Amundi DJIA UCITS ETF (Distributing): A Guide To Net Asset Value

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated for Amundi DJIA UCITS ETF?

Net Asset Value (NAV) represents the net value of an ETF's underlying assets. For the Amundi DJIA UCITS ETF (Distributing), which tracks the Dow Jones Industrial Average (DJIA), the NAV reflects the total value of the ETF's holdings in the 30 constituent companies of the DJIA, minus its liabilities. Understanding the Amundi DJIA UCITS ETF NAV is key to evaluating its performance and your investment returns.

The calculation is relatively straightforward:

- Total asset value of the ETF: This is the sum of the market values of all the stocks held within the ETF portfolio, representing its investment in the DJIA companies.

- Total liabilities of the ETF: This includes expenses such as management fees and other operational costs.

- Number of outstanding shares: This is the total number of Amundi DJIA UCITS ETF shares currently held by investors.

The formula for calculating NAV is: (Total Asset Value - Total Liabilities) / Number of Outstanding Shares.

The Amundi DJIA UCITS ETF NAV is calculated daily, providing investors with an up-to-date reflection of the ETF's value. This daily NAV calculation ensures transparency and allows for accurate performance tracking.

Factors Affecting the Amundi DJIA UCITS ETF's NAV

Several factors influence the Amundi DJIA UCITS ETF's NAV. Understanding these influences is vital for informed investment decisions.

-

Market movements of the Dow Jones Industrial Average (DJIA): As the ETF tracks the DJIA, fluctuations in the index directly impact the NAV. A rise in the DJIA generally leads to an increase in the ETF's NAV, while a decline results in a lower NAV. This highlights the importance of monitoring market volatility.

-

Dividend payments from the underlying stocks: When the companies within the DJIA pay dividends, the ETF receives these payments, which can subsequently increase the NAV. However, remember that the Amundi DJIA UCITS ETF (Distributing) distributes these dividends to its shareholders, impacting the NAV accordingly.

-

Expense ratio impact: The expense ratio, representing the annual cost of managing the ETF, subtly reduces the NAV over time. It's important to consider the expense ratio when evaluating the overall performance and returns of your investment.

-

Currency fluctuations: While the DJIA is a US-dollar-denominated index, currency exchange rates can affect the NAV if you are investing in a currency other than USD. For example, a stronger US dollar against your local currency would reduce the NAV expressed in your local currency.

Using NAV to Evaluate Amundi DJIA UCITS ETF Performance

Investors use NAV data to track the Amundi DJIA UCITS ETF's performance over time. By comparing the NAV to previous periods, you can analyze trends and calculate returns. This comparative analysis is crucial in forming an effective investment strategy.

-

Comparing NAV to previous periods: Track the daily, weekly, or monthly NAV changes to understand the growth or decline of your investment.

-

Analyzing NAV trends: Identify long-term trends to assess the ETF's overall performance.

-

Calculating returns based on NAV changes: Determine your investment's returns based on the change in NAV.

-

Comparing NAV to market price: While the market price of the ETF usually closely tracks the NAV, slight discrepancies can sometimes present arbitrage opportunities. However, these are generally short-lived.

Where to Find Amundi DJIA UCITS ETF NAV Information

Reliable NAV data for the Amundi DJIA UCITS ETF is readily accessible through various sources:

-

Amundi website: The official Amundi website is the primary source for accurate and up-to-date NAV information.

-

Financial news websites: Many reputable financial news websites and portals provide real-time or delayed NAV data for ETFs.

-

Brokerage platforms: If you hold the Amundi DJIA UCITS ETF through a brokerage account, the platform will typically display the current NAV.

-

ETF data providers: Several specialized data providers offer comprehensive ETF information, including NAV data.

Conclusion: Mastering Amundi DJIA UCITS ETF (Distributing) NAV

Understanding the Amundi DJIA UCITS ETF's NAV is crucial for successful investment. By understanding how it's calculated, the factors affecting it, and how to interpret the data, you can make more informed decisions regarding your investment strategy. Learn more about this ETF and its Net Asset Value today, and take control of your investment journey!

