DAX Surge: Will A Wall Street Rebound Dampen German Market Gains?

Table of Contents

The DAX (Deutscher Aktienindex), or German stock index, is a blue-chip stock market index consisting of the 40 largest German companies listed on the Frankfurt Stock Exchange. It's a key indicator of the health of the German economy and plays a significant role in the broader European financial markets. The central question we aim to address is: Will a potential Wall Street rebound significantly impact the recent DAX surge? This article will argue that while a connection exists, the DAX's performance is driven by a complex interplay of factors, not solely mirroring Wall Street trends.

Recent DAX Performance and Driving Factors

The recent DAX surge is attributable to a confluence of factors, not solely dependent on global market sentiment.

Strong Earnings Reports from German Companies

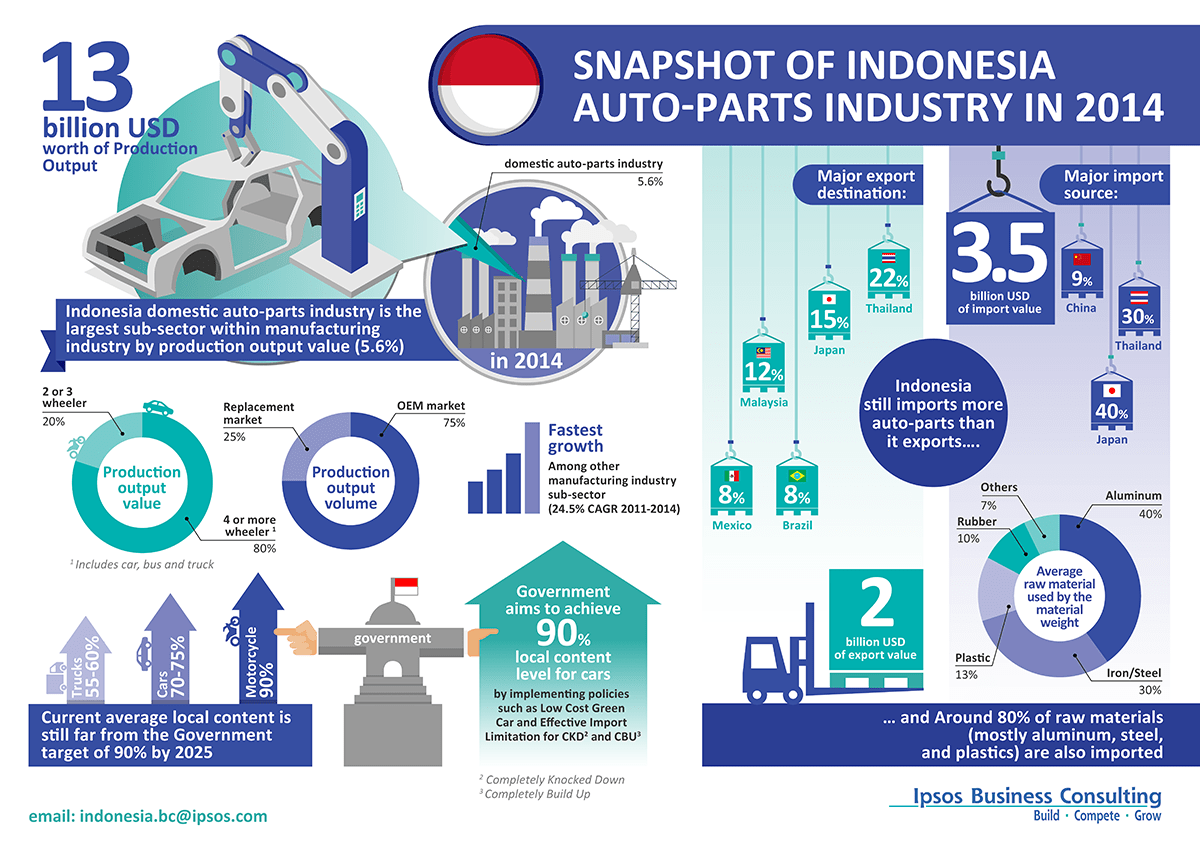

Several key German sectors have reported exceptionally strong earnings, fueling the DAX's rise. The automotive industry, a cornerstone of the German economy, has seen significant growth, with companies like Volkswagen and BMW posting impressive sales figures and increased profits. Similarly, the technology sector, boosted by strong export demand and innovation, has contributed significantly to the overall index performance. For instance, SAP, a leading software company, has reported exceeding expectations, contributing positively to the DAX's overall gains. These strong earnings, often exceeding analyst predictions by a significant margin (e.g., 15-20% in some cases), have injected considerable confidence into the market.

Positive Economic Indicators for Germany

Positive economic news further bolsters investor confidence in the German market. Lower-than-expected unemployment rates, coupled with increased consumer spending, point towards a healthy domestic economy. Government initiatives aimed at fostering economic growth, such as targeted investments in renewable energy and infrastructure projects, also contribute to the positive outlook. The recent data released by Destatis (the Federal Statistical Office of Germany) shows a robust increase in GDP growth, surpassing initial forecasts. These positive indicators reinforce the narrative of a thriving German economy, attracting further investment.

Global Market Sentiment

