Analyzing The Canadian Tire-Hudson's Bay Merger: Opportunities And Challenges

Table of Contents

Synergies and Opportunities for a Canadian Tire-Hudson's Bay Merger

A successful Canadian Tire-Hudson's Bay merger could unlock significant synergies and opportunities, reshaping the Canadian retail landscape.

Enhanced Retail Reach and Market Share

- Increased store presence across Canada: Combining the existing extensive networks of both retailers would create an unparalleled retail footprint, reaching more consumers nationwide.

- Access to new customer demographics: Canadian Tire's focus on automotive, home improvement, and sporting goods complements HBC's offerings in fashion, home furnishings, and luxury goods. This diversification could attract a broader range of customers.

- Potential for cross-selling: Imagine seamlessly integrating the loyalty programs, allowing customers to earn rewards across both brands, driving increased spending and brand loyalty.

Currently, both companies hold significant market share in their respective sectors. However, a merger could alleviate market saturation by offering a wider range of products and services under one roof, potentially leading to increased market dominance. Data on current market shares for both companies would be crucial for a complete analysis, demonstrating the potential for expansion and growth following a merger.

Supply Chain Optimization and Cost Savings

- Streamlined supply chains: Combining logistics and distribution networks could lead to significant efficiencies, reducing transportation costs and improving delivery times.

- Reduced warehousing costs: Consolidating warehouses and optimizing inventory management would lower overhead expenses significantly.

- Negotiation of better bulk purchasing prices: The combined purchasing power of a merged entity would allow for more favorable terms with suppliers, leading to lower input costs.

Numerous successful mergers have demonstrated the potential for significant cost savings through supply chain optimization. By leveraging best practices and adopting innovative technologies, a Canadian Tire-Hudson's Bay merger could achieve substantial efficiencies, boosting profitability.

Brand Synergy and Cross-Promotion

- Joint loyalty programs: A unified loyalty program would incentivize customers to shop across both brands, increasing customer lifetime value.

- Combined marketing campaigns: Joint marketing initiatives could leverage the strengths of both brands, creating powerful and engaging campaigns.

- Leveraging HBC's luxury brands alongside Canadian Tire's everyday essentials: This creates a more comprehensive retail ecosystem, offering a wider choice to consumers at various price points.

The challenge lies in maintaining the distinct identities of both brands while leveraging their combined strengths. Careful branding strategies would be crucial to avoid diluting the individual brand equity that each company has carefully cultivated.

Challenges and Risks of a Canadian Tire-Hudson's Bay Merger

While the opportunities are significant, a Canadian Tire-Hudson's Bay merger also presents considerable challenges and risks.

Integration Difficulties and Cultural Differences

- Potential for conflict between employees: Merging two large organizations with different corporate cultures can lead to conflicts and integration challenges.

- Challenges in harmonizing different operational procedures: Standardizing operations, IT systems, and human resource practices across two large companies requires significant time, effort, and investment.

- IT system integration hurdles: Integrating complex IT systems is often a major challenge in large-scale mergers, potentially leading to disruptions and delays.

Past mergers have shown that integration difficulties can derail even the most promising deals. Careful planning and a well-defined integration strategy are essential to mitigate these risks.

Regulatory Hurdles and Antitrust Concerns

- Competition Bureau review: The merger would likely face stringent scrutiny from the Competition Bureau of Canada, requiring extensive documentation and potentially leading to delays.

- Potential divestitures required to gain approval: To address antitrust concerns, the Competition Bureau might mandate the divestiture of certain assets or business units.

- Legal and compliance costs: Navigating the regulatory process involves significant legal and compliance costs, potentially impacting the overall financial viability of the merger.

Understanding the Canadian regulatory framework and anticipating potential hurdles is crucial for a successful merger. Thorough due diligence and proactive engagement with regulatory bodies are essential.

Financial Risks and Debt Burden

- Increased debt levels: Financing a merger of this scale would require substantial debt financing, increasing financial risk.

- Potential for shareholder dissatisfaction: If the merger fails to deliver on its projected synergies, it could lead to shareholder dissatisfaction and a decline in stock value.

- The need for significant capital investment: Integrating systems, renovating stores, and implementing new technologies would require significant capital investments.

A comprehensive financial model is crucial to assess the financial viability of the merger, considering the potential debt burden, projected synergies, and the ability of the merged entity to manage its financial obligations. The financial performance of both Canadian Tire and HBC in recent years should be thoroughly analyzed.

