Amundi Dow Jones Industrial Average UCITS ETF: NAV Calculation And Implications

Table of Contents

Understanding the Amundi Dow Jones Industrial Average UCITS ETF

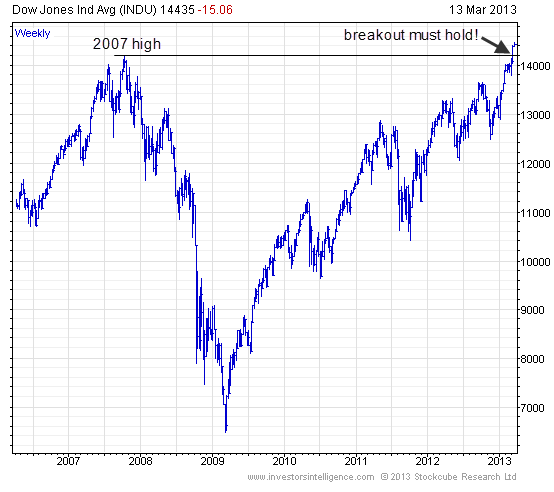

The Amundi Dow Jones Industrial Average UCITS ETF is a passively managed exchange-traded fund designed to track the performance of the Dow Jones Industrial Average (DJIA). The DJIA is a price-weighted index of 30 large-cap, blue-chip US companies, representing a significant portion of the American economy. As a UCITS (Undertakings for Collective Investment in Transferable Securities) ETF, it's regulated under EU directives, ensuring a high level of investor protection. The ETF aims to provide investors with diversified exposure to the US equity market through a single investment.

Key features of the Amundi Dow Jones Industrial Average UCITS ETF include:

- Tracks the performance of 30 large-cap US companies: This provides broad exposure to the US market's leading companies.

- Offers diversified exposure to the US equity market: Reduces overall portfolio risk by investing across multiple sectors.

- Regulated under UCITS IV directives: Ensures compliance with stringent regulatory standards.

- Typically trades on major stock exchanges: Provides easy access and liquidity for investors.

- Competitive expense ratio: The ETF's expense ratio (check the provider's website for the most up-to-date information) represents the annual cost of managing the fund and should be considered when comparing it to similar ETFs. A lower expense ratio generally translates to better returns for investors.

- High trading volume: Facilitates easy buying and selling of shares, minimizing slippage.

- Historical performance: While past performance is not indicative of future results, reviewing the ETF's historical performance data can give you an idea of its volatility and potential returns (available on financial websites and the fund provider’s website).

Deconstructing the NAV Calculation

The Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF represents the net value of the fund's assets minus its liabilities, divided by the number of outstanding shares. More specifically:

NAV = (Total Assets – Total Liabilities) / Number of Outstanding Shares

Components of NAV:

- Total Assets: This includes the market value of the ETF's holdings in the 30 companies comprising the Dow Jones Industrial Average, plus any accrued dividend income.

- Total Liabilities: This primarily consists of management fees, administrative expenses, and other operational costs associated with running the fund.

Factors Affecting NAV:

- Market fluctuations of the underlying index: The primary driver of NAV changes is the performance of the Dow Jones Industrial Average. An increase in the index value leads to a rise in the NAV, and vice versa.

- Dividend payments: Dividends received from the underlying companies increase the fund's assets and consequently, its NAV.

- Management fees: These fees, deducted regularly, reduce the fund's assets and therefore its NAV.

- Currency fluctuations: For international investors, currency exchange rate fluctuations between their local currency and the US dollar can impact the NAV.

Implications of NAV Fluctuations on Your Investment

Changes in the NAV directly reflect the change in the net asset value of the ETF. While the ETF's market price usually closely tracks the NAV, especially for highly liquid ETFs, there might be minor discrepancies due to market supply and demand.

- NAV reflects the intrinsic value of your investment: The NAV provides a measure of the underlying value of your investment in the ETF.