While the German economy's strength is a primary driver, global market sentiment also plays a role. Periods of increased global optimism, often driven by positive geopolitical developments or easing global trade tensions, tend to positively impact the DAX. Conversely, periods of global uncertainty or negative news can dampen investor enthusiasm, even if the German economy remains strong. The current global sentiment, though volatile, leans toward cautious optimism, influencing investor behavior in the German market.

Wall Street's Current Situation and Potential for Rebound

Understanding Wall Street's current state is crucial to assessing its potential impact on the DAX.

Analyzing Key US Economic Indicators

Several key US economic indicators are currently under scrutiny. Inflation, while showing signs of cooling, remains a concern for investors. Interest rate hikes by the Federal Reserve, aimed at curbing inflation, can impact investor confidence and potentially dampen the US stock market. GDP growth, while generally positive, has shown some signs of slowing. These intertwined factors create a complex picture, making it difficult to predict a clear trajectory for the US market. Comparing current data with previous periods reveals a mixed picture, with some indicators showing improvement while others remain challenging.

Potential Triggers for a Wall Street Rebound

Several factors could trigger a Wall Street rebound. A positive earnings season, exceeding expectations across various sectors, could boost investor confidence. A sustained decrease in inflation, signaling a potential end to interest rate hikes, would likely stimulate a market rally. Improved geopolitical stability and reduced uncertainty would also contribute to a more positive market outlook. The timing and likelihood of these factors aligning remain uncertain, making any prediction speculative.

The Impact of a US Rebound on Global Markets

A US market rebound would likely have a ripple effect on global markets, including the DAX. Increased investor confidence in the US could lead to capital flows into other markets, potentially bolstering the DAX. However, the impact's magnitude depends on the strength and duration of the US rebound, and the degree to which the DAX is decoupled from Wall Street trends. Historical precedents show varying levels of correlation, with periods of strong linkage and periods of independence.

Correlation Between DAX and Wall Street Performance

Analyzing the historical relationship between the DAX and Wall Street provides valuable insights.

