Analysis Of ING Group's 2024 Annual Report: Form 20-F Filing

Table of Contents

Key Financial Highlights from ING Group's 2024 Form 20-F

The 20-F filing provides a detailed breakdown of ING Group's financial performance. Analyzing key metrics gives us a clear picture of the bank's financial health.

Revenue and Net Income Analysis

ING Group's 2024 financial report reveals [insert actual figures here – e.g., a 5% increase] in revenue compared to 2023, reaching [insert actual revenue figure]. Net income also showed [insert actual figures and percentage change here – e.g., a robust 8% growth], reaching [insert actual net income figure].

- Year-over-year revenue growth: [Insert percentage and context – e.g., Driven by strong performance in the Wholesale Banking division.]

- Key factors impacting profitability: [Insert key factors – e.g., Increased interest rates, cost optimization initiatives, growth in specific market segments.]

- Comparison with industry benchmarks: [Insert comparison data – e.g., Outperformed major European competitors in terms of net income growth.]

Asset Quality and Loan Performance

Assessing the quality of ING Group's assets is critical. The 20-F filing indicates [insert data on Non-Performing Loans (NPLs) – e.g., a slight increase in NPLs to X%]. Loan loss provisions were [insert data on loan loss provisions – e.g., increased to Y% to account for potential economic headwinds].

- NPL ratio: [Insert the NPL ratio and analysis – e.g., The NPL ratio remains below industry average, suggesting a relatively healthy loan portfolio.]

- Changes in loan loss provisions: [Explain the changes – e.g., The increase in loan loss provisions reflects a cautious approach to managing credit risk in the current economic climate.]

- Impact of economic conditions on loan performance: [Analyze the impact – e.g., The ongoing economic uncertainty could potentially impact future loan performance.]

Capital Ratios and Liquidity Position

A strong capital position and ample liquidity are fundamental to a bank's stability. ING Group's 2024 Form 20-F shows a [insert data on CET1 ratio – e.g., CET1 ratio of 16%], comfortably exceeding regulatory requirements. The Liquidity Coverage Ratio (LCR) also demonstrates [insert data on LCR – e.g., strong liquidity with an LCR well above the regulatory minimum].

- Key capital ratios: [List and explain key ratios – e.g., CET1, Tier 1, Total Capital Ratio.]

- Comparison with regulatory requirements: [Show how ING's ratios compare – e.g., Significantly above regulatory minimums, indicating strong capital adequacy.]

- Liquidity risk assessment: [Assess liquidity risk – e.g., The bank’s robust liquidity position mitigates short-term funding risks.]

ING Group's Strategic Initiatives and Outlook as Revealed in the 20-F Filing

ING Group's 20-F filing offers insights into its strategic direction and future plans.

Growth Strategies and Business Development

ING's strategic focus includes [insert details from the 20-F – e.g., continued investment in digital transformation, expansion into sustainable finance, and targeted growth in specific geographic markets].

- Key strategic initiatives: [List key initiatives – e.g., Enhancement of digital banking platforms, expansion into new markets, strategic partnerships.]

- New market entry plans: [Mention any expansion plans – e.g., Focus on further penetration in Asian markets.]

- Planned investments in technology: [Highlight technological investments – e.g., significant investment in AI and cloud technologies.]

Risk Management and Regulatory Compliance

The 20-F filing highlights ING Group's commitment to robust risk management and regulatory compliance. The bank's approach emphasizes [insert details on risk management – e.g., proactive risk identification, robust internal controls, and strict adherence to regulatory frameworks like Basel III].

- Key risk factors: [List key risks – e.g., Credit risk, market risk, operational risk, regulatory risk.]

- Compliance measures: [Describe compliance measures – e.g., Regular audits, robust compliance programs, and ongoing monitoring.]

- Regulatory changes and their impact: [Discuss the impact of regulatory changes – e.g., Adapting to evolving regulatory landscape related to data privacy and sustainable finance.]

Environmental, Social, and Governance (ESG) Performance

ING Group's commitment to ESG is evident in its 20-F filing. The report details [insert specific ESG initiatives from the 20-F – e.g., targets for reducing carbon emissions, initiatives promoting financial inclusion, and diversity and inclusion programs].

- ESG targets: [List specific targets – e.g., Reduction of carbon footprint by X% by year Y.]

- Progress towards sustainability goals: [Evaluate progress – e.g., Successful implementation of sustainable finance initiatives.]

- Key ESG risks and opportunities: [Discuss ESG related risks and opportunities – e.g., Transitioning to a low-carbon economy presents both challenges and opportunities.]

Comparison with Previous Years and Industry Peers: ING Group's 2024 Performance in Context

Understanding ING Group's 2024 performance requires comparing it to previous years and industry peers.

Year-over-Year Performance Comparison

Comparing key metrics year-over-year reveals trends and patterns. [Insert comparison data – e.g., A comparison of key performance indicators (KPIs) such as Return on Equity (ROE) and Return on Assets (ROA) with previous years shows a positive trend.]

- Key performance indicators (KPIs) year-over-year comparison: [Provide detailed year-over-year comparisons of key KPIs.]

- Highlighting significant changes: [Point out significant changes and explain the reasons behind them.]

Benchmarking against Industry Competitors

Benchmarking ING Group against its peers helps assess its competitive positioning. [Insert comparison data and analysis – e.g., Comparison with competitors like [Competitor names] reveals ING Group’s strengths in [Area of strength] and areas for improvement in [Area for improvement].]

- Comparison with key competitors: [Compare key metrics with industry competitors, providing a detailed analysis.]

