Amundi DJIA UCITS ETF: Daily NAV And Its Significance

Table of Contents

Understanding the Amundi DJIA UCITS ETF

The Amundi DJIA UCITS ETF is an exchange-traded fund that tracks the performance of the Dow Jones Industrial Average. UCITS (Undertakings for Collective Investment in Transferable Securities) is a European Union regulatory framework ensuring investor protection and standardization for investment funds. This makes the Amundi DJIA UCITS ETF a suitable investment vehicle for European and international investors seeking exposure to the DJIA. The ETF boasts a low-cost structure and typically employs a full replication strategy, aiming to mirror the DJIA's composition precisely.

- Investment Objective: Tracking the DJIA performance as closely as possible.

- Underlying Asset: The 30 constituent stocks of the Dow Jones Industrial Average.

- Expense Ratio: [Insert the actual expense ratio here] – a competitively low fee compared to many similar ETFs.

- Currency: [Insert the base currency, e.g., EUR or USD].

Daily NAV Explained

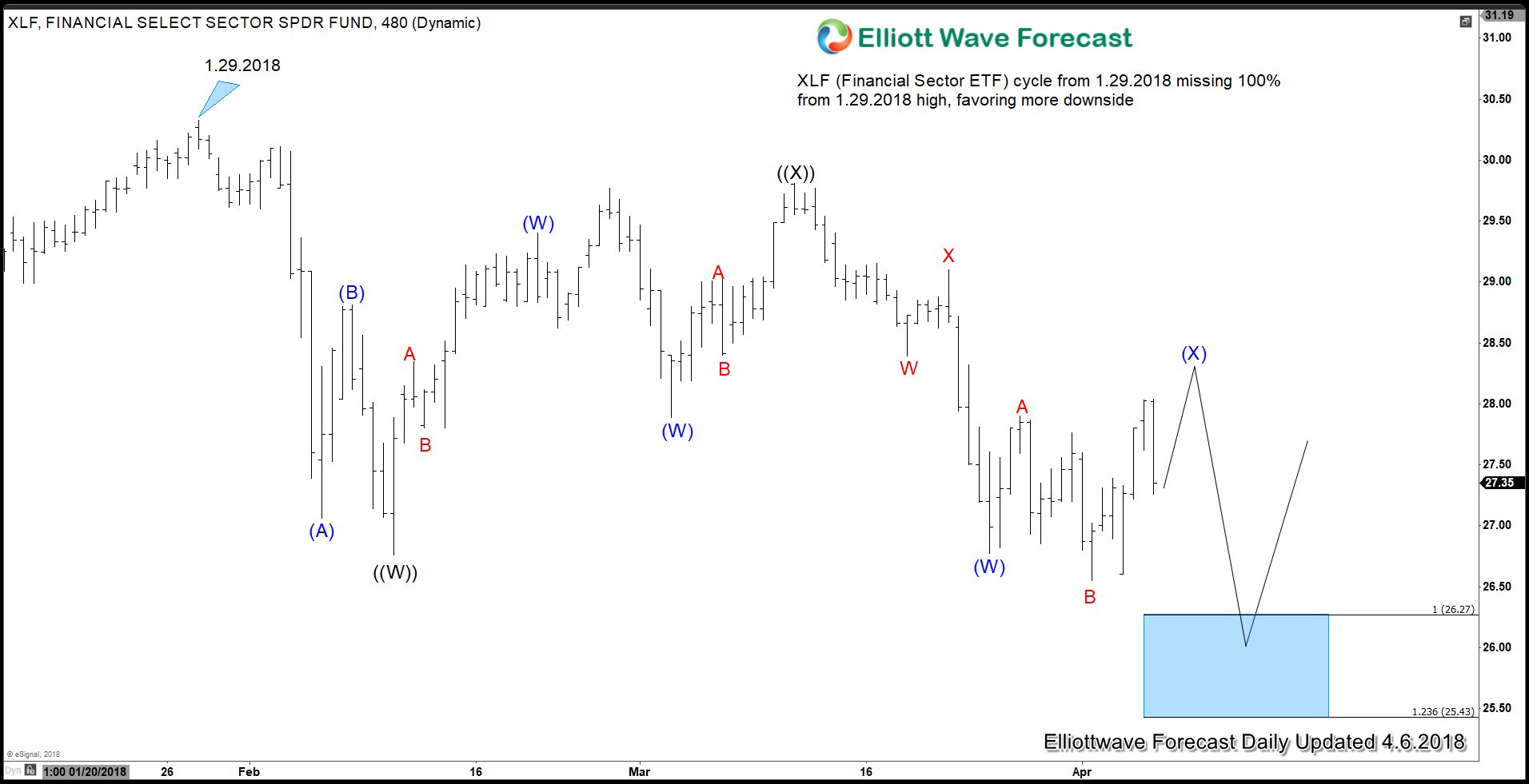

The Net Asset Value (NAV) is the value of a single share in the Amundi DJIA UCITS ETF. It's calculated daily by taking the total market value of all the ETF's holdings (the 30 DJIA stocks), subtracting any liabilities, and dividing by the total number of outstanding shares. This calculation reflects the current market price of the underlying assets.

