Analysis: House GOP Releases Trump Tax Plan Details

Table of Contents

Key Proposals of the Trump Tax Plan (as detailed by the House GOP):

The House GOP's unveiled details reveal a tax plan echoing many of the proposals championed during the Trump administration. While specific numbers may vary slightly from initially proposed figures, the core tenets remain largely consistent. Key proposals include:

-

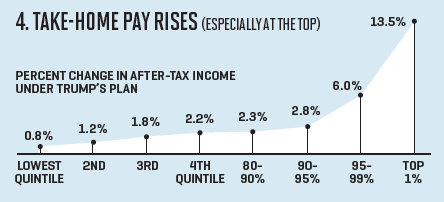

Individual Income Tax Rate Changes: While precise rates need further clarification, the plan generally suggests lower individual income tax rates across the board. This would result in tax cuts for many Americans, though the degree of benefit would vary significantly across income brackets.

-

Corporate Tax Rate Changes: A central element of the plan focuses on reducing the corporate tax rate. Lower corporate taxes are argued to stimulate business investment, job creation, and overall economic growth. The proposed rate requires further specification.

-

Changes to Deductions: The plan likely involves modifications to existing deductions. This may include alterations to the standard deduction, itemized deductions (such as mortgage interest deductions and state and local taxes – SALT), impacting taxpayers' overall tax liability.

-

Changes to Credits: The plan may also include adjustments to various tax credits, such as the child tax credit and the earned income tax credit. These changes could significantly affect lower- and middle-income families.

-

Impact on Different Income Brackets: The plan's impact will vary considerably across income levels. High-income earners are projected to receive substantial tax cuts, while the effects on middle- and low-income brackets remain a subject of debate and further analysis is necessary to fully understand the impact on each income group.

Economic Implications of the Proposed Tax Plan:

The economic implications of this Trump tax plan are far-reaching and complex. Proponents argue that significant tax cuts will spur economic growth through increased investment and consumer spending. This could lead to:

-

GDP Growth: Lower taxes could potentially boost GDP growth in the short term. However, the long-term effects are less certain and depend on several factors, including government spending and inflation.

-

Job Creation: Tax cuts for businesses could theoretically encourage investment and hiring. However, this effect is not guaranteed and depends on factors beyond the tax code itself.

-

National Debt: Significant tax cuts without corresponding spending cuts would likely increase the national debt. The extent of this increase is a major point of contention.

-

Income Inequality: Critics argue that the proposed tax cuts disproportionately benefit high-income earners, potentially exacerbating income inequality. Further studies are needed to accurately measure the impact.

[Insert citations to reputable economic studies and forecasts here.]

Political Ramifications and Public Reaction:

The release of the House GOP's Trump tax plan details has ignited a firestorm of political debate. Republicans generally support the plan, viewing it as a continuation of pro-growth economic policies. However, Democrats have voiced strong opposition, citing concerns about its impact on the national debt and income inequality.

-

Political Landscape: The plan is highly divisive, reflecting the broader partisan divide in American politics. The debate extends beyond party lines, with various interest groups and economists weighing in with differing perspectives.

-

Public Opinion: Public opinion polls on the matter are varied and often depend on the way the question is framed. There is no clear consensus, highlighting the complexity of the issue.

-

Legislative Hurdles: Passing any significant tax reform legislation requires navigating the complexities of Congress. The plan may face significant obstacles in achieving bipartisan support and overcoming potential filibusters.

Comparison to Previous Tax Legislation (Obama era, etc.):

The proposed Trump-era tax plan differs significantly from previous tax legislation, particularly the Affordable Care Act (ACA) and tax reforms enacted during the Obama administration. While the Obama-era tax policies focused on expanding access to healthcare and increasing taxes on higher earners, the Trump plan prioritizes broad-based tax cuts for individuals and corporations. This fundamental difference reflects contrasting economic philosophies and political priorities. A detailed historical analysis of US tax reform is necessary to place this plan within the larger context of national fiscal policy.