Featured Posts

-

Classic Cars And Art Porsche Indonesia Classic Art Week 2025

May 24, 2025

Classic Cars And Art Porsche Indonesia Classic Art Week 2025

May 24, 2025 -

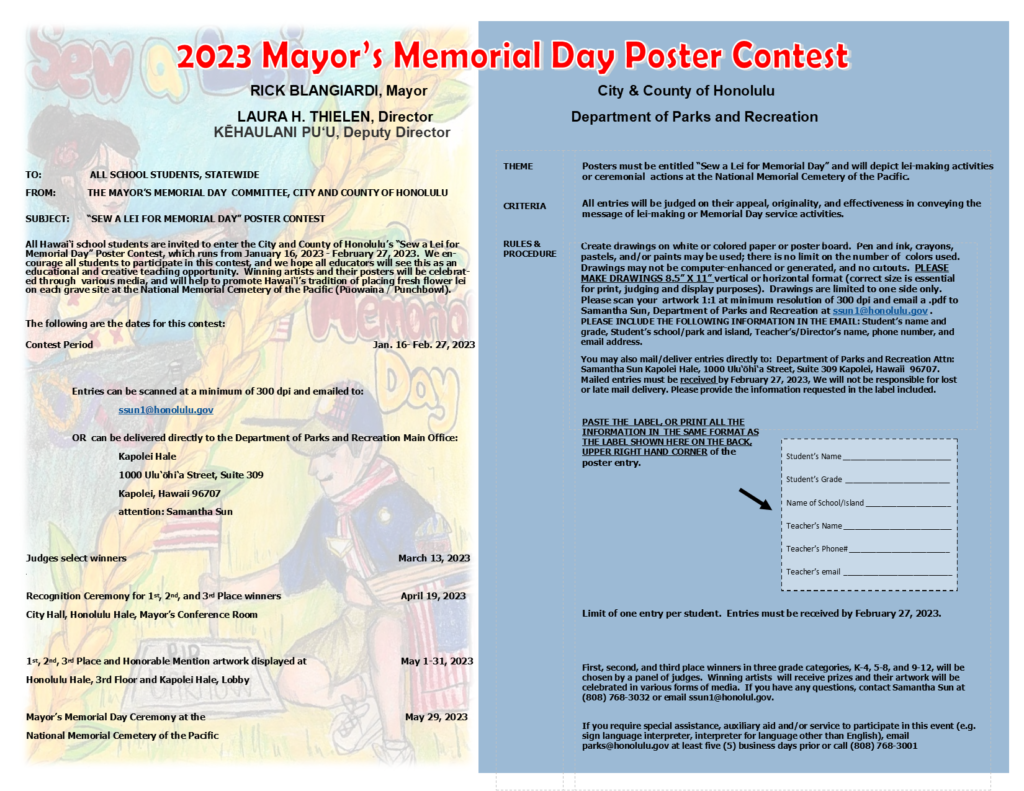

Hawaii Keiki Showcase Artistic Talents Sew A Lei For Memorial Day Poster Contest

May 24, 2025

Hawaii Keiki Showcase Artistic Talents Sew A Lei For Memorial Day Poster Contest

May 24, 2025 -

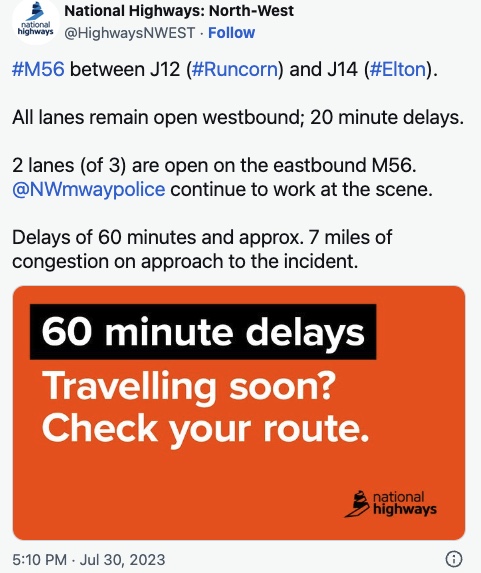

M56 Collision Cheshire Deeside Border Delays

May 24, 2025

M56 Collision Cheshire Deeside Border Delays

May 24, 2025 -

Amundi Msci World Ii Ucits Etf Dist Nav Calculation And Implications

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist Nav Calculation And Implications

May 24, 2025 -

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Net Asset Value Nav

May 24, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Net Asset Value Nav

May 24, 2025

Latest Posts

