Amundi MSCI World II UCITS ETF Dist: Daily NAV Updates And Analysis

Table of Contents

Understanding the Amundi MSCI World II UCITS ETF Dist

What is an ETF?

An Exchange-Traded Fund (ETF) is an investment fund traded on stock exchanges, much like individual stocks. Unlike mutual funds, ETFs can be bought and sold throughout the trading day. Their key advantages include:

- Liquidity: ETFs offer high liquidity, meaning they are easy to buy and sell quickly.

- Diversification: A single ETF can provide exposure to a basket of assets, instantly diversifying your portfolio across various sectors and geographies.

- Low Costs: ETFs typically have lower expense ratios compared to actively managed mutual funds.

The Amundi MSCI World II UCITS ETF Dist Explained

The Amundi MSCI World II UCITS ETF Dist is a passively managed ETF designed to track the performance of the MSCI World Index. This index represents a broad range of large and mid-cap companies across developed markets globally, providing significant diversification. The "Dist" in its name signifies that it distributes dividends to its shareholders regularly. Crucially, it’s a UCITS (Undertakings for Collective Investment in Transferable Securities) ETF, meaning it complies with stringent EU regulations, ensuring investor protection.

- Tracks the MSCI World Index: Providing broad global market exposure.

- Low expense ratio: Making it a cost-effective investment option.

- Regular dividend distributions: Generating passive income for investors.

- Regulated under UCITS: Ensuring transparency and investor protection.

Daily NAV Updates: Sources and Interpretation

Where to Find Daily NAV Data

Reliable sources for accessing the Amundi MSCI World II UCITS ETF Dist's daily NAV include:

- The official Amundi website: This is the primary and most accurate source for NAV information.

- Major financial data providers: Bloomberg, Refinitiv, and Yahoo Finance often provide real-time and historical NAV data.

- Your brokerage account: If you hold the ETF, your brokerage platform will typically display its current NAV.

Understanding NAV Fluctuations

The daily NAV of the Amundi MSCI World II UCITS ETF Dist fluctuates based on several factors:

-

Market movements: Changes in the prices of the underlying assets in the MSCI World Index directly impact the ETF's NAV.

-

Currency fluctuations: If the ETF holds assets in multiple currencies, exchange rate changes influence the NAV.

-

Dividend distributions: On ex-dividend dates, the NAV typically adjusts downwards to reflect the dividend payout.

-

Regularly check the official Amundi website for the most up-to-date information.

-

Utilize reputable financial news websites and platforms to track market trends alongside the NAV.

-

Consider using investment tracking tools and apps for automated updates and analysis.

-

Always analyze NAV changes within the broader context of global market trends and economic news.