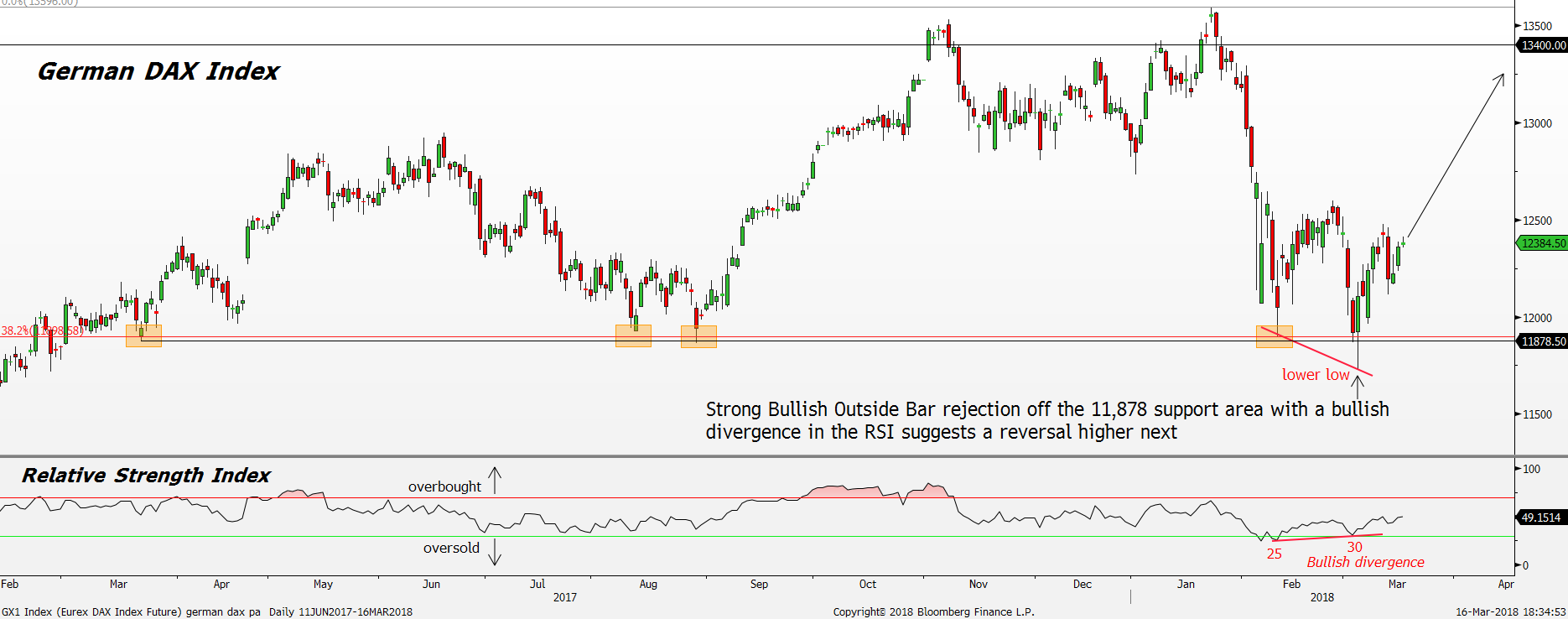

Historical Data Analysis

Historical data reveals a complex correlation between the DAX and Wall Street. While periods of strong correlation exist, particularly during times of significant global economic shifts, there are also instances of notable decoupling. Visualizing this relationship through charts and graphs clearly shows periods of synchronized movements and periods where the two markets diverge significantly. This lack of perfect correlation highlights the independent factors influencing each market.

Factors Influencing the Correlation

Several factors influence the correlation between the two markets. Global economic events, such as shifts in oil prices or global trade tensions, tend to impact both markets. Sector-specific trends, particularly in industries with significant global exposure, also influence the correlation. Investor sentiment and market psychology play a critical role; periods of widespread fear or optimism can lead to synchronized movements, while diversification strategies by investors can weaken the correlation.

Conclusion: DAX Surge – A Sustainable Trend?

The recent DAX surge is driven by a combination of robust German economic indicators, strong corporate earnings, and generally positive global sentiment. While a potential Wall Street rebound could influence the DAX, historical data suggests that the correlation isn't absolute. The German market's strength, evident in recent positive economic data, provides a strong foundation for continued growth. However, global uncertainties and the potential impact of a US market rebound remain factors to consider.

Stay tuned for further updates on the DAX surge and its relationship with Wall Street's performance. Understanding the interplay between these markets is crucial for navigating the complexities of global investment. Careful monitoring of key economic indicators in both Germany and the US is vital for making informed investment decisions in this dynamic environment.

