Apple Stock (AAPL) Price Targets: Key Levels To Watch

Table of Contents

Current Analyst Price Targets for AAPL

Staying informed about AAPL price target predictions from reputable analysts is a vital step in any Apple stock investment strategy. These predictions provide a valuable perspective on where experts believe the stock price might move in the future. However, it's crucial to remember that these are just estimations, and the actual price can deviate significantly.

-

Analyst Firm Price Targets (12-month outlook, as of October 26, 2023 - Note: These are hypothetical examples and should not be considered financial advice.):

- Goldman Sachs: $200 - $220

- Morgan Stanley: $185 - $210

- JPMorgan Chase: $195 - $205

- Bank of America: $175 - $190

- Credit Suisse: $180 - $200

-

Analyst Consensus: While individual price targets vary, there's a general bullish sentiment among analysts regarding AAPL, suggesting a belief in continued growth. However, this sentiment can shift based on various factors, including upcoming product launches and macroeconomic conditions.

-

Timeframe: The price targets mentioned above are primarily 12-month predictions. Longer-term forecasts (18-month or 24-month) will usually offer a wider range, reflecting increased uncertainty further into the future. Always check the specific timeframe for each analyst's prediction. This is crucial for understanding the context of the AAPL stock forecast.

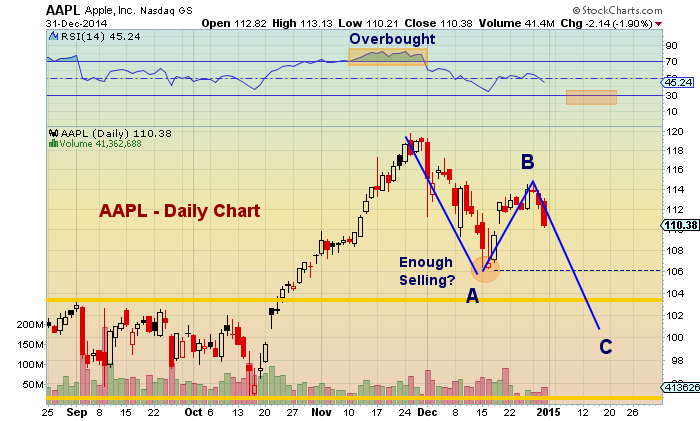

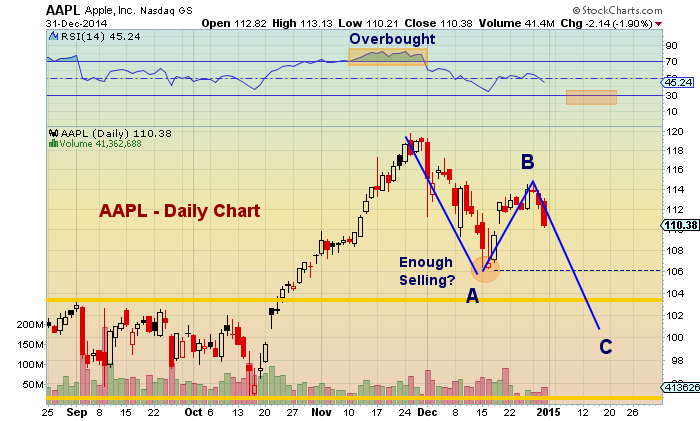

Key Technical Levels to Monitor for AAPL

Technical analysis offers another layer to understanding AAPL price targets. By examining charts and key indicators, we can identify potential support and resistance levels that might influence future price movements.

-

Support and Resistance Levels: Support levels represent price points where buying pressure is expected to outweigh selling pressure, potentially preventing further price declines. Conversely, resistance levels represent price points where selling pressure is expected to outweigh buying pressure, potentially capping price increases. Recent AAPL charts might show support around $170 and resistance around $190 (again, these are hypothetical examples and can change rapidly). Analyzing the Apple stock chart is key for identifying these levels.

-

Moving Averages: Moving averages, such as the 50-day and 200-day moving averages, smooth out price fluctuations and can signal potential trend changes. A “golden cross” (50-day MA crossing above the 200-day MA) is often viewed as a bullish signal, while a “death cross” (the opposite) is often seen as bearish. Monitoring the relationship between these moving averages can provide insights into potential AAPL stock price direction.

