Amundi Dow Jones Industrial Average UCITS ETF: A Guide To Net Asset Value

Table of Contents

What is Net Asset Value (NAV) and How Does it Work?

Net Asset Value (NAV) represents the underlying value of an ETF's assets. For the Amundi Dow Jones Industrial Average UCITS ETF, the NAV reflects the total value of the ETF's holdings – primarily the 30 companies that make up the Dow Jones Industrial Average – minus its liabilities. This value is then divided by the number of outstanding shares to arrive at the NAV per share.

- Components of NAV Calculation:

- Market Value of Holdings: This is the most significant component, representing the current market price of all the stocks held within the ETF, weighted according to their representation in the DJIA index.

- Cash and Other Assets: The ETF may hold cash or other assets, which are also included in the NAV calculation.

- Liabilities: These include expenses such as management fees, administrative costs, and any other outstanding obligations.

The NAV is calculated daily by the ETF's custodian, a specialized financial institution responsible for safeguarding the ETF's assets. This process involves determining the market value of all holdings at the close of the market and then performing the calculations outlined above. Understanding this NAV calculation is essential for grasping the true value of your investment. The Amundi DJIA ETF, like most ETFs, is an asset-backed security, meaning its value is directly tied to the value of its underlying assets.

Factors Affecting the Amundi Dow Jones Industrial Average UCITS ETF's NAV

Several factors can influence the Amundi Dow Jones Industrial Average UCITS ETF's NAV. Fluctuations in the overall market are a primary driver.

- DJIA Performance: The performance of the Dow Jones Industrial Average directly impacts the ETF's NAV. Positive movement in the DJIA generally leads to a higher NAV, while negative movement leads to a lower NAV. Monitoring DJIA performance is, therefore, critical.

- Market Volatility: Periods of high market volatility can significantly affect the NAV, leading to larger daily fluctuations. Understanding market volatility and its potential impact is crucial for long-term investment planning.

- Currency Exchange Rates: While the DJIA is denominated in USD, investors outside the US may experience fluctuations in NAV due to currency risk if they hold the ETF in a different currency. These exchange rate changes can impact the overall value.

- Dividends: Dividends paid by the companies in the DJIA are usually reinvested into the ETF, influencing the NAV positively. However, a portion might be used to cover expense ratio which also affects the NAV.

- Expense Ratio: The ETF's expense ratio, which covers management fees and other operational costs, indirectly affects the NAV. These expenses are deducted from the total asset value before calculating the NAV per share.

Understanding the Difference Between NAV and Market Price

While the NAV represents the intrinsic value of the ETF, the market price reflects the price at which the ETF shares are traded on the exchange. There's often a small difference between these two values. This difference can result from:

- Bid-Ask Spread: The difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask).

- Trading Volume: Higher trading volume generally leads to a smaller discrepancy between NAV and market price, while low volume can create larger discrepancies. Price discovery is a dynamic process influenced by the interplay of supply and demand.

Accessing the Amundi Dow Jones Industrial Average UCITS ETF's NAV

Finding the daily NAV data for the Amundi Dow Jones Industrial Average UCITS ETF is relatively straightforward. You can usually find this information on:

- Amundi Website: The official Amundi website is the primary source for accurate and up-to-date daily NAV information.

- Financial News Sources: Reputable financial news websites and data providers often publish this data.

The NAV is typically updated daily, often at the close of the market, reflecting the final market values of the underlying assets. Regularly checking the real-time NAV or end-of-day NAV is crucial for monitoring your investment performance and making informed investment decisions.

Using NAV for Investment Strategies with the Amundi Dow Jones Industrial Average UCITS ETF

Understanding the NAV is key to using the Amundi DJIA ETF effectively within your investment strategy.

- Investment Performance Evaluation: By tracking NAV changes over time, you can assess the performance of your investment.

- Benchmarking: Comparing the Amundi DJIA ETF's NAV with other similar ETFs allows you to benchmark its performance. This enables benchmarking against competitors to make strategic decisions.

- Long-Term Investment: Analyzing long-term investment trends via NAV changes helps you understand the ETF’s overall performance over time, informing long-term investment decisions.

