Apple Stock Performance: Key Levels And Q2 Earnings Preview

Table of Contents

Recent Apple Stock Performance and Key Levels

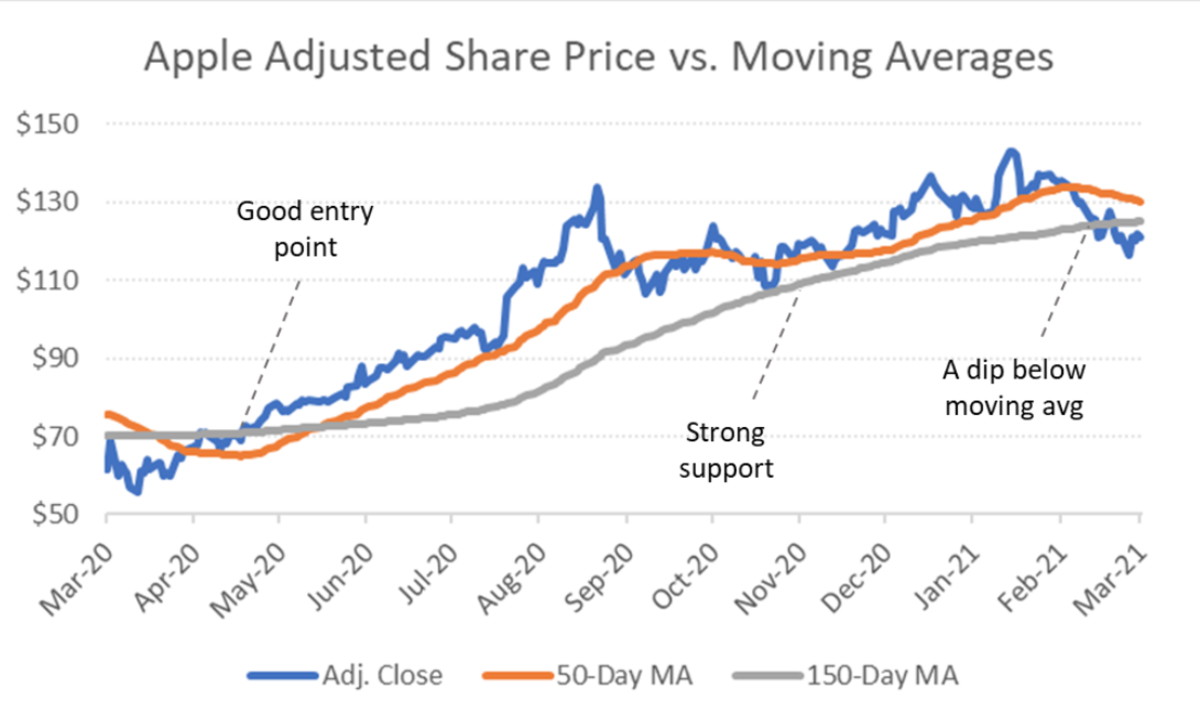

Understanding the recent price action of Apple stock is crucial for predicting future movements. Analyzing the Apple stock chart reveals key support and resistance levels that have influenced the AAPL stock price. Let's examine some key aspects:

-

Significant Highs and Lows: Over the past few months, Apple stock has seen significant price fluctuations. Identifying these highs and lows helps us understand potential support and resistance zones. For example, a previous low might act as a support level, preventing further declines, while a previous high could act as resistance, capping further upward movement. (Note: Specific price points would be included here with a relevant chart).

-

Trading Volume Analysis: High trading volume during significant price changes confirms the strength of the movement. Conversely, low volume suggests weak price action, and the movement might be easily reversed. By analyzing trading volume alongside price changes, we can better gauge the conviction behind the market's sentiment towards Apple stock. (Note: Data illustrating volume changes during significant price moves would be incorporated here).

-

Impact of News Events: News events, such as new product launches (like the iPhone 15 rumors), regulatory changes impacting Apple's operations, or broader macroeconomic news, significantly impact Apple stock price. For example, strong iPhone sales figures would typically boost the Apple stock price, while negative news regarding supply chain disruptions could lead to a decline. (Note: Specific examples of news events and their impact would be detailed here).

(Note: A relevant chart showing Apple stock performance over the past few months, clearly marked with key support and resistance levels, would be inserted here).

Factors Influencing Apple Stock Price in Q2

Several factors influence the Apple stock price in Q2, impacting both the short-term and long-term outlook for AAPL stock. These include:

-

iPhone Sales: The iPhone remains Apple's flagship product, contributing significantly to its revenue. Macroeconomic conditions, such as inflation and consumer spending habits, significantly influence iPhone sales and thus the Apple stock price. A strong demand for iPhones typically translates to higher revenue and a positive impact on the Apple stock forecast.

