Analyzing QBTS Stock Performance Following Earnings Releases

Table of Contents

Pre-Earnings Expectations and Market Sentiment

Analyzing pre-earnings expectations is paramount for understanding QBTS stock performance. Analyst estimates, news articles, social media chatter, and financial blog discussions all contribute to the overall market sentiment surrounding the upcoming earnings release. These expectations significantly influence the stock's price leading up to and immediately following the announcement.

- Methods for gauging pre-earnings sentiment: Scrutinize financial news outlets, social media platforms (like Twitter and StockTwits), and reputable financial blogs for insights into investor sentiment. Look for mentions of QBTS and assess whether the overall tone is positive, negative, or neutral.

- Impact of positive vs. negative surprises: If QBTS surpasses analyst expectations (a positive surprise), the stock price typically jumps. Conversely, a negative surprise (missing earnings estimates) often leads to a price drop. The magnitude of the price movement usually correlates with the degree of the surprise.

- Role of analyst ratings and price targets: Analyst ratings (buy, hold, sell) and price targets significantly influence market sentiment. A cluster of positive ratings and high price targets can boost pre-earnings expectations, while negative ratings can lead to a decline.

Immediate Post-Earnings Reaction of QBTS Stock

The immediate post-earnings reaction of QBTS stock can be dramatic. Whether the price jumps or drops sharply depends on several key factors. The most significant is whether QBTS beats or misses earnings expectations and revenue targets. Guidance for future quarters also plays a crucial role, influencing investor confidence.

- Examples of QBTS's past performance following earnings releases: (This section would ideally include charts and graphs illustrating QBTS's historical stock price movements following various earnings announcements. Data visualization is critical here).

- Identifying key metrics influencing the immediate post-earnings stock price movement: Pay close attention to earnings per share (EPS), revenue growth, operating margins, and any significant changes in the company's financial position.

- The importance of understanding the company's press release and conference call: Carefully review the press release for a detailed account of the financial results and listen to the conference call to understand management's perspective and answer any questions from analysts. This provides crucial context for interpreting the numbers.

Long-Term Impact of Earnings Releases on QBTS Stock

While the immediate post-earnings reaction is significant, the long-term impact on QBTS stock is equally, if not more, important for long-term investors. Positive earnings reports often lead to sustained growth, while consistently negative reports can result in a prolonged decline.

- Correlation between short-term volatility and long-term stock performance: While short-term volatility is common after earnings releases, it doesn't always accurately predict long-term performance. Analyze the underlying fundamentals of the company to assess its long-term prospects.

- Identifying trends in QBTS's post-earnings recovery or decline: Track the stock's performance over several weeks and months after the earnings release to identify any trends. This helps determine the sustained impact of the report.

- Influence of external factors (economic conditions, industry trends): Remember that external factors can influence QBTS's long-term performance irrespective of the earnings report. Consider macroeconomic conditions and industry trends when assessing long-term prospects.

Strategies for Investing in QBTS Based on Earnings Releases

Informed investment decisions regarding QBTS require careful consideration of earnings release information. Here are some actionable strategies:

- Strategies for short-term trading based on post-earnings price movements: Short-term traders might employ strategies like buying on dips after a negative surprise if they believe the market overreacted. However, this requires significant experience and risk tolerance.

- Long-term investment strategies considering the impact of earnings on future growth: Long-term investors should focus on the company's overall growth trajectory, using earnings reports as one data point among many.

- The importance of not reacting emotionally to short-term price fluctuations: Avoid emotional decision-making. Stick to your investment plan and don't panic-sell based on short-term price swings.

Mastering QBTS Stock Performance After Earnings Releases

Analyzing QBTS stock performance following earnings releases is crucial for successful investing. We've examined pre-earnings expectations, the immediate post-earnings reaction, and the long-term implications. Remember that informed decision-making and risk management are key. By understanding the intricacies of QBTS stock performance following earnings releases, you can significantly improve your investment strategy. Start your analysis today!

