Analyzing Nicolai Tangen's Approach To Trump's Trade Policies

Table of Contents

Nicolai Tangen, CEO of Norway's sovereign wealth fund – the world's largest – faced a formidable challenge during the Trump administration: navigating the turbulent waters of unpredictable trade policies. This analysis delves into Tangen's strategic responses to the opportunities and threats presented by Trump's protectionist measures, examining their impact on Norway's investments and global economic stability. We will explore his approach to risk management, portfolio diversification, and engagement with US businesses within this volatile trading environment, providing insight into the complexities of Nicolai Tangen Trump trade policies.

Tangen's Initial Response to Trump's Trade Wars

Assessing the Risk

How did Tangen and the fund initially assess the risks posed by Trump's tariffs and trade disputes? The initial response required a thorough evaluation of potential market volatility stemming from these protectionist policies. The fund likely employed sophisticated econometric models and scenario planning to predict the impact on various asset classes.

- Analysis of potential market volatility: The inherent uncertainty of Trump's actions necessitated rigorous stress testing of the fund's portfolio to identify vulnerabilities.

- Examination of specific sectors vulnerable to trade wars: Sectors heavily reliant on international trade, such as energy (oil and gas) and technology, were likely identified as high-risk areas requiring closer monitoring and potential adjustments. The impact on global supply chains was a crucial consideration.

- Evaluation of the impact on US and global economic growth: The fund's analysts probably assessed the broader macroeconomic consequences of escalating trade tensions, considering their potential impact on global growth forecasts and investor sentiment.

Early Strategic Adjustments

What initial adjustments did the fund make to its portfolio in response to the escalating trade tensions? Given the uncertainty, a proactive approach was likely adopted, prioritizing portfolio diversification and a shift towards less trade-sensitive investments.

- Diversification strategies to mitigate exposure to affected sectors: The fund may have reduced its holdings in sectors deemed particularly vulnerable to trade wars, rebalancing its portfolio to lessen overall risk.

- Adjustments to investment allocation across different geographic regions: Diversification across geographies is crucial for mitigating geopolitical risk. The fund might have shifted allocations away from regions heavily impacted by the trade disputes, perhaps favouring those less exposed to the US-China trade war.

- Shift in emphasis towards less trade-sensitive investments: Investments in sectors less susceptible to trade disruptions, such as infrastructure, healthcare, or consumer staples, might have become more attractive during this period.

Navigating the Uncertainty: Long-Term Investment Strategy

Maintaining a Long-Term Perspective

How did Tangen maintain a long-term investment strategy amidst the short-term volatility created by Trump's policies? Despite the turbulence, a long-term perspective remained crucial. The fund's investment strategy likely emphasized long-term value creation over short-term gains.

- Focus on sustainable and responsible investing principles: A commitment to ESG (environmental, social, and governance) factors could have provided a degree of resilience during this volatile period, as sustainable investments often demonstrate greater long-term stability.

- Emphasis on long-term value creation rather than short-term gains: Resisting the temptation to make hasty decisions driven by short-term market fluctuations was vital. The fund's long-term horizon allowed for weathering market storms.

- Maintaining a diversified portfolio across asset classes and geographies: This served as a crucial buffer against the impact of trade wars, minimizing exposure to any single sector or region.

Engagement with US Businesses

Did Tangen engage directly with US businesses affected by the trade disputes? While specific details of private communications might not be publicly available, it's plausible the fund engaged in dialogue with US companies to assess the long-term impacts on their operations and the broader economy.

- Examples of dialogue or communication with US companies: Open communication channels with portfolio companies would allow the fund to understand firsthand the implications of the trade disputes and adjust its investment strategy accordingly.

- Potential lobbying efforts or participation in industry discussions: While less likely for a sovereign wealth fund, indirect influence on trade policy through industry participation might have been considered.

- Assessment of the effectiveness of such engagement: Evaluating the success of such engagement would help inform future responses to similar geopolitical events.

The Impact on Norway's Sovereign Wealth Fund

Performance Metrics

What was the measurable impact of Trump's trade policies on the performance of the Norwegian sovereign wealth fund? Analyzing performance metrics during this period is crucial to assessing the overall impact.

