Analyzing The Impact Of ‘Liberation Day’ Tariffs On Stock Market Performance

Table of Contents

Pre-Tariff Stock Market Conditions

The period leading up to "Liberation Day" saw the [Country/Region] stock market exhibiting [describe overall market trend – e.g., steady growth, moderate decline, high volatility]. Key economic indicators painted a mixed picture. GDP growth stood at [percentage]% in the preceding quarter, while inflation hovered around [percentage]%, indicating [interpret the economic state – e.g., a healthy economy, signs of overheating, a period of slow growth]. Consumer confidence, as measured by [mention specific index, e.g., the Consumer Confidence Index], was [high/low/moderate], reflecting [explain the consumer sentiment].

Existing market trends included [mention specific trends, e.g., a strong technology sector, weakness in the manufacturing sector, rising interest rates]. Significant events impacting the market before "Liberation Day" included [mention relevant events, e.g., a major political announcement, a significant international trade agreement].

- S&P 500 equivalent (if applicable): [Data point showing performance – e.g., a 2% increase in the previous month].

- [Relevant sector-specific index]: [Data point showing performance – e.g., a 5% decline in the energy sector].

- [Another relevant economic indicator]: [Data point – e.g., unemployment rate at 4.5%].

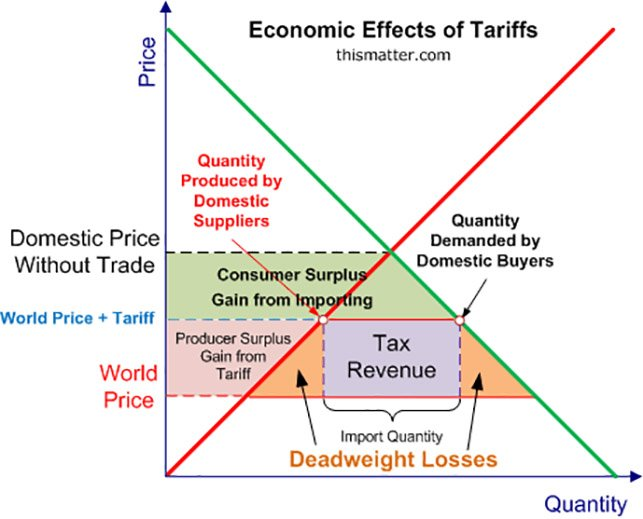

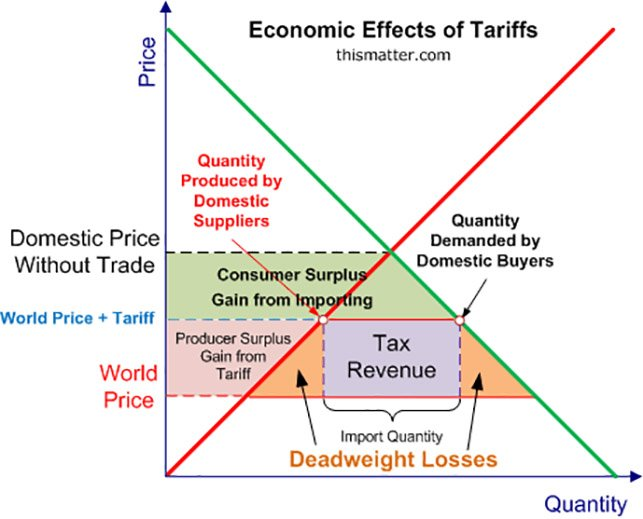

Immediate Impact of ‘Liberation Day’ Tariffs on Stock Prices

The "Liberation Day Tariffs" involved [detail specific tariffs – e.g., a 10% increase on imported steel, a 25% tariff on certain agricultural products]. The announcement/implementation of these tariffs triggered an immediate [describe the market reaction – e.g., sharp decline, moderate sell-off, initial shock followed by recovery] in the stock market. Import-dependent industries, such as [mention specific examples – e.g., automobile manufacturing, consumer electronics], experienced significant negative impacts, with many stocks experiencing [quantify the drop – e.g., double-digit percentage drops]. In contrast, certain export-oriented sectors, like [mention specific examples – e.g., agriculture, certain manufacturing sectors], initially showed resilience or even minor gains.

