Net Asset Value (NAV) Explained: Amundi MSCI World II UCITS ETF USD Hedged Dist

Table of Contents

Calculating the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist

The Net Asset Value represents the net worth of an ETF per share. It's calculated using a simple formula:

(Total Assets - Total Liabilities) / Number of Outstanding Shares = NAV

Let's break down the components for the Amundi MSCI World II UCITS ETF USD Hedged Dist:

Total Assets: This includes the market value of all the underlying assets held by the ETF. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, this primarily consists of a diversified portfolio of global equities mirroring the MSCI World Index. The value fluctuates daily based on the market performance of these holdings.

Total Liabilities: These are the ETF's expenses and obligations, such as management fees, administrative costs, and any outstanding payable amounts.

Number of Outstanding Shares: This represents the total number of Amundi MSCI World II UCITS ETF USD Hedged Dist shares currently in circulation.

The Impact of Currency Hedging: The "USD Hedged" aspect means the ETF employs strategies to minimize the impact of currency fluctuations between the base currency of the underlying assets and the US dollar. This hedging can influence the NAV calculation, potentially reducing volatility but also introducing complexities. While hedging aims to provide stability, it's not a perfect safeguard, and unexpected currency movements can still subtly affect the NAV.

Simplified Example:

- Let's say the ETF's total assets are $100 million, total liabilities are $1 million, and there are 10 million outstanding shares.

- The NAV would be calculated as: ($100,000,000 - $1,000,000) / 10,000,000 = $9.90 per share.

NAV and ETF Pricing: How are they related?

The market price of the Amundi MSCI World II UCITS ETF USD Hedged Dist is the price at which you can buy or sell shares on the exchange. Ideally, the market price should closely track the NAV. However, it can sometimes trade at a premium or discount to the NAV.

Factors Affecting the Difference:

- Supply and Demand: High demand can push the market price above the NAV (premium), while low demand can cause it to trade below (discount).

- Trading Volume: High trading volume generally leads to a tighter correlation between NAV and market price.

- Market Sentiment: Investor sentiment towards the ETF and the overall market can influence the market price independently of the NAV.

Reasons for Premiums or Discounts:

- High Demand: Positive market outlook or anticipation of future growth can drive up demand, leading to a premium.

- Low Demand: Negative market sentiment or concerns about the ETF's performance might cause a discount.

- Arbitrage Opportunities: Significant discrepancies between NAV and market price can attract arbitrageurs who try to profit from the difference.

Using NAV to Evaluate the Amundi MSCI World II UCITS ETF USD Hedged Dist Performance

Investors use NAV to monitor the ETF's performance over time. By tracking daily or periodic NAV changes, you can assess the growth or decline of your investment. Comparing these NAV changes to the MSCI World Index, the benchmark for this ETF, helps determine if the ETF is performing in line with its reference index or outperforming/underperforming it. This comparison is crucial for judging the fund manager's skill in tracking the index. You can calculate your returns by comparing the initial NAV with the current NAV, taking into account any distributions received. Find the daily NAV on the Amundi ETF website.

Benefits of Monitoring NAV:

- Provides a clear picture of long-term growth.

- Helps in making informed buy/sell decisions.

- Allows for performance comparison with benchmark indices.

- Facilitates the calculation of returns on investment.

Understanding the Amundi MSCI World II UCITS ETF USD Hedged Dist Holdings and their Impact on NAV

The Amundi MSCI World II UCITS ETF USD Hedged Dist tracks the MSCI World Index, which represents a broad range of large and mid-cap equities across developed markets globally. This diversification strategy aims to minimize risk and contribute to NAV stability. Changes in the value of the underlying assets directly impact the ETF's NAV. For instance, a strong performance by a significant holding in the portfolio will likely increase the NAV, while underperformance will have the opposite effect.

Examples of NAV Impact:

- A significant increase in the share price of Apple (a major component of the MSCI World Index) will positively affect the ETF's NAV.

- A market downturn affecting technology companies, leading to declines in the value of several holdings, will negatively impact the NAV.

