Analyzing The Friday Rise In D-Wave Quantum (QBTS) Stock Value

Table of Contents

D-Wave Quantum (QBTS), a leading player in the burgeoning field of quantum computing, experienced a significant stock price increase last Friday. This unexpected surge in QBTS stock value has piqued the interest of investors and analysts alike, prompting a closer look at the underlying factors. This article aims to analyze the potential reasons behind this Friday stock surge, examining news announcements, market sentiment, technical analysis, and competitive landscape to understand the volatility surrounding QBTS stock. We'll explore keywords such as D-Wave Quantum, QBTS stock, quantum computing, stock market, and Friday stock surge to uncover the drivers of this notable event.

Main Points:

News and Announcements Impacting QBTS Stock Price

Positive news and announcements often significantly influence investor sentiment and stock prices. Analyzing the week leading up to the Friday QBTS stock surge reveals several potential contributing factors related to D-Wave news and advancements in quantum computing.

- New Partnership with a Major Tech Company: A newly announced collaboration with a major technology company could have injected significant optimism into the market. This partnership might involve joint development projects, technology licensing agreements, or access to wider distribution channels. The potential for increased revenue and market share would undoubtedly be attractive to investors.

- Successful Demonstration of a Novel Quantum Algorithm: The successful demonstration of a new quantum algorithm, showcasing the capabilities of D-Wave's quantum computers, could have boosted investor confidence. Such an achievement would highlight the company's technological progress and the potential for future applications of its technology.

- Positive Analyst Report on QBTS Future: A positive report from a reputable financial analyst firm forecasting strong growth for QBTS could generate significant buying pressure. Analyst endorsements carry substantial weight in influencing investor decisions, driving up demand for the stock. The timing of such a report, close to the Friday price jump, would be highly relevant. This highlights the importance of understanding D-Wave news and QBTS partnership announcements in influencing the stock's performance. Any quantum computing advancements reported would naturally also increase investor confidence.

The timing of these announcements relative to the Friday price increase is crucial. If any news broke earlier in the week, the subsequent market reaction on Friday could reflect a delayed response or a culmination of positive sentiment building throughout the week.

Market Sentiment and Investor Behavior

The Friday surge in QBTS stock wasn't solely driven by D-Wave's specific news; broader market trends and investor behavior also played a significant role. Understanding QBTS investor sentiment and general quantum computing investment trends is key.

- Overall Market Optimism: A generally positive market sentiment could have led investors to seek higher-risk, higher-reward investments such as QBTS stock. In a bullish market, investors are often more willing to embrace growth stocks, even in a relatively nascent sector like quantum computing.

- Sector-Specific Investment Trends: Increased interest in the quantum computing sector could have driven investors towards QBTS as a prominent player in this space. A rising tide lifts all boats, and a wave of positive sentiment surrounding the quantum computing industry as a whole would naturally benefit QBTS.

- Potential Short Squeeze: A short squeeze, where investors buying a stock force short-sellers to cover their positions, resulting in a rapid price increase, could have contributed to the surge. This scenario requires a significant level of short interest in QBTS prior to the Friday price increase.

Analyzing these elements alongside QBTS investor sentiment reveals a multifaceted picture of the factors influencing the stock's performance.