Conclusion: Understanding the House GOP’s Trump Tax Plan: Next Steps and Implications

The House GOP's release of the Trump tax plan's details provides a crucial opportunity to assess its potential impacts. The plan proposes significant changes to individual and corporate tax rates, deductions, and credits. While supporters argue it will boost economic growth and job creation, critics express concern about its effects on income inequality and the national debt. The long-term consequences remain uncertain, requiring close monitoring of economic indicators and further analysis. To stay informed about legislative developments and the ongoing debate surrounding the Trump tax plan and its House GOP revisions, we encourage you to visit the official websites of the House of Representatives and the Congressional Budget Office. Contact your representatives to voice your opinions and participate in the democratic process. Understanding the intricacies of the Trump tax plan is crucial for every American taxpayer.

Featured Posts

-

12 Milyon Avroluk Kktc Yatirimi Tuerk Devletlerinin Rolue Ve Gelecegi

May 15, 2025

12 Milyon Avroluk Kktc Yatirimi Tuerk Devletlerinin Rolue Ve Gelecegi

May 15, 2025 -

Examining Trumps Oil Price Outlook Goldman Sachs Social Media Scrutiny

May 15, 2025

Examining Trumps Oil Price Outlook Goldman Sachs Social Media Scrutiny

May 15, 2025 -

High Bids For Kid Cudis Auctioned Personal Effects

May 15, 2025

High Bids For Kid Cudis Auctioned Personal Effects

May 15, 2025 -

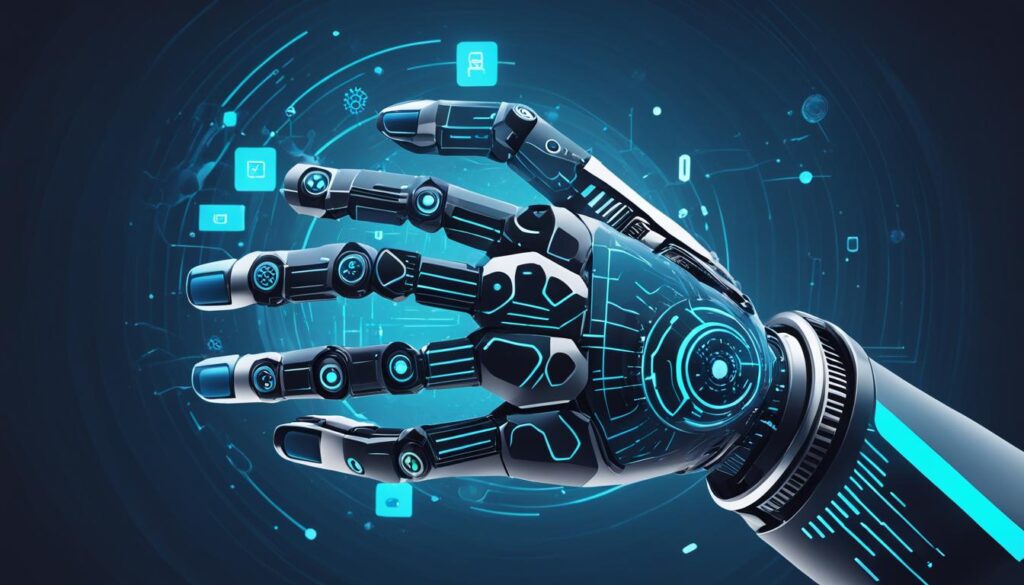

Ai Digest Transforming Repetitive Documents Into A Poop Podcast

May 15, 2025

Ai Digest Transforming Repetitive Documents Into A Poop Podcast

May 15, 2025 -

Padres Vs Rockies Home Winning Streak On The Line

May 15, 2025

Padres Vs Rockies Home Winning Streak On The Line

May 15, 2025