-

Breakouts: A breakout above a resistance level can signal a potential upward trend, while a breakdown below a support level might suggest a downward trend. These breakouts often lead to significant price movements and should be closely monitored. Successfully predicting these breakouts is a key part of Apple stock prediction.

Factors Influencing Apple Stock Price

Multiple factors influence AAPL’s price, making it crucial to monitor several key areas for a comprehensive understanding of the AAPL stock drivers.

-

Product Launches: New iPhone releases, iPad updates, and Mac innovations historically have a significant impact on AAPL's stock price. Strong sales and positive reviews often lead to increased investor confidence and higher stock prices, while underperformance can cause declines. Following the news cycle regarding new product announcements is vital for any AAPL stock forecast.

-

Financial Performance: Apple's quarterly earnings reports are closely scrutinized by investors. Revenue growth, profit margins, and guidance for future performance significantly influence investor sentiment and subsequent AAPL stock price movements. Exceptional earnings often lead to stock price increases, while disappointing results can lead to drops. Analyzing Apple earnings is essential for accurate Apple stock prediction.

-

Market Trends & Macroeconomic Factors: The overall performance of the tech sector and broader macroeconomic conditions also play a role. Factors like interest rate hikes, inflation, and geopolitical events can impact investor risk appetite and affect the AAPL stock price.

Risks and Opportunities in Investing in AAPL

Like any investment, AAPL stock presents both risks and opportunities.

-

Risks:

- Intense Competition: Apple faces stiff competition in various markets from companies like Samsung, Google, and others.

- Economic Downturn: A general economic downturn could reduce consumer spending on discretionary items like Apple products.

- Supply Chain Disruptions: Global supply chain issues can impact Apple's ability to manufacture and deliver its products.

-

Opportunities:

- Growth in Emerging Markets: Expanding into and capturing market share in emerging markets presents significant growth potential.

- New Product Categories: Expansion into new areas such as augmented reality (AR), virtual reality (VR), and electric vehicles could unlock substantial revenue streams.

- Services Revenue Growth: Apple's services segment (Apple Music, iCloud, etc.) is a steadily growing source of recurring revenue, bolstering the company's financial strength.

Conclusion

Analyzing current analyst price targets for AAPL, combined with an understanding of key technical levels and the factors influencing the stock price, provides a more complete picture for investment decisions. Monitoring support and resistance levels around $170 and $190 (hypothetical examples), as well as the 50-day and 200-day moving averages, can offer valuable insights into potential price movements. Remember that external factors like product launches, financial performance, and macroeconomic trends also significantly impact AAPL stock performance. Understanding these factors and the associated risks and opportunities is key for successful AAPL investment.

Call to Action: Stay informed on the latest Apple stock (AAPL) price targets and market trends to optimize your investment strategy. Regularly review our analysis for updated information on key levels to watch for AAPL and make informed decisions about your investment in Apple stock. Remember to conduct your own thorough research and consult with a financial advisor before making any investment decisions.

Featured Posts

-

1 08 Euro Live Updates Over Kapitaalmarktrentes En Wisselkoersen

May 24, 2025

1 08 Euro Live Updates Over Kapitaalmarktrentes En Wisselkoersen

May 24, 2025 -

Porsche Investuoja I Elektromobiliu Infrastruktura Europoje Atidarytas Naujas Ikrovimo Centras

May 24, 2025

Porsche Investuoja I Elektromobiliu Infrastruktura Europoje Atidarytas Naujas Ikrovimo Centras

May 24, 2025 -

Auto Legendas F1 Motorral Szerelt Porsche Koezuton

May 24, 2025

Auto Legendas F1 Motorral Szerelt Porsche Koezuton

May 24, 2025 -

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In Het Groen

May 24, 2025

Herstel Op Beurzen Na Uitstel Trump Alle Aex Fondsen In Het Groen

May 24, 2025 -

Understanding Frank Sinatras Four Marriages

May 24, 2025

Understanding Frank Sinatras Four Marriages

May 24, 2025

Latest Posts

-

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025 -

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025 -

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025 -

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025 -

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025