Analyzing The GOP Tax Plan: The Reality Of Deficit Reduction

Table of Contents

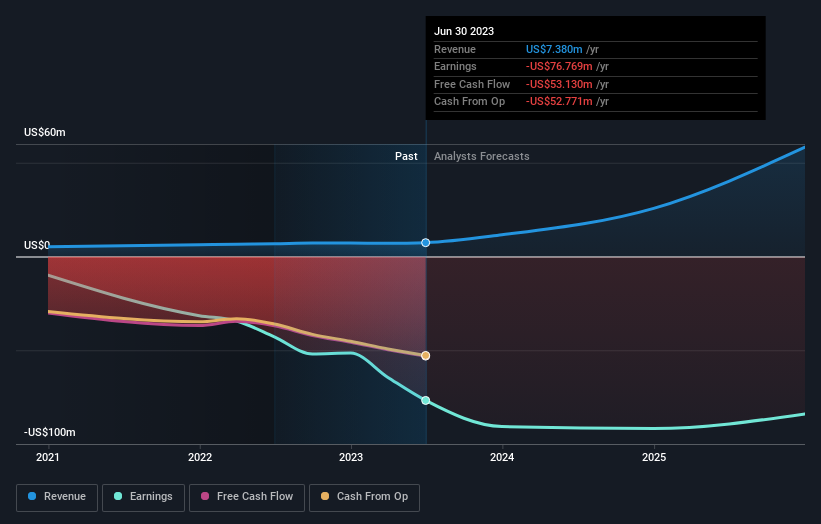

Projected Revenue Impacts of the GOP Tax Plan

Tax Cuts and Their Effect on Government Revenue

The GOP tax plan, enacted in 2017, included significant tax cuts across the board. These cuts had a substantial projected impact on federal revenue.

- Individual Income Tax Cuts: Reductions in individual tax rates across various brackets, leading to decreased tax liabilities for many Americans.

- Corporate Tax Rate Reductions: A significant reduction in the corporate tax rate from 35% to 21%, intended to stimulate business investment and job growth.

- Changes to Deductions and Credits: Modifications to deductions (like the standard deduction) and tax credits, altering the overall tax burden for individuals and businesses.

- Estimated Revenue Losses per Tax Cut: While precise figures vary depending on the model used, most analyses projected substantial revenue losses from each of these measures.

The use of dynamic scoring versus static scoring significantly impacts revenue projections. Static scoring assumes no change in economic behavior, while dynamic scoring accounts for potential behavioral responses to tax changes. Dynamic scoring, often favored by proponents of the GOP tax plan, projects higher revenue in the long run due to increased economic activity. However, the inherent uncertainties in economic forecasting make these projections inherently unreliable. Predicting future economic growth with precision remains a challenge.

Economic Growth Arguments and Their Validity

A central argument for the GOP tax plan was that tax cuts would stimulate economic growth, leading to increased tax revenue. This argument rests on supply-side economics and the Laffer curve.

- Supply-side economics theory: This theory posits that lower taxes incentivize investment, production, and employment, ultimately boosting economic activity and increasing government revenue.

- Laffer Curve: This illustrates the relationship between tax rates and government revenue, suggesting that excessively high tax rates can stifle economic activity and reduce revenue.

- Evidence supporting and contradicting the theory: Empirical evidence supporting supply-side economics and the Laffer curve is mixed, with studies yielding varying results. Some research suggests that tax cuts can stimulate growth, while others find little or no effect.

- Potential for increased investment and job creation: Proponents argued the plan would boost investment and job creation, leading to higher wages and increased tax receipts. However, critics pointed to the lack of substantial increases in wages and investment following the tax cuts.

The magnitude of economic growth needed to offset the revenue losses from the tax cuts was significant, requiring a considerable boost to the economy. Whether this level of growth materialized remains a subject of debate.

Analysis of the National Debt under the GOP Tax Plan

Baseline Projections vs. Actual Outcomes

The GOP projected the tax plan would lead to deficit reduction. However, comparing initial projections with actual outcomes reveals a different picture.

