Apple Stock Investment: Analyzing A $254 Price Target

Table of Contents

Current Market Valuation and Performance

Apple's current market valuation and performance are crucial factors in assessing the $254 price target's feasibility. Analyzing key financial metrics and investor sentiment provides a clearer picture.

Apple's Financial Health

Apple's recent financial reports paint a picture of continued strength, though not without challenges. Let's examine some key metrics:

- Revenue Growth: Apple has shown consistent revenue growth over the past few years, although the pace may have slowed slightly in recent quarters. Analyzing year-over-year and quarter-over-quarter growth provides a clearer trend.

- Profit Margin Trends: Apple boasts impressive profit margins, a testament to its strong brand and pricing power. However, fluctuations in component costs and increased competition can impact these margins. Monitoring these trends is vital for Apple stock investment decisions.

- Cash Reserves: Apple possesses substantial cash reserves, offering financial flexibility for acquisitions, research and development, and weathering economic downturns. This strong financial position is a key factor supporting the $254 Apple stock price target.

- Debt-to-Equity Ratio: Apple maintains a healthy debt-to-equity ratio, indicating a low level of financial risk. This strong balance sheet reinforces investor confidence.

These metrics, combined with any significant news impacting Apple's financial performance (e.g., supply chain issues, new product launches), are critical in evaluating the company's health and future potential for Apple stock investment.

Market Sentiment and Investor Confidence

Investor sentiment toward Apple is generally positive, but it fluctuates based on various factors.

- Analyst Ratings and Price Targets: Many analysts maintain a "buy" or "hold" rating on Apple stock, with varying price targets. Analyzing the range of these targets and the rationale behind them is crucial.

- Recent News Coverage: Positive news regarding new product launches, strong sales figures, or innovative technologies tends to boost investor confidence and push the Apple stock price upward. Conversely, negative news can negatively impact the Apple stock price.

- Social Media Sentiment: Tracking social media conversations around Apple reveals the overall sentiment among individual investors. While not a definitive indicator, it can provide valuable insights into the general perception of the company.

These factors collectively influence investor confidence and ultimately drive the Apple stock price. Understanding this dynamic is key to informed Apple stock investment.

Factors Driving the $254 Price Target

The $254 Apple stock price target is underpinned by several key factors. Let's analyze these drivers in detail.

Future Product Launches and Innovation

Apple's history of innovative product launches is a key driver of the $254 price target.

- New iPhone Models: The iPhone remains Apple's flagship product, and each new iteration fuels significant sales and revenue. Expectations surrounding upcoming iPhone models and their features heavily influence investor sentiment.

- Apple Watch Updates: The Apple Watch continues to gain market share in the smartwatch sector. New features and health-related advancements can significantly boost sales and overall revenue.

- Mac Upgrades: Apple's Mac lineup is also crucial. Performance enhancements, new designs, and the integration of Apple silicon chips are all drivers for revenue growth.

- Service Expansion (Apple TV+, Apple Music, etc.): Apple's services segment is a rapidly growing revenue stream. Increased subscriber numbers for Apple TV+, Apple Music, and other services significantly impact the overall valuation.

The potential market demand and projected revenue contribution from these future product releases are critical components in supporting the $254 Apple stock price target.

Growth in Services Revenue

Apple's services segment is a key driver of future growth and the $254 price target.

- Apple Music Subscribers: The growth in Apple Music subscribers directly impacts revenue. Increased penetration in the music streaming market contributes to the overall services revenue.

- iCloud Storage Adoption: As more users utilize iCloud for storage, Apple's revenue from this service increases. This ongoing expansion is a steady revenue stream for the company.

- Apple Arcade Usage: The growth of Apple Arcade, Apple's gaming subscription service, adds to the overall services revenue. Increased adoption among gamers translates to more revenue.

- App Store Revenue: The App Store generates substantial revenue for Apple. The continuous growth in app downloads and in-app purchases is a major contributor to overall revenue.

The long-term potential of the services segment to generate recurring revenue and boost profitability significantly contributes to the $254 Apple stock price target.

Macroeconomic Factors and Global Demand

External factors can influence the validity of the $254 Apple stock price target.

- Inflation: High inflation can reduce consumer spending, potentially impacting sales of Apple products. This is a critical consideration for Apple stock investment.

- Interest Rates: Rising interest rates can impact borrowing costs and investor sentiment, potentially influencing stock prices.

- Global Economic Growth: Strong global economic growth generally benefits Apple, while economic slowdowns can negatively affect sales.

- Supply Chain Disruptions: Any disruptions to Apple's supply chain can impede production and sales, impacting the Apple stock price and the $254 target.

Careful consideration of these macroeconomic factors is crucial for evaluating the potential risks and rewards of Apple stock investment.

Risks and Potential Downsides

While the $254 Apple stock price target seems achievable based on certain factors, several potential risks could hinder its realization.

