Analyst Sees Apple Reaching $254: Investment Implications At $200

Table of Contents

Why $254? Understanding the Analyst's Apple Stock Price Prediction

The Analyst's Rationale

The $254 Apple stock price prediction stems from a comprehensive analysis conducted by [Analyst Name/Firm Name – replace with actual name]. Their rationale rests on several key pillars:

- Robust Revenue Projections: The analyst forecasts continued strong revenue growth driven by sustained demand for iPhones, Macs, and wearables. They project [Insert specific percentage or dollar amount] growth in revenue over the next [Timeframe – e.g., 12-18 months].

- Expanding Services Ecosystem: Apple's services segment, encompassing Apple Music, iCloud, and Apple TV+, is expected to continue its impressive trajectory, contributing significantly to overall profitability and revenue diversification. The analyst projects a [Specific percentage or dollar amount] increase in services revenue.

- Innovative Product Launches: Anticipated product launches, such as new iPhone models, Apple Watch iterations, and potential advancements in augmented reality/virtual reality (AR/VR) technology, are projected to fuel further sales growth and investor enthusiasm.

- Market Share Dominance: The analyst highlights Apple's continued market leadership in key segments, particularly smartphones and tablets, contributing to their confidence in the $254 prediction.

The analyst's model also assumes a stable macroeconomic environment and no significant disruptions to Apple's supply chain.

Assessing the Reliability of the Prediction

While the analyst's credentials are impressive [mention specific achievements or experience], it's crucial to consider the inherent uncertainties in stock market predictions. Their past predictions for Apple [mention accuracy or track record, if available], provide some indication of their forecasting abilities. However, comparing this prediction with those of other analysts reveals a range of opinions, highlighting the inherent volatility of the stock market. Some analysts project a more conservative price target, while others are more bullish. The prediction's reliability should be viewed within the context of this broader range of opinions. Remember that unforeseen events can significantly impact stock prices.

Investment Implications of Apple Stock at $200

Potential Returns and Risks

If Apple stock reaches $254 from the current $200 price point, investors stand to gain a substantial return of 27%. However, this potential return is accompanied by inherent risks:

- Market Volatility: The stock market is inherently volatile, and Apple's stock price is subject to fluctuations influenced by various economic, political, and company-specific factors.

- Unforeseen Events: Negative news about Apple, such as product recalls, supply chain disruptions, or a significant economic downturn, could negatively impact the stock price.

- Competition: Increased competition in the tech sector could affect Apple's market share and profitability.

Upside Scenario: Reaching $254 provides a significant return.

Downside Scenario: The stock could underperform, leading to losses if the price fails to rise or declines.

This investment opportunity presents a moderate-to-high risk depending on your individual risk tolerance.

Alternative Investment Strategies

For investors with varying risk appetites, several alternative strategies exist:

- Dollar-Cost Averaging (DCA): Investing a fixed amount at regular intervals mitigates the risk of investing a lump sum at a market peak.

- Diversification: Spreading investments across different tech stocks or sectors reduces overall portfolio risk.

- Apple-Related ETFs: Exchange-traded funds (ETFs) tracking the tech sector or broader market indices offer diversified exposure to Apple and related companies.

Each strategy has its own advantages and disadvantages. Consider consulting a financial advisor to determine the best approach for your financial goals and risk profile.

Beyond the $254 Target: Long-Term Outlook for Apple Stock

Growth Drivers for Apple

Apple's long-term growth hinges on several key factors:

- Expansion into New Markets: Further penetration into emerging markets presents substantial growth potential.

- Innovation in Existing Product Lines: Continued innovation in iPhones, Macs, wearables, and services will be crucial for sustaining growth.

- Services Segment Growth: The services segment is a key driver of recurring revenue and profitability, showcasing strong growth potential.

Apple's strong brand reputation, robust ecosystem, and innovative culture are likely to maintain its competitive advantage. However, emerging technologies and competitive pressures could challenge Apple's leadership in certain markets.

Factors that Could Impact the Prediction

Several factors could impact the $254 price target:

- Economic Downturn: A global recession could dampen consumer spending and negatively affect Apple's sales.

- Geopolitical Instability: International conflicts or trade disputes could disrupt supply chains and negatively impact Apple's operations.

- Internal Factors: Product delays, supply chain issues, or unforeseen internal challenges could influence Apple's financial performance.

Conclusion: Apple Stock: Making Informed Investment Decisions at $200

The analyst's $254 Apple stock price prediction presents a compelling potential return. However, this projection should be viewed within the context of market volatility and the inherent uncertainties associated with stock market forecasts. Investing in Apple at $200 carries both significant potential returns and risks. Understanding the analyst's rationale, considering alternative investment strategies, and carefully assessing your own risk tolerance are crucial before making any investment decisions. Remember to conduct thorough research and consult a financial advisor before investing in Apple stock or any other asset. Invest wisely in Apple, employing strategies that align with your financial goals and risk appetite. Thoroughly understanding Apple stock investment strategies is essential for navigating this exciting but potentially volatile investment opportunity.

