Analyzing The XRP (Ripple) Investment Opportunity Below $3

Table of Contents

2.1 Understanding the Current Market Sentiment Towards XRP

The market sentiment surrounding XRP is complex and often volatile. Recent news, including ongoing regulatory battles and evolving partnerships, significantly impacts its price. Analyzing market trends and predictions requires careful consideration of various factors. Technical indicators, such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), can offer insights into short-term price movements. However, interpreting these indicators requires experience and a nuanced understanding of the cryptocurrency market. Social media sentiment, while not always reliable, can provide a glimpse into the overall investor mood.

- Positive sentiment indicators: Positive news regarding Ripple's partnerships, increasing adoption of RippleNet by financial institutions, and favorable court rulings could drive bullish sentiment.

- Negative sentiment indicators: Negative regulatory news, particularly concerning the ongoing SEC lawsuit, or a broader cryptocurrency market downturn can fuel bearish sentiment.

- Neutral perspectives on XRP: Many analysts advocate a wait-and-see approach, emphasizing the need for regulatory clarity before making significant investments in XRP.

2.2 Assessing Ripple's Technology and Future Potential

Ripple's technology, centered around RippleNet and xRapid, aims to revolutionize cross-border payments. RippleNet offers a faster, cheaper, and more transparent solution for banks and financial institutions to transfer money globally. xRapid, leveraging XRP, facilitates faster liquidity transfers between different currencies. The potential for widespread adoption is substantial, especially given the inefficiencies and high costs associated with traditional cross-border payment systems.

- Key advantages of RippleNet: Speed, lower transaction costs, increased transparency, and improved security.

- Potential future use cases for XRP: Expansion into new markets, integration with decentralized finance (DeFi) platforms, and broader adoption by businesses and individuals.

- Major competitors and their weaknesses: While competitors exist in the cross-border payment space, Ripple's established network and technological advantages offer a strong competitive edge.

2.3 Evaluating the Risks Associated with Investing in XRP Below $3

Investing in XRP, or any cryptocurrency, carries significant risk. The cryptocurrency market is notoriously volatile, and XRP's price can fluctuate dramatically in short periods. The ongoing SEC lawsuit presents a major regulatory risk, with an unfavorable outcome potentially impacting XRP's price significantly. Furthermore, the potential for price manipulation and the inherent risks of investing in a relatively new technology cannot be ignored.

- Potential downside risks of investing in XRP: Regulatory uncertainty, market volatility, price manipulation, and technological obsolescence.

- Strategies for mitigating these risks: Diversification of your investment portfolio, employing a dollar-cost averaging strategy, and only investing what you can afford to lose.

- Importance of risk tolerance assessment before investing: Carefully assess your own risk tolerance before investing in XRP, understanding the potential for both significant gains and significant losses.

2.4 Financial Modeling and Potential Return on Investment (ROI)

Predicting the future price of XRP is impossible, but financial modeling can help illustrate potential ROI scenarios. Consider various price targets and investment amounts. A conservative scenario might assume a modest price increase, while a more aggressive scenario projects a substantial price surge. The time horizon significantly influences ROI. Remember, achieving high ROI requires patience and a long-term investment strategy.

- Example ROI calculations (conservative, moderate, aggressive): These calculations would be presented in a table format, showing potential profits based on different investment amounts and price targets.

- Factors affecting XRP's price: Adoption rate by financial institutions, regulatory clarity from the SEC lawsuit, and overall cryptocurrency market trends.

3. Conclusion: Making Informed Decisions about the XRP (Ripple) Investment Opportunity Below $3

This analysis highlights the potential benefits and risks associated with the XRP investment opportunity below $3. While Ripple's technology offers promising potential, significant regulatory and market risks remain. Thorough research, understanding your risk tolerance, and developing a well-defined investment strategy are crucial. Don't solely rely on this analysis; conduct your own due diligence before making any investment decisions. Consider the XRP investment opportunity below $3, but always conduct thorough due diligence before investing. For more information on Ripple's technology and initiatives, visit the official Ripple website.

