The China Factor: Why BMW And Porsche Are Facing Headwinds

Table of Contents

Intensifying Competition from Domestic Chinese Brands

The rise of domestic Chinese automakers is a defining characteristic of the "China Factor." Brands like Nio, Xpeng, and BYD are rapidly gaining market share, fueled by technological advancements and aggressive pricing strategies. These companies are not merely competing on price; they are offering compelling alternatives that directly challenge the established dominance of international luxury brands.

- Increased availability of electric vehicles (EVs): Chinese brands are leading the charge in EV adoption, offering a wide range of models at competitive price points, attracting environmentally conscious and tech-savvy consumers. This directly challenges BMW and Porsche's traditionally internal combustion engine (ICE)-focused product lines.

- Superior understanding of Chinese consumer preferences and technological integration: Domestic brands possess an intimate understanding of local preferences and seamlessly integrate advanced technology features, appealing to a younger, more digitally native consumer base. This includes personalized infotainment systems and advanced driver assistance systems (ADAS).

- Government support and incentives favoring domestic automakers: The Chinese government actively supports domestic automakers through subsidies, tax breaks, and infrastructure development for electric vehicles. This creates a significant advantage for Chinese brands over their foreign competitors.

This intensified competition is directly impacting BMW and Porsche's sales figures and market positioning, forcing them to reassess their strategies and investments in the Chinese market.

Evolving Consumer Preferences in the Chinese Market

The Chinese automotive market is undergoing a rapid transformation driven by evolving consumer preferences. The shift towards electric and hybrid vehicles is particularly significant, forcing established players like BMW and Porsche to rapidly adapt their product portfolios. Beyond electrification, luxury car buyers in China increasingly prioritize technology and digital connectivity.

- Demand for advanced driver-assistance systems (ADAS): Features like autonomous emergency braking, lane keeping assist, and adaptive cruise control are becoming standard expectations, not luxury add-ons.

- Preference for personalized in-car entertainment and connectivity solutions: Seamless smartphone integration, high-quality audio systems, and over-the-air software updates are key selling points for Chinese consumers.

- Emphasis on sustainable and environmentally friendly vehicles: The growing awareness of environmental issues is driving demand for electric vehicles and brands that demonstrate a commitment to sustainability.

BMW and Porsche are responding by investing heavily in electric vehicle development, expanding their digital services, and incorporating advanced technologies into their vehicles. However, adapting to the pace of change in the Chinese market remains a significant challenge.

Economic Slowdown and Geopolitical Uncertainty

The "China Factor" also encompasses broader macroeconomic and geopolitical considerations. A potential economic slowdown in China could significantly impact luxury car sales, as consumers become more cautious about discretionary spending. Geopolitical tensions and trade disputes further add to the uncertainty.

- Impact of fluctuating currency exchange rates on profitability: Changes in the value of the Chinese Yuan against other currencies can affect the profitability of imported vehicles.

- Supply chain disruptions caused by geopolitical instability: Global supply chains can be disrupted by trade wars or other geopolitical events, impacting the availability and cost of parts and vehicles.

- Uncertainty regarding future government regulations and policies: Changes in government regulations can significantly impact the automotive industry, creating uncertainty for foreign investors.

These macroeconomic factors introduce significant short-term and long-term risks for BMW and Porsche's operations in China.

Strategies for BMW and Porsche to Navigate the Challenges

To successfully navigate the complexities of the Chinese automotive market, BMW and Porsche must implement several key strategies:

- Increased investment in electric vehicle (EV) technology and infrastructure: This includes developing and manufacturing more EVs tailored specifically to the Chinese market and investing in charging infrastructure.

- Development of China-specific models tailored to local preferences: This requires a deep understanding of local tastes and preferences, including design features and technological integrations.

- Strengthening partnerships with local suppliers and distributors: Collaborating with Chinese companies can enhance efficiency, reduce costs, and improve market access.

- Emphasis on digital marketing and engagement with Chinese consumers: Reaching and engaging Chinese consumers requires leveraging digital channels effectively.