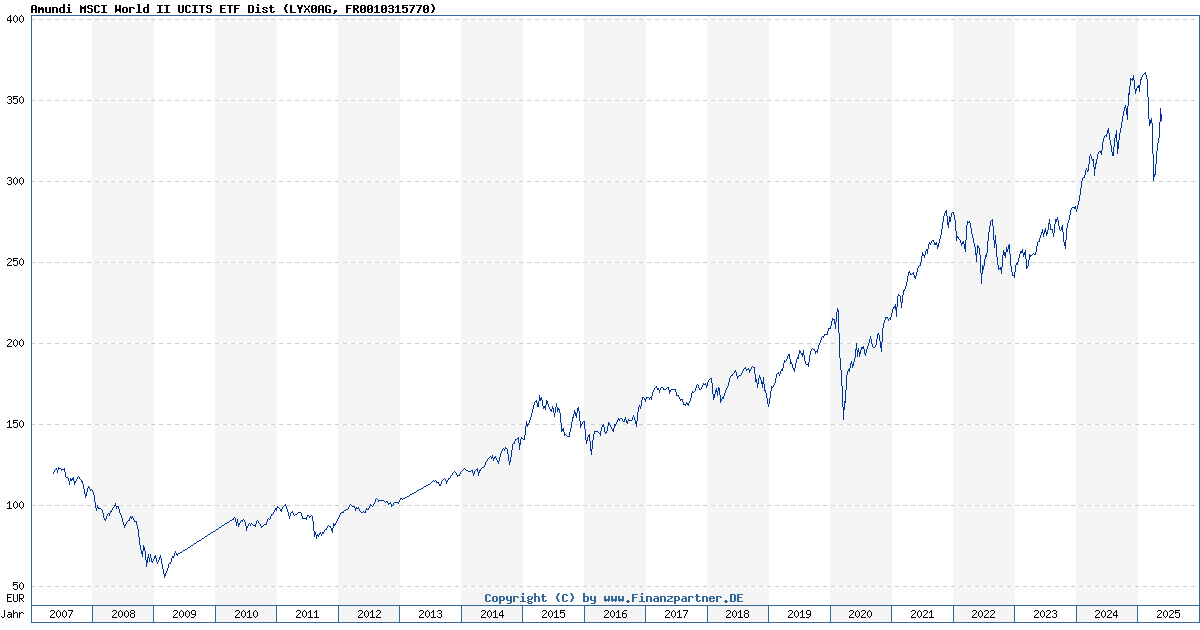

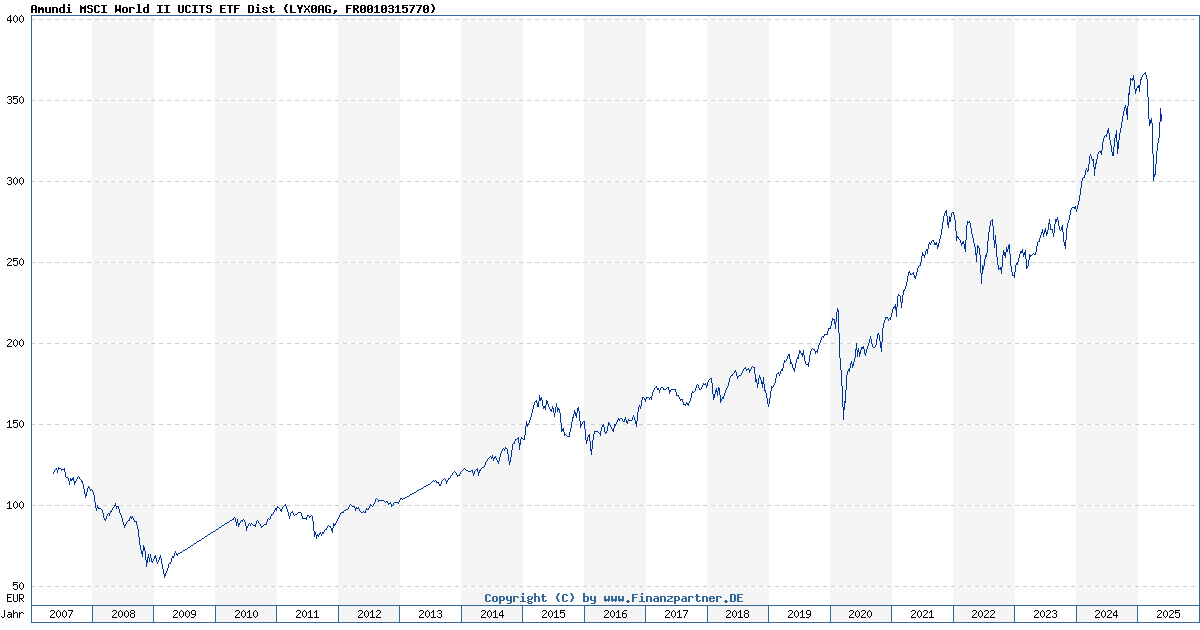

Analyzing NAV Trends and Performance

Short-Term vs. Long-Term Analysis

It's essential to analyze the Amundi MSCI World II UCITS ETF Dist's NAV from both short-term and long-term perspectives. Short-term fluctuations are common and often influenced by daily market volatility. However, long-term trends provide a more meaningful indication of the ETF's overall performance.

