Amundi MSCI World Ex-US UCITS ETF Acc: Understanding Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

Defining Net Asset Value (NAV)

The Net Asset Value (NAV) represents the per-share value of an ETF. Simply put, it's the total value of all the assets the fund owns, minus its liabilities (like management fees and expenses), divided by the total number of outstanding shares. Think of it like calculating the net worth of a company – assets minus liabilities equals net worth. For an ETF, this net worth is then divided by the number of shares to arrive at the NAV per share. This calculation is performed daily, reflecting the closing market prices of the underlying assets.

Components of NAV Calculation for the Amundi MSCI World ex-US UCITS ETF Acc

The Amundi MSCI World ex-US UCITS ETF Acc primarily invests in a diversified portfolio of non-US equities. The NAV calculation therefore involves:

- Determining the market value of each holding: The ETF's holdings are valued at their closing market prices on the relevant exchange. This is a crucial step, as market fluctuations directly impact the NAV.

- Aggregating asset values: The total market value of all the holdings is calculated.

- Subtracting liabilities: Expenses such as management fees, administrative costs, and any other outstanding liabilities are deducted from the total asset value.

- Dividing by the number of shares: The final step involves dividing the net asset value (total assets minus liabilities) by the total number of outstanding shares of the ETF.

Key factors impacting the daily NAV calculation include:

- Fluctuations in the market prices of the underlying securities.

- Changes in the number of outstanding shares.

- Accrual of management fees and expenses.

- Any capital gains distributions made to investors.

NAV vs. Market Price

While NAV is the intrinsic value of the ETF, the market price is what buyers and sellers are actually trading the ETF for on the exchange. These two figures might differ slightly due to various market factors:

- Bid-ask spread: The difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask).

- Trading volume: Higher trading volume generally leads to a smaller gap between NAV and market price.

- Market sentiment: Investor demand can cause the market price to temporarily trade at a premium or discount to the NAV.

The Importance of NAV for Amundi MSCI World ex-US UCITS ETF Acc Investors

Making Informed Investment Decisions

Understanding the NAV is crucial for making sound investment decisions:

- Performance tracking: Monitoring NAV changes helps track the ETF's performance over time, allowing investors to assess the success of their investment strategy.

- Comparative analysis: NAV allows for easy comparison with other investment options, aiding in portfolio diversification.

- Buy/sell decisions: While not the sole determinant, NAV provides valuable context when deciding whether to buy or sell shares of the ETF.

Monitoring Investment Performance

NAV plays a key role in monitoring your investment returns:

- Return calculation: Changes in NAV over a period can be used to directly calculate the return on investment.

- Portfolio diversification: Analyzing the NAV helps assess the contribution of the Amundi MSCI World ex-US UCITS ETF Acc to overall portfolio diversification.

- Trend analysis: Tracking NAV fluctuations over time can reveal trends and patterns in the ETF's performance.

Transparency and Accountability

Regulatory requirements mandate regular NAV disclosures, ensuring transparency and accountability:

- Regulatory compliance: Publicly accessible NAV data ensures compliance with financial regulations.

- Investor confidence: Reliable NAV information builds trust and confidence in the ETF and its management.

Where to Find the NAV of the Amundi MSCI World ex-US UCITS ETF Acc

Official Sources for NAV Data

Investors can find the daily NAV from several sources:

- Amundi's official website: The fund manager's website typically provides up-to-date NAV information.

- Financial data providers: Platforms like Bloomberg, Refinitiv, and Yahoo Finance usually provide NAV data for various ETFs, including the Amundi MSCI World ex-US UCITS ETF Acc.

- Your brokerage account: Most brokerage platforms will display the NAV of your holdings directly within your account summary.

Understanding Data Presentation

NAV is usually presented as:

- A numerical value representing the per-share value in the base currency of the ETF.

- The date and time of the calculation, typically the end of the trading day.

Conclusion: Mastering Net Asset Value for Successful Amundi MSCI World ex-US UCITS ETF Acc Investing

Understanding Net Asset Value is fundamental to successful investing in the Amundi MSCI World ex-US UCITS ETF Acc. By regularly monitoring your ETF's NAV and understanding how it's calculated, you can make more informed decisions, track your investment performance, and ensure your portfolio aligns with your financial goals. We encourage you to regularly monitor the NAV of your Amundi MSCI World ex-US UCITS ETF Acc holdings and consult with a qualified financial advisor for personalized investment advice tailored to your specific financial situation and risk tolerance. Mastering your ETF's NAV is key to successful long-term investing.

