Are Quantum Stocks Like Rigetti (RGTI) And IonQ Worth Buying In 2025?

Table of Contents

Technological Advancements and Competitive Landscape

The quantum computing technology landscape is rapidly evolving. Rigetti and IonQ, two leading players, are pushing the boundaries of what's possible, albeit using different approaches. Rigetti focuses on superconducting qubits, while IonQ utilizes trapped ion qubits. Both technologies hold promise, but they present unique advantages and challenges.

-

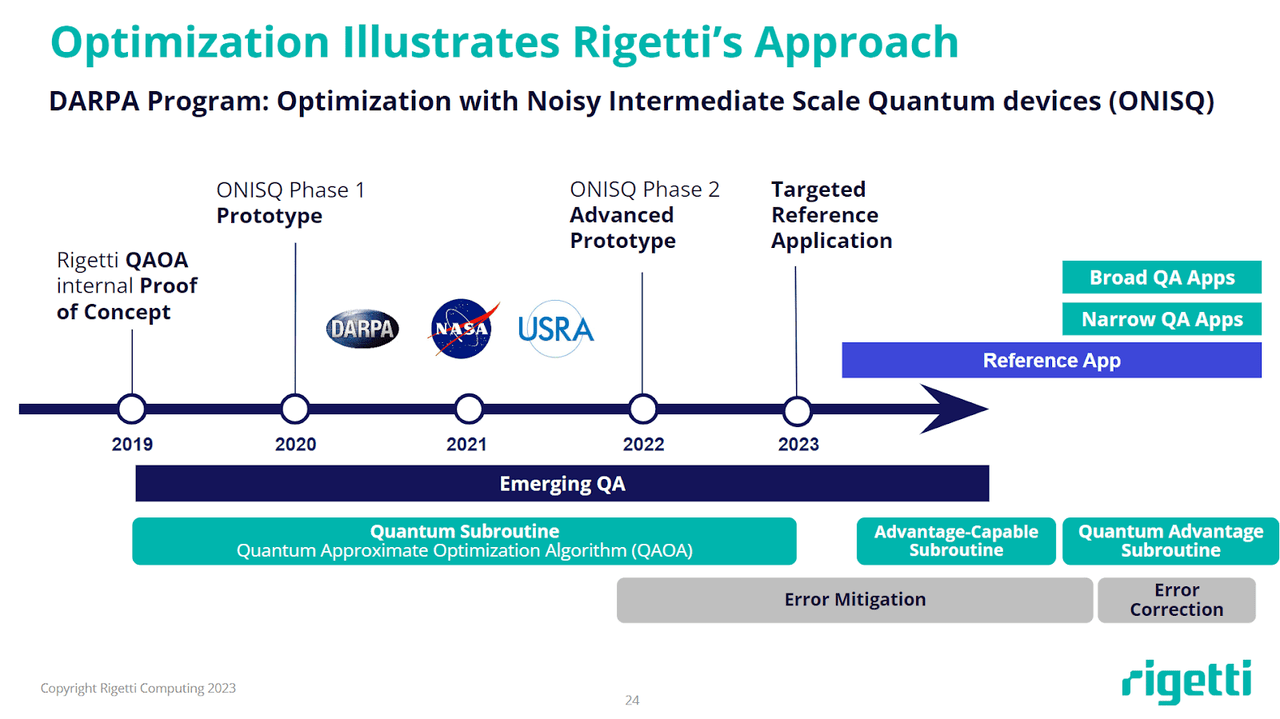

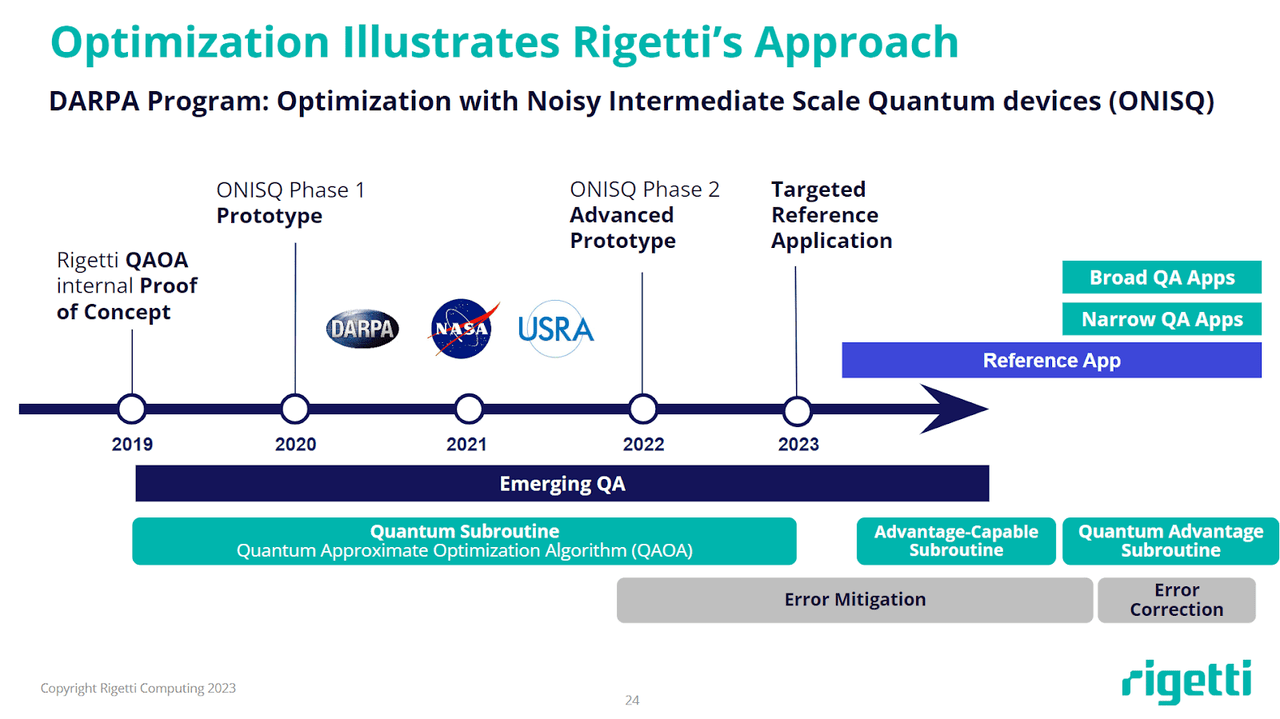

Rigetti (RGTI) Technology: Rigetti has made strides in developing its superconducting qubit-based processors, achieving significant increases in qubit count and coherence times. They've also forged partnerships to accelerate the development and deployment of their quantum computing systems. However, challenges remain in scaling up the technology to maintain qubit coherence and reduce error rates.

-

IonQ Technology: IonQ's trapped ion technology offers potentially higher qubit coherence times, contributing to greater computational accuracy. The company has also announced impressive qubit counts and is actively pursuing collaborations to expand its applications. Nevertheless, scalability remains a key technological hurdle for trapped ion systems.

-

Key Milestones:

- Rigetti: Announced a significant increase in qubit count in its latest processor generation. Secured strategic partnerships with major corporations for quantum computing research and development.

- IonQ: Achieved record-breaking coherence times for its trapped ion qubits. Expanded its partnerships with cloud computing providers to make its quantum systems more accessible.

-

Technological Hurdles: Both companies continue to face significant challenges, including improving qubit stability, reducing error rates, and developing efficient error correction methods. The development of fault-tolerant quantum computers is still some years away. These challenges contribute significantly to the risks associated with investing in these quantum stocks.

Market Potential and Growth Projections for Quantum Computing

The quantum computing market is poised for explosive growth. Market research firms predict substantial expansion in the coming years, driven by the potential applications of this transformative technology across diverse industries.

-

Industry Disruptor Potential: Quantum computing has the potential to revolutionize fields like drug discovery, materials science, financial modeling, and artificial intelligence. Its ability to solve currently intractable problems could unlock significant economic value.

-

Quantum Computing Applications:

- Finance: Quantum algorithms could optimize portfolio management, risk assessment, and fraud detection.

- Healthcare: Quantum computing could accelerate drug discovery and personalized medicine.

- Materials Science: It could design new materials with superior properties for various applications.

-

Market Growth Predictions: Reports from leading market research firms project significant growth in the quantum computing market, reaching tens of billions of dollars by the end of the decade. However, these projections are subject to considerable uncertainty and depend on technological breakthroughs and market adoption. The long-term value proposition is substantial, but realization is contingent on overcoming significant technological and commercial hurdles.