- Data from the Congressional Budget Office (CBO) or other reputable sources: The CBO and other independent organizations produced analyses showing increased deficits following the tax cuts.

- Comparison of projected vs. actual deficits: The actual increases in the national debt exceeded the initial projections in several years following the plan’s implementation.

- Discussion of factors that may have contributed to discrepancies: Several factors, including unexpected economic slowdowns and increased government spending, contributed to the discrepancy between projected and actual deficits.

Long-Term Fiscal Sustainability

The GOP tax plan's long-term impact on the national debt raises concerns about fiscal sustainability.

- Consider the impact on future generations: The increased national debt places a significant burden on future taxpayers, who will face higher interest payments and reduced resources for other government programs.

- Potential for increased interest payments on the national debt: Higher levels of debt mean increased interest payments, further straining the federal budget.

- Analysis of debt-to-GDP ratios: Rising debt-to-GDP ratios indicate a worsening fiscal position, posing risks to long-term economic stability.

Alternative Perspectives and Criticisms of the GOP Tax Plan

Arguments Against Deficit Reduction

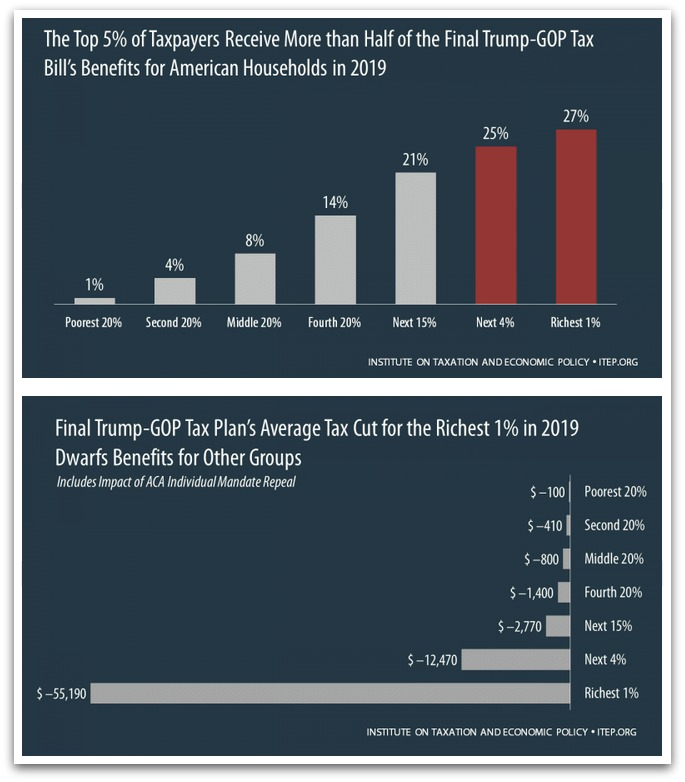

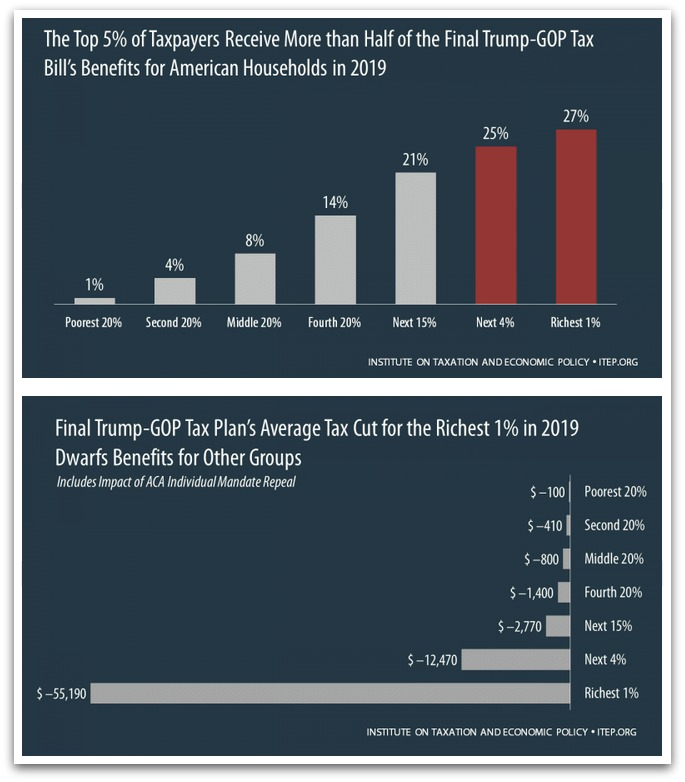

Critics argued the tax cuts disproportionately benefited the wealthy, leading to increased income inequality with minimal economic growth.

- Distributional effects of tax cuts: A significant portion of the tax benefits went to high-income earners, exacerbating income inequality.

- Arguments against trickle-down economics: Critics questioned the effectiveness of trickle-down economics, arguing that tax cuts for corporations and the wealthy do not automatically translate into widespread economic benefits.

- Alternative approaches to deficit reduction (e.g., spending cuts, tax increases on higher earners): Critics proposed alternative approaches to deficit reduction, such as targeted spending cuts and progressive tax increases on higher-income individuals and corporations.

Policy Recommendations for Improved Fiscal Health

