Analyzing The Net Asset Value Of The Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

Table of Contents

What is Net Asset Value (NAV) and why is it important for ETFs?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. For the Amundi Dow Jones Industrial Average UCITS ETF (Distributing), this means calculating the total value of its holdings in the 30 companies that make up the Dow Jones Industrial Average, subtracting any expenses or liabilities, and then dividing by the total number of ETF shares. This calculation, performed daily, provides a snapshot of the ETF's intrinsic worth.

Why is NAV important?

- NAV reflects the underlying asset value of the ETF. It provides a transparent view of what your investment is actually worth.

- Daily NAV calculation ensures transparency for investors. This allows investors to track the performance of their investment closely.

- Tracking NAV helps assess ETF performance against the benchmark (Dow Jones Industrial Average). By comparing the NAV to the Dow Jones Industrial Average, you can gauge how effectively the ETF is tracking its benchmark.

- Differences between NAV and market price indicate potential buying/selling opportunities (though arbitrage usually keeps them close). While generally small, discrepancies can present brief opportunities for savvy traders.

Factors Influencing the NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

Several factors influence the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing):

-

The performance of the Dow Jones Industrial Average significantly impacts the ETF's NAV. A rising Dow generally translates to a higher NAV, while a falling Dow leads to a lower NAV. This is because the ETF aims to track the index's performance.

-

Currency fluctuations can affect the NAV if the ETF holds assets denominated in different currencies. For example, a weakening US dollar (USD) could negatively impact the NAV if a significant portion of the underlying assets are held in other currencies.

-

Dividends and distribution policies affect the NAV. When the ETF distributes dividends to shareholders, the NAV decreases on the ex-dividend date, reflecting the payout. This is a crucial point to consider when analyzing Amundi Dow Jones Industrial Average UCITS ETF NAV trends.

-

Other factors: While less direct, economic factors, market sentiment, and global events can also indirectly influence the NAV through their impact on the constituent companies of the Dow Jones Industrial Average.

How to Track and Interpret the NAV of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing)

Tracking the Amundi Dow Jones Industrial Average UCITS ETF NAV is straightforward:

-

Regularly check the official Amundi website. This is the most reliable source for the daily NAV. You can typically find this information in the ETF's fact sheet or daily pricing data.

-

Utilize financial news sources. Many reputable financial websites and platforms provide real-time or delayed pricing information, including the NAV, for major ETFs.

-

Compare the NAV to the ETF's market price. While generally very close, discrepancies may provide insights into market sentiment and potential trading opportunities. A significant divergence warrants further investigation.

-

Consider the NAV alongside other performance indicators. Don't rely solely on NAV. Factors such as total return, expense ratio, and historical performance provide a more holistic view of the ETF's investment worth.

-

Use online charting tools. Visualizing NAV trends over time provides a clear understanding of the ETF's performance trajectory.

Analyzing NAV Trends for Investment Decisions

Analyzing historical Amundi Dow Jones Industrial Average UCITS ETF NAV data is crucial for investment decisions:

- Long-term NAV trends reflect the overall performance of the underlying index. A consistently upward trend suggests strong long-term performance.

- Short-term fluctuations are common and should be viewed in context. Don't overreact to daily or weekly changes.

- Consider other factors like market sentiment and economic indicators. A comprehensive approach is necessary.

- Consult a financial advisor before making investment decisions. Professional guidance can help you align your investment strategy with your financial goals.

Conclusion

Analyzing the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF (Distributing) is a critical aspect of effective investment management. By tracking the NAV, understanding its influencing factors, and comparing it to the market price alongside other key metrics, investors can gain valuable insights. Remember to always consult with a financial advisor before investing. Learn more about how to effectively track the Amundi Dow Jones Industrial Average UCITS ETF NAV and optimize your investment strategy.

