Examining Trump's Oil Price Outlook: Goldman Sachs' Social Media Scrutiny

Table of Contents

Trump's Energy Policies and Their Impact on Oil Prices

Trump's administration pursued a distinct energy agenda, aiming for "energy dominance" through deregulation and increased domestic production. These policies significantly impacted global oil prices, creating both opportunities and challenges.

Deregulation and Increased Domestic Production

Trump's focus on deregulation, including the push to approve the Keystone XL pipeline and relax environmental regulations on oil and gas production, aimed to boost domestic output. This increase in supply had the potential to lower global oil prices, particularly through a surge in shale oil production.

- Keystone XL Pipeline: The approval of this pipeline was a key policy decision, aimed at increasing Canadian oil imports and US refining capacity. This contributed to increased North American oil production.

- Environmental Regulations: Relaxing environmental regulations, while boosting production, also raised concerns about environmental impact and long-term sustainability.

- Data & Statistics: While precise figures are debated, data from the Energy Information Administration (EIA) shows a significant increase in US oil production during Trump's presidency, potentially influencing global supply and price dynamics. This increase in oil production, particularly shale oil, impacted global oil markets.

International Relations and OPEC Influence

Trump's foreign policy decisions significantly affected the dynamics of the Organization of the Petroleum Exporting Countries (OPEC). His administration's approach to dealing with countries like Saudi Arabia and Iran impacted oil production quotas and global supply.

- Saudi Arabia: The relationship between the US and Saudi Arabia, a major OPEC player, evolved significantly under Trump. This influenced OPEC's output decisions and therefore global oil prices.

- Iran Sanctions: The reimposition and tightening of sanctions on Iran, a significant oil producer, aimed to reduce its oil exports, impacting global supply and potentially pushing prices upward.

- Geopolitical Risk: Geopolitical tensions in regions like the Middle East, often exacerbated by international relations, caused significant price fluctuations due to the inherent risk of supply disruptions.

Impact of Sanctions and Trade Wars

Trump's administration employed sanctions and engaged in trade wars with various countries, indirectly impacting oil prices. These actions disrupted global supply chains and created uncertainty in the market.

- Venezuela Sanctions: Sanctions imposed on Venezuela, another oil-producing nation, reduced its oil exports, contributing to tighter global supply and higher prices.

- Trade Wars: Trade tensions with China and other countries created uncertainty in global markets, impacting oil demand and hence price stability. This uncertainty is a major factor influencing the global oil market.

- Oil Sanctions: The use of oil-related sanctions as a geopolitical tool highlighted the intricate relationship between politics, economics, and oil price volatility.

Goldman Sachs' Oil Price Predictions and Social Media Backlash

Goldman Sachs, a prominent investment bank, regularly publishes analyses and forecasts on oil prices. Their predictions concerning Trump's impact on the oil market sparked significant debate and criticism on social media.

Goldman Sachs' Analysis of Trump's Impact

Goldman Sachs' reports incorporated various factors – including Trump's deregulation policies, OPEC's actions, and geopolitical events – into their oil price forecasting models. These models used sophisticated financial modeling techniques to predict future oil price trends.

- Specific Reports: While pinpointing specific reports requires detailed research (and possibly accessing paywalled content), one can search for Goldman Sachs publications relating to oil price forecasts during the Trump administration to gain insights into their methodology.

- Market Analysis: Their analyses aimed to provide insights into the market's potential response to policy changes and global events, offering guidance to investors.

- Financial Modeling: Goldman Sachs employs complex financial models that consider numerous variables to generate its forecasts.

Social Media Reactions and Criticism

Goldman Sachs' predictions and the underlying assumptions were subject to intense scrutiny on platforms like Twitter and Facebook. Criticism ranged from accusations of bias to concerns about potential conflicts of interest.

- Accusations of Bias: Some critics argued that Goldman Sachs' analyses were biased, reflecting the interests of their clients or favoring certain political agendas.

- Conflicts of Interest: Concerns were raised about potential conflicts of interest arising from Goldman Sachs' various business activities in the energy sector.

- Examples of Criticism: Searching relevant hashtags on social media platforms like Twitter will reveal various opinions and critiques of Goldman Sachs’ predictions.

Analyzing the Scrutiny: Was the Criticism Justified?

The criticism leveled at Goldman Sachs raises important questions about transparency, bias, and the influence of social media on public perception. While some criticisms were valid concerns about potential biases inherent in any financial analysis, other criticisms might have been overblown or misinformed.

- Financial Transparency: The need for greater transparency in financial modeling and reporting is paramount to foster public trust.

- Media Scrutiny: The role of media in shaping public understanding of complex financial matters like oil price forecasting is undeniable. A balanced perspective on both the analysis and the reaction is critical.