- Analysis of return rates during the period: Comparing return rates during the Trump administration's trade policy period with previous and subsequent periods would reveal any significant deviations.

- Comparison to benchmark indices: Benchmarking against relevant global indices can help isolate the impact of trade policies on the fund's performance.

- Identification of specific investments affected by trade disputes: Analyzing specific investments affected by tariffs or trade disruptions can provide a granular understanding of the impact.

Lessons Learned

What key lessons did Tangen and the fund learn from navigating this period of trade uncertainty? The experience provided invaluable insights into navigating geopolitical risk.

- Enhanced risk management strategies: The experience likely refined the fund's risk assessment models and scenario planning, leading to more robust risk management practices.

- Refinement of portfolio diversification techniques: The importance of diversification across geographies, sectors, and asset classes would have been reinforced.

- Improved understanding of geopolitical risk and its impact on investments: The episode offered a valuable lesson in understanding and mitigating the unpredictable impact of geopolitical events on investment performance.

Conclusion

This analysis of Nicolai Tangen's approach to Trump's trade policies highlights a strategic response characterized by long-term value creation, diversification, and proactive risk management. While the Trump administration's actions introduced significant uncertainty, Tangen's leadership ensured the Norwegian sovereign wealth fund maintained a robust investment strategy. By prioritizing sustainable investments and adapting to the changing geopolitical landscape, Tangen demonstrated effective leadership during a challenging period. Further research into specific investment decisions and outcomes will provide a deeper understanding of the efficacy of Nicolai Tangen Trump Trade Policies, particularly within the context of global economic volatility. Understanding how the fund navigated these challenges offers valuable insights for other investors facing similar geopolitical uncertainty.

