Amundi MSCI World II UCITS ETF USD Hedged Dist: Net Asset Value (NAV) Explained

Table of Contents

What is Net Asset Value (NAV) and Why is it Important?

Net Asset Value (NAV) represents the value of an ETF's underlying assets minus its liabilities, all divided by the number of outstanding shares. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, this means the total value of all the global stocks held within the ETF, less any expenses or liabilities, divided by the total number of ETF shares.

Why is NAV important? Simply put, it reflects the intrinsic value of your investment in the ETF. Understanding the NAV allows you to:

- Track your investment's performance: Daily changes in NAV directly show how your investment is performing.

- Compare performance to the market price: The NAV provides a benchmark against which to compare the market price of the ETF shares.

- Assess the ETF's efficiency: A significant divergence between NAV and market price might indicate trading inefficiencies.

The NAV changes daily due to various factors:

- Market fluctuations: Changes in the prices of the underlying assets directly affect the ETF's NAV.

- Currency exchange rates: For a USD-hedged ETF like the Amundi MSCI World II UCITS ETF USD Hedged Dist, fluctuations in exchange rates (especially the USD against other currencies) will influence the NAV.

- Dividend distributions: When the underlying companies pay dividends, the NAV will adjust accordingly, usually decreasing slightly after the distribution.

It's crucial to differentiate between NAV and the market price (bid/ask spread). The market price reflects the price at which you can buy or sell the ETF shares at any given time, which can differ slightly from the NAV due to supply and demand.

NAV Calculation for Amundi MSCI World II UCITS ETF USD Hedged Dist

Calculating the NAV for the Amundi MSCI World II UCITS ETF USD Hedged Dist involves several key factors:

- Underlying asset performance: The performance of the hundreds of companies within the MSCI World Index directly impacts the NAV. Growth or decline in these companies' share prices will be reflected in the ETF's NAV.

- Currency hedging strategy (USD Hedged): The "USD Hedged" aspect means the ETF employs strategies to minimize the impact of currency fluctuations on the USD value of the investment. This hedging process influences the final NAV calculation.

- Dividend distributions: Dividends received from the underlying companies are reinvested or distributed to shareholders, impacting the NAV.

The calculation, while complex, boils down to this simplified process:

- Determine the total market value of all underlying assets: This involves summing the value of each individual stock held within the ETF.

- Subtract liabilities: This includes management fees, operational expenses, and any other outstanding liabilities.

- Divide by the number of outstanding shares: This yields the NAV per share.

Amundi, the ETF provider, is responsible for calculating and publishing the NAV daily, typically at the close of the market. This ensures transparency and allows investors to track their investment’s value effectively.

How to Find the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Finding the daily NAV for the Amundi MSCI World II UCITS ETF USD Hedged Dist is straightforward:

- Amundi's official website: Amundi typically publishes the daily NAV on their website within their ETF listings.

- Financial news websites: Many financial news sites, such as Bloomberg or Yahoo Finance, provide real-time and historical NAV data for ETFs.

- Brokerage platforms: If you hold the ETF through a brokerage account, the platform will usually display the current NAV along with the market price.

When interpreting NAV data, look for the date and time the NAV was calculated. Remember, the NAV is usually calculated at the close of the market for the underlying assets.

Using NAV to Make Informed Investment Decisions

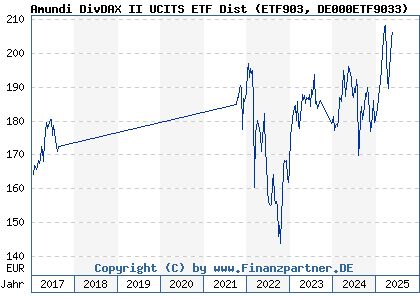

The NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is a valuable tool for tracking your investment's performance over time. By monitoring changes in the NAV, you can:

- Track long-term growth: Compare the NAV over months or years to assess the ETF's overall growth.

- Identify potential entry or exit points: While not the sole factor, significant changes in the NAV, in conjunction with market analysis, might inform buy or sell decisions.

However, it's critical to remember that NAV is just one piece of the puzzle. Other factors essential to informed investment decisions include:

- Your risk tolerance: The Amundi MSCI World II UCITS ETF USD Hedged Dist, while diversified, still carries inherent market risk.

- Your investment time horizon: Your investment goals (short-term or long-term) will influence your decision-making.

- Overall market conditions: A broader understanding of market trends is essential to avoid emotional decision-making.

Conclusion: Mastering the Amundi MSCI World II UCITS ETF USD Hedged Dist Net Asset Value

Understanding the Net Asset Value (NAV) is crucial for effectively managing your investment in the Amundi MSCI World II UCITS ETF USD Hedged Dist. By learning how to track the NAV, interpret its changes, and use it alongside other investment metrics, you can make more informed decisions. Regularly check the NAV, and remember to consider your overall investment strategy and risk tolerance before making any buy or sell decisions related to this ETF. Further research into broader investment strategies can significantly improve your understanding of ETF investments and lead to greater success. Start mastering the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV today!