Benchmarking against the MSCI World Index

To assess the ETF's performance, compare its NAV movements against the MSCI World Index itself. A closely tracking ETF should exhibit similar percentage changes in NAV over time. Significant deviations might warrant further investigation.

Using Charts and Graphs for Visualization

Visualizing NAV data through line graphs and bar charts simplifies identifying trends and patterns. For instance:

-

Line graphs effectively show NAV changes over time.

-

Bar charts are useful for comparing NAV performance across different time periods.

-

Consider using moving averages to smooth out short-term fluctuations and better identify long-term trends.

-

Compare the ETF's performance against other similar ETFs offering exposure to the global market.

-

Analyze how specific economic events or geopolitical factors have influenced NAV movements.

-

Employ various visual tools to gain a clearer understanding of performance and risk.

Risks and Considerations

Market Risk

Investing in the Amundi MSCI World II UCITS ETF Dist carries inherent market risk. Global equity markets can experience periods of significant volatility, potentially leading to NAV declines.

Currency Risk

Fluctuations in exchange rates between the currencies of the underlying assets and the investor's base currency can impact the NAV, particularly for investors outside the Eurozone.

Expense Ratio and Fees

Remember that the ETF has an expense ratio, representing the annual cost of managing the fund. This fee will impact your overall returns.

- Diversification does not eliminate all risk. Market downturns can still affect your investment.

- Conduct thorough research and understand the investment's risks before committing your capital.

- Assess your own risk tolerance before investing in any ETF, including the Amundi MSCI World II UCITS ETF Dist.

- Consider seeking advice from a qualified financial advisor to create a personalized investment strategy that aligns with your goals and risk profile.

Conclusion

Regularly monitoring the daily NAV of the Amundi MSCI World II UCITS ETF Dist is crucial for informed investment decisions. By understanding the factors influencing NAV fluctuations and utilizing appropriate analytical tools, you can gain valuable insights into the ETF's performance and its suitability for your portfolio. Remember to consider both short-term volatility and long-term trends when making your investment decisions. Further research into global market trends and potential economic factors affecting the MSCI World Index will enhance your understanding. Consult a financial advisor for personalized guidance on incorporating the Amundi MSCI World II UCITS ETF Dist into your investment strategy. Share your experiences and insights regarding the Amundi MSCI World II UCITS ETF Dist in the comments section below!

Featured Posts

-

Nicki Chapman Shares Her Stunning Chiswick Garden Design

May 24, 2025

Nicki Chapman Shares Her Stunning Chiswick Garden Design

May 24, 2025 -

Crystal Palace Eye Kyle Walker Peters On A Free Transfer

May 24, 2025

Crystal Palace Eye Kyle Walker Peters On A Free Transfer

May 24, 2025 -

Veterans Memorial Elementary Welcomes Lego Master Manny Garcia Photos From The Visit

May 24, 2025

Veterans Memorial Elementary Welcomes Lego Master Manny Garcia Photos From The Visit

May 24, 2025 -

M62 Resurfacing Westbound Closure From Manchester To Warrington

May 24, 2025

M62 Resurfacing Westbound Closure From Manchester To Warrington

May 24, 2025 -

Bbc Big Weekend 2025 Sefton Park Ticket Information And Application

May 24, 2025

Bbc Big Weekend 2025 Sefton Park Ticket Information And Application

May 24, 2025

Latest Posts

-

M6 Southbound Road Closure Following Accident Expect Delays

May 24, 2025

M6 Southbound Road Closure Following Accident Expect Delays

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Dist Understanding Net Asset Value Nav

May 24, 2025 -

Is She Still Waiting By The Phone Exploring Themes Of Hope And Despair

May 24, 2025

Is She Still Waiting By The Phone Exploring Themes Of Hope And Despair

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Understanding Net Asset Value Nav

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Understanding Net Asset Value Nav

May 24, 2025 -

Police Helicopter Pursuit Astonishing Text And Refuel At 90mph

May 24, 2025

Police Helicopter Pursuit Astonishing Text And Refuel At 90mph

May 24, 2025