Amundi MSCI World Catholic Principles UCITS ETF: NAV Calculation And Importance

Table of Contents

Understanding the Amundi MSCI World Catholic Principles UCITS ETF

The Amundi MSCI World Catholic Principles UCITS ETF tracks the MSCI World Catholic Principles Index. This index represents a carefully selected portfolio of companies that meet specific ethical criteria aligned with Catholic social teachings. These criteria exclude companies involved in activities considered morally objectionable, such as those related to:

- Arms manufacturing

- Pornography

- Gambling

- Alcohol production

- Abortion-related services

This rigorous ethical screening process makes the ETF an attractive option for investors seeking socially responsible investments (SRI), ESG (Environmental, Social, and Governance) investing, and sustainable investing opportunities. The target market includes individuals and institutions prioritizing both financial returns and ethical considerations in their investment strategies.

Detailed Breakdown of NAV Calculation

The Net Asset Value (NAV) of the Amundi MSCI World Catholic Principles UCITS ETF, like any ETF, represents the net value of its underlying assets per share. The NAV calculation is a crucial aspect of understanding the ETF's performance. It's determined by considering several key components:

- Market Value of Assets: This is the total market value of all the securities held within the ETF portfolio. This is determined daily based on closing prices.

- Total Liabilities: These include all expenses and obligations associated with managing the ETF, such as management fees and other operational costs.

- Number of Outstanding Shares: This refers to the total number of ETF shares currently held by investors.

A simplified formula for calculating the NAV is:

NAV = (Total Assets - Total Liabilities) / Number of Outstanding Shares

The NAV is typically calculated daily by the fund manager, Amundi, and verified by the custodian bank responsible for safeguarding the ETF's assets. This daily calculation provides investors with an up-to-date valuation of their investment.

The Importance of Monitoring the Amundi MSCI World Catholic Principles UCITS ETF NAV

Monitoring the NAV of the Amundi MSCI World Catholic Principles UCITS ETF is essential for several reasons:

- Tracking ETF Performance: Changes in the NAV directly reflect the ETF's performance over time. A rising NAV indicates positive performance, while a falling NAV suggests negative performance.

- Buy/Sell Decisions: Investors often use NAV data as an indicator to inform their buy and sell decisions. Comparing the NAV with the ETF's trading price can reveal potential buying or selling opportunities (premium or discount).

- Return on Investment (ROI): By tracking the NAV, investors can easily monitor their returns and assess the overall success of their investment in the ETF.

- Portfolio Performance: The NAV plays a key role in calculating overall portfolio performance, particularly for investors holding multiple assets.

Finding the NAV is straightforward; it's usually available on the Amundi website, major financial data platforms (like Bloomberg or Refinitiv), and on many brokerage account platforms.

Factors Affecting the Amundi MSCI World Catholic Principles UCITS ETF NAV

Several factors influence the NAV of the Amundi MSCI World Catholic Principles UCITS ETF:

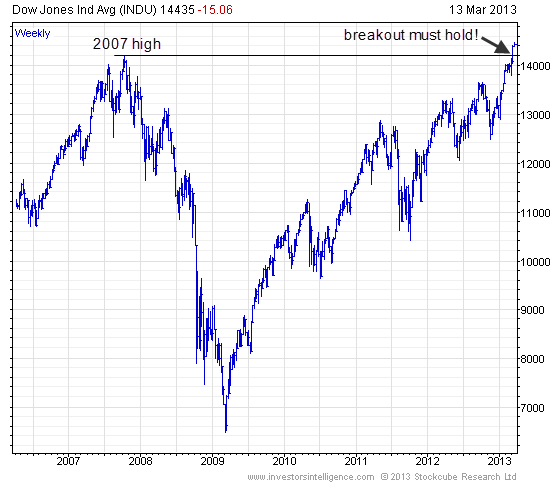

- Market Fluctuations: Like any investment, the NAV is affected by market volatility. A downturn in the overall market will typically lead to a decrease in the NAV, and vice versa.

- Currency Exchange Rates: Given the global nature of the underlying index, currency fluctuations can impact the NAV if holdings are denominated in currencies other than the ETF's base currency.

- Dividend Distributions: When companies within the ETF pay dividends, the NAV will typically adjust downward to reflect the distribution. This doesn't represent a loss; the dividend income is usually paid separately to investors.

- Portfolio Rebalancing: Amundi will rebalance the portfolio periodically to maintain alignment with the index's weighting and to account for any changes in the underlying companies. This may cause minor fluctuations in the NAV.

Conclusion: Making Informed Decisions with Amundi MSCI World Catholic Principles UCITS ETF NAV Data

Understanding the NAV of the Amundi MSCI World Catholic Principles UCITS ETF is crucial for effectively monitoring its performance and making informed investment decisions. Regularly checking the NAV, along with understanding the factors that influence it, empowers investors to track their returns and assess the success of their investment aligned with their ethical and financial goals. Remember to consult the ETF provider's official documentation for detailed information and disclosures. Learn more about the Amundi MSCI World Catholic Principles UCITS ETF and its NAV calculation to make informed investment decisions aligned with your ethical and financial goals. [Link to Amundi Website]

Featured Posts

-

Escape To The Country Top Destinations For A Relaxing Getaway

May 24, 2025

Escape To The Country Top Destinations For A Relaxing Getaway

May 24, 2025 -

Escape To The Country Dream Homes Under 1 Million

May 24, 2025

Escape To The Country Dream Homes Under 1 Million

May 24, 2025 -

The Kyle Walker And Annie Kilner Situation A Breakdown Of Recent Events

May 24, 2025

The Kyle Walker And Annie Kilner Situation A Breakdown Of Recent Events

May 24, 2025 -

M62 Westbound Closure Manchester To Warrington Resurfacing Works

May 24, 2025

M62 Westbound Closure Manchester To Warrington Resurfacing Works

May 24, 2025 -

Emergency Services Respond To Major Crash Road Closure In Effect

May 24, 2025

Emergency Services Respond To Major Crash Road Closure In Effect

May 24, 2025

Latest Posts

-

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav Explained

May 24, 2025

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav Explained

May 24, 2025 -

She Still Waiting By The Phone A Study In Patience And Perseverance

May 24, 2025

She Still Waiting By The Phone A Study In Patience And Perseverance

May 24, 2025 -

The Phone Rings A Look At She Still Waiting By The Phone

May 24, 2025

The Phone Rings A Look At She Still Waiting By The Phone

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf A Deep Dive Into Net Asset Value

May 24, 2025 -

Waiting By The Phone The Lingering Power Of A Simple Gesture

May 24, 2025

Waiting By The Phone The Lingering Power Of A Simple Gesture

May 24, 2025