Analyzing The Canadian Dollar's Performance: A Complex Currency Landscape

Table of Contents

H2: The Impact of Commodity Prices on the CAD

The Canadian dollar is often referred to as a "commodity currency" due to its strong correlation with the prices of raw materials, particularly oil and gas. Canada is a major exporter of these resources, and fluctuations in global demand directly impact the CAD's value.

H3: Oil and Gas Prices

Canada's economy is heavily reliant on its energy sector. Therefore, changes in global oil and gas prices have a profound effect on the Canadian dollar. When oil prices rise, the CAD tends to appreciate as increased export revenue flows into the country. Conversely, a decline in oil prices typically weakens the CAD.

- Recent Price Fluctuations and Their Impact: The sharp drop in oil prices in early 2020 due to the COVID-19 pandemic significantly weakened the CAD. Conversely, the subsequent price recovery saw the Canadian dollar strengthen. Similarly, geopolitical events impacting global oil supply, such as the war in Ukraine, also influence the CAD's performance.

- Other Commodities: While oil is dominant, other commodities like lumber and potash also play a role. Strong global demand for these resources can boost the Canadian economy and strengthen the CAD. Conversely, reduced demand weakens the currency.

H3: The Role of Diversification

While Canada's dependence on commodities is undeniable, economic diversification plays a crucial role in mitigating the risks associated with commodity price volatility. A diversified economy reduces the impact of fluctuations in a single sector on the overall economy and, subsequently, the CAD.

- Other Contributing Sectors: The Canadian economy is increasingly driven by sectors like technology, tourism, and finance. The growth of these sectors acts as a buffer against extreme volatility stemming from commodity price swings.

- Mitigating Risks: A diversified economy makes the Canadian dollar less susceptible to drastic fluctuations driven solely by commodity price changes, leading to greater stability in the long run.

H2: Interest Rate Influence and Monetary Policy

The Bank of Canada's monetary policy plays a significant role in shaping the CAD's value. Interest rate decisions influence investment flows and inflation expectations, directly impacting the currency's strength.

H3: Bank of Canada's Role

The Bank of Canada utilizes interest rate adjustments to manage inflation and maintain economic stability. Raising interest rates typically attracts foreign investment, increasing demand for the CAD and strengthening its value. Conversely, lowering interest rates can weaken the currency.

- Interest Rates and Currency Value: Higher interest rates make the CAD more attractive to investors seeking higher returns, leading to increased demand and a stronger currency.

- Inflation's Impact: Inflationary pressures often prompt the Bank of Canada to raise interest rates to cool down the economy, which can positively affect the CAD in the short term. However, persistently high inflation can erode purchasing power and potentially negatively impact the currency in the long run.

H3: Comparison with Other Central Banks

The Bank of Canada's monetary policy decisions are often compared to those of other major central banks, particularly the US Federal Reserve. Diverging monetary policies can significantly impact the CAD/USD exchange rate.

- Diverging Monetary Policies: If the Bank of Canada raises interest rates while the US Federal Reserve keeps rates low, the CAD will likely appreciate against the USD. Conversely, if the Bank of Canada lowers rates while the US Fed maintains higher rates, the CAD will likely depreciate.

- Implications for Investors: Understanding the comparative monetary policies of these central banks is crucial for investors making decisions about currency trading and investments in Canadian assets.

H2: Geopolitical Factors and Global Economic Trends

Geopolitical events and global economic trends can significantly influence the CAD's performance. The close economic ties between Canada and the US, in particular, make the Canadian dollar susceptible to shifts in the US economy and political landscape.

H3: US-Canada Relations

The strong economic relationship between Canada and the US is paramount. The two countries are major trading partners, and any significant economic or political shifts in the US are likely to impact the Canadian economy and, consequently, the CAD.

- US-Canada Trade Relationship: A strong US economy typically benefits Canada, supporting the CAD. Conversely, economic downturns or trade disputes between the two countries can negatively impact the CAD.

