Analyzing QBTS Stock's Reaction To Its Next Earnings Announcement

Table of Contents

The upcoming earnings announcement for QBTS stock is a significant event that will likely cause considerable market fluctuation. Understanding how QBTS stock typically reacts to earnings reports is crucial for investors looking to make informed decisions. This analysis will explore key factors influencing QBTS's price movement after its next earnings release, providing insights to help you navigate this potentially volatile period. This guide will help you understand the nuances of QBTS analysis and develop a sound investment strategy for Qubits stock.

Historical Performance Analysis of QBTS Stock Post-Earnings

Past Earnings Surprises and Market Response

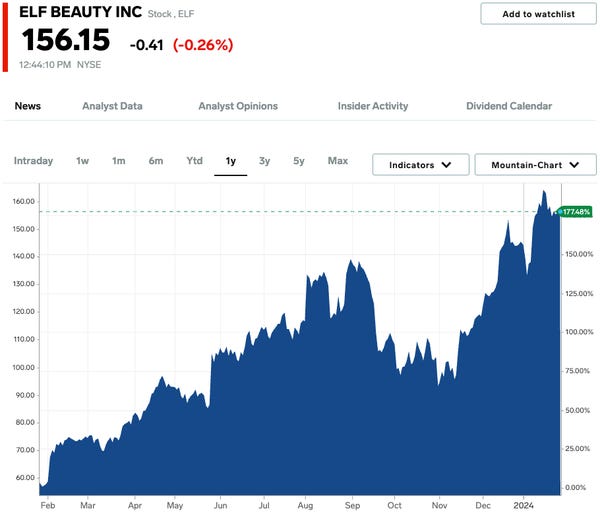

Analyzing past earnings reports is the cornerstone of any effective QBTS analysis. We need to identify trends in QBTS stock price movements following previous earnings announcements – categorizing them into positive surprises, negative surprises, and instances where expectations were met. Visualizing this data with charts and graphs is essential; it not only clarifies trends but also significantly improves the SEO and engagement of this analysis.

By studying these historical price movements, we can identify the average percentage change in QBTS stock price after earnings releases. Looking for recurring patterns in market reaction is crucial for predicting future behavior.

- Example: Q1 2023 beat expectations by 15%, and the QBTS stock price increased by 8%.

- Example: Q2 2023 missed expectations by 5%, and the QBTS stock price decreased by 3%.

This historical data provides a baseline for understanding the typical market response to QBTS's performance.

Identifying Key Performance Indicators (KPIs) for QBTS

Understanding which Key Performance Indicators (KPIs) drive QBTS stock price movements is vital. Investors keenly watch several metrics in QBTS earnings reports. These include:

- Revenue growth: Comparing revenue growth to previous quarters and industry benchmarks helps gauge the company's overall performance and market position.

- Earnings per share (EPS): EPS growth is a direct indicator of profitability and a major driver of stock valuation. Analyzing EPS trends gives a clear picture of QBTS's financial health.

- User growth (if applicable): For companies with a substantial user base, user growth is a critical metric reflecting the success of their product or service. A strong correlation often exists between user growth and QBTS stock price.

- Gross margin: Analyzing gross margin provides insight into the company's pricing power and efficiency in managing its costs.

By carefully evaluating these KPIs, investors can develop a better understanding of QBTS's financial performance and its implications for future stock price movements.

Factors Influencing QBTS Stock's Post-Earnings Volatility

Market Sentiment and Overall Economic Conditions

The broader market conditions leading up to the earnings announcement significantly impact QBTS stock's price. A generally bullish market sentiment will often lead to a more positive reaction to earnings, even if the results are only moderately good. Conversely, a bearish market can dampen the positive impact of strong earnings.

- Macroeconomic Factors: Inflation rates, interest rate changes, and geopolitical events all influence investor sentiment and can impact QBTS stock, regardless of its earnings report.

- Sector Performance: The overall performance of the technology sector (if applicable) also plays a role. A strong sector performance can boost QBTS stock even if its earnings are less impressive.

Analyst Ratings and Predictions

Analyst ratings and price targets are another crucial factor influencing QBTS stock's post-earnings volatility. Before and after previous earnings announcements, analysts issue their predictions. The consensus estimate – the average of all analyst predictions – acts as a benchmark against which actual results are measured. Any significant revisions to these estimates before the announcement signal shifts in market expectations and can dramatically influence the stock's reaction.

- Analyst Ratings: A summary of analyst ratings from major financial institutions provides valuable insight into the overall market sentiment towards QBTS.

- Sentiment Changes: Note any significant changes in analyst sentiment leading up to the announcement. A sudden shift from positive to negative can indicate looming concerns.

Developing an Effective Investment Strategy for QBTS Stock

Risk Management and Portfolio Diversification

Investing in QBTS stock, or any stock, involves risk. Effective risk management is crucial. Diversifying your portfolio across different asset classes reduces the impact of any single investment's poor performance. This is a fundamental principle of prudent investing.

- Stop-Loss Orders: Consider setting stop-loss orders to limit potential losses if the QBTS stock price moves against your expectations.

- Diversification: Diversify your investments across stocks, bonds, and other assets to mitigate risk.

Long-Term vs. Short-Term Investment Approach

Your investment approach for QBTS stock should align with your risk tolerance and investment goals.

