Amundi DJIA UCITS ETF: A Deep Dive Into Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and Why is it Important?

Net Asset Value (NAV) represents the per-share value of an ETF's underlying assets. Simply put, it's the total value of all the stocks held within the Amundi DJIA UCITS ETF, minus any liabilities (like expenses), divided by the total number of outstanding shares. Understanding NAV is crucial for several reasons:

- NAV reflects the true value of the ETF's holdings. It provides a snapshot of the intrinsic worth of your investment, based on the current market value of the underlying DJIA components.

- NAV helps compare ETF prices to intrinsic value. This comparison allows you to identify potential opportunities or risks. A significant difference between NAV and market price might indicate arbitrage possibilities or market inefficiencies.

- Tracking NAV changes reveals performance over time. By monitoring NAV fluctuations, you can accurately assess the growth or decline of your investment, independent of market price volatility.

- Essential for calculating returns and assessing investment growth. NAV is the foundational figure for calculating your investment's return on investment (ROI) and overall growth trajectory.

How is the Amundi DJIA UCITS ETF's NAV Calculated?

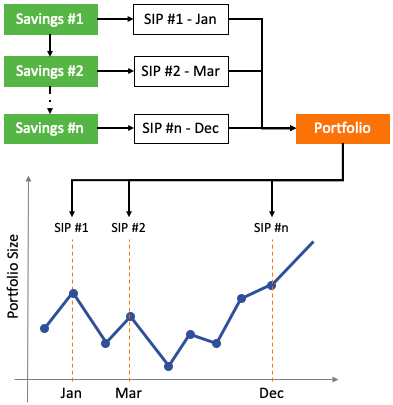

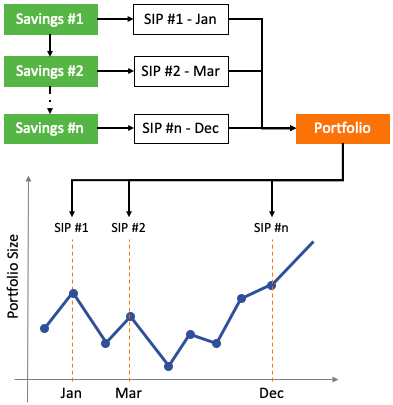

The Amundi DJIA UCITS ETF's NAV is calculated daily by a process that mirrors the valuation of its underlying assets. The formula is relatively straightforward:

NAV = (Total Market Value of Holdings - Liabilities) / Number of Outstanding Shares

- Breakdown of the calculation formula: The total market value of holdings is determined by adding up the current market price of each stock in the DJIA portfolio held by the ETF, weighted according to their representation in the index. Liabilities include management fees, administrative costs, and other expenses associated with running the fund.

- Explanation of how the DJIA's performance directly impacts the NAV: Since the ETF tracks the DJIA, the ETF's NAV will generally move in line with the index's performance. A rise in the DJIA usually leads to a rise in the ETF's NAV, and vice versa.

- Factors that could influence NAV besides DJIA performance: While the DJIA is the primary driver, currency fluctuations (if the ETF holds international securities) and dividend payouts from the underlying companies can also impact the NAV.

- Frequency of NAV calculation (daily, etc.): The NAV is typically calculated at the close of each trading day, reflecting the end-of-day market values of the DJIA components.

Factors Affecting the Amundi DJIA UCITS ETF's NAV:

Several factors beyond the simple DJIA performance directly influence the Amundi DJIA UCITS ETF's NAV:

-

Market movements impacting the DJIA: Broad market trends, sector-specific performance, and individual stock movements within the DJIA all affect the NAV. A market crash, for instance, would negatively impact the NAV.

-

Influence of dividends and corporate actions: Dividend payouts from the underlying companies increase the cash holdings of the ETF, boosting the NAV. Similarly, corporate actions like stock splits or mergers can alter the NAV calculation.

-

Expense ratios or management fees impacting NAV: These fees, while typically small, are deducted from the ETF's assets and thus indirectly reduce the NAV.

-

Specific examples of DJIA events affecting the NAV: A significant increase in the tech sector could positively impact the NAV if technology stocks have a larger weighting within the DJIA. Conversely, a decline in the financial sector could negatively impact it.

-

How dividend payouts influence NAV: Dividends received by the ETF are reinvested or distributed to shareholders, impacting the NAV depending on the distribution policy.

-

The impact of stock splits or mergers on the ETF's NAV: These events adjust the number of shares and their respective values, necessitating recalculation of the NAV.

-

Transparency of fee structures and their influence on NAV: The expense ratio is publicly disclosed and impacts the NAV through reductions in the fund's total asset value.

NAV vs. Market Price: Understanding the Difference

The NAV and the market price of the Amundi DJIA UCITS ETF are not always identical. The market price is determined by supply and demand in the secondary market, while the NAV reflects the intrinsic value of the underlying assets.

- Reasons for discrepancies (supply and demand, trading fees): Differences arise due to market forces, trading volume, and transaction costs. High demand might push the market price above NAV (premium), while low demand might push it below (discount).

