Apple Stock: Below Key Support Ahead Of Fiscal Q2

Table of Contents

Technical Analysis: Breaking Key Support Levels

Identifying the Support Level

Apple stock recently broke below a significant support level around $[Insert Price Here], a price point that had held for [Number] weeks/months. This level was identified using several technical indicators:

- 200-Day Moving Average: The stock price fell below its 200-day moving average, a key long-term trend indicator, signaling a potential bearish shift in momentum.

- Trendline Support: The price action had consistently bounced off a rising trendline connecting several previous lows. The breach of this trendline further confirms the weakening support.

- Fibonacci Retracement: The decline brought the price down to a key Fibonacci retracement level (e.g., 38.2% or 50%), suggesting potential further downside.

[Insert chart showing the support level and its breach here]

The volume accompanying the support break was [High/Low/Moderate], indicating [Strong/Weak/Moderate] selling pressure. High volume confirms a more significant bearish signal.

Implications of Breaking Support

Breaking below the key support level carries several potential implications:

- Further Downward Movement: Technical analysis suggests potential further downside to the next support level at $[Insert Price Here] or even $[Insert Price Here], depending on the chosen technical indicators and patterns.

- Increased Risk for Investors: Investors currently holding Apple stock face increased risk, as the price could continue its downward trajectory. Stop-loss orders should be considered to mitigate potential losses.

Fundamental Factors Affecting Apple Stock Price

Concerns Regarding iPhone Sales

While Apple remains a dominant player, concerns linger regarding iPhone sales, a major revenue driver:

- Market Saturation: The smartphone market is maturing, leading to potential saturation in developed markets. Growth may increasingly rely on emerging markets.

- Android Competition: Intense competition from Android devices, particularly in the mid-range and budget segments, continues to challenge Apple's market share.

- Economic Climate: The current economic climate, with inflation and potential recessionary fears, may dampen consumer spending on high-priced electronics like iPhones.

Supply Chain Issues and Inflation

Persistent supply chain challenges and rising inflation exert pressure on Apple's profitability and stock price:

- Increased Production Costs: Higher material and labor costs significantly impact Apple's profit margins.

- Impact on Product Launches and Pricing: Supply chain disruptions could delay new product launches, while inflation might force Apple to increase prices, potentially affecting demand.

Overall Economic Outlook

The broader macroeconomic environment significantly impacts Apple's performance:

- Interest Rate Hikes: Rising interest rates increase borrowing costs for businesses and consumers, potentially slowing economic growth and impacting demand for Apple products.

- Inflation and Recessionary Fears: High inflation and recessionary concerns create an uncertain economic climate, impacting investor sentiment and overall market performance. Apple stock is often viewed as a bellwether for the broader market, meaning its performance often mirrors the overall economic sentiment.

Investor Sentiment and Market Reaction

Analyst Ratings and Price Targets

Analyst ratings on Apple stock show a mixed sentiment. Some analysts maintain a "Buy" rating, citing Apple's strong brand and loyal customer base. However, other analysts have issued "Hold" or "Sell" ratings, citing the above-mentioned risks. Price targets range from $[Low Price] to $[High Price].

- Downgrades: Downgrades often cite concerns about iPhone sales, economic headwinds, and the impact of increased competition.

- Upgrades: Upgrades generally point to Apple's strong financial position, innovative product pipeline, and potential for growth in services revenue.

Investor Behavior and Trading Volume

The price drop has been accompanied by [High/Low/Moderate] trading volume, indicating [Strong/Weak/Moderate] investor participation.

- Options Trading Activity: Analysis of options trading data (puts versus calls) provides further insights into investor sentiment. A high volume of put options suggests increased bearish sentiment, while a high volume of call options reflects bullishness.

- Short Selling: The extent of short selling activity can indicate investor expectations of further price declines.

Conclusion

Apple stock's recent fall below key support, coupled with concerns about iPhone sales, supply chain issues, and the overall economic outlook, has created a mixed investor sentiment. The technical analysis indicates potential for further downside, while fundamental factors highlight challenges to Apple's profitability. Investors should carefully consider these factors before making any decisions.