Conclusion: Trump's Legacy on Oil Prices and the Importance of Critical Analysis

Trump's energy policies undeniably influenced global oil prices, creating a complex interplay of increased domestic production, geopolitical tensions, and sanctions. Goldman Sachs' attempts to forecast these impacts were met with varying degrees of social media scrutiny. This highlights the importance of critical analysis in evaluating the impact of political decisions on complex economic indicators like oil prices. Social media, while democratizing access to information and fostering debate, also presents challenges in terms of ensuring accuracy and mitigating bias.

To fully understand Trump's oil price outlook and the complexities of the global energy market, continue your research. Critically evaluate future economic predictions, compare diverse perspectives, and stay informed about the ever-evolving dynamics of the global oil market. Understanding the nuances of Trump's oil price outlook requires a commitment to informed decision-making and critical thinking.

Featured Posts

-

Rockets Vs Warriors Game 6 Jimmy Butlers Picks And Expert Predictions

May 15, 2025

Rockets Vs Warriors Game 6 Jimmy Butlers Picks And Expert Predictions

May 15, 2025 -

Dodgers Prospect Hyeseong Kim Homer 2 Steals Fuel Okc Doubleheader Sweep

May 15, 2025

Dodgers Prospect Hyeseong Kim Homer 2 Steals Fuel Okc Doubleheader Sweep

May 15, 2025 -

Stock Market Valuations Bof A Explains Why Investors Shouldnt Be Concerned

May 15, 2025

Stock Market Valuations Bof A Explains Why Investors Shouldnt Be Concerned

May 15, 2025 -

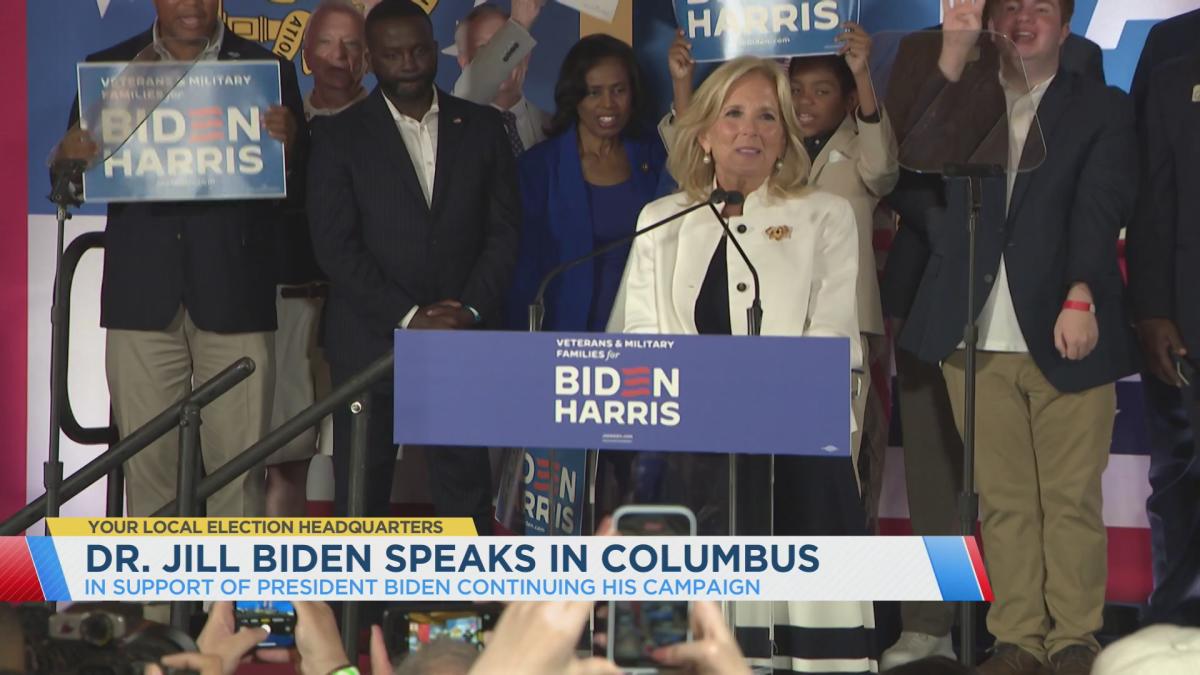

Jill Bidens Aide Advises Against Further Political Involvement

May 15, 2025

Jill Bidens Aide Advises Against Further Political Involvement

May 15, 2025 -

Is Anthony Edwards Baby Mama Drama All Its Cracked Up To Be A Closer Look

May 15, 2025

Is Anthony Edwards Baby Mama Drama All Its Cracked Up To Be A Closer Look

May 15, 2025