Conclusion: The Future of the Canadian Tire-Hudson's Bay Merger Landscape

The potential Canadian Tire-Hudson's Bay merger presents a complex picture with significant opportunities and challenges. While synergies in retail reach, supply chain optimization, and brand synergy are enticing, integration difficulties, regulatory hurdles, and financial risks pose significant obstacles. Ultimately, the success of such a merger would depend on meticulous planning, effective execution, and a clear understanding of the potential pitfalls. A balanced approach, considering both the potential benefits and drawbacks, is crucial for all stakeholders involved.

We encourage you to share your thoughts and opinions on the Canadian Tire-Hudson's Bay merger prospects and contribute to the ongoing discussion on the future of this potential retail giant. Share your analysis of the Canadian Tire and Hudson's Bay merger or your evaluation of the Canadian Tire-HBC merger in the comments below.

Featured Posts

-

Kyren Paris Clutch Homer Delivers Angels Win Over White Sox In Rainy Game

May 18, 2025

Kyren Paris Clutch Homer Delivers Angels Win Over White Sox In Rainy Game

May 18, 2025 -

Gridlock On Gop Tax Bill Conservatives Demand Changes To Medicaid And Clean Energy Policies

May 18, 2025

Gridlock On Gop Tax Bill Conservatives Demand Changes To Medicaid And Clean Energy Policies