Several policy recommendations could improve fiscal health and achieve more effective deficit reduction.

- Targeted tax reforms: Focusing tax cuts on specific areas that stimulate economic growth, such as investments in research and development or education, could yield more effective results.

- Spending cuts in specific areas: Identifying and reducing wasteful government spending could contribute significantly to deficit reduction.

- Investments in infrastructure or human capital: Investing in infrastructure and human capital can boost long-term economic growth and productivity, leading to increased tax revenue.

Conclusion

The GOP tax plan's impact on deficit reduction has been mixed. While it temporarily boosted economic growth in some sectors, it ultimately led to significant increases in the national debt and failed to achieve its stated goal of deficit reduction. The economic growth projections were not realized to the extent necessary to offset the revenue losses from the significant tax cuts. The long-term fiscal implications remain a concern, particularly regarding the burden on future generations.

To foster responsible fiscal policymaking, we must critically evaluate future tax plans by considering the long-term fiscal consequences and exploring alternative policy solutions that promote both economic growth and fiscal responsibility. Continue to analyze the GOP tax plan and its lasting impacts on the national debt and the economy. Further research into the effectiveness of different tax policies is crucial for informed decision-making.

Featured Posts

-

Historic Burnham And Highbridge Photos Now Accessible

May 20, 2025

Historic Burnham And Highbridge Photos Now Accessible

May 20, 2025 -

Ray Epps Sues Fox News For Defamation Jan 6th Allegations And The Trump Connection

May 20, 2025

Ray Epps Sues Fox News For Defamation Jan 6th Allegations And The Trump Connection

May 20, 2025 -

Asbh A Biarritz Pro D2 Le Mental Cle De La Victoire

May 20, 2025

Asbh A Biarritz Pro D2 Le Mental Cle De La Victoire

May 20, 2025 -

Deconstructing On This Love Exploring The Lyrics And Themes Of Suki Waterhouses Song

May 20, 2025

Deconstructing On This Love Exploring The Lyrics And Themes Of Suki Waterhouses Song