Featured Posts

-

Analyzing Dragons Den Success Stories Lessons Learned

May 01, 2025

Analyzing Dragons Den Success Stories Lessons Learned

May 01, 2025 -

Shh Rg Kb Tk Zyr Khnjr Rhe Gy Ayksprys Ardw Ka Tjzyh

May 01, 2025

Shh Rg Kb Tk Zyr Khnjr Rhe Gy Ayksprys Ardw Ka Tjzyh

May 01, 2025 -

Key Moments Duponts Masterclass In Frances Rugby Win Over Italy

May 01, 2025

Key Moments Duponts Masterclass In Frances Rugby Win Over Italy

May 01, 2025 -

Sheens Charity Documentary Reactions And Debate

May 01, 2025

Sheens Charity Documentary Reactions And Debate

May 01, 2025 -

Breda 30 000 Mensen Getroffen Door Stroomstoring

May 01, 2025

Breda 30 000 Mensen Getroffen Door Stroomstoring

May 01, 2025

Latest Posts

-

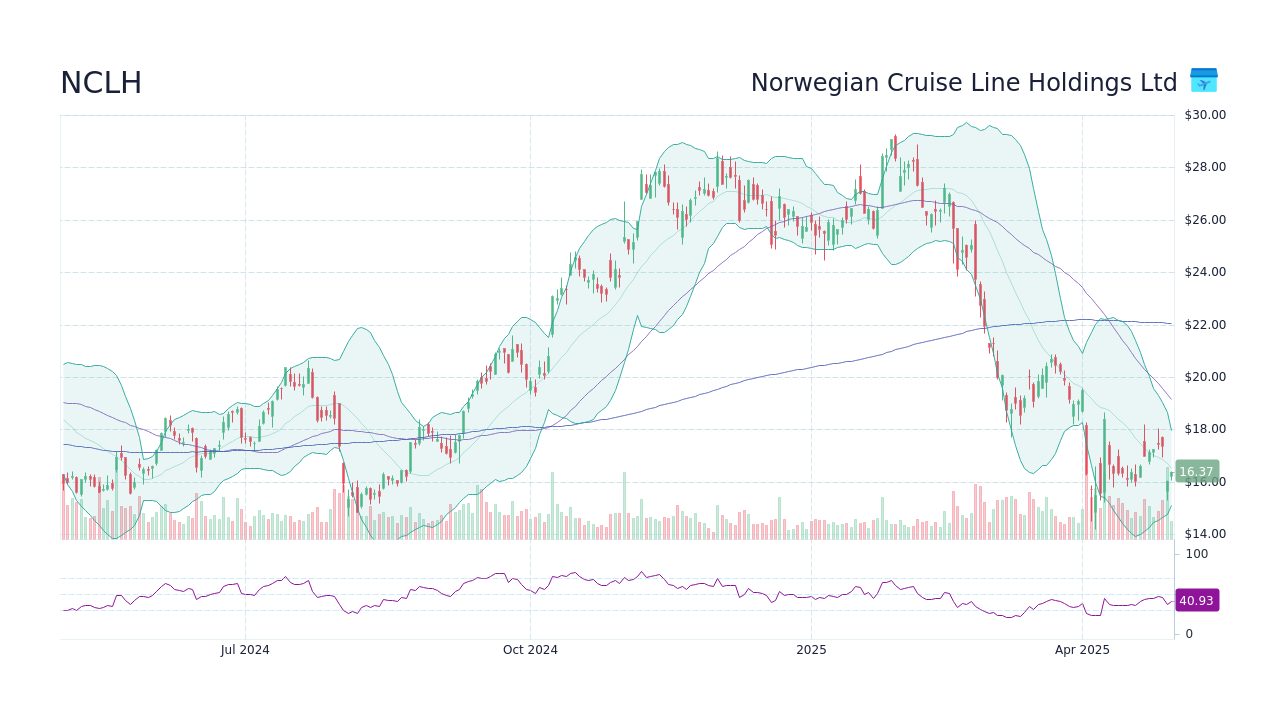

Analyzing Nclh Stock What Hedge Fund Activity Reveals

May 01, 2025

Analyzing Nclh Stock What Hedge Fund Activity Reveals

May 01, 2025 -

Choosing The Right Family Cruise Line 5 Top Contenders

May 01, 2025

Choosing The Right Family Cruise Line 5 Top Contenders

May 01, 2025 -

New Southbound Cruises For 2025 A Comprehensive Guide

May 01, 2025

New Southbound Cruises For 2025 A Comprehensive Guide

May 01, 2025 -

Best Southern Cruise Itineraries Launching In 2025

May 01, 2025

Best Southern Cruise Itineraries Launching In 2025

May 01, 2025 -

Top New Cruise Lines Sailing South In 2025

May 01, 2025

Top New Cruise Lines Sailing South In 2025

May 01, 2025