-

Services Revenue Growth: Apple's Services segment (App Store, Apple Music, iCloud, Apple Pay, etc.) shows consistent growth and is becoming increasingly important to the company's overall revenue. Analyzing the growth trajectory of this segment is crucial for assessing the long-term health and potential of the Apple stock.

-

Supply Chain and Production: Supply chain disruptions and component shortages can significantly impact Apple's production capacity and sales. Any disruptions to the supply chain could negatively influence the Apple stock price, while smoother production processes would likely have a positive impact.

-

Macroeconomic Factors: Broader macroeconomic factors, such as inflation rates, interest rate hikes, and overall economic growth (or recessionary fears), significantly influence consumer spending and investor sentiment. These factors can impact the demand for Apple products and investor confidence in the Apple stock market performance.

Analyzing Q2 Earnings Expectations

Analyzing the Q2 earnings expectations for Apple is crucial for understanding the potential impact on the Apple stock price.

-

Analyst Estimates: Before the earnings announcement, analysts provide estimates for Apple's Q2 earnings per share (EPS) and revenue growth. These estimates are important benchmarks against which the actual results will be compared. (Note: Specific EPS and revenue growth estimates would be included here).

-

Market Expectations: The market already incorporates expectations about Apple's Q2 performance into the current Apple stock price. If the actual earnings exceed expectations, the Apple stock price may rise; conversely, if the results fall short, the price may decline.

-

Potential Surprises and Risks: Unexpected events, such as significant changes in consumer demand, unforeseen supply chain disruptions, or unexpected competition, could lead to surprises in the Q2 earnings report. These surprises, both positive and negative, would significantly influence the Apple stock price.

-

Guidance for Future Quarters: Apple's guidance for future quarters provides insights into the company's long-term outlook. This guidance often influences investor sentiment and the Apple stock forecast for the months ahead.

Technical Analysis and Apple Stock Forecast

Technical analysis provides another perspective on Apple stock performance by examining chart patterns and technical indicators.

-

Technical Indicators: Indicators like moving averages (e.g., 50-day, 200-day), the Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD) offer insights into price momentum and potential trend reversals. (Note: Analysis of relevant technical indicators for AAPL stock would be included here).

-

Chart Patterns: Recognizing chart patterns (e.g., head and shoulders, double tops/bottoms) can offer potential insights into future price movements. However, it's important to remember that chart patterns are not foolproof predictions.

-

Apple Stock Forecast (Disclaimer): (Optional) Based on the combination of fundamental and technical analysis, a cautiously worded, short-term or medium-term price forecast could be provided here. However, it’s crucial to emphasize that any forecast is inherently uncertain, and past performance is not indicative of future results.

Conclusion

Apple stock performance in Q2 will depend heavily on factors ranging from iPhone sales and Services revenue growth to macroeconomic conditions and investor sentiment. Analyzing key levels, understanding influencing factors, and interpreting earnings expectations are crucial for navigating the current market landscape. While technical analysis offers potential insights, it's important to remember that no prediction is certain. Stay informed on the latest developments in Apple stock performance by regularly checking reputable financial news sources and conducting your own research. Understanding the key levels and factors influencing Apple stock price is vital for making informed investment decisions. Continue monitoring the Apple stock price and Q2 earnings report for further insights into Apple stock performance.

Featured Posts

-

Following Kyle Walkers Night Out Annie Kilners Solo Errands

May 24, 2025

Following Kyle Walkers Night Out Annie Kilners Solo Errands

May 24, 2025 -

Pre Q2 Apple Stock Market Reaction And Price Analysis

May 24, 2025

Pre Q2 Apple Stock Market Reaction And Price Analysis

May 24, 2025 -

Dutch Stocks Suffer Another Setback Amidst Escalating Us Trade War

May 24, 2025

Dutch Stocks Suffer Another Setback Amidst Escalating Us Trade War

May 24, 2025 -

Amsterdam Stock Exchange Suffers Third Consecutive Day Of Heavy Losses

May 24, 2025

Amsterdam Stock Exchange Suffers Third Consecutive Day Of Heavy Losses

May 24, 2025 -

Escape To The Country The Pros And Cons Of Rural Living

May 24, 2025

Escape To The Country The Pros And Cons Of Rural Living

May 24, 2025

Latest Posts

-

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025 -

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025 -

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025 -

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025 -

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025