May 18, 2025 -

Dry Weather Could Douse Easter Bonfire Plans

May 18, 2025

Dry Weather Could Douse Easter Bonfire Plans

May 18, 2025 -

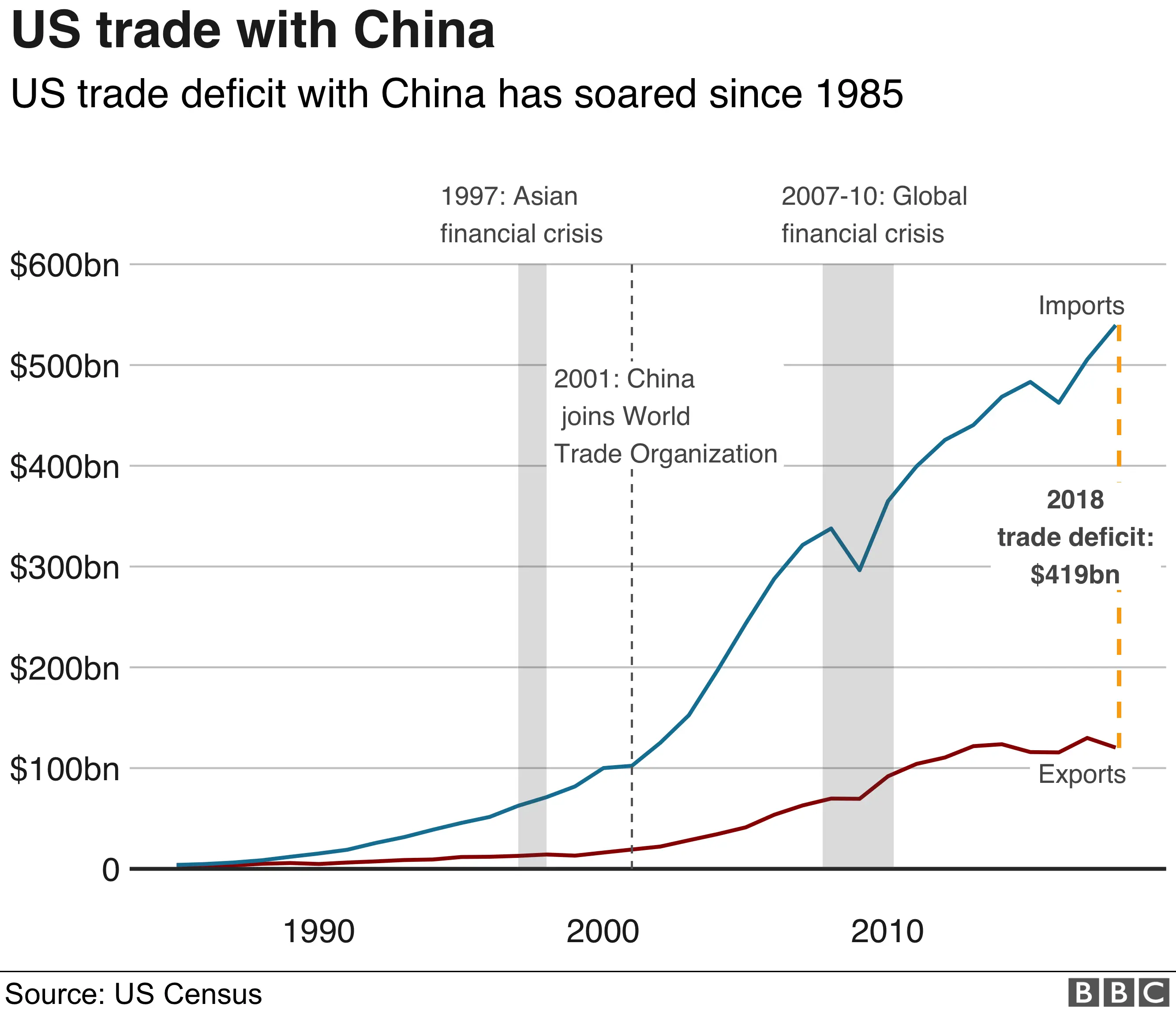

Analysis Trumps 30 China Tariffs Projected To Remain Until 2025

May 18, 2025

Analysis Trumps 30 China Tariffs Projected To Remain Until 2025

May 18, 2025 -

Will Michael Conforto Mirror Teoscar Hernandezs Impact On The Dodgers

May 18, 2025

Will Michael Conforto Mirror Teoscar Hernandezs Impact On The Dodgers

May 18, 2025

Latest Posts

-

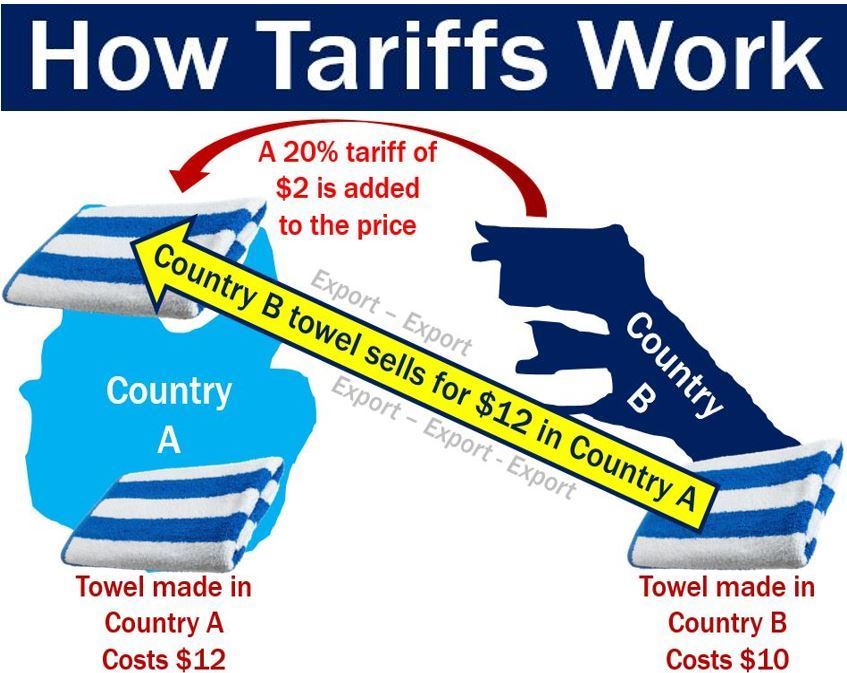

Southwest Washingtons Economic Future Navigating The Tariff Challenge

May 18, 2025

Southwest Washingtons Economic Future Navigating The Tariff Challenge

May 18, 2025 -

The Impact Of Tariffs On Southwest Washingtons Economy

May 18, 2025

The Impact Of Tariffs On Southwest Washingtons Economy

May 18, 2025 -

Tariffs Hit Southwest Washington Businesses Brace For Impact

May 18, 2025

Tariffs Hit Southwest Washington Businesses Brace For Impact

May 18, 2025 -

Analyzing The Financial Success Of Major Music Festivals

May 18, 2025

Analyzing The Financial Success Of Major Music Festivals

May 18, 2025 -

Economic Benefits Of Large Scale Music Events A Case Study

May 18, 2025

Economic Benefits Of Large Scale Music Events A Case Study

May 18, 2025