Amundi MSCI World II UCITS ETF USD Hedged Dist: A Guide To NAV And Its Implications

Table of Contents

What is NAV and How is it Calculated for Amundi MSCI World II UCITS ETF USD Hedged Dist?

Net Asset Value (NAV) represents the value of an ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, this calculation is slightly more complex due to the currency hedging component.

-

Asset Valuation: The ETF holds a diverse portfolio of global equities. The value of these assets is determined daily based on their closing prices in their respective markets. This involves converting all non-USD denominated assets into USD using the prevailing exchange rates.

-

Liabilities: These include the ETF's operating expenses, management fees, and any other outstanding obligations.

-

Outstanding Shares: This represents the total number of Amundi MSCI World II UCITS ETF USD Hedged Dist shares currently held by investors.

-

Currency Hedging Impact: The USD hedging strategy aims to minimize the impact of currency fluctuations on the ETF's value. The hedging instrument's value is factored into the NAV calculation. It's important to remember that while the hedge reduces currency risk, it doesn't eliminate it entirely. Unforeseen market events can still influence the effectiveness of the hedge.

-

NAV Updates: The NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is typically calculated and published daily, usually at the end of the trading day. You can find the most up-to-date NAV information on the Amundi website, major financial data providers like Bloomberg or Refinitiv, and through your brokerage account. Keywords: NAV calculation, asset valuation, liabilities, outstanding shares, currency hedging impact, USD hedging, NAV updates.

Factors Affecting the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Several key factors influence the daily fluctuations of the Amundi MSCI World II UCITS ETF USD Hedged Dist's NAV.

-

Market Fluctuations: The performance of the global stock market significantly impacts the NAV. Positive market movements generally lead to a rising NAV, while negative movements cause it to fall. This is because the ETF's underlying assets are primarily global equities.

-

Currency Fluctuations: Despite the USD hedging, residual currency risk remains. Unexpected shifts in exchange rates can still affect the NAV, though to a lesser extent than in an unhedged ETF. A strengthening dollar might slightly increase the NAV, and vice-versa.

-

Dividend Distributions: When the underlying companies in the ETF pay dividends, the NAV is typically adjusted downwards to reflect the distribution to shareholders. Investors will receive the dividend separately.

-

Expense Ratios: The ETF's expense ratio, which covers management fees and other operating costs, gradually erodes the NAV over time. This is a small but ongoing deduction. Keywords: market fluctuations, global stock market, currency risk, dividend distributions, expense ratios, NAV changes.

Interpreting NAV Changes and Their Implications for Investors

Understanding NAV changes is crucial for informed investment decisions.

-

NAV Interpretation: An increasing NAV signifies that the value of the ETF's underlying assets has grown, potentially reflecting positive market performance. Conversely, a decreasing NAV indicates a decline in the value of the underlying assets.

-

Relationship between NAV and ETF Share Price: While the ETF share price should closely track the NAV, a small discrepancy, known as tracking error, can occur due to market forces and trading activity. This difference is usually minimal for liquid ETFs like this one.

-

Impact on Investment Returns: NAV changes directly affect your investment returns. A rising NAV translates to capital appreciation, while a falling NAV leads to capital losses.

-

Monitoring NAV: Regularly monitoring the NAV helps investors track their investment performance and make adjustments to their investment strategy as needed.

-

Examples:

- Rising NAV: Indicates strong performance of the underlying assets, potentially driven by positive global economic news or sector-specific growth.

- Falling NAV: Could signal negative market sentiment, sector-specific downturns, or broader economic concerns. Keywords: NAV interpretation, investment returns, share price, tracking error, investment strategy, NAV monitoring.

Amundi MSCI World II UCITS ETF USD Hedged Dist: Advantages of NAV Understanding

Understanding the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist offers several key advantages:

-

Informed Investment Decisions: By monitoring NAV changes and understanding their causes, you can make more informed decisions about buying, holding, or selling the ETF.

-

Investment Performance Tracking: The NAV provides a clear measure of your investment's performance over time.

-

Potential Arbitrage Opportunities (though rare): In less liquid markets, temporary discrepancies between NAV and market price might present arbitrage opportunities, allowing you to buy low and sell high. However, with a highly liquid ETF like the Amundi MSCI World II UCITS ETF USD Hedged Dist, such opportunities are less frequent. Keywords: informed investment decisions, investment performance, arbitrage opportunities, risk management.