Call to Action: Investors should carefully monitor Apple stock (AAPL) performance ahead of the fiscal Q2 earnings report and consider the factors discussed in this analysis before making any investment decisions. Stay informed about the Apple Q2 earnings and their impact on the Apple stock price and its key support levels. Continuously monitor Apple stock for any significant changes in price and trading volume to inform your trading strategies. Remember to conduct thorough due diligence before making any investment decisions related to Apple stock.

Featured Posts

-

Paris Economic Slowdown Luxury Sector Impact March 7 2025

May 24, 2025

Paris Economic Slowdown Luxury Sector Impact March 7 2025

May 24, 2025 -

Facing Retribution The Risks Of Challenging The Status Quo

May 24, 2025

Facing Retribution The Risks Of Challenging The Status Quo

May 24, 2025 -

Best New R And B Songs This Week Leon Thomas And Flo Lead The Pack

May 24, 2025

Best New R And B Songs This Week Leon Thomas And Flo Lead The Pack

May 24, 2025 -

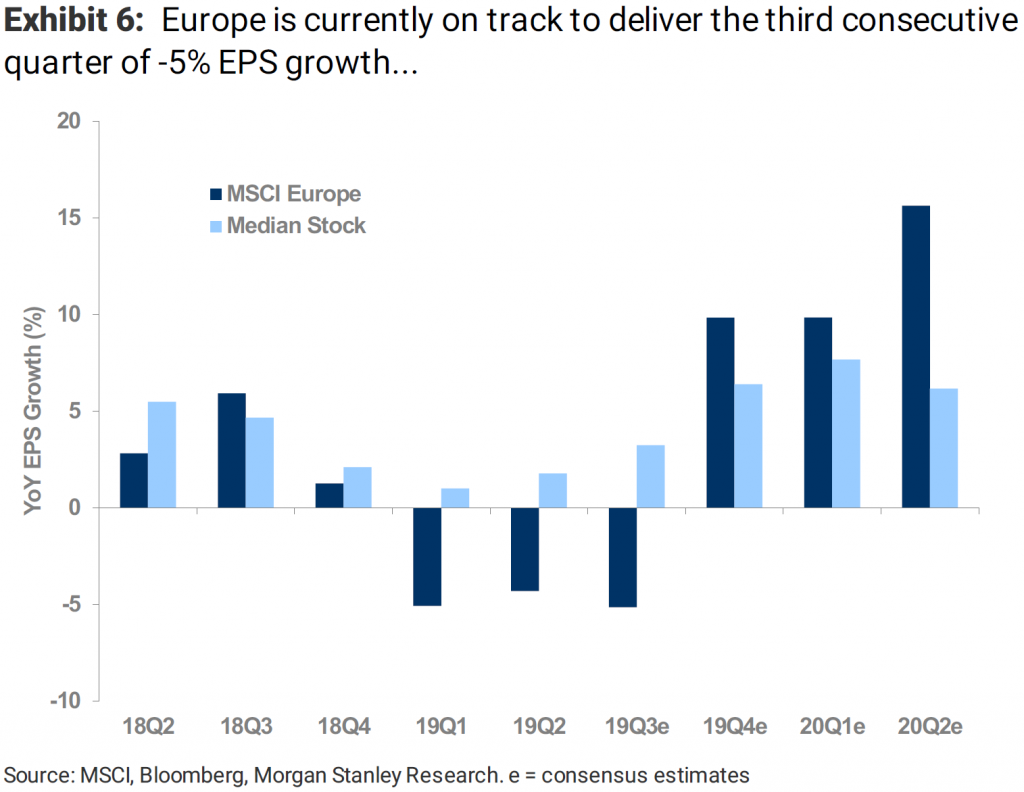

Voorspelling Vervolg Van De Recente Marktbeweging In Europese Aandelen

May 24, 2025

Voorspelling Vervolg Van De Recente Marktbeweging In Europese Aandelen