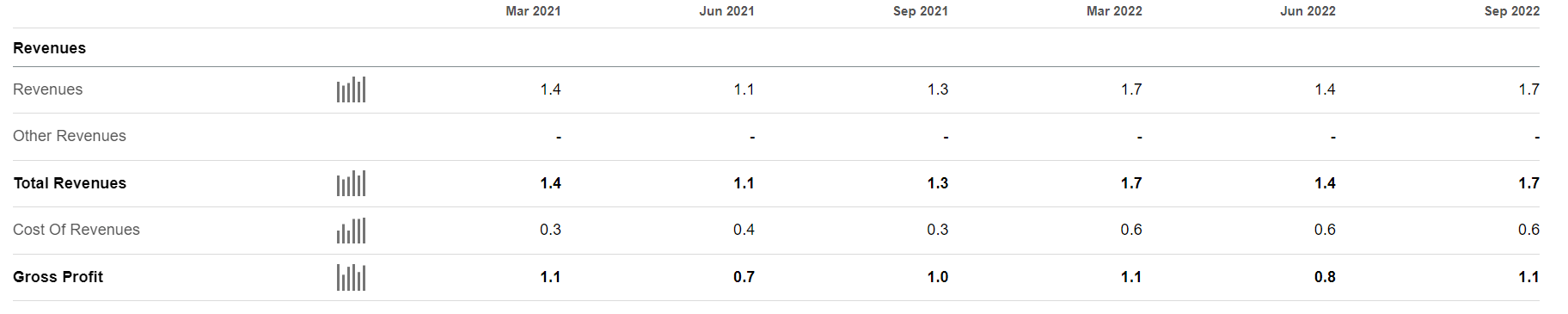

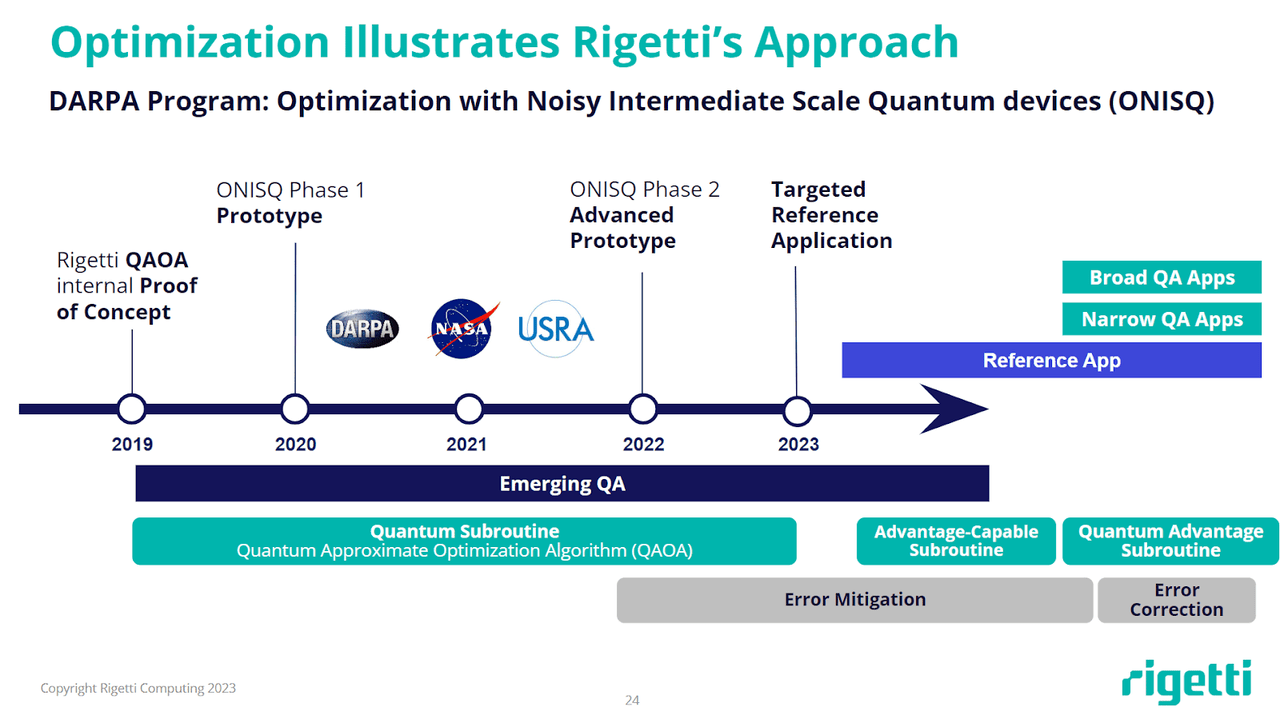

Technical Analysis of QBTS Stock Chart

Analyzing the QBTS stock chart for Friday provides valuable insights into the dynamics of the price increase. Examining key technical indicators can provide a clearer picture of the QBTS stock chart analysis.

- High Trading Volume: A significantly higher-than-average trading volume on Friday suggests strong buying pressure. This indicates that many investors were actively trading QBTS stock, leading to the price increase.

- Sharp Price Increase within a Short Timeframe: A rapid price increase within a short time period points to a sudden influx of buy orders exceeding sell orders. This rapid movement often indicates strong market momentum.

- Candlestick Patterns: Certain candlestick patterns, like bullish engulfing patterns, can signal a significant price reversal or a continuation of an upward trend.

(Insert chart or graph of QBTS stock price movement on Friday here)

By analyzing these technical indicators and the visual data presented in the chart, we can gain valuable insights into the mechanics of the Friday price surge.

Comparing QBTS Performance to Competitors

Benchmarking QBTS's Friday performance against its competitors in the quantum computing sector allows for a more nuanced understanding of its market position. This involves assessing quantum computing stocks comparison and the relative performance of QBTS competitors.

- Stock Price Movements: Comparing the percentage change in QBTS stock price on Friday to that of other publicly traded quantum computing companies helps determine if the surge was unique to QBTS or a broader sector trend.

- Market Capitalization: Examining the relative market capitalization of QBTS versus its competitors provides a perspective on its overall valuation and market share within the industry.