- NAV Calculation Methodology: The NAV is typically calculated at the end of each trading day, using the closing prices of the 30 DJIA components.

- Factors Affecting NAV: The daily NAV fluctuates based on changes in the prices of the underlying DJIA stocks. Other factors such as currency exchange rates (if the ETF is not denominated in USD) can also impact the NAV.

- Where to Find the Daily NAV: You can find the daily NAV of the Amundi DJIA UCITS ETF on Amundi's official website, major financial news websites (like Bloomberg or Yahoo Finance), and through your brokerage account's platform.

The Significance of Daily NAV Monitoring

Monitoring the Amundi DJIA UCITS ETF Daily NAV is essential for several reasons:

- Performance Tracking: Comparing the daily NAV changes allows you to track the ETF's performance against the DJIA benchmark. This helps assess how effectively the ETF is replicating the index.

- Investment Decisions: Tracking the NAV can inform your buy and sell decisions. Strategies like dollar-cost averaging, where you invest a fixed amount at regular intervals regardless of the NAV, can be optimized using daily NAV data.

- Risk Assessment: Fluctuations in the daily NAV reflect the inherent market risk associated with investing in the DJIA. Significant drops in the NAV might signal a need to reassess your risk tolerance and investment strategy.

Amundi DJIA UCITS ETF vs. Other DJIA ETFs

Several ETFs track the DJIA; however, the Amundi DJIA UCITS ETF offers several potential advantages.

- Expense Ratio Comparison: Compare the Amundi ETF's expense ratio to other similar ETFs. A lower expense ratio translates to higher returns over the long term.

- Tracking Error Comparison: The tracking error measures how closely the ETF's performance mirrors the DJIA's. A lower tracking error is generally preferable.

- Distinctive Features: [Mention any specific features, such as responsible investing options or dividend reinvestment plans offered by the Amundi ETF].

Conclusion

Understanding the daily NAV of the Amundi DJIA UCITS ETF is crucial for investors seeking exposure to the Dow Jones Industrial Average. By regularly monitoring the NAV, investors can effectively track performance, make informed investment decisions, and assess market risk. While other DJIA ETFs exist, the Amundi DJIA UCITS ETF offers a compelling option due to its low expense ratio and generally low tracking error. Therefore, staying informed about the Amundi DJIA UCITS ETF daily NAV and its implications is essential for maximizing returns from your investment. Regularly check the daily NAV to optimize your investment strategy in the Amundi DJIA UCITS ETF.

Featured Posts

-

Sean Penns Support For Woody Allen A Me Too Blind Spot

May 25, 2025

Sean Penns Support For Woody Allen A Me Too Blind Spot

May 25, 2025 -

Onrust Op Amerikaanse Beurs Aex Klimt Ondanks Tegenwind

May 25, 2025

Onrust Op Amerikaanse Beurs Aex Klimt Ondanks Tegenwind

May 25, 2025 -

Glastonbury 2024 Unconfirmed Us Band Teases Festival Performance

May 25, 2025

Glastonbury 2024 Unconfirmed Us Band Teases Festival Performance

May 25, 2025 -

Amira Al Zuhair Models For Zimmermann In Paris Fashion Week

May 25, 2025

Amira Al Zuhair Models For Zimmermann In Paris Fashion Week

May 25, 2025 -

7 Plunge For Amsterdam Stocks Trade War Uncertainty Creates Market Volatility

May 25, 2025

7 Plunge For Amsterdam Stocks Trade War Uncertainty Creates Market Volatility

May 25, 2025

Latest Posts

-

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025 -

Actress Mia Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 25, 2025

Actress Mia Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 25, 2025 -

Overnight Disasters 17 Celebrities Whose Careers Imploded

May 25, 2025

Overnight Disasters 17 Celebrities Whose Careers Imploded

May 25, 2025 -

From Fame To Shame 17 Celebrity Downfalls

May 25, 2025

From Fame To Shame 17 Celebrity Downfalls

May 25, 2025 -

17 Famous Faces How One Mistake Ruined Their Reputations

May 25, 2025

17 Famous Faces How One Mistake Ruined Their Reputations

May 25, 2025