May 24, 2025 -

Mia Farrow And Christina Ricci At The Florida Film Festival A Star Studded Event

May 24, 2025

Mia Farrow And Christina Ricci At The Florida Film Festival A Star Studded Event

May 24, 2025

Latest Posts

-

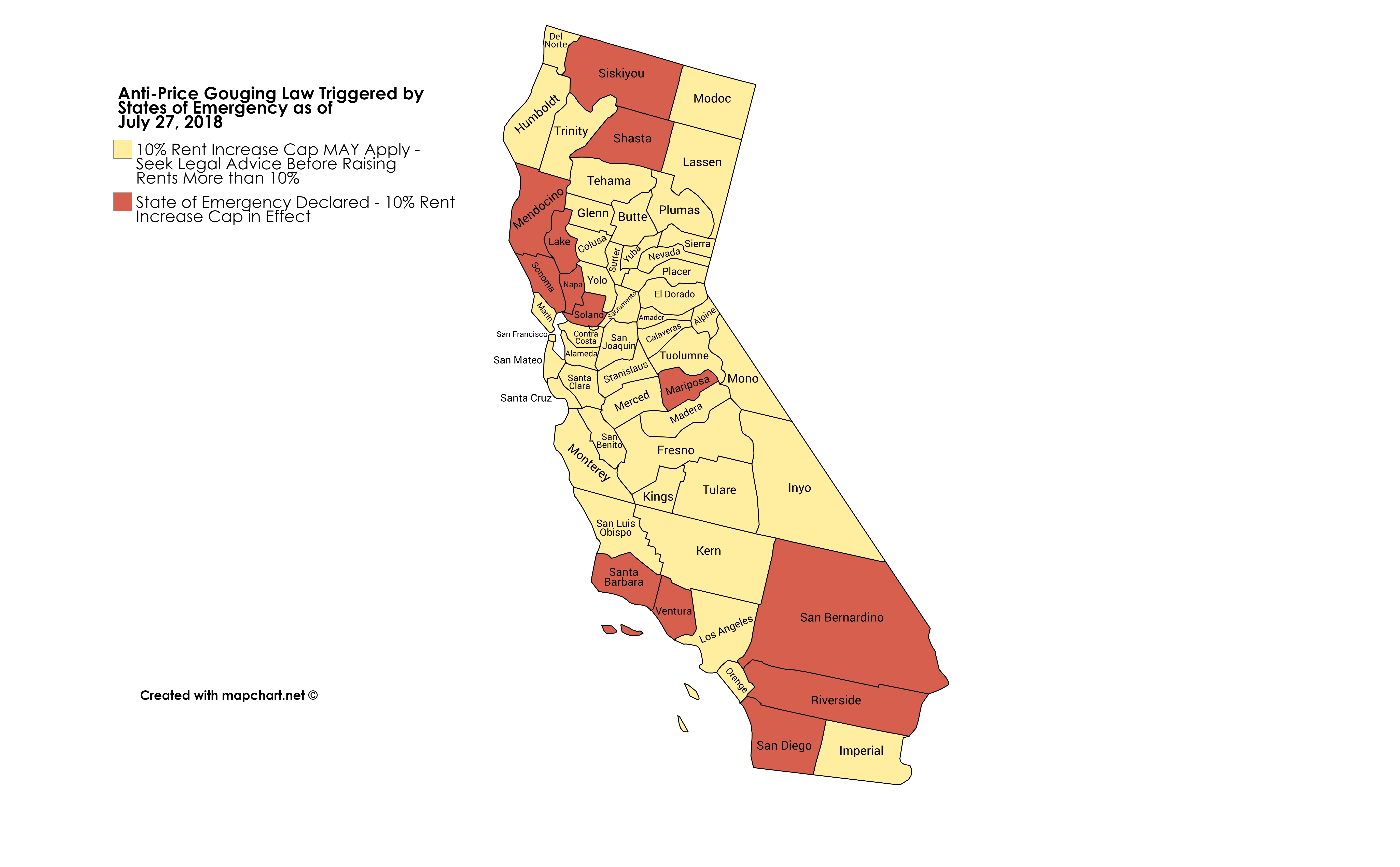

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025 -

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025 -

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025 -

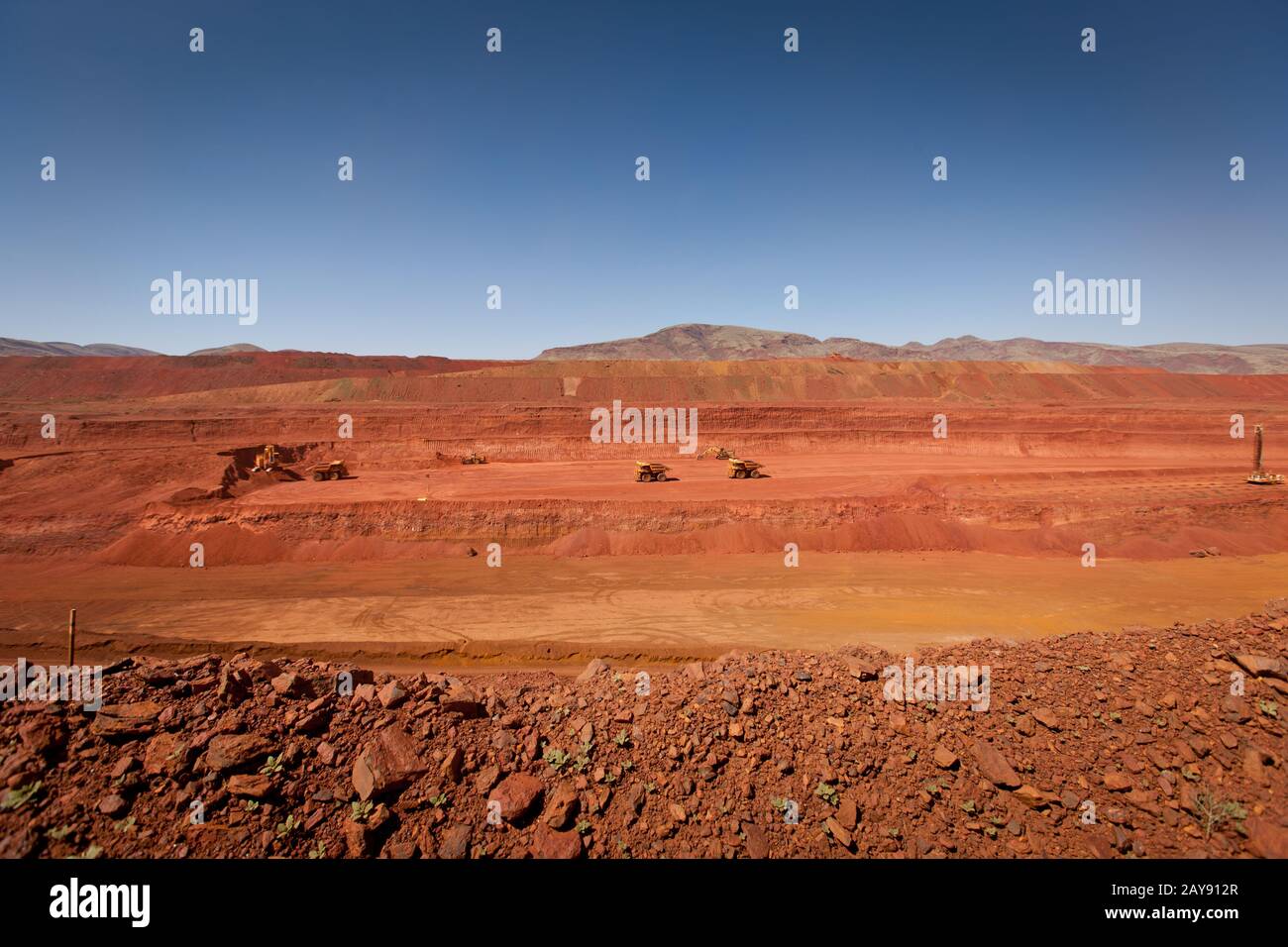

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025 -

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025