Conclusion: Mastering the Amundi Dow Jones Industrial Average UCITS ETF through NAV Understanding

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV is fundamental for successful investing in this ETF. This guide has highlighted the importance of NAV, its calculation, the factors influencing it, and the difference between NAV and market price. Remember to regularly check the ETF's NAV for informed decision-making and to monitor your investment performance. By mastering the concepts related to Amundi DJIA ETF NAV, you can enhance your investment strategy and navigate the market with greater confidence. To learn more about the Amundi Dow Jones Industrial Average UCITS ETF and other investment opportunities, visit the Amundi website [insert link here].

Featured Posts

-

Pengalaman Seni Dan Otomotif Porsche Indonesia Classic Art Week 2025

May 25, 2025

Pengalaman Seni Dan Otomotif Porsche Indonesia Classic Art Week 2025

May 25, 2025 -

Ecb Faiz Indirimi Avrupa Borsalarinda Karisik Bir Guen

May 25, 2025

Ecb Faiz Indirimi Avrupa Borsalarinda Karisik Bir Guen

May 25, 2025 -

Net Asset Value Nav Explained Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 25, 2025

Net Asset Value Nav Explained Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 25, 2025 -

Yurskiy V Mossovete Vecher Pamyati I Vospominaniy

May 25, 2025

Yurskiy V Mossovete Vecher Pamyati I Vospominaniy

May 25, 2025 -

Mia Farrows Future Ronan Farrows Influence

May 25, 2025

Mia Farrows Future Ronan Farrows Influence

May 25, 2025

Latest Posts

-

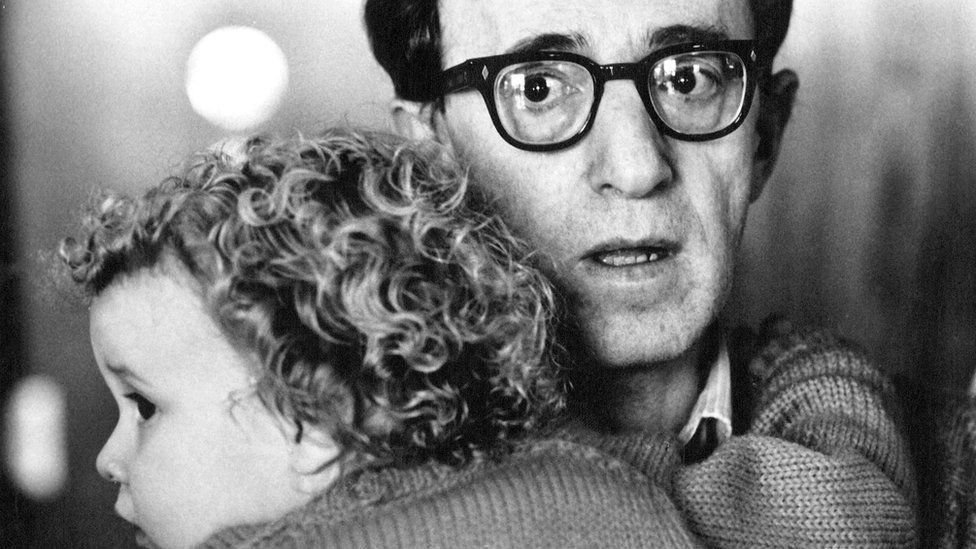

The Woody Allen Dylan Farrow Case Sean Penns Doubts

May 25, 2025

The Woody Allen Dylan Farrow Case Sean Penns Doubts

May 25, 2025 -

Woody Allen Sexual Assault Case Sean Penn Expresses Doubts

May 25, 2025

Woody Allen Sexual Assault Case Sean Penn Expresses Doubts

May 25, 2025 -

Sean Penns Skepticism Regarding Woody Allen And Dylan Farrows Allegations

May 25, 2025

Sean Penns Skepticism Regarding Woody Allen And Dylan Farrows Allegations

May 25, 2025 -

Dylan Farrows Woody Allen Accusation Sean Penns Skepticism

May 25, 2025

Dylan Farrows Woody Allen Accusation Sean Penns Skepticism

May 25, 2025 -

Sean Penn Questions Dylan Farrows Accusation Against Woody Allen

May 25, 2025

Sean Penn Questions Dylan Farrows Accusation Against Woody Allen

May 25, 2025