Analyzing Elon Musk's Net Worth: The Role Of US Political And Economic Factors

Table of Contents

Impact of US Government Regulations on Tesla and SpaceX

Government regulations and policies in the US profoundly impact both Tesla and SpaceX, directly influencing their profitability and, subsequently, Elon Musk's net worth.

Environmental Policies and Subsidies

US environmental policies and government incentives play a crucial role in Tesla's success. The push for sustainable energy and electric vehicles has created a favorable environment for Tesla, manifested in several ways:

- Tax Credits for Electric Vehicles: The US government's offering of tax credits for electric vehicle purchases significantly boosts Tesla's sales and overall revenue. Changes to these credits, or the introduction of new ones, directly impact Tesla's stock price and profitability.

- Investment in Renewable Energy Infrastructure: Government investments in charging stations and renewable energy infrastructure indirectly benefit Tesla by expanding its market reach and increasing consumer adoption of electric vehicles.

- Government Support for SpaceX: While not directly impacting Tesla, government contracts and support for SpaceX’s space exploration projects, including NASA partnerships and military contracts, contribute significantly to SpaceX's valuation and, therefore, Musk's overall net worth.

Trade Policies and International Relations

US trade policies and international relations significantly affect Tesla's global operations and SpaceX's international ambitions.

- Tariffs and Trade Disputes: Trade disputes and tariffs imposed by the US or other countries can disrupt Tesla's global supply chains, increase production costs, and negatively impact profitability. For example, tariffs on imported materials can directly affect Tesla's manufacturing costs.

- International Collaborations and Sanctions: SpaceX's international partnerships and projects can be affected by US foreign policy and sanctions. Restrictions on collaborations with certain countries can limit SpaceX’s expansion and revenue potential.

The Role of the US Economy on Musk's Holdings

The health and trajectory of the US economy directly correlate with the valuation of Musk's companies and his personal wealth.

Economic Growth and Consumer Spending

US economic growth and consumer spending are key drivers of Tesla's sales and, consequently, its stock price.

- Correlation between GDP Growth and Tesla Sales: Data shows a strong positive correlation between US GDP growth and Tesla vehicle sales. Periods of strong economic growth generally translate to increased consumer confidence and higher demand for luxury goods like Tesla vehicles.

- Recessionary Impacts on Tesla's Stock Price: Conversely, during recessionary periods, consumer spending declines, affecting Tesla's sales and leading to a decrease in its stock price, thereby impacting Musk's net worth.

Inflation and Interest Rates

Inflation and interest rate changes impact Tesla's operational costs, borrowing costs, and investor sentiment.

- Inflation's Effect on Production Costs: Rising inflation increases the cost of raw materials, labor, and transportation, directly impacting Tesla's production costs and profit margins.

- Interest Rate Hikes and Investment: Interest rate hikes increase Tesla's borrowing costs and can make the company's stock less attractive to investors, potentially leading to a decrease in its valuation.

Market Sentiment and Media Influence on Musk's Net Worth

Public perception, media coverage, and social media significantly influence investor behavior and Tesla's stock price, creating volatility in Musk's net worth.

Public Opinion and Stock Market Volatility

Public opinion regarding Elon Musk and his companies greatly influences investor confidence.

- News Events and Social Media Trends: Positive or negative news coverage, social media trends, and controversies surrounding Musk directly affect investor sentiment and Tesla's stock price.

- Musk's Public Statements and Actions: Musk's public statements and actions, especially on social media, often cause significant swings in Tesla's stock price, illustrating the impact of his personal brand on market valuation.

Short Selling and Market Manipulation

Short-selling and potential market manipulation play a role in the volatility of Tesla's stock price.

- Mechanics of Short Selling: Short-selling involves betting against a stock's price, and a large amount of short selling can contribute to price drops.

- Potential for Market Manipulation: Allegations of market manipulation affecting Tesla's stock price highlight the external factors that influence the valuation independent of the company's underlying performance.

Conclusion

Analyzing Elon Musk's net worth reveals a complex interplay between US political and economic factors. Government regulations, economic trends, and market sentiment all significantly influence the valuation of his companies, Tesla and SpaceX, directly impacting his personal fortune. The analysis shows how environmental policies, trade relations, economic growth, inflation, interest rates, public opinion, and even short selling all contribute to the volatility of Musk's net worth. To fully understand the dynamics of extreme wealth in the modern era, further analyzing Elon Musk's net worth and its determinants is crucial. We encourage you to explore further resources on economic policy, market analysis, and the impact of social media on financial markets to gain a deeper understanding of this fascinating intersection.

Featured Posts

-

The Life And Times Of Samuel Dickson A Canadian Industrialist

May 09, 2025

The Life And Times Of Samuel Dickson A Canadian Industrialist

May 09, 2025 -

Updated Police Probe Threats Made Against Madeleine Mc Canns Parents

May 09, 2025

Updated Police Probe Threats Made Against Madeleine Mc Canns Parents

May 09, 2025 -

Brekelmans Wil India Aan Zijn Zijde Houden Strategie En Uitdagingen

May 09, 2025

Brekelmans Wil India Aan Zijn Zijde Houden Strategie En Uitdagingen

May 09, 2025 -

Morgans 5 Biggest Strategic Mistakes In High Potential Season 1

May 09, 2025

Morgans 5 Biggest Strategic Mistakes In High Potential Season 1

May 09, 2025 -

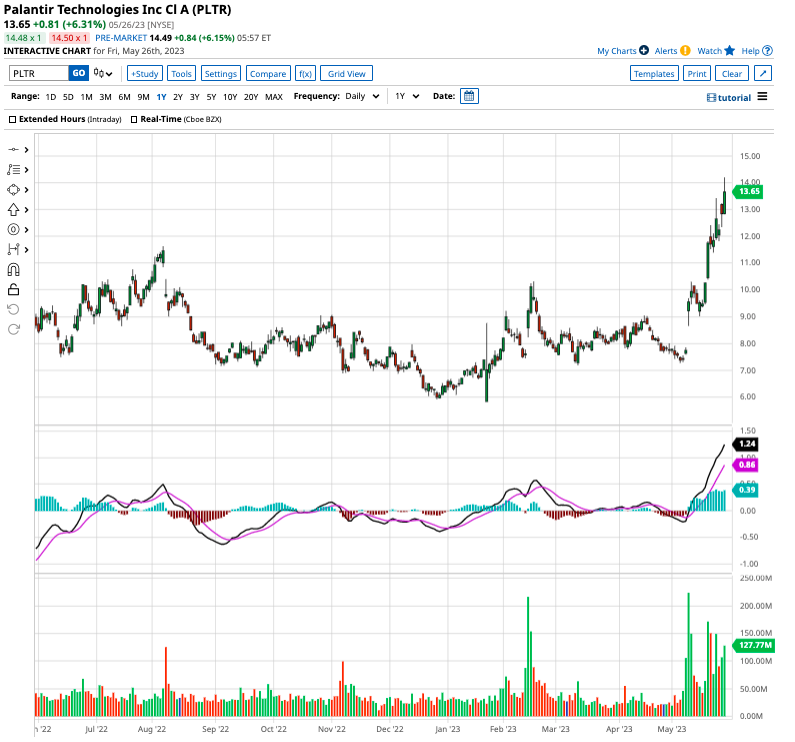

Is Palantir Stock A Good Investment Right Now Risks And Rewards Explained

May 09, 2025

Is Palantir Stock A Good Investment Right Now Risks And Rewards Explained

May 09, 2025