Conclusion: Mastering Net Asset Value (NAV) for Successful Amundi MSCI World II UCITS ETF USD Hedged Dist Investment

Understanding Net Asset Value is critical for any investor in the Amundi MSCI World II UCITS ETF USD Hedged Dist or any ETF, for that matter. Regularly checking the NAV, comparing it to the market price, and analyzing its changes over time provides invaluable insights into the ETF's performance and your investment's growth. By utilizing NAV data alongside other relevant metrics, you can make informed decisions about your investment strategy. Learn more about NAV and successfully navigate your Amundi MSCI World II UCITS ETF USD Hedged Dist investments. [Link to relevant resource - e.g., Amundi's website]

Featured Posts

-

Cheaper Flights For Memorial Day 2025 Best And Worst Travel Dates

May 25, 2025

Cheaper Flights For Memorial Day 2025 Best And Worst Travel Dates

May 25, 2025 -

Serious M56 Crash Causes Significant Traffic Disruption Live Updates

May 25, 2025

Serious M56 Crash Causes Significant Traffic Disruption Live Updates

May 25, 2025 -

Escape To The Country Pros Cons And Considerations

May 25, 2025

Escape To The Country Pros Cons And Considerations

May 25, 2025 -

Avrupa Piyasalari Karisik Seyirle Guenuenue Tamamladi

May 25, 2025

Avrupa Piyasalari Karisik Seyirle Guenuenue Tamamladi

May 25, 2025 -

Avrupa Borsalarinda Karisik Seans Guenuen Oezeti

May 25, 2025

Avrupa Borsalarinda Karisik Seans Guenuen Oezeti

May 25, 2025

Latest Posts

-

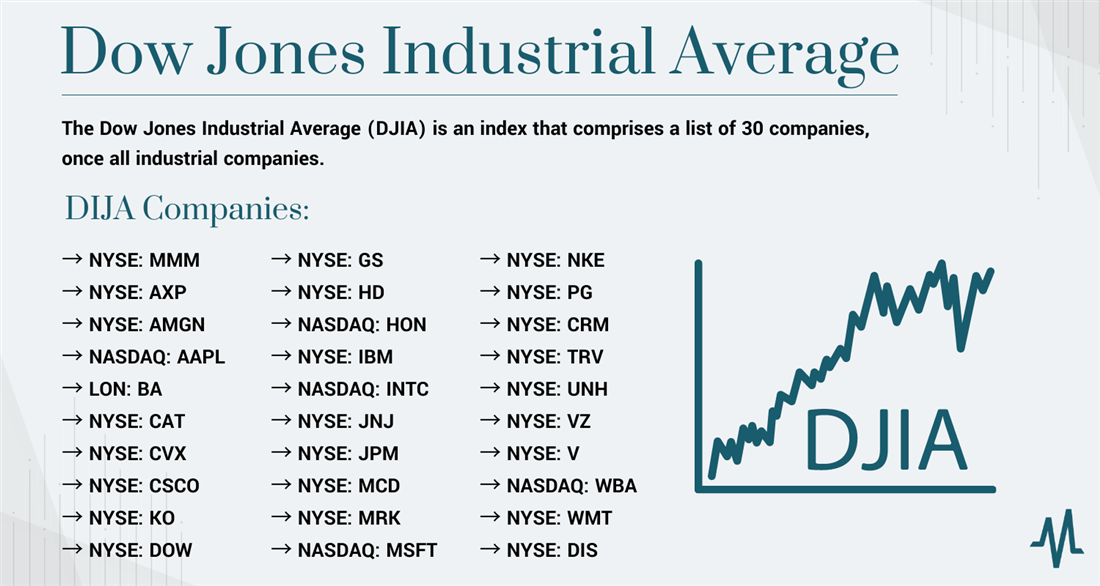

Analyzing The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 25, 2025

Analyzing The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 25, 2025 -

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 25, 2025

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 25, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Dist A Guide To Net Asset Value

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf Dist A Guide To Net Asset Value

May 25, 2025 -

Police Helicopter Pursuit Unbelievable Refueling Stop At 90mph

May 25, 2025

Police Helicopter Pursuit Unbelievable Refueling Stop At 90mph

May 25, 2025 -

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf Dist

May 25, 2025

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf Dist

May 25, 2025