- Regular monitoring helps track investment performance: Comparing the NAV over time allows investors to track the performance of their investment.

- Understanding NAV fluctuations assists in strategic decision-making: By understanding how different factors affect NAV, investors can make more informed buy and sell decisions.

- Comparing NAV with the ETF's market price reveals potential arbitrage opportunities: While rare in liquid ETFs, significant discrepancies between NAV and market price could indicate arbitrage opportunities.

Impact on Investment Strategies

Understanding NAV is crucial for various investment strategies:

- Buy-and-hold strategy: For long-term investors employing a buy-and-hold strategy, focusing on the long-term growth potential of the underlying index is more important than daily NAV fluctuations.

- Active trading strategy: For active traders, monitoring NAV and market price changes is critical for short-term trading decisions. They would look for price discrepancies to potentially profit from arbitrage.

- Risk management: Understanding NAV fluctuations is key to risk management. Regular monitoring allows investors to adjust their portfolio based on their risk tolerance.

Conclusion

Understanding the Net Asset Value (NAV) calculation of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for successful investing. By grasping the factors that influence NAV, you can better assess your investment's performance, manage risk, and make informed decisions about buying, selling, or holding this ETF. Regularly monitor the NAV and consider your investment strategy in relation to its fluctuations. For a deeper understanding of the Amundi Dow Jones Industrial Average UCITS ETF and its NAV, consult professional financial advice. Learn more about effectively managing your investment portfolio using the Amundi Dow Jones Industrial Average UCITS ETF and its NAV calculation.

Featured Posts

-

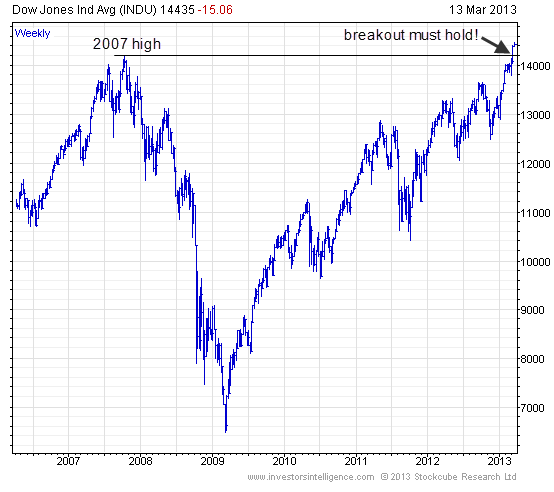

M56 Motorway Closed Cheshire Deeside Area Experiencing Long Delays

May 24, 2025

M56 Motorway Closed Cheshire Deeside Area Experiencing Long Delays

May 24, 2025 -

Paris Faces Economic Headwinds Luxury Sector Decline March 7 2025

May 24, 2025

Paris Faces Economic Headwinds Luxury Sector Decline March 7 2025

May 24, 2025 -

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025 -

Demna Gvasalia Reimagining Guccis Brand Identity

May 24, 2025

Demna Gvasalia Reimagining Guccis Brand Identity

May 24, 2025 -

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value Nav

May 24, 2025

Amundi Djia Ucits Etf A Deep Dive Into Net Asset Value Nav

May 24, 2025

Latest Posts

-

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation Policy

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportation Policy

May 24, 2025 -

Reputation Wreckage 17 Celebrities Whose Careers Ended Abruptly

May 24, 2025

Reputation Wreckage 17 Celebrities Whose Careers Ended Abruptly

May 24, 2025 -

Understanding Frank Sinatras Four Marriages

May 24, 2025

Understanding Frank Sinatras Four Marriages

May 24, 2025 -

The Fall From Grace 17 Celebrities Who Ruined Their Public Image

May 24, 2025

The Fall From Grace 17 Celebrities Who Ruined Their Public Image

May 24, 2025 -

17 Celebrity Scandals That Changed Everything

May 24, 2025

17 Celebrity Scandals That Changed Everything

May 24, 2025