Featured Posts

-

Czy Porsche Cayenne Gts Coupe To Idealny Suv Moja Opinia

May 24, 2025

Czy Porsche Cayenne Gts Coupe To Idealny Suv Moja Opinia

May 24, 2025 -

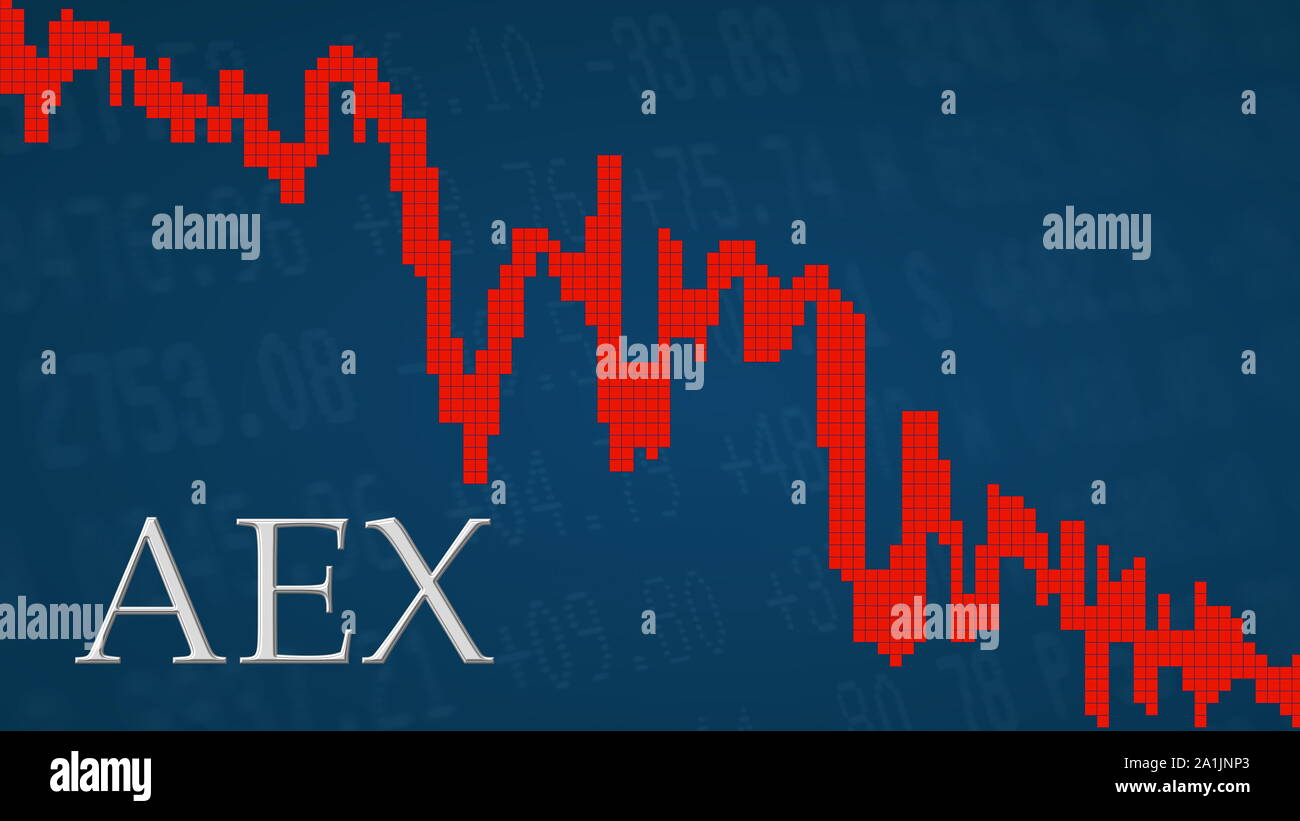

Amsterdam Aex Index Suffers Sharpest Fall In Over A Year

May 24, 2025

Amsterdam Aex Index Suffers Sharpest Fall In Over A Year

May 24, 2025 -

The Farrow Warning Trump Congress And The 3 4 Month Countdown For American Democracy

May 24, 2025

The Farrow Warning Trump Congress And The 3 4 Month Countdown For American Democracy

May 24, 2025 -

Smart Travel Tips Avoiding Crowds Around Memorial Day 2025

May 24, 2025

Smart Travel Tips Avoiding Crowds Around Memorial Day 2025

May 24, 2025 -

80

May 24, 2025

80

May 24, 2025

Latest Posts

-

Guilty Plea Lab Owner Admitted To Faking Covid 19 Test Results

May 24, 2025

Guilty Plea Lab Owner Admitted To Faking Covid 19 Test Results

May 24, 2025 -

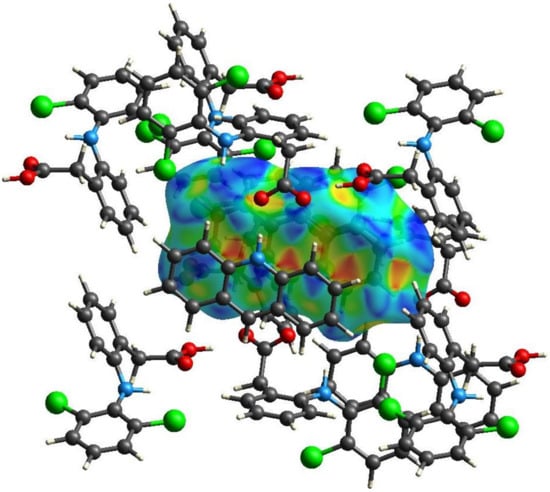

The Role Of Orbital Space Crystals In Advanced Pharmaceuticals

May 24, 2025

The Role Of Orbital Space Crystals In Advanced Pharmaceuticals

May 24, 2025 -

Improving Drug Development Through Orbital Space Crystal Research

May 24, 2025

Improving Drug Development Through Orbital Space Crystal Research

May 24, 2025 -

Space Crystals And The Future Of Pharmaceutical Innovation

May 24, 2025

Space Crystals And The Future Of Pharmaceutical Innovation

May 24, 2025 -

The Future Of Ai Open Ai And Jony Ives Collaboration

May 24, 2025

The Future Of Ai Open Ai And Jony Ives Collaboration

May 24, 2025