- Geopolitical Events: International events affecting the US or impacting global trade and investment sentiment can also influence the CAD's value.

H3: Global Economic Uncertainty

Global economic uncertainty, such as recessions or trade wars, can trigger risk aversion among investors, causing them to move away from riskier assets, including emerging market currencies like the CAD.

- Global Risk Aversion: During periods of global uncertainty, investors often flock to safe-haven assets like the US dollar, leading to a weakening of the CAD.

- Past Global Events: The 2008 financial crisis and the COVID-19 pandemic are prime examples of global events that significantly impacted the Canadian dollar's performance.

3. Conclusion

Analyzing the Canadian dollar's performance involves understanding the interplay of commodity prices, interest rates set by the Bank of Canada, and the influence of geopolitical factors and global economic trends. Commodity price volatility, particularly in oil and gas, can significantly impact the CAD. Interest rate differentials between the Bank of Canada and other major central banks, such as the US Federal Reserve, also play a crucial role in determining the CAD's exchange rate. Finally, global economic uncertainty and events affecting the US-Canada relationship can cause significant fluctuations. Understanding these complexities is crucial for informed decision-making. Stay updated on the latest economic indicators and policy changes to effectively navigate this dynamic currency landscape and refine your approach to analyzing the Canadian dollar's performance.

Featured Posts

-

Nba Investigates Ja Morant Report Details New Incident

Apr 24, 2025

Nba Investigates Ja Morant Report Details New Incident

Apr 24, 2025 -

Ella Travolta Kci Johna Travolte Rast I Ljepota

Apr 24, 2025

Ella Travolta Kci Johna Travolte Rast I Ljepota

Apr 24, 2025 -

India Market Update Tailwinds Driving Nifty Gains

Apr 24, 2025

India Market Update Tailwinds Driving Nifty Gains

Apr 24, 2025 -

India And Saudi Arabia To Jointly Develop Two Major Oil Refineries

Apr 24, 2025

India And Saudi Arabia To Jointly Develop Two Major Oil Refineries

Apr 24, 2025 -

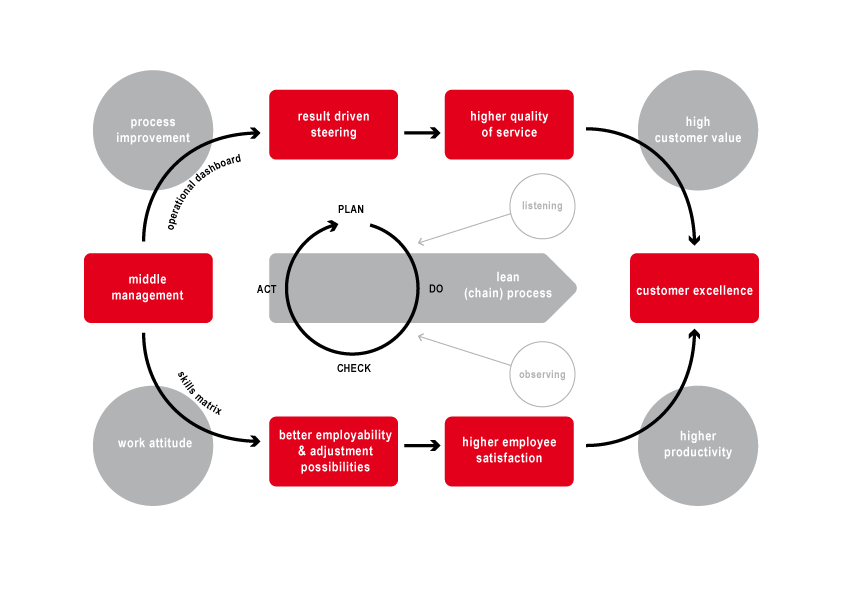

How Middle Management Drives Company Performance And Employee Satisfaction

Apr 24, 2025

How Middle Management Drives Company Performance And Employee Satisfaction

Apr 24, 2025