May 20, 2025 -

Why Did D Wave Quantum Qbts Stock Decline On Monday

May 20, 2025

Why Did D Wave Quantum Qbts Stock Decline On Monday

May 20, 2025

Latest Posts

-

Updated Forecast Precise On And Off Times For Rain

May 20, 2025

Updated Forecast Precise On And Off Times For Rain

May 20, 2025 -

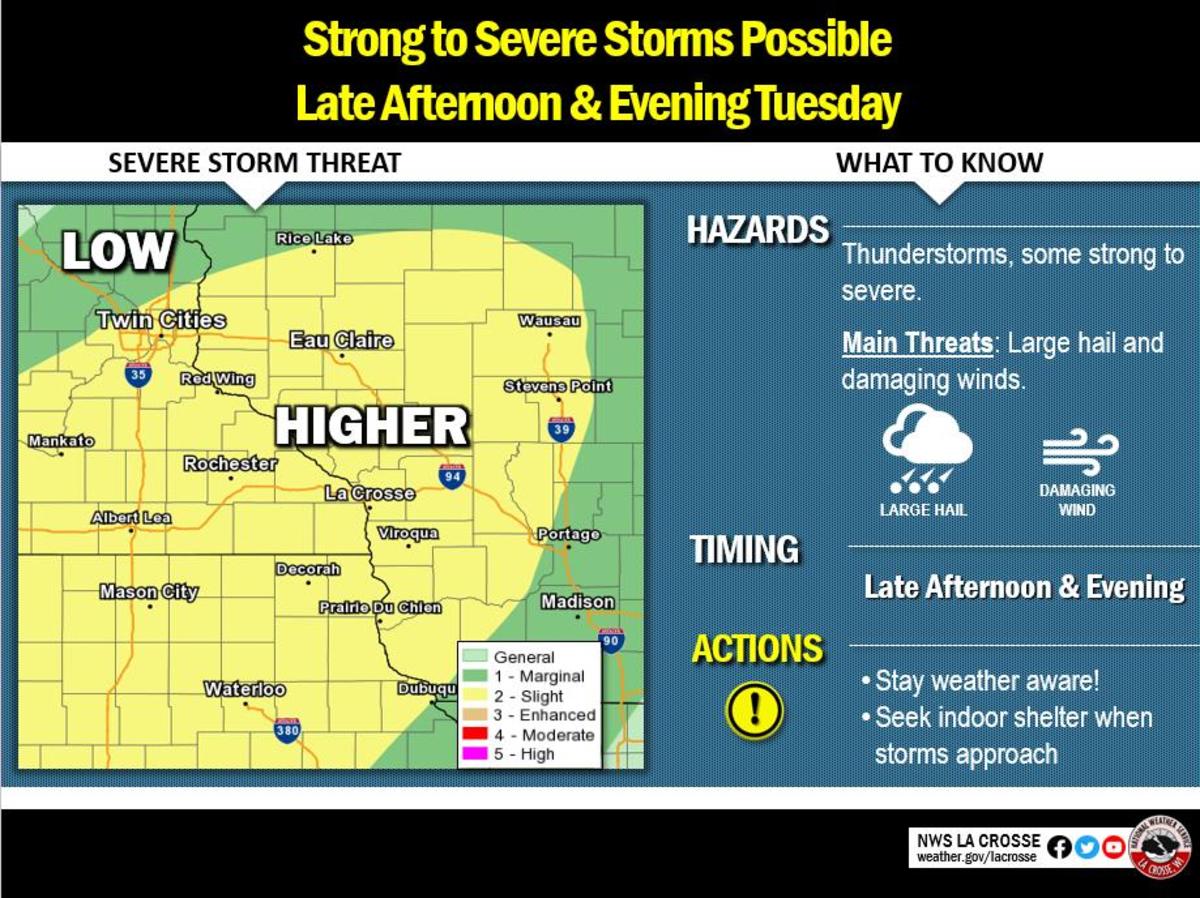

Severe Weather Alert Strong Winds And Storms Approaching

May 20, 2025

Severe Weather Alert Strong Winds And Storms Approaching

May 20, 2025 -

