: Diversifying your investment portfolio across different asset classes and geographic regions is crucial to mitigate risk. This reduces the impact of a single sector or market's downturn on your overall investment performance.

-

Strategies for mitigating losses and protecting investments: Consider employing strategies like stop-loss orders to limit potential losses or shifting to less volatile investments during periods of high uncertainty.

-

The long-term perspective on stock market fluctuations: Remember that stock markets are inherently volatile. A long-term investment strategy, focusing on the overall growth potential rather than short-term fluctuations, is generally advisable.

-

Consideration of alternative investment options: Explore alternative investment options such as bonds or real estate, which tend to be less volatile than stocks, to balance your portfolio.

Conclusion

The 7% drop in the Amsterdam Stock Market highlights the significant impact of the global trade war and underscores the need for careful investment strategies. The potential long-term consequences for the Dutch economy are substantial, and investors need to adapt their portfolios to mitigate risks. Staying informed about Amsterdam Stock Market volatility and its impact on your investments is paramount. Regularly monitor the AEX index and other relevant economic indicators to make informed decisions. Consider consulting a financial advisor for personalized guidance on navigating Amsterdam Stock Market volatility.

Featured Posts

-

Amundi Msci World Ex Us Ucits Etf A Deep Dive Into Net Asset Value

May 25, 2025

Amundi Msci World Ex Us Ucits Etf A Deep Dive Into Net Asset Value

May 25, 2025 -

Escape To The Country Top Locations For A Tranquil Lifestyle

May 25, 2025

Escape To The Country Top Locations For A Tranquil Lifestyle

May 25, 2025 -

Is The Glastonbury 2025 Lineup A Letdown Fan Reactions

May 25, 2025

Is The Glastonbury 2025 Lineup A Letdown Fan Reactions

May 25, 2025 -

Addressing Stock Market Valuation Worries Insights From Bof A

May 25, 2025

Addressing Stock Market Valuation Worries Insights From Bof A

May 25, 2025 -

A Successful Escape To The Country Tips For A Smooth Transition

May 25, 2025

A Successful Escape To The Country Tips For A Smooth Transition

May 25, 2025

Latest Posts

-

Trump Vs Europe The Trade Disputes And Their Underlying Causes

May 25, 2025

Trump Vs Europe The Trade Disputes And Their Underlying Causes

May 25, 2025 -

Why Did Trump Attack European Trade Policies A Deep Dive Into His Rationale

May 25, 2025

Why Did Trump Attack European Trade Policies A Deep Dive Into His Rationale

May 25, 2025 -

Trumps Pressure Tactics Forcing A Republican Deal

May 25, 2025

Trumps Pressure Tactics Forcing A Republican Deal

May 25, 2025 -

Buy And Hold Facing The Uncomfortable Truths Of Long Term Investing

May 25, 2025

Buy And Hold Facing The Uncomfortable Truths Of Long Term Investing

May 25, 2025 -

Apple Ceo Tim Cooks Troubled Year A Deeper Look

May 25, 2025

Apple Ceo Tim Cooks Troubled Year A Deeper Look

May 25, 2025