Featured Posts

-

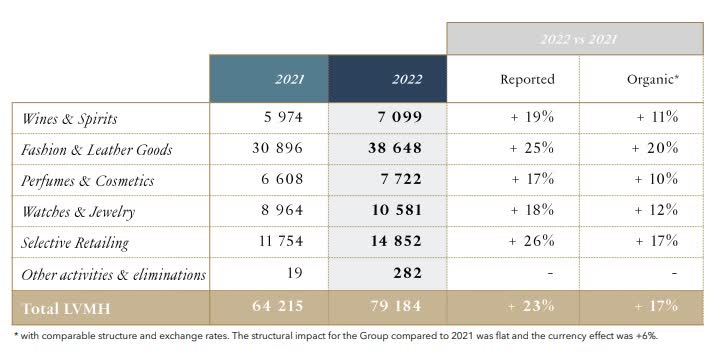

Lvmh Stock Drops After Missing Q1 Sales Targets

May 24, 2025

Lvmh Stock Drops After Missing Q1 Sales Targets

May 24, 2025 -

Escape To The Country Making The Most Of Your Countryside Adventure

May 24, 2025

Escape To The Country Making The Most Of Your Countryside Adventure

May 24, 2025 -

The Ultimate Porsche Macan Buyers Guide Models Specs And Pricing

May 24, 2025

The Ultimate Porsche Macan Buyers Guide Models Specs And Pricing

May 24, 2025 -

Ecb Karari Ve Avrupa Piyasalarinin Gelecegi Analiz Ve Tahminler

May 24, 2025

Ecb Karari Ve Avrupa Piyasalarinin Gelecegi Analiz Ve Tahminler

May 24, 2025 -

Experience The Ferrari Difference Bengalurus New Service Centre

May 24, 2025

Experience The Ferrari Difference Bengalurus New Service Centre

May 24, 2025

Latest Posts

-

Pavel I I Trillery Pochemu Lyudi Lyubyat Schekotat Nervy Vzglyad Fedora Lavrova

May 24, 2025

Pavel I I Trillery Pochemu Lyudi Lyubyat Schekotat Nervy Vzglyad Fedora Lavrova

May 24, 2025 -

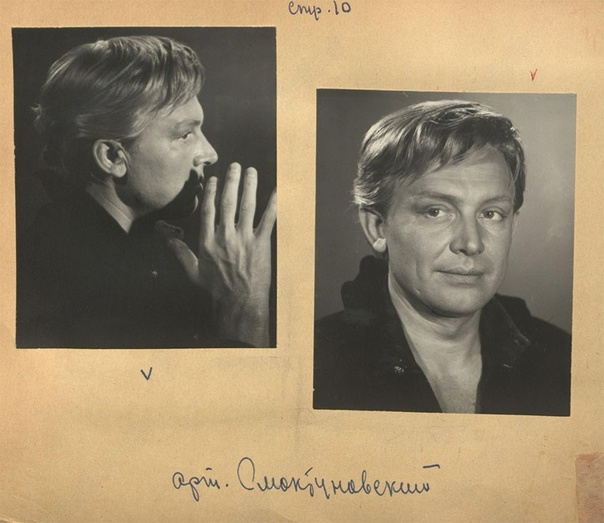

Innokentiy Smoktunovskiy 100 Let Film Menya Vela Kakaya To Sila

May 24, 2025

Innokentiy Smoktunovskiy 100 Let Film Menya Vela Kakaya To Sila

May 24, 2025 -

Schekotat Nervy Interpretatsiya Fedora Lavrova Pavel I I Trillery

May 24, 2025

Schekotat Nervy Interpretatsiya Fedora Lavrova Pavel I I Trillery

May 24, 2025 -

K 100 Letiyu Innokentiya Smoktunovskogo Istoriya Zhizni V Filme Menya Vela Kakaya To Sila

May 24, 2025

K 100 Letiyu Innokentiya Smoktunovskogo Istoriya Zhizni V Filme Menya Vela Kakaya To Sila

May 24, 2025 -

Analiz Proizvedeniya Gryozy Lyubvi Ili Ilicha Gazeta Trud

May 24, 2025

Analiz Proizvedeniya Gryozy Lyubvi Ili Ilicha Gazeta Trud

May 24, 2025