Analysis: Reduced Chinese Steel Production And The Plunge In Iron Ore Prices

Table of Contents

H2: Reduced Chinese Steel Production: The Driving Forces

The dramatic decrease in Chinese steel production isn't a singular event but rather a confluence of factors impacting the world's largest steel producer. These factors can be broadly categorized into government regulations, weakening domestic demand, and increased production costs.

H3: Government Regulations and Environmental Concerns:

China's commitment to environmental protection has significantly impacted its steel industry. Stricter regulations are aimed at curbing pollution stemming from steel mills, leading to production cutbacks.

- Stricter environmental regulations: These include limits on emissions of pollutants like sulfur dioxide and particulate matter. Non-compliant mills face heavy fines and potential closures.

- Carbon emission reduction targets: China's ambitious goals to reduce its carbon footprint necessitate a shift away from traditional, high-emission steel production methods. This requires significant investment in cleaner technologies and potentially reduced output in the interim.

- Increased scrutiny of illegal steel production: Crackdowns on illegal and smaller, less regulated steel plants have further reduced overall output.

- Example: The implementation of the "ultra-low emission" standards in key steel-producing regions has forced many mills to invest heavily in upgrades or face significant penalties, directly impacting production levels.

- Impact on different steel production methods: The shift towards greener technologies disproportionately affects older, less efficient methods, impacting production volumes and profitability.

H3: Weakening Domestic Demand:

A slowdown in China's overall economy has significantly reduced demand for steel, a key input in construction and infrastructure projects.

- Slowdown in China's construction and infrastructure sectors: Government efforts to curb excessive debt and prioritize sustainable development have led to a decrease in large-scale infrastructure projects.

- Decreased demand in the real estate market: A cooling real estate market, characterized by declining property prices and tighter lending regulations, significantly impacts steel consumption.

- Reduced demand from other major steel-consuming industries: Sectors like automotive manufacturing have also experienced a decline in demand, leading to a reduction in steel purchases.

- Data illustrating the decline in steel consumption: Official statistics from China's National Bureau of Statistics clearly show a downward trend in apparent steel consumption in recent years.

- Correlation between construction activity and steel demand: Analysis reveals a strong positive correlation between the volume of construction projects and the amount of steel consumed. As construction activity slows, so does steel demand.

H3: Increased Production Costs:

Rising energy prices and increased labor costs have significantly impacted the profitability of steel production in China.

- Rising energy prices: Fluctuations in global energy markets, coupled with China's efforts to transition to cleaner energy sources, have led to higher production costs.

- Higher costs of raw materials beyond iron ore: The price of coal, coke, and other essential inputs has also increased, adding to the overall cost of steel production.

- Increased labor costs: Rising wages and improved worker benefits have contributed to higher labor costs in the steel industry.

- Impact on steel production profitability: The combination of increased costs and reduced demand has squeezed profit margins for many steel producers in China.

- Comparison of production costs: Comparing production costs in China with other major steel-producing nations highlights the challenges faced by Chinese steelmakers in maintaining global competitiveness.