Featured Posts

-

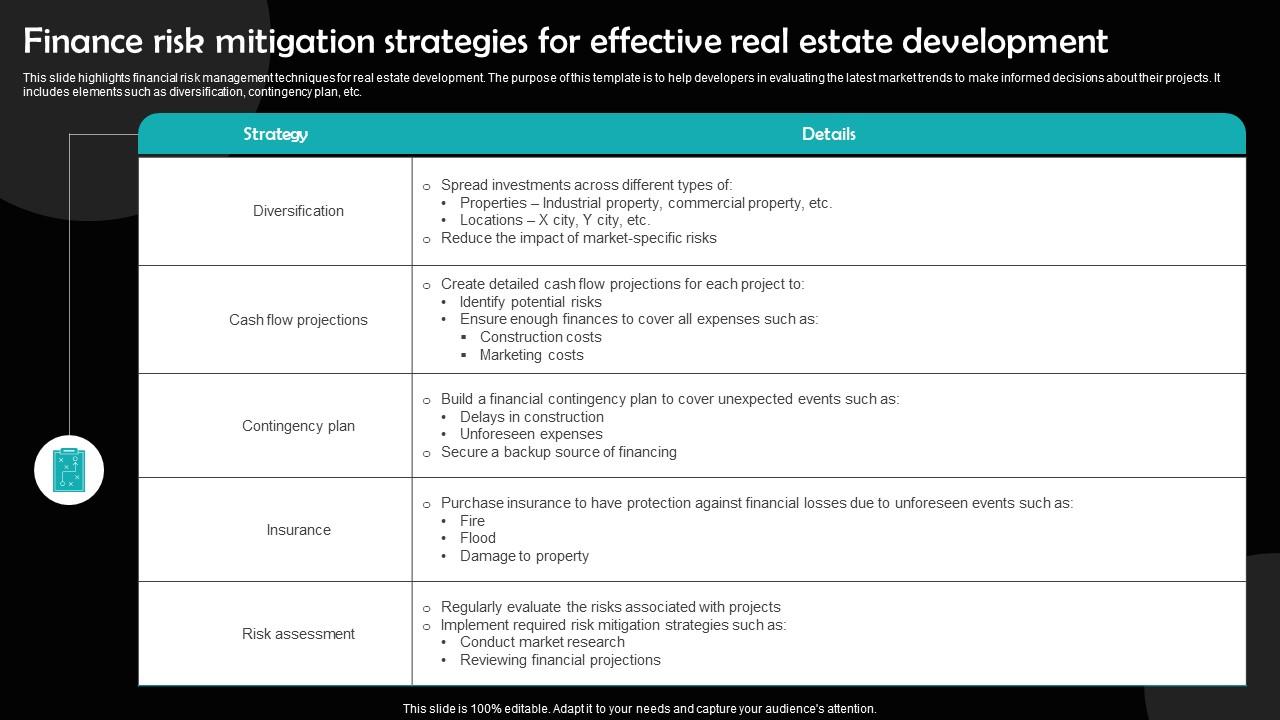

Risk Assessment And Mitigation Strategies For 270 M Wh Bess Financing In Belgium

May 04, 2025

Risk Assessment And Mitigation Strategies For 270 M Wh Bess Financing In Belgium

May 04, 2025 -

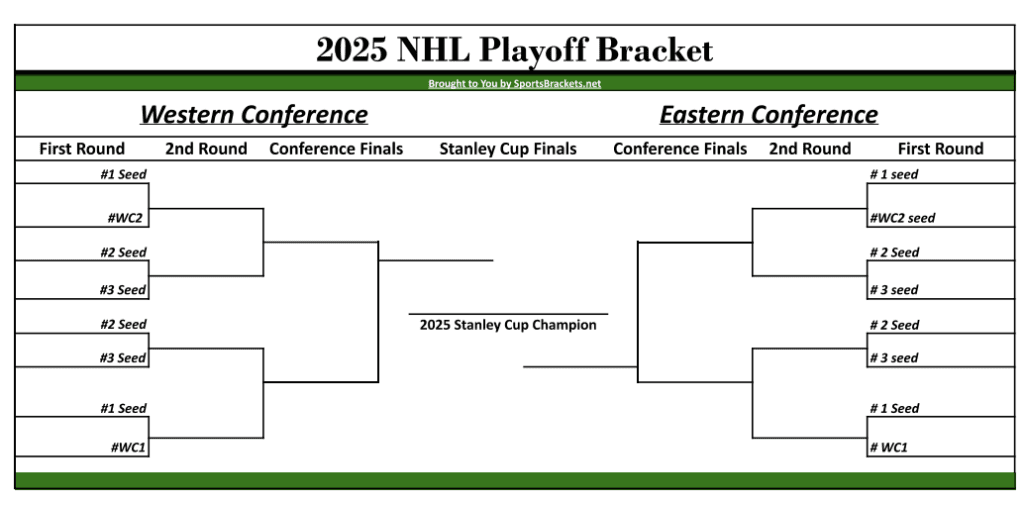

First Round Nhl Stanley Cup Playoffs What You Need To Know

May 04, 2025

First Round Nhl Stanley Cup Playoffs What You Need To Know

May 04, 2025 -

2025 Gold Market Facing First Consecutive Weekly Price Drops

May 04, 2025

2025 Gold Market Facing First Consecutive Weekly Price Drops

May 04, 2025 -

Vegas Golden Knights Stanley Cup Contenders

May 04, 2025

Vegas Golden Knights Stanley Cup Contenders

May 04, 2025 -

Addressing Criticism Lizzos Trainer Speaks Out On Her Fitness Journey

May 04, 2025

Addressing Criticism Lizzos Trainer Speaks Out On Her Fitness Journey

May 04, 2025

Latest Posts

-

The Paddy Pimblett Dustin Poirier Retirement Debate

May 04, 2025

The Paddy Pimblett Dustin Poirier Retirement Debate

May 04, 2025 -

Poirier Retires Paddy Pimbletts Reaction Sparks Debate

May 04, 2025

Poirier Retires Paddy Pimbletts Reaction Sparks Debate

May 04, 2025 -

Ufc 314 In Depth Look At Chandler Vs Pimblett Odds And Predictions

May 04, 2025

Ufc 314 In Depth Look At Chandler Vs Pimblett Odds And Predictions

May 04, 2025 -

Ufc 314 Co Main Event Prediction Analyzing Chandler Vs Pimblett

May 04, 2025

Ufc 314 Co Main Event Prediction Analyzing Chandler Vs Pimblett

May 04, 2025 -

Chandler Vs Pimblett Ufc 314 Co Main Event Fight Breakdown And Betting Odds

May 04, 2025

Chandler Vs Pimblett Ufc 314 Co Main Event Fight Breakdown And Betting Odds

May 04, 2025