Featured Posts

-

Indonesia Classic Art Week 2025 Featuring Porsche

May 24, 2025

Indonesia Classic Art Week 2025 Featuring Porsche

May 24, 2025 -

Bbc Radio 1 Big Weekend 2025 Tickets How To Get Yours Now

May 24, 2025

Bbc Radio 1 Big Weekend 2025 Tickets How To Get Yours Now

May 24, 2025 -

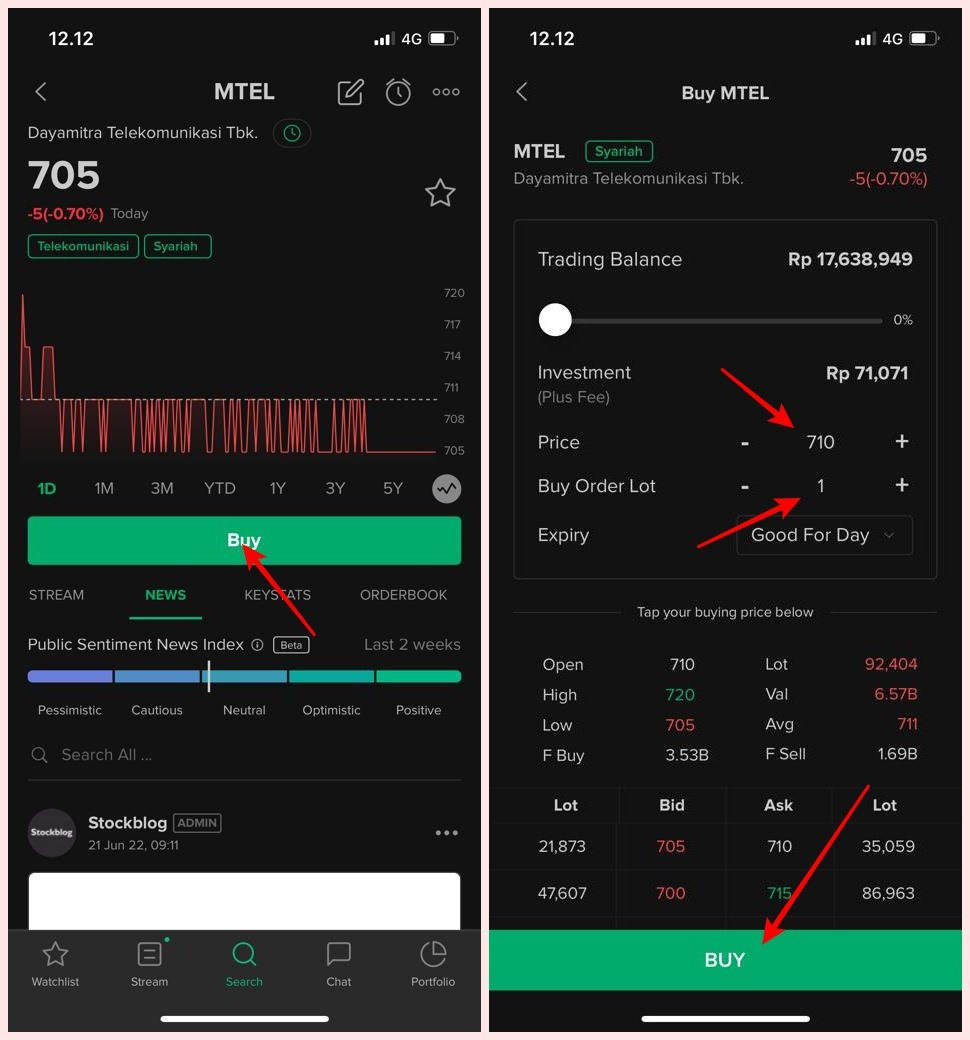

Analisis Saham Mtel And Mbma Setelah Masuk Msci Small Cap

May 24, 2025

Analisis Saham Mtel And Mbma Setelah Masuk Msci Small Cap

May 24, 2025 -

Escape To The Countryside Top Locations And Considerations

May 24, 2025

Escape To The Countryside Top Locations And Considerations

May 24, 2025 -

Tracking The Net Asset Value Nav Of Amundi Msci World Ex Us Ucits Etf Acc

May 24, 2025

Tracking The Net Asset Value Nav Of Amundi Msci World Ex Us Ucits Etf Acc

May 24, 2025

Latest Posts

-

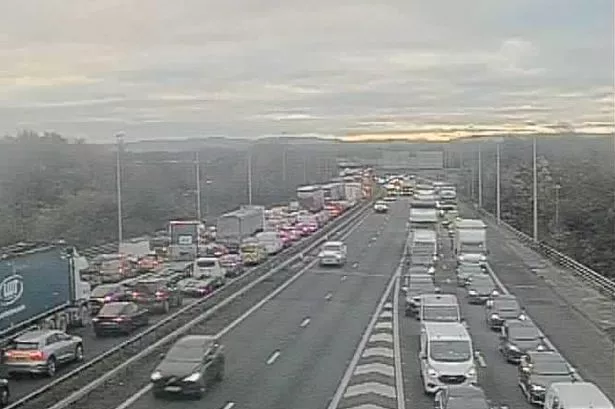

Emergency Services Respond To M56 Crash Car Overturn And Casualty

May 24, 2025

Emergency Services Respond To M56 Crash Car Overturn And Casualty

May 24, 2025 -

M56 Motorway Crash Car Overturns Paramedics Treat Casualty

May 24, 2025

M56 Motorway Crash Car Overturns Paramedics Treat Casualty

May 24, 2025 -

M62 Westbound Planned Resurfacing Closure Manchester Warrington

May 24, 2025

M62 Westbound Planned Resurfacing Closure Manchester Warrington

May 24, 2025 -

Live Updates M6 Crash Causes Significant Delays For Drivers

May 24, 2025

Live Updates M6 Crash Causes Significant Delays For Drivers

May 24, 2025 -

M62 Resurfacing Westbound Closure From Manchester To Warrington

May 24, 2025

M62 Resurfacing Westbound Closure From Manchester To Warrington

May 24, 2025