Financial Performance and Investment Risks of Quantum Stocks

Investing in Rigetti (RGTI) stock and IonQ stock involves substantial risk. Both companies are currently operating at a loss and are far from achieving profitability. Their valuations reflect the high potential of the quantum computing market, but also the significant uncertainties involved.

-

Financial Analysis: (Note: Detailed financial analysis requires access to current financial statements of RGTI and IonQ. This section would include analysis of revenue, expenses, profitability, and valuation metrics based on the available data.)

-

Investment Risks:

- Regulatory Changes: Government regulations could significantly impact the development and deployment of quantum computing technologies.

- Competition: The quantum computing field is highly competitive, with numerous players vying for market share.

- Technological Setbacks: Unexpected technical challenges could delay progress and impact the companies' financial performance.

- Stock Volatility: Quantum stocks are inherently volatile, reflecting the high-risk, high-reward nature of the industry.

Alternative Investment Options in the Quantum Computing Sector

Investing directly in quantum computing stocks like RGTI and IonQ is not the only way to participate in this exciting sector. Diversification is crucial to mitigate risk.

-

ETFs: Some ETFs offer exposure to the broader technology sector, including companies involved in quantum computing research and development.

-

Venture Capital: Venture capital firms are actively investing in early-stage quantum computing companies, offering high-risk, high-reward investment opportunities.

-

Large Tech Companies: Major tech companies are increasingly investing in quantum computing research, providing a more stable, albeit less concentrated, investment option.

-

Diversification Strategies: A diversified approach, combining investments in ETFs, established tech companies, and potentially some carefully selected quantum stocks, can help mitigate risk while participating in the potential growth of the quantum computing market.

Conclusion: Are Quantum Stocks Right for Your Portfolio in 2025?

Investing in quantum stocks like Rigetti (RGTI) and IonQ in 2025 presents a compelling yet risky proposition. The potential for transformative technological advancements and substantial market growth is undeniable. However, the significant financial risks associated with early-stage technology companies, technological hurdles, and market uncertainties should not be underestimated. Thorough due diligence, a comprehensive understanding of the technology, and a careful assessment of your own risk tolerance are paramount before investing in quantum stocks. Conduct further research, consult with a financial advisor, and explore additional resources like industry reports and financial news to make an informed investment decision. Remember, investing in quantum stocks requires a long-term perspective and acceptance of substantial risk.

Featured Posts

-

Gangsta Granny Activities And Crafts Inspired By The Book

May 21, 2025

Gangsta Granny Activities And Crafts Inspired By The Book

May 21, 2025 -

Mummy Pigs Big Announcement Peppa Pigs Family Welcomes A New Piglet

May 21, 2025

Mummy Pigs Big Announcement Peppa Pigs Family Welcomes A New Piglet

May 21, 2025 -

Sandylands U Your Complete Tv Guide

May 21, 2025

Sandylands U Your Complete Tv Guide

May 21, 2025 -

Symvoylio Megalis Tessarakostis Ekdilosi Stin Patriarxiki Akadimia Kritis

May 21, 2025

Symvoylio Megalis Tessarakostis Ekdilosi Stin Patriarxiki Akadimia Kritis

May 21, 2025 -

Antiques Roadshow Arrest Couple Charged With Trafficking National Treasure

May 21, 2025

Antiques Roadshow Arrest Couple Charged With Trafficking National Treasure

May 21, 2025

Latest Posts

-

Bp Ceo Targets Valuation Doubling Rejects Us Stock Market Transfer

May 22, 2025

Bp Ceo Targets Valuation Doubling Rejects Us Stock Market Transfer

May 22, 2025 -

The Goldbergs Where To Watch And Stream Every Episode

May 22, 2025

The Goldbergs Where To Watch And Stream Every Episode

May 22, 2025 -

The Goldbergs Comparing The Show To Real Life 1980s Families

May 22, 2025

The Goldbergs Comparing The Show To Real Life 1980s Families

May 22, 2025 -

The Goldbergs Behind The Scenes Facts And Trivia

May 22, 2025

The Goldbergs Behind The Scenes Facts And Trivia

May 22, 2025 -

The Evolution Of The Goldbergs From Pilot To Present Day

May 22, 2025

The Evolution Of The Goldbergs From Pilot To Present Day

May 22, 2025