- Analysis of strengths and weaknesses relative to peers: [Highlight strengths and weaknesses in comparison to competitors.]

Conclusion: Understanding the Implications of ING Group's 2024 Form 20-F Filing

Analyzing ING Group's 2024 Form 20-F filing reveals a [insert overall assessment - e.g., generally strong financial performance] with [insert positive aspects - e.g., healthy capital ratios and robust liquidity], while also highlighting [insert challenges/risks - e.g., potential challenges related to the macroeconomic environment]. The bank's strategic initiatives demonstrate a focus on [insert key strategic focus - e.g., digital transformation and sustainable finance].

Key Takeaways: This analysis provides insights into ING Group's financial health, strategic direction, and competitive standing. Understanding these factors is critical for investors and stakeholders making informed decisions.

Call to Action: Deepen your understanding of ING Group's financial health by reviewing the full 2024 Form 20-F filing today! [Insert link to the 20-F filing here]. For a complete analysis of ING Group's 2024 financial performance and to gain a deeper understanding of its strategic outlook, access the full Form 20-F filing now.

Featured Posts

-

Karate Kid Legend Of Miyagi Dos Connection To The Franchise

May 23, 2025

Karate Kid Legend Of Miyagi Dos Connection To The Franchise

May 23, 2025 -

Zvanicno Vanja Mijatovic Sada Se Zove

May 23, 2025

Zvanicno Vanja Mijatovic Sada Se Zove

May 23, 2025 -

Edinburgh To Host The Tour De France Grand Depart In 2027

May 23, 2025

Edinburgh To Host The Tour De France Grand Depart In 2027

May 23, 2025 -

Grand Ole Oprys Historic London Concert A Royal Albert Hall Debut

May 23, 2025

Grand Ole Oprys Historic London Concert A Royal Albert Hall Debut

May 23, 2025 -

Employee Quits Faces Landladys Rot In Hell Outburst Full Video

May 23, 2025

Employee Quits Faces Landladys Rot In Hell Outburst Full Video

May 23, 2025

Latest Posts

-

Open Ai And Jony Ive Exploring The Rumored Ai Hardware Deal

May 23, 2025

Open Ai And Jony Ive Exploring The Rumored Ai Hardware Deal

May 23, 2025 -

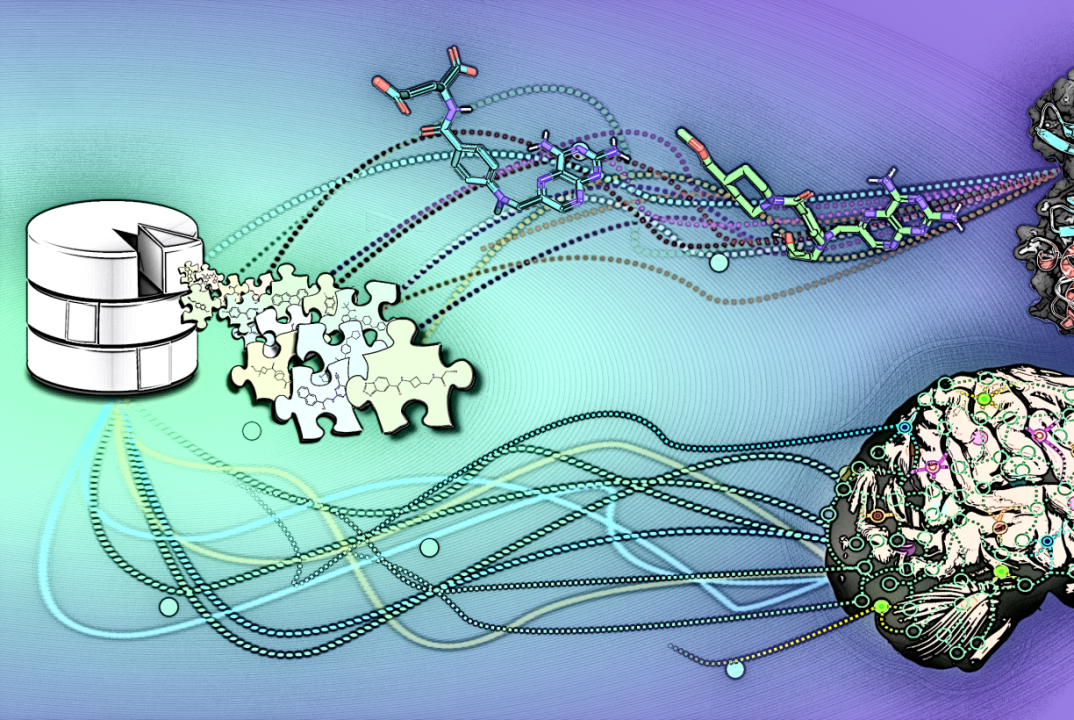

Orbital Crystallography Revolutionizing Drug Design And Production

May 23, 2025

Orbital Crystallography Revolutionizing Drug Design And Production

May 23, 2025 -

Jony Ives Ai Company Potential Open Ai Acquisition Analyzed

May 23, 2025

Jony Ives Ai Company Potential Open Ai Acquisition Analyzed

May 23, 2025 -

Harnessing Space Crystals A New Frontier In Drug Discovery And Development

May 23, 2025

Harnessing Space Crystals A New Frontier In Drug Discovery And Development

May 23, 2025 -

Is Open Ai Acquiring Jony Ives Ai Startup A Deep Dive

May 23, 2025

Is Open Ai Acquiring Jony Ives Ai Startup A Deep Dive

May 23, 2025