- How to interpret a premium or discount relative to NAV: A premium might suggest market optimism, while a discount could signal pessimism or temporary market inefficiencies.

- Risks associated with trading at a significant premium or discount: Significant premiums or discounts involve greater risk, as the market price may revert to a level closer to the NAV over time. Arbitrage opportunities exist for traders who can exploit these differences.

Conclusion

This deep dive into the Net Asset Value (NAV) of the Amundi DJIA UCITS ETF highlights its crucial role in understanding investment performance and making informed decisions. By understanding the factors influencing NAV and its relationship to the market price, investors can better assess the true value of their holdings and make more effective investment choices. Regularly monitoring the Amundi DJIA UCITS ETF's NAV, along with the DJIA itself, is essential for successful long-term investing. For a comprehensive understanding of your Amundi DJIA UCITS ETF investments, consider consulting a financial advisor. Remember that understanding Amundi DJIA UCITS ETF NAV is key to responsible ETF investing.

Featured Posts

-

Amundi Msci World Catholic Principles Ucits Etf Nav Calculation And Importance

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Nav Calculation And Importance

May 24, 2025 -

Demna Gvasalia Reimagining Guccis Brand Identity

May 24, 2025

Demna Gvasalia Reimagining Guccis Brand Identity

May 24, 2025 -

The Ultimate Porsche Macan Buyers Guide Models Specs And Pricing

May 24, 2025

The Ultimate Porsche Macan Buyers Guide Models Specs And Pricing

May 24, 2025 -

Koezuti Porsche F1 Motorral Felszerelve

May 24, 2025

Koezuti Porsche F1 Motorral Felszerelve

May 24, 2025 -

Live Concert Conchita Wurst And Jj At Eurovision Village Esc 2025

May 24, 2025

Live Concert Conchita Wurst And Jj At Eurovision Village Esc 2025

May 24, 2025

Latest Posts

-

Mia Farrows Career Revival The Influence Of Ronan Farrow

May 24, 2025

Mia Farrows Career Revival The Influence Of Ronan Farrow

May 24, 2025 -

Mia Farrows Comeback Is Ronan Farrow The Key

May 24, 2025

Mia Farrows Comeback Is Ronan Farrow The Key

May 24, 2025 -

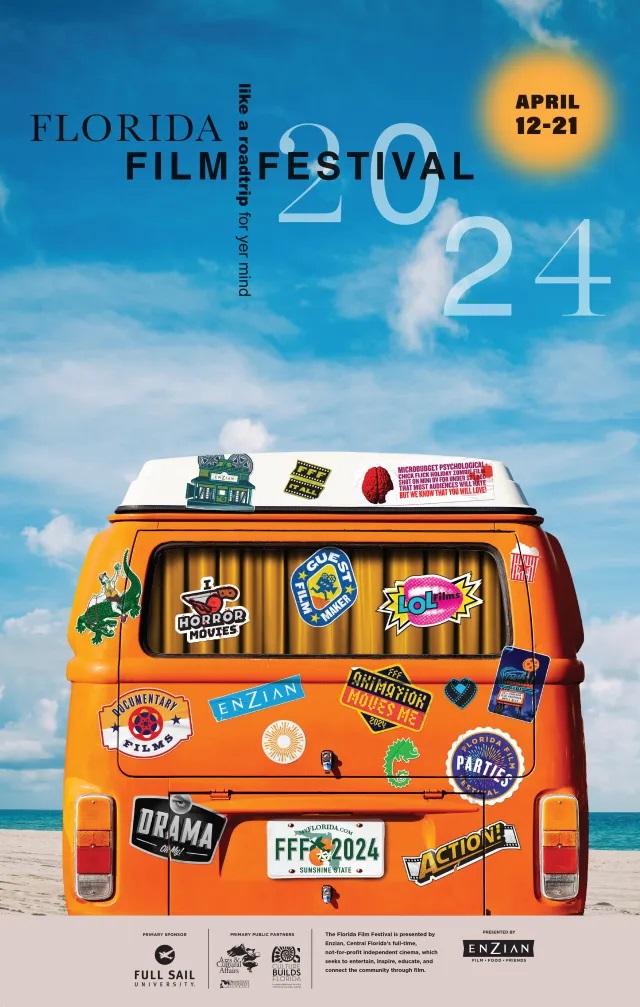

Florida Film Festival Past And Present Celebrity Appearances Featuring Mia Farrow And Christina Ricci

May 24, 2025

Florida Film Festival Past And Present Celebrity Appearances Featuring Mia Farrow And Christina Ricci

May 24, 2025 -

Ronan Farrows Role In Mia Farrows Potential Comeback

May 24, 2025

Ronan Farrows Role In Mia Farrows Potential Comeback

May 24, 2025 -

Celebrities At The Florida Film Festival Mia Farrow Christina Ricci And More

May 24, 2025

Celebrities At The Florida Film Festival Mia Farrow Christina Ricci And More

May 24, 2025