Featured Posts

-

The China Factor Why Bmw And Porsche Are Facing Headwinds

May 21, 2025

The China Factor Why Bmw And Porsche Are Facing Headwinds

May 21, 2025 -

No Es El Arandano Descubre El Superalimento Para Un Envejecimiento Saludable

May 21, 2025

No Es El Arandano Descubre El Superalimento Para Un Envejecimiento Saludable

May 21, 2025 -

Surviving A Screen Free Week Practical Advice For Parents

May 21, 2025

Surviving A Screen Free Week Practical Advice For Parents

May 21, 2025 -

The Numbers Game Examining The Details Or Lack Thereof In Trumps Aerospace Deals

May 21, 2025

The Numbers Game Examining The Details Or Lack Thereof In Trumps Aerospace Deals

May 21, 2025 -

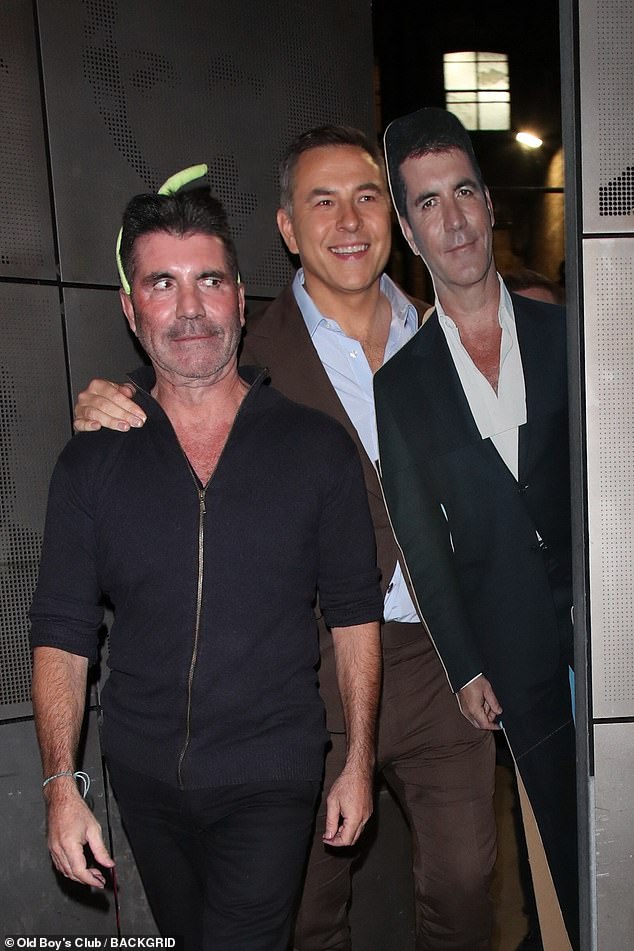

Is It Over David Walliams And Simon Cowells Reported Rift

May 21, 2025

Is It Over David Walliams And Simon Cowells Reported Rift

May 21, 2025

Latest Posts

-

1 3

May 22, 2025

1 3

May 22, 2025 -

Thlathy Jdyd Fy Tshkylt Mntkhb Amryka Tht Qyadt Almdrb Bwtshytynw

May 22, 2025

Thlathy Jdyd Fy Tshkylt Mntkhb Amryka Tht Qyadt Almdrb Bwtshytynw

May 22, 2025 -

Almntkhb Alamryky Andmam Thlathy Jdyd Lawl Mrt

May 22, 2025

Almntkhb Alamryky Andmam Thlathy Jdyd Lawl Mrt

May 22, 2025 -

Qaymt Mntkhb Amryka Ttdmn Thlathy Jdyd Tht Qyadt Almdrb Bwtshytynw

May 22, 2025

Qaymt Mntkhb Amryka Ttdmn Thlathy Jdyd Tht Qyadt Almdrb Bwtshytynw

May 22, 2025 -

Bwtshytynw Ydm Thlathy Jdyd Lqaymt Mntkhb Alwlayat Almthdt

May 22, 2025

Bwtshytynw Ydm Thlathy Jdyd Lqaymt Mntkhb Alwlayat Almthdt

May 22, 2025