Featured Posts

-

A Realistic Look At Escaping To The Country

May 25, 2025

A Realistic Look At Escaping To The Country

May 25, 2025 -

Yubiley Sergeya Yurskogo 90 Let Nezabvennomu Akteru

May 25, 2025

Yubiley Sergeya Yurskogo 90 Let Nezabvennomu Akteru

May 25, 2025 -

Test Drogowy Porsche Cayenne Gts Coupe Suv Dla Wybrednych

May 25, 2025

Test Drogowy Porsche Cayenne Gts Coupe Suv Dla Wybrednych

May 25, 2025 -

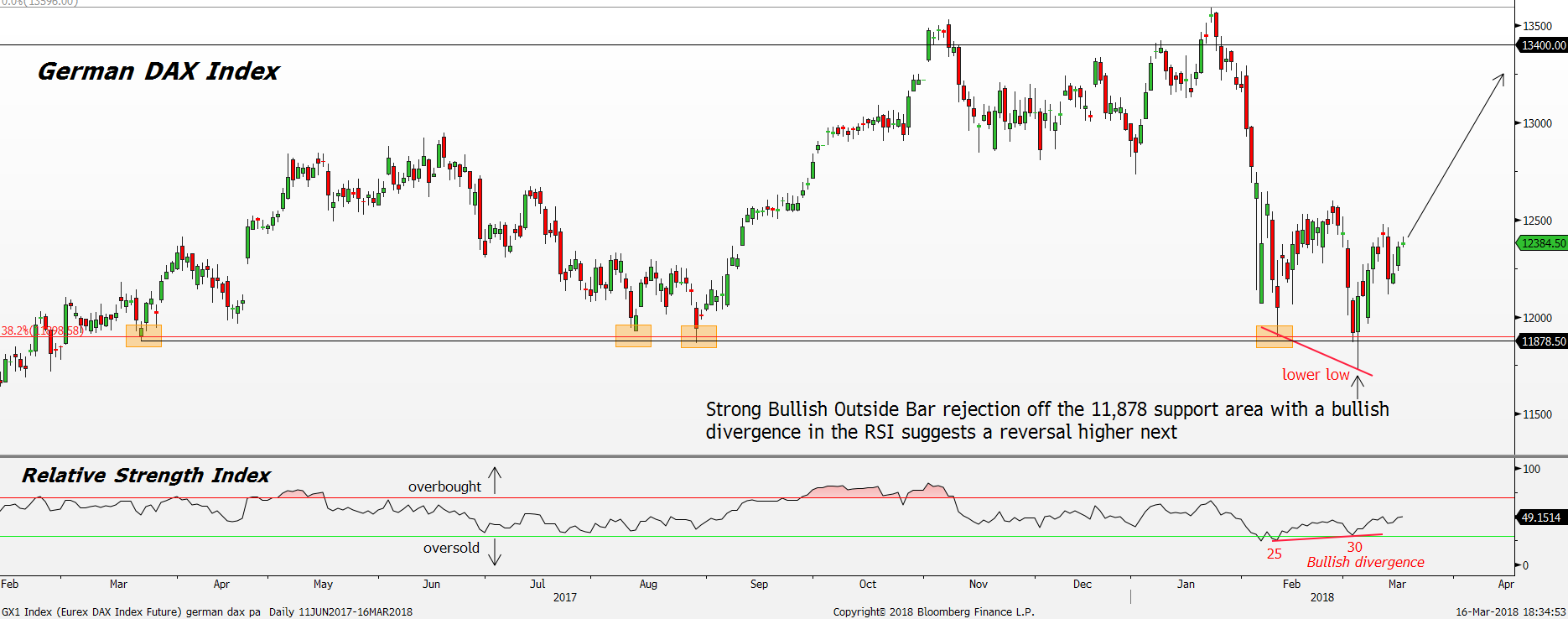

Dax Surge Will A Wall Street Rebound Dampen German Market Gains

May 25, 2025

Dax Surge Will A Wall Street Rebound Dampen German Market Gains

May 25, 2025 -

Dow Jones Grinds Higher Following Positive Pmi Report

May 25, 2025

Dow Jones Grinds Higher Following Positive Pmi Report

May 25, 2025

Latest Posts

-

Yurskiy V Mossovete Vecher Pamyati I Vospominaniy

May 25, 2025

Yurskiy V Mossovete Vecher Pamyati I Vospominaniy

May 25, 2025 -

Vecher Pamyati Sergeya Yurskogo V Teatre Mossoveta

May 25, 2025

Vecher Pamyati Sergeya Yurskogo V Teatre Mossoveta

May 25, 2025 -

V Teatre Mossoveta Pamyati Sergeya Yurskogo

May 25, 2025

V Teatre Mossoveta Pamyati Sergeya Yurskogo

May 25, 2025 -

Jack Draper Wins First Atp Masters 1000 Championship In Indian Wells

May 25, 2025

Jack Draper Wins First Atp Masters 1000 Championship In Indian Wells

May 25, 2025 -

Pokolenie Peremen Chto Udalos Dostich

May 25, 2025

Pokolenie Peremen Chto Udalos Dostich

May 25, 2025