H2: The Plunge in Iron Ore Prices: Ripple Effects

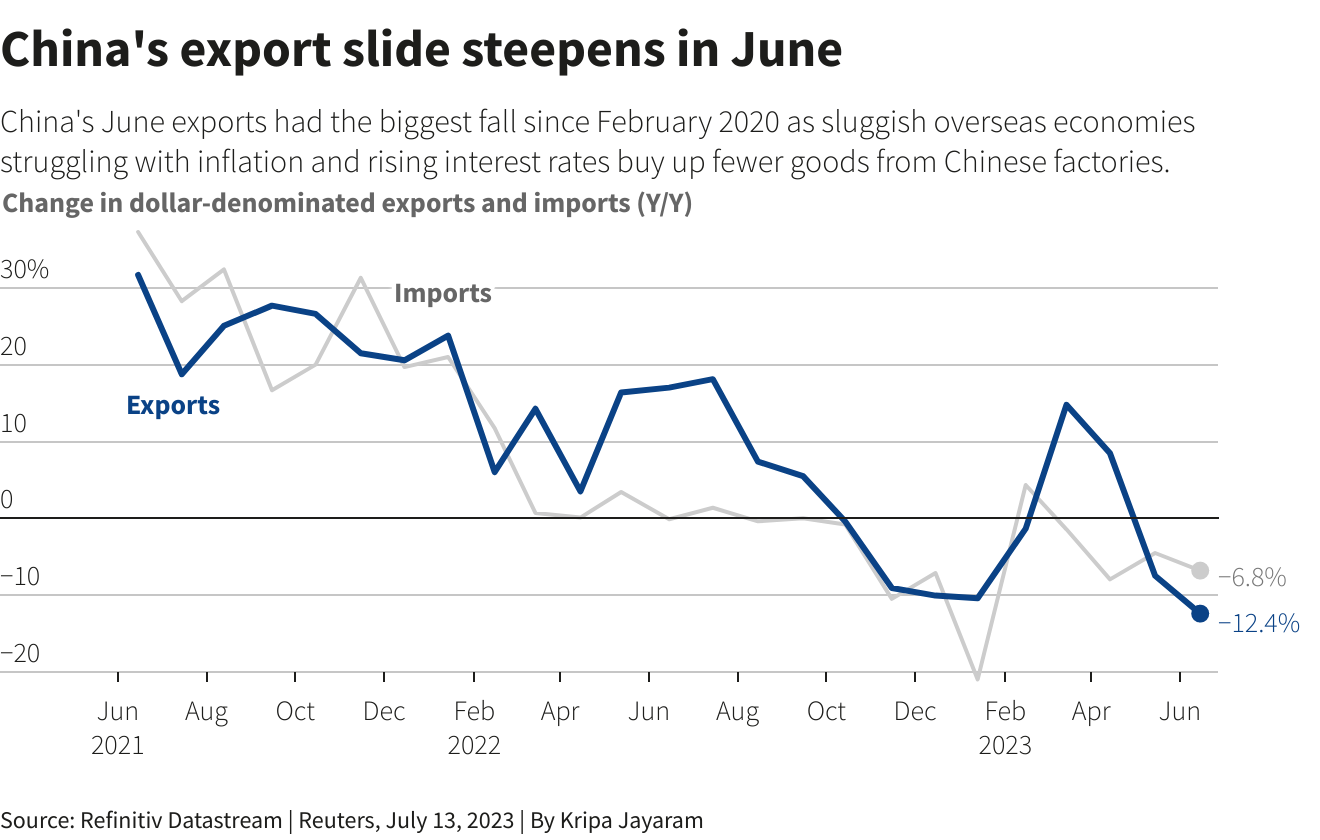

The reduced demand for steel in China has directly translated into a significant decrease in iron ore imports, causing a dramatic plunge in iron ore prices.

H3: Reduced Demand for Iron Ore:

- Direct correlation between lower Chinese steel production and decreased iron ore imports: As China produces less steel, its demand for iron ore—a key raw material—falls proportionally.

- Impact on major iron ore exporting countries: Australia and Brazil, major iron ore exporters, have experienced significant revenue losses due to the price decline.

- Supply-demand imbalance: The decreased demand coupled with relatively stable supply has created a significant imbalance, resulting in lower prices.

- Charts depicting the price fluctuation: Visual representations of iron ore price movements clearly demonstrate the sharp decline.

- Futures market predictions: Analysis of the futures market provides insight into potential future price movements and market sentiment.

H3: Impact on Mining Companies:

- Reduced profitability: Lower iron ore prices have significantly reduced the profitability of mining companies, impacting their share prices and investor confidence.

- Potential job losses and investment cuts: Mining companies may be forced to cut jobs and reduce capital expenditure in response to declining revenues.

- Cost-cutting measures: Mining companies are implementing cost-cutting strategies, such as reducing operational expenses and streamlining production processes.

- Case studies: Examining specific examples of how major mining companies are adapting to the lower prices provides valuable insights.

- Mergers and acquisitions: The challenging market conditions may lead to increased mergers and acquisitions within the mining industry.

H3: Global Implications:

The price decline has global ramifications beyond China and the iron ore mining industry.

- Effects on global steel prices and competitiveness: Lower iron ore prices can lead to a temporary reduction in global steel prices, impacting the competitiveness of steel producers worldwide.

- Impact on related industries: The decline ripples through industries reliant on steel, such as construction and shipbuilding, creating further economic challenges.

- Geopolitical implications: The shift in the global steel market could have geopolitical consequences, particularly concerning trade relations and resource security.

- Potential trade disputes: The impact on global steel markets might trigger trade disputes and protectionist measures.

- Long-term consequences: The long-term impacts on the global steel and mining industries are still uncertain, requiring ongoing monitoring and analysis.

3. Conclusion:

The decline in Chinese steel production has undeniably triggered a significant plunge in iron ore prices, creating ripple effects across the global steel and mining industries. Understanding the complex interplay of government policies, economic slowdown, production costs, and international trade is crucial for navigating this volatile market. Further analysis of Chinese steel production and its impact on iron ore prices will be necessary to predict future market trends and mitigate risks. Staying informed about future developments in Chinese steel production is essential for all stakeholders in the iron ore and steel markets. Continue to monitor this dynamic relationship between Chinese steel production and iron ore prices for informed decision-making.

Featured Posts

-

Mariah The Scientists Burning Blue A Highly Anticipated Return

May 09, 2025

Mariah The Scientists Burning Blue A Highly Anticipated Return

May 09, 2025 -

Golden Knights Defeat Blue Jackets 4 0 Hills Strong Performance Leads The Way

May 09, 2025

Golden Knights Defeat Blue Jackets 4 0 Hills Strong Performance Leads The Way

May 09, 2025 -

Phan No Vu Bao Mau Tat Tre Em Tien Giang Phai Bao Ve Tre Em

May 09, 2025

Phan No Vu Bao Mau Tat Tre Em Tien Giang Phai Bao Ve Tre Em

May 09, 2025 -

Nhl 2024 25 Season Key Storylines To Follow

May 09, 2025

Nhl 2024 25 Season Key Storylines To Follow

May 09, 2025 -

Trade Disruptions How The Bubble Blaster Crisis Affects Chinese Exports

May 09, 2025

Trade Disruptions How The Bubble Blaster Crisis Affects Chinese Exports

May 09, 2025