This comparative analysis assists in determining whether the Friday price increase was a result of factors specific to D-Wave or a reflection of wider market dynamics within the quantum computing sector.

Conclusion: Understanding the QBTS Stock Price Volatility and Future Outlook

The Friday rise in D-Wave Quantum (QBTS) stock value resulted from a confluence of factors, including positive news announcements, overall market sentiment, technical trading patterns, and the company's position relative to competitors. While the short-term volatility in QBTS stock is undeniable, understanding these contributing factors is crucial for assessing future potential.

Investing in QBTS, or any stock in the nascent quantum computing sector, involves significant risks. Thorough due diligence is essential. This analysis provides a snapshot of one event; ongoing monitoring of D-Wave news and the wider quantum computing future is necessary for informed decision-making. Continue researching D-Wave Quantum (QBTS) and stay updated on developments in the quantum computing sector to make well-informed investment decisions. Careful consideration of the factors outlined above, as well as ongoing analysis of QBTS investment opportunities, is recommended.

Featured Posts

-

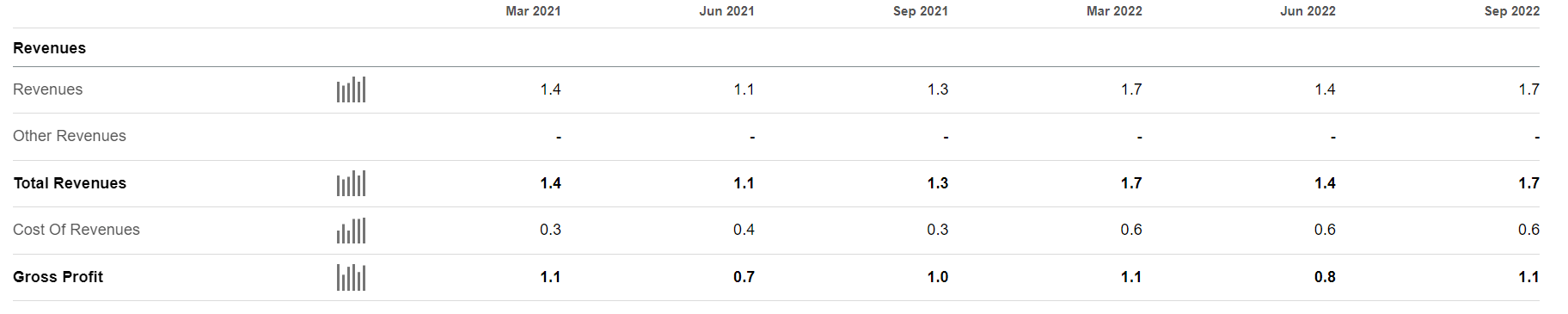

Are Quantum Stocks Like Rigetti Rgti And Ion Q Worth Buying In 2025

May 21, 2025

Are Quantum Stocks Like Rigetti Rgti And Ion Q Worth Buying In 2025

May 21, 2025 -

Provence Walking Tour Mountains To Mediterranean Coast

May 21, 2025

Provence Walking Tour Mountains To Mediterranean Coast

May 21, 2025 -

Canadian Tire And Hudsons Bay A Strategic Fit

May 21, 2025

Canadian Tire And Hudsons Bay A Strategic Fit

May 21, 2025 -

Voedselexport Naar Vs Instort Abn Amro Analyseert De Impact Van Heffingen

May 21, 2025

Voedselexport Naar Vs Instort Abn Amro Analyseert De Impact Van Heffingen

May 21, 2025 -

Antiques Roadshow Appearance Leads To Arrest Of American Couple In Britain

May 21, 2025

Antiques Roadshow Appearance Leads To Arrest Of American Couple In Britain

May 21, 2025

Latest Posts

-

Southport Racial Hate Case Councillors Wife Sentenced

May 22, 2025

Southport Racial Hate Case Councillors Wife Sentenced

May 22, 2025 -

Racial Hatred Tweet Ex Tory Councillors Wife Seeks To Overturn Sentence

May 22, 2025

Racial Hatred Tweet Ex Tory Councillors Wife Seeks To Overturn Sentence

May 22, 2025 -

Racist Tweets Lead To Jail Time For Tory Councillors Wife In Southport

May 22, 2025

Racist Tweets Lead To Jail Time For Tory Councillors Wife In Southport

May 22, 2025 -

Councillors Wife Faces Jail For Anti Migrant Social Media Post

May 22, 2025

Councillors Wife Faces Jail For Anti Migrant Social Media Post

May 22, 2025 -

Legal Challenge To Racial Hatred Tweet Sentence Ex Tory Councillors Wife

May 22, 2025

Legal Challenge To Racial Hatred Tweet Sentence Ex Tory Councillors Wife

May 22, 2025