- Long-Term Strategy: A long-term strategy focuses on fundamental analysis, considering the company's long-term growth potential. This approach is less sensitive to short-term market fluctuations.

- Short-Term Strategy: A short-term strategy is more speculative and focuses on short-term price movements. This approach requires a higher risk tolerance and more active monitoring.

Conclusion

Analyzing QBTS stock's reaction to its next earnings announcement demands a thorough understanding of past performance, key influencing factors, and robust risk management strategies. By considering historical trends, market sentiment, analyst predictions, and by diversifying your investments, you can develop a well-informed investment strategy. Remember to conduct your own research and consult with a financial advisor before making any investment decisions related to QBTS stock or any other security. Stay informed about the upcoming QBTS earnings announcement and continue analyzing QBTS stock's performance for optimal investment results. Keep a close eye on QBTS stock and its reaction to the upcoming earnings announcement to make the best investment decisions possible.

Featured Posts

-

Find The Answers Nyt Mini Crossword April 2

May 20, 2025

Find The Answers Nyt Mini Crossword April 2

May 20, 2025 -

Onko Uusi Valmennus Huuhkajien Avain Mm Karsintoihin

May 20, 2025

Onko Uusi Valmennus Huuhkajien Avain Mm Karsintoihin

May 20, 2025 -

Will Canadian Tire Thrive Under Hudsons Bay Ownership A Cautious Analysis

May 20, 2025

Will Canadian Tire Thrive Under Hudsons Bay Ownership A Cautious Analysis

May 20, 2025 -

Matheus Cunha To Man United Journalist Shares Concerning News

May 20, 2025

Matheus Cunha To Man United Journalist Shares Concerning News

May 20, 2025 -

Unclaimed Savings Thousands Owe Money From Hmrc

May 20, 2025

Unclaimed Savings Thousands Owe Money From Hmrc

May 20, 2025

Latest Posts

-

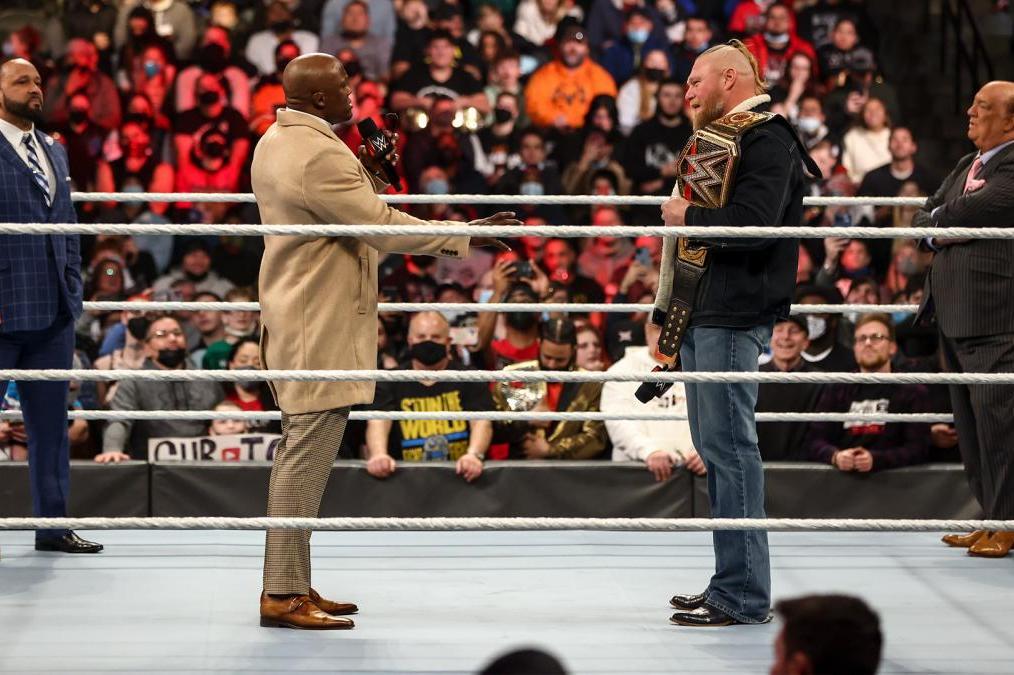

Wwe Raw 5 19 2025 3 Things We Loved And 3 We Hated

May 20, 2025

Wwe Raw 5 19 2025 3 Things We Loved And 3 We Hated

May 20, 2025 -

Ronda Rousey Logan Paul Jey Uso And Big E Latest Wwe Rumors And News

May 20, 2025

Ronda Rousey Logan Paul Jey Uso And Big E Latest Wwe Rumors And News

May 20, 2025 -

Review Wwe Raw Winners And Grades May 19 2025

May 20, 2025

Review Wwe Raw Winners And Grades May 19 2025

May 20, 2025 -

Wwe Rumors Ronda Rousey Logan Paul Jey Uso And Big Es Engagement

May 20, 2025

Wwe Rumors Ronda Rousey Logan Paul Jey Uso And Big Es Engagement

May 20, 2025 -

Wwe Raw Results And Grades For May 19 2025

May 20, 2025

Wwe Raw Results And Grades For May 19 2025

May 20, 2025