Featured Posts

-

Amundi Djia Ucits Etf Daily Nav And Its Significance

May 25, 2025

Amundi Djia Ucits Etf Daily Nav And Its Significance

May 25, 2025 -

Escape To The Countryside Homes Land And Lifestyle Choices

May 25, 2025

Escape To The Countryside Homes Land And Lifestyle Choices

May 25, 2025 -

O Chyom Govorit Uspekh Nashego Pokoleniya

May 25, 2025

O Chyom Govorit Uspekh Nashego Pokoleniya

May 25, 2025 -

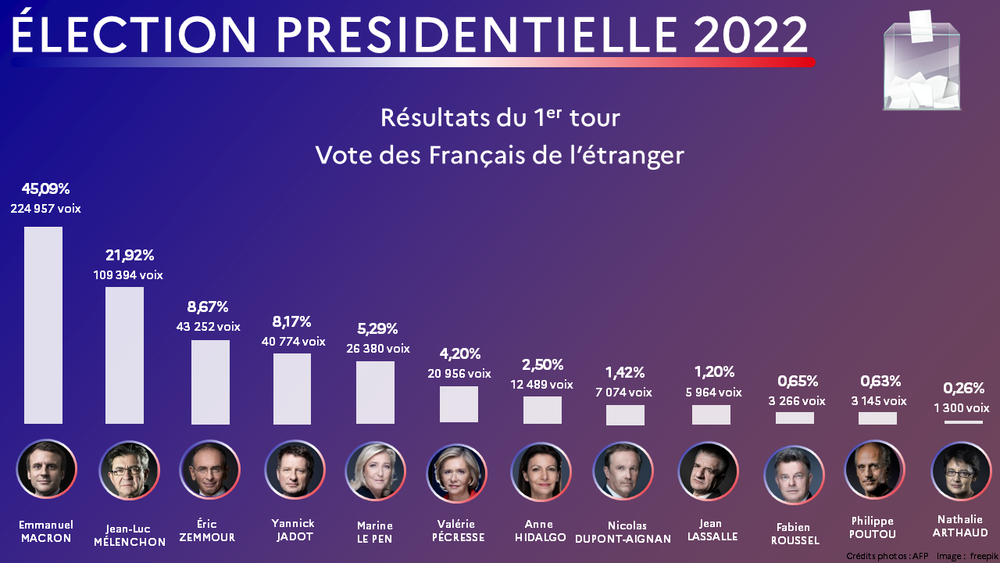

Jordan Bardella And The 2027 French Presidential Election A Realistic Assessment

May 25, 2025

Jordan Bardella And The 2027 French Presidential Election A Realistic Assessment

May 25, 2025 -

Kyle Walker Spotted Partying In Milan Hours After Wifes Return To Uk

May 25, 2025

Kyle Walker Spotted Partying In Milan Hours After Wifes Return To Uk

May 25, 2025

Latest Posts

-

New Evidence Implicates Najib Razak In French Submarine Bribery Case

May 25, 2025

New Evidence Implicates Najib Razak In French Submarine Bribery Case

May 25, 2025 -

The Problem With Thames Waters Executive Bonus Structure

May 25, 2025

The Problem With Thames Waters Executive Bonus Structure

May 25, 2025 -

Addressing Stock Market Valuation Worries Insights From Bof A

May 25, 2025

Addressing Stock Market Valuation Worries Insights From Bof A

May 25, 2025 -

Chinas Impact How The Auto Industry Responds To Evolving Market Dynamics

May 25, 2025

Chinas Impact How The Auto Industry Responds To Evolving Market Dynamics

May 25, 2025 -

The Dark Side Of Disaster Exploring The Market For Los Angeles Wildfire Bets

May 25, 2025

The Dark Side Of Disaster Exploring The Market For Los Angeles Wildfire Bets

May 25, 2025