Competition and Market Saturation

Apple faces intense competition and market saturation in several product categories.

- Competition from Android: Android devices continue to hold a significant share of the global smartphone market, posing a continuous challenge to Apple's market dominance.

- Samsung and Other Tech Companies: Samsung and other tech companies are strong competitors, offering rival products with similar or better features at competitive prices.

- Market Saturation in Key Product Categories: Market saturation in key product categories like smartphones could limit growth opportunities for Apple.

This competitive landscape presents a real challenge to Apple's continued growth and could impact the feasibility of the $254 Apple stock price target.

Supply Chain Challenges and Geopolitical Risks

Supply chain vulnerabilities and geopolitical instability pose significant risks.

- Manufacturing Challenges: Disruptions to Apple's manufacturing processes, whether due to natural disasters, political instability, or pandemics, can severely impact production and sales.

- Trade Wars: Trade disputes and tariffs can increase production costs and negatively impact profitability.

- Political Instability in Key Regions: Political instability in regions crucial for Apple's manufacturing or distribution can disrupt operations and hurt sales.

These challenges highlight the potential for unforeseen events to affect Apple's performance and the achievement of the $254 Apple stock price target.

Conclusion

The $254 Apple stock price target presents both opportunities and risks. While strong financial health, innovative product launches, and growth in the services segment support this target, competition, market saturation, and macroeconomic factors pose potential challenges. A thorough understanding of Apple's financial health, future prospects, and the broader market dynamics is crucial for informed Apple stock investment decisions.

While a $254 price target for Apple stock presents both opportunities and risks, a thorough understanding of the company's financial health, future prospects, and market dynamics is crucial for informed investment decisions. Further research and careful consideration of your personal investment strategy are advised before making any decisions regarding Apple stock investment. Continue your due diligence on Apple stock and consider consulting a financial advisor.

Featured Posts

-

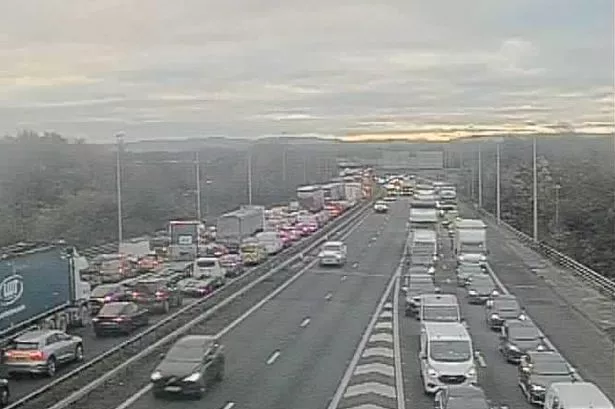

Emergency Services Respond To M56 Crash Car Overturn And Casualty

May 24, 2025

Emergency Services Respond To M56 Crash Car Overturn And Casualty

May 24, 2025 -

Lauryn Goodmans Relocation To Italy A Bizarre Twist Following Kyle Walkers Transfer

May 24, 2025

Lauryn Goodmans Relocation To Italy A Bizarre Twist Following Kyle Walkers Transfer

May 24, 2025 -

Kyle Walker Peters To Leeds Latest Transfer News

May 24, 2025

Kyle Walker Peters To Leeds Latest Transfer News

May 24, 2025 -

Test Proverte Svoi Znaniya O Rolyakh Olega Basilashvili

May 24, 2025

Test Proverte Svoi Znaniya O Rolyakh Olega Basilashvili

May 24, 2025 -

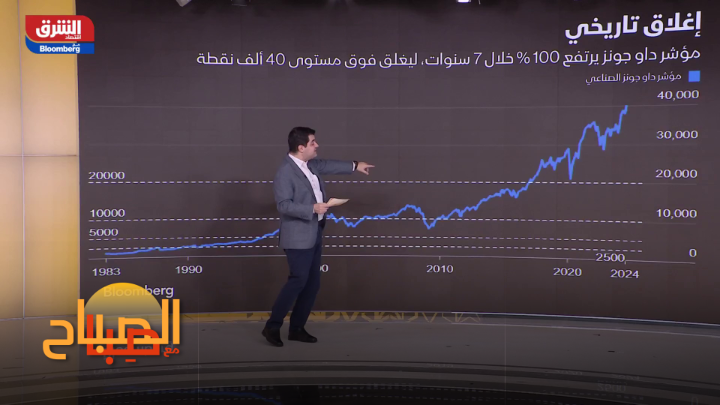

Atfaq Tjary Jdyd Daks Almanya Yrtfe Ila 24 Alf Nqtt

May 24, 2025

Atfaq Tjary Jdyd Daks Almanya Yrtfe Ila 24 Alf Nqtt

May 24, 2025

Latest Posts

-

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025 -

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025 -

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025 -

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025 -

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025