Conclusion: Mastering the Amundi MSCI World II UCITS ETF USD Hedged Dist's NAV

Understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist is paramount for successful investment management. By comprehending how the NAV is calculated, the factors that influence it, and how to interpret its changes, investors can gain valuable insights into their investment performance and make more informed decisions. Regularly monitoring the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV, alongside other key ETF metrics, is crucial for navigating the complexities of global markets. To further enhance your understanding of this and other ETFs, explore resources available on the Amundi website and other reputable financial information sources. Learn more about Amundi MSCI World II UCITS ETF USD Hedged Dist NAV today and make well-informed investment choices.

Featured Posts

-

Joy Crookes Drops Haunting New Track I Know You D Kill Details Inside

May 25, 2025

Joy Crookes Drops Haunting New Track I Know You D Kill Details Inside

May 25, 2025 -

Young Hawaiian Artists Shine Memorial Day Lei Poster Contest

May 25, 2025

Young Hawaiian Artists Shine Memorial Day Lei Poster Contest

May 25, 2025 -

Matt Maltese Intimacy Growth And His New Album Her In Deep

May 25, 2025

Matt Maltese Intimacy Growth And His New Album Her In Deep

May 25, 2025 -

Kyle Walkers Wife Annie Kilner Seen Out And About After Husbands Night Out

May 25, 2025

Kyle Walkers Wife Annie Kilner Seen Out And About After Husbands Night Out

May 25, 2025 -

Nemecke Firmy A Vlna Prepustania Prehlad Najvaecsich Rezov

May 25, 2025

Nemecke Firmy A Vlna Prepustania Prehlad Najvaecsich Rezov

May 25, 2025

Latest Posts

-

Police Helicopter Pursuit Unbelievable Refueling Stop At 90mph

May 25, 2025

Police Helicopter Pursuit Unbelievable Refueling Stop At 90mph

May 25, 2025 -

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf Dist

May 25, 2025

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf Dist

May 25, 2025 -

Road Closure And Delays On M6 Southbound Due To Serious Crash

May 25, 2025

Road Closure And Delays On M6 Southbound Due To Serious Crash

May 25, 2025 -

Shes Still Waiting By The Phone A Personal Account

May 25, 2025

Shes Still Waiting By The Phone A Personal Account

May 25, 2025 -

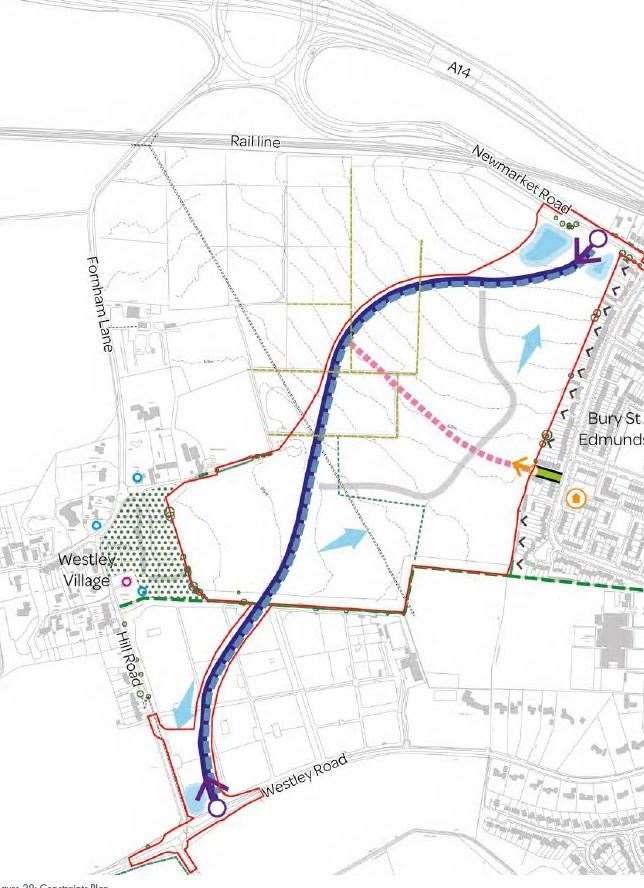

The M62 Relief Road Burys Unrealized Infrastructure Project

May 25, 2025

The M62 Relief Road Burys Unrealized Infrastructure Project

May 25, 2025