Understanding and adapting to the unique characteristics of the Chinese market is crucial for long-term success. A one-size-fits-all approach will not suffice; a nuanced strategy tailored to the specific challenges and opportunities presented by the "China Factor" is essential.

Conclusion: The China Factor and the Future of Luxury Car Brands

The "China Factor" presents a formidable challenge for luxury car brands like BMW and Porsche. Intensifying competition from domestic brands, evolving consumer preferences, and macroeconomic uncertainties create a dynamic and complex market environment. Adapting to the rapidly changing landscape of the Chinese automotive industry is crucial for maintaining market share and profitability. To thrive in this environment, luxury brands must prioritize innovation, localization, and a deep understanding of Chinese consumer behavior. We encourage further research into the specific strategies employed by other luxury brands operating successfully in China, closely following how the "China Factor" continues to reshape the global automotive landscape and the specific strategies luxury brands must implement to overcome the challenges of the China market.

Featured Posts

-

Wtt Press Conference Unveils Revolutionary Competitive Concept

May 21, 2025

Wtt Press Conference Unveils Revolutionary Competitive Concept

May 21, 2025 -

Former Liverpool Managers Impact On Hout Bay Fc

May 21, 2025

Former Liverpool Managers Impact On Hout Bay Fc

May 21, 2025 -

Saskatchewan Political Panel Discussion The Federal Elections Aftermath

May 21, 2025

Saskatchewan Political Panel Discussion The Federal Elections Aftermath

May 21, 2025 -

Combate Las Enfermedades Cronicas El Superalimento Que Te Ayudara A Envejecer Bien

May 21, 2025

Combate Las Enfermedades Cronicas El Superalimento Que Te Ayudara A Envejecer Bien

