Amundi MSCI World II UCITS ETF USD Hedged Dist: Understanding Net Asset Value (NAV)

Table of Contents

What is NAV and How is it Calculated for the Amundi MSCI World II UCITS ETF USD Hedged Dist?

The Net Asset Value (NAV) of an ETF represents the net value of its assets minus its liabilities, divided by the number of outstanding shares. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, understanding the NAV is paramount due to its investment strategy focused on tracking the MSCI World Index with a USD currency hedge. This hedge protects investors from currency fluctuations between the ETF's base currency and the US dollar.

The calculation of the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV involves several key components:

- Assets: This includes the market value of all the underlying securities held within the ETF, mirroring the holdings of the MSCI World Index. These assets are valued daily based on the closing prices of the constituent stocks.

- Liabilities: This encompasses the ETF's expenses, such as management fees, administrative costs, and other operational expenses. These liabilities are deducted from the total asset value.

- NAV Calculation: The basic formula is: NAV = (Total Assets - Total Liabilities) / Number of Shares Outstanding. This yields the NAV per share.

Impact of Currency Hedging: The USD hedging strategy employed by the Amundi MSCI World II UCITS ETF USD Hedged Dist influences the NAV calculation. The hedge aims to minimize the impact of currency fluctuations between the euro (or other currencies of the underlying assets) and the US dollar on the NAV. While the hedge aims to reduce volatility, its effectiveness can vary depending on market conditions.

Illustrative Example:

Let's assume:

- Total Assets: $100,000,000

- Total Liabilities: $500,000

- Number of Shares Outstanding: 10,000,000

NAV = ($100,000,000 - $500,000) / 10,000,000 = $9.95 per share

This simplified example ignores the complexities of currency hedging, which would introduce additional calculations based on the hedging strategies employed.

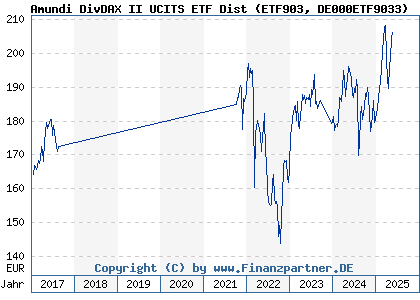

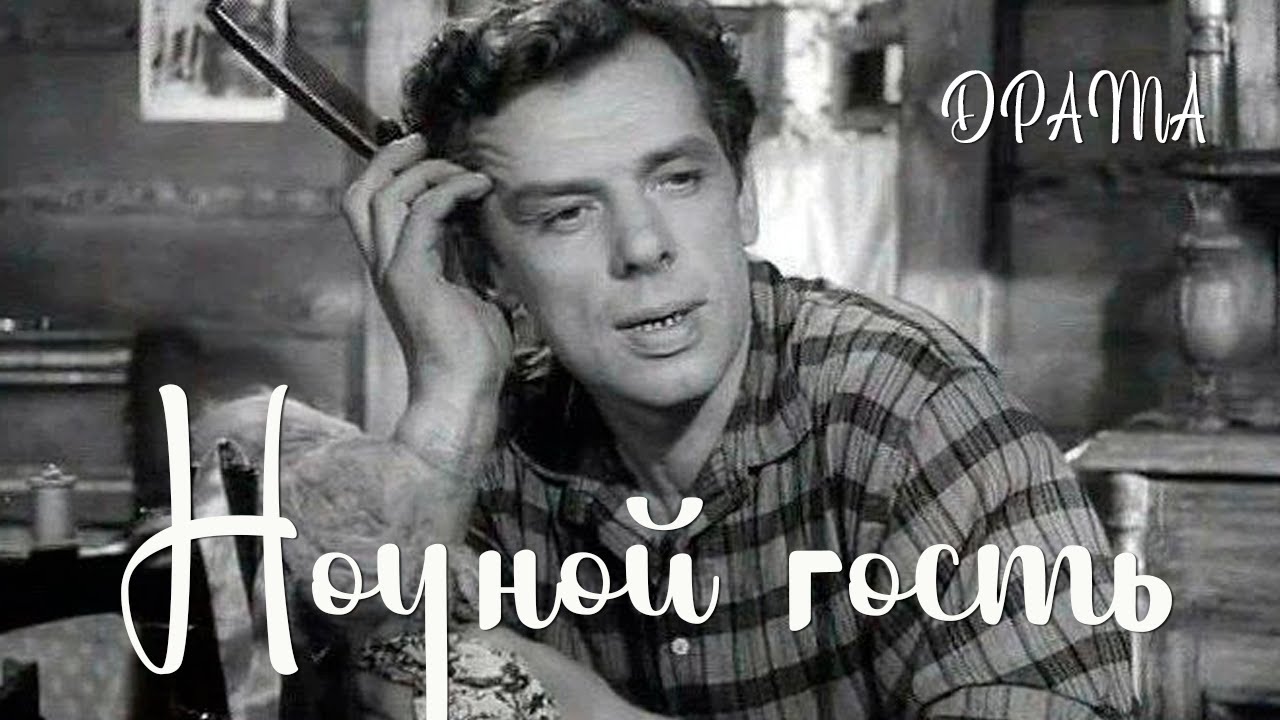

Factors Affecting the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Several factors influence the daily NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist:

- Market Performance of Underlying Assets (MSCI World Index): The primary driver of the NAV is the performance of the MSCI World Index, which the ETF seeks to track. A rise in the index generally leads to an increase in the ETF's NAV, and vice versa.