Your First Alert Strong Wind And Severe Storms Expected

May 20, 2025

Your First Alert Strong Wind And Severe Storms Expected

May 20, 2025 -

Analyzing Big Bear Ai Stock A Practical Guide For Investors

May 20, 2025

Analyzing Big Bear Ai Stock A Practical Guide For Investors

May 20, 2025 -

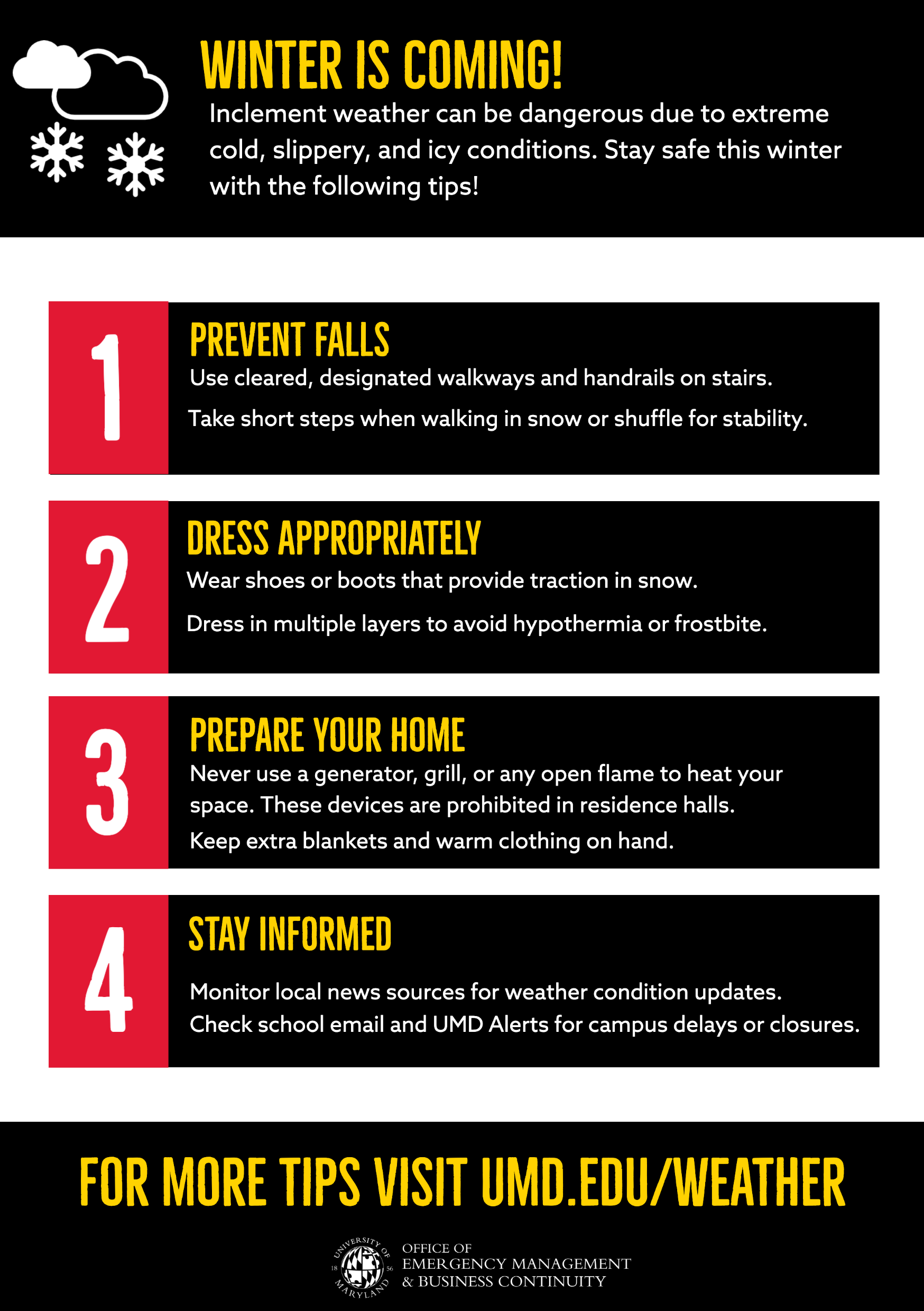

Preparing For School Delays During Winter Weather Advisories

May 20, 2025

Preparing For School Delays During Winter Weather Advisories

May 20, 2025