-

Mia Farrows Comeback Is Ronan Farrow The Key

May 24, 2025

Mia Farrows Comeback Is Ronan Farrow The Key

May 24, 2025 -

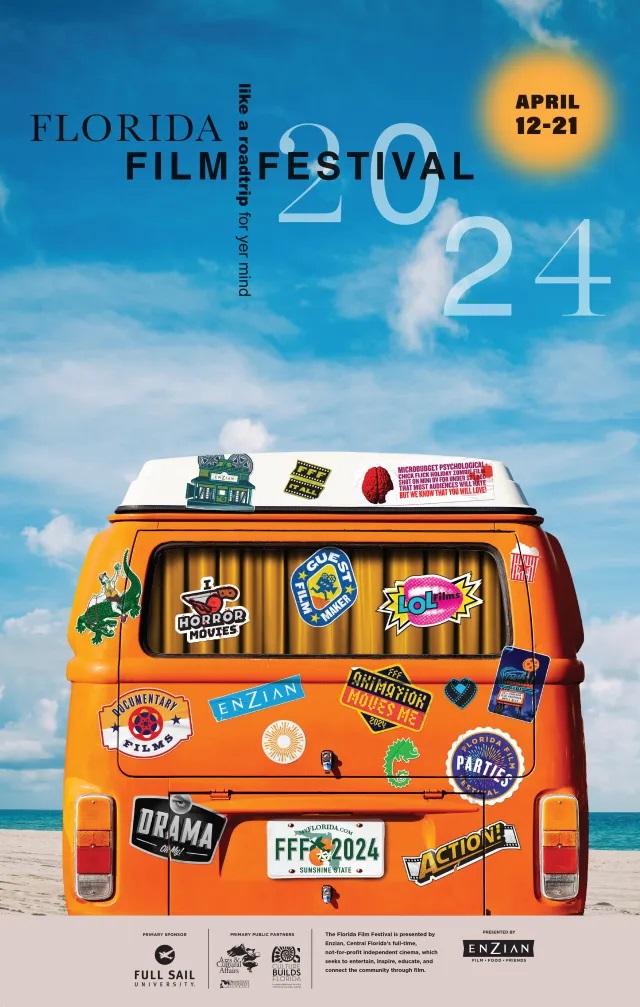

Florida Film Festival Past And Present Celebrity Appearances Featuring Mia Farrow And Christina Ricci

May 24, 2025

Florida Film Festival Past And Present Celebrity Appearances Featuring Mia Farrow And Christina Ricci

May 24, 2025 -

Ronan Farrows Role In Mia Farrows Potential Comeback

May 24, 2025

Ronan Farrows Role In Mia Farrows Potential Comeback

May 24, 2025 -

Celebrities At The Florida Film Festival Mia Farrow Christina Ricci And More

May 24, 2025

Celebrities At The Florida Film Festival Mia Farrow Christina Ricci And More

May 24, 2025 -

The Farrow Warning Trump Congress And The 3 4 Month Countdown For American Democracy

May 24, 2025

The Farrow Warning Trump Congress And The 3 4 Month Countdown For American Democracy

May 24, 2025