- Stock X (import-dependent): [Quantify price change – e.g., a 15% drop in the first trading day].

- Stock Y (export-oriented): [Quantify price change – e.g., a 2% increase].

- [Relevant Index]: [Quantify the index change – e.g., a 3% overall market decline].

Short-Term and Long-Term Effects of the ‘Liberation Day’ Tariffs

The weeks and months following "Liberation Day" witnessed significant volatility. The initial shock gave way to [describe the trend – e.g., a slow recovery, a prolonged period of uncertainty, further declines]. While short-term fluctuations were pronounced, longer-term trends were shaped by the government's response to the tariff's impact. [Describe government actions – e.g., subsidies for affected industries, initiatives to stimulate domestic production].

- Market Performance (3 months post-tariffs): [Comparative data, e.g., a 1% overall decline compared to a projected 3% growth without tariffs].

- Market Performance (12 months post-tariffs): [Comparative data, e.g., a 5% recovery but still below pre-tariff levels].

Sector-Specific Analysis of ‘Liberation Day’ Tariff Impact

The impact of the "Liberation Day Tariffs" varied significantly across sectors. The [mention specific sector] sector was among the hardest hit, with companies like [mention specific companies] experiencing considerable losses. Conversely, the [mention specific sector] sector demonstrated resilience, with firms like [mention specific companies] benefiting from increased domestic demand. This led to a noticeable shift in market leadership within certain industries.

- [Sector A]: Winners: [Company examples]; Losers: [Company examples].

- [Sector B]: Winners: [Company examples]; Losers: [Company examples].

Conclusion: Understanding the Impact of ‘Liberation Day’ Tariffs on Stock Market Performance

The "Liberation Day Tariffs" had a multifaceted and significant impact on the [Country/Region] stock market. The immediate reaction was largely negative, particularly affecting import-dependent industries. While some sectors demonstrated resilience, the long-term effects involved a complex interplay of market forces and government policy. Understanding the impact of "Liberation Day Tariffs" highlights the crucial relationship between policy decisions and market fluctuations, offering valuable lessons for investors and policymakers alike. Analyzing the impact of Liberation Day tariffs on various economic sectors requires further detailed research. We encourage readers to conduct further research on the "Liberation Day" tariffs and similar economic events to gain a more comprehensive understanding of the complex relationship between government policy and investment strategies. Stay informed about the effects of government policy on your investments by analyzing the impact of Liberation Day tariffs and other similar economic shifts.

Featured Posts

-

Rising Taiwan Dollar Pressure Mounts For Economic Overhaul

May 08, 2025

Rising Taiwan Dollar Pressure Mounts For Economic Overhaul

May 08, 2025 -

Artetas Arsenal Faces Challenge Following Dembele Injury Update

May 08, 2025

Artetas Arsenal Faces Challenge Following Dembele Injury Update

May 08, 2025 -

Anons Matchiv Ligi Chempioniv Arsenal Ps Zh Barselona Inter 2024 2025

May 08, 2025

Anons Matchiv Ligi Chempioniv Arsenal Ps Zh Barselona Inter 2024 2025

May 08, 2025 -

Liga De Quito Iguala Ante Flamengo Resumen Del Partido De Copa Libertadores

May 08, 2025

Liga De Quito Iguala Ante Flamengo Resumen Del Partido De Copa Libertadores

May 08, 2025 -

Lahore Zoo Ticket Price Hike Clarification From Marriyum Aurangzeb

May 08, 2025

Lahore Zoo Ticket Price Hike Clarification From Marriyum Aurangzeb

May 08, 2025