May 21, 2025 -

Is A Manchester City Move On The Cards For This Arsenal Legend

May 21, 2025

Is A Manchester City Move On The Cards For This Arsenal Legend

May 21, 2025

Latest Posts

-

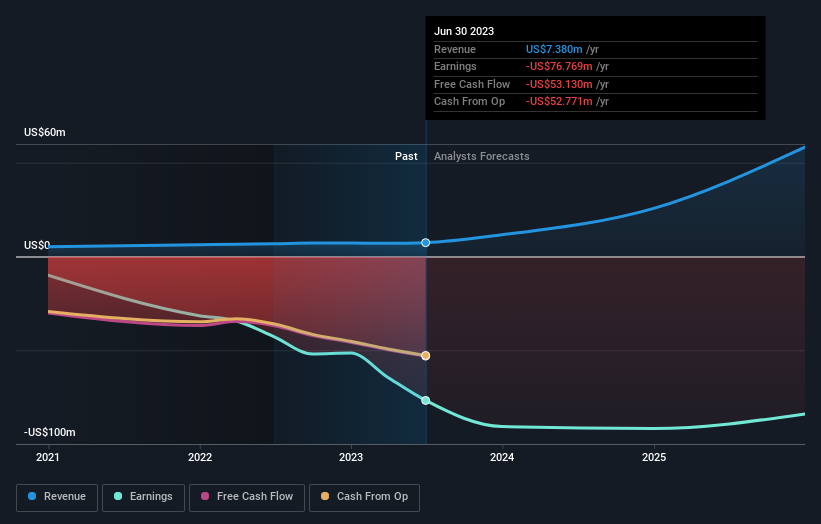

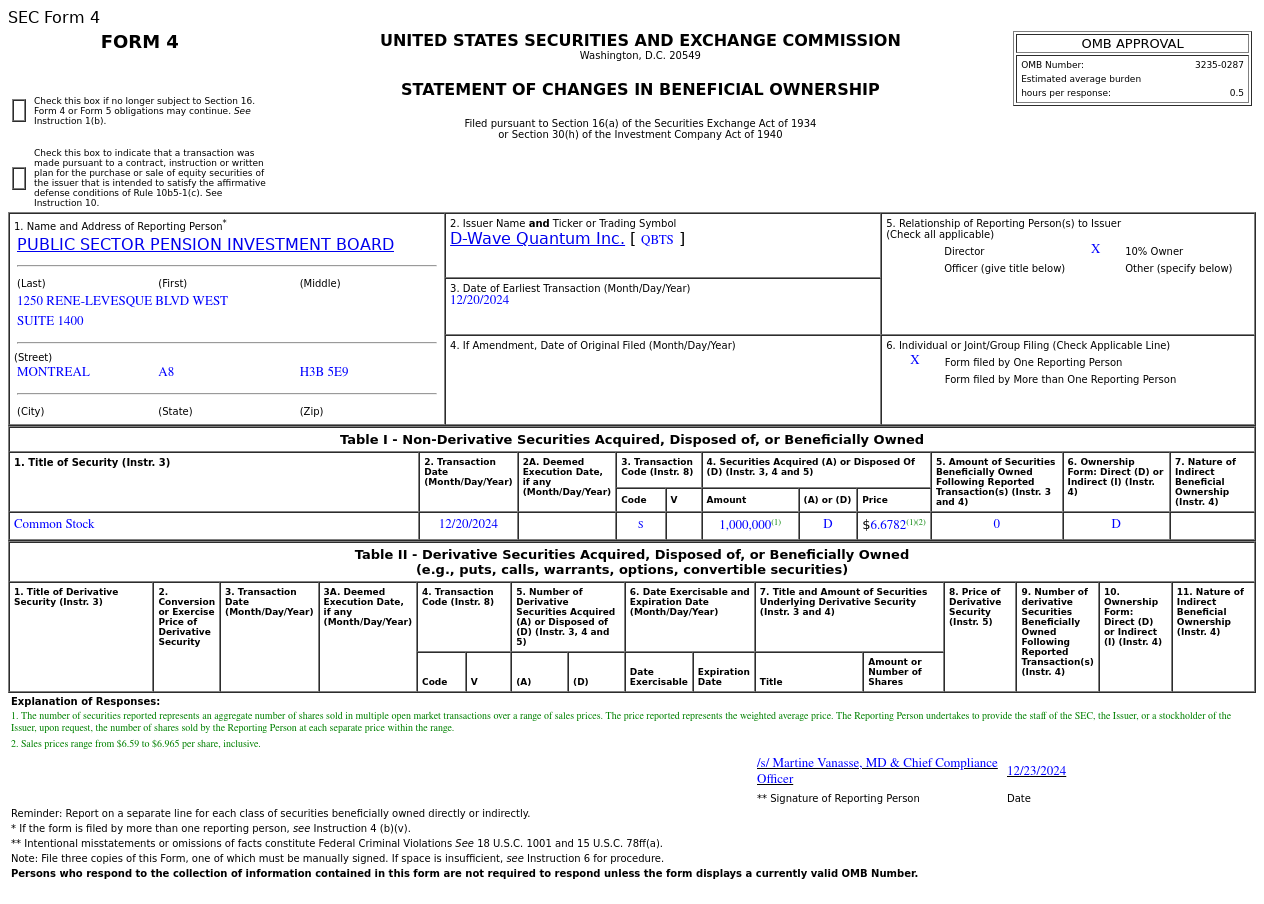

Understanding The Recent Decline In D Wave Quantum Qbts Stock

May 21, 2025

Understanding The Recent Decline In D Wave Quantum Qbts Stock

May 21, 2025 -

D Wave Quantum Qbts Stock Performance Monday Causes And Implications

May 21, 2025

D Wave Quantum Qbts Stock Performance Monday Causes And Implications

May 21, 2025 -

Understanding The Factors Behind D Wave Quantum Inc S Qbts 2025 Stock Drop

May 21, 2025

Understanding The Factors Behind D Wave Quantum Inc S Qbts 2025 Stock Drop

May 21, 2025 -

D Wave Quantum Qbts Stock Mondays Significant Drop Explained

May 21, 2025

D Wave Quantum Qbts Stock Mondays Significant Drop Explained

May 21, 2025 -

Market Update Dissecting The D Wave Quantum Qbts Stock Decline On Monday

May 21, 2025

Market Update Dissecting The D Wave Quantum Qbts Stock Decline On Monday

May 21, 2025