- Currency Fluctuations (USD/Other Currencies): Even with the USD hedge, residual currency fluctuations can still impact the NAV. Significant movements in exchange rates can affect the value of the underlying assets and, consequently, the NAV.

- Expense Ratio and Management Fees: The expense ratio and management fees, which are deducted from the assets, directly impact the NAV. Higher fees result in a lower NAV.

- Capital Gains Distributions: When the ETF distributes capital gains to shareholders, it reduces the total assets and consequently the NAV per share. This is a common occurrence with many ETFs.

Examples of Impact:

- MSCI World Index Increase: A 5% increase in the MSCI World Index will generally lead to a similar percentage increase in the ETF's NAV, all other factors remaining constant.

- Currency Fluctuation: A strengthening of the US dollar against the euro could positively impact the NAV due to the USD hedge, while a weakening would have the opposite effect, although the impact is usually mitigated by the hedging strategy.

Using NAV to Monitor Your Investment in Amundi MSCI World II UCITS ETF USD Hedged Dist

Monitoring the NAV is crucial for effective investment management.

- Finding Daily NAV Data: The daily NAV can be found on the Amundi website, major financial news websites (like Bloomberg or Yahoo Finance), and through your brokerage account.

- Interpreting NAV Changes: A consistent upward trend in the NAV indicates positive performance, while a downward trend suggests the opposite. It’s vital to consider the trend over time, rather than focusing on daily fluctuations.

- Comparing with Other ETFs: Compare the NAV performance of the Amundi MSCI World II UCITS ETF USD Hedged Dist with similar ETFs tracking the MSCI World Index or other global equity indices. This comparison helps gauge relative performance.

- Investment Decisions: While NAV is a vital indicator, it should not be the sole determinant for buy/sell decisions. Consider your investment goals, risk tolerance, and overall market conditions.

Conclusion: Mastering Amundi MSCI World II UCITS ETF USD Hedged Dist NAV for Informed Investing

Understanding the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV is a cornerstone of successful investing in this UCITS ETF. This article has explored the NAV's calculation, the factors that influence it, and how to use it effectively to monitor your investment. Remember to regularly check your Amundi MSCI World II UCITS ETF USD Hedged Dist NAV. Stay informed about your Amundi MSCI World II UCITS ETF USD Hedged Dist NAV to make informed decisions about your portfolio. Understanding Amundi MSCI World II UCITS ETF USD Hedged Dist NAV is crucial for successful investing. However, always consult with a qualified financial professional for personalized investment advice tailored to your specific circumstances and risk profile.

Featured Posts

-

Nicki Chapmans 700 000 Country Home Investment A Smart Property Move

May 24, 2025

Nicki Chapmans 700 000 Country Home Investment A Smart Property Move

May 24, 2025 -

Demna Gvasalias Appointment As Guccis Creative Director A New Era For The Brand

May 24, 2025

Demna Gvasalias Appointment As Guccis Creative Director A New Era For The Brand

May 24, 2025 -

Apakah Mtel Dan Mbma Layak Dibeli Setelah Masuk Msci Small Cap

May 24, 2025

Apakah Mtel Dan Mbma Layak Dibeli Setelah Masuk Msci Small Cap

May 24, 2025 -

Us Band Confirms Glastonbury Performance No Official Announcement Yet

May 24, 2025

Us Band Confirms Glastonbury Performance No Official Announcement Yet

May 24, 2025 -

Serious M56 Crash Car Overturns Paramedic Response Underway

May 24, 2025

Serious M56 Crash Car Overturns Paramedic Response Underway

May 24, 2025

Latest Posts

-

Gryozy Lyubvi Ili Ilicha Otsenka Publikatsii V Gazete Trud

May 24, 2025

Gryozy Lyubvi Ili Ilicha Otsenka Publikatsii V Gazete Trud

May 24, 2025 -

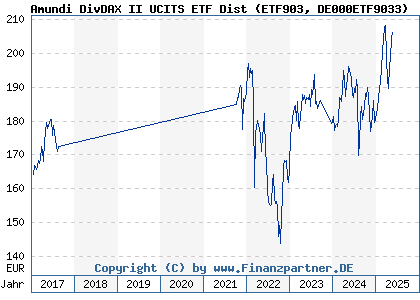

Fedor Lavrov O Trillerakh I Imperatore Pavle I O Prirode Chelovecheskogo Interesa K Opasnosti

May 24, 2025

Fedor Lavrov O Trillerakh I Imperatore Pavle I O Prirode Chelovecheskogo Interesa K Opasnosti

May 24, 2025 -

Gryozy Lyubvi Ili Ilicha Gazeta Trud Kratkiy Analiz

May 24, 2025

Gryozy Lyubvi Ili Ilicha Gazeta Trud Kratkiy Analiz

May 24, 2025 -

Pavel I I Trillery Pochemu Lyudi Lyubyat Schekotat Nervy Vzglyad Fedora Lavrova

May 24, 2025

Pavel I I Trillery Pochemu Lyudi Lyubyat Schekotat Nervy Vzglyad Fedora Lavrova

May 24, 2025 -

Innokentiy Smoktunovskiy 100 Let Film Menya Vela Kakaya To Sila

May 24, 2025

Innokentiy Smoktunovskiy 100 Let Film Menya Vela Kakaya To Sila

May 24, 2025