Apple Stock Price Decline: Analyzing The Pre-Q2 Report Situation

Table of Contents

Macroeconomic Factors Influencing Apple Stock

Several macroeconomic headwinds are contributing to the Apple Stock Price Decline. Understanding these external pressures is crucial for assessing the company's performance and future prospects.

Global Inflation and Recessionary Fears

Rising inflation and global recessionary fears are significantly impacting consumer spending. This reduction in discretionary spending directly affects demand for premium electronics like Apple products.

- Reduced consumer discretionary spending: Higher prices for essential goods are forcing consumers to cut back on non-essential purchases, including iPhones and other Apple devices.

- Potential impact on iPhone sales: The iPhone, while a flagship product, is still susceptible to decreased demand during economic uncertainty. Lower-than-expected sales figures could further pressure the Apple Stock Price Decline.

- Weakening demand for premium electronics: In times of economic hardship, consumers often prioritize essential purchases over high-priced electronics, leading to a decrease in demand for Apple's premium product line.

The correlation between macroeconomic uncertainty and Apple's stock performance is historically strong. Periods of economic instability often lead to a sell-off in tech stocks, including Apple, as investors seek safer investments.

Supply Chain Disruptions and Component Shortages

Lingering supply chain disruptions continue to impact Apple's production capabilities and ability to meet global demand. These issues contribute to the Apple Stock Price Decline through various channels.

- Impact on iPhone and other product availability: Component shortages can lead to delays in production and reduced availability of Apple products, potentially impacting sales figures.

- Increased production costs: Supply chain issues often translate to higher production costs for Apple, squeezing profit margins and potentially impacting investor confidence.

- Potential delays in product launches: Delays in securing necessary components could push back the launch of new products, affecting revenue projections and contributing to the Apple Stock Price Decline.

These supply chain challenges have undeniably affected Apple's profitability and investor confidence. The company's ability to navigate these disruptions effectively will be a key factor influencing its stock performance in the coming quarters.

Company-Specific Factors Contributing to the Decline

Beyond macroeconomic factors, several company-specific issues are contributing to the Apple Stock Price Decline.

Slowing iPhone Sales Growth

While the iPhone remains a major revenue driver, slowing sales growth is a concern. Several factors contribute to this trend:

- Comparison to previous years' sales figures: Analyzing year-over-year sales growth reveals a potential slowdown in iPhone demand.

- Impact of new iPhone releases (or lack thereof): The reception and sales figures of new iPhone models significantly influence overall sales growth. A lack of groundbreaking new features may lead to less excitement and slower adoption rates.

- Competition from Android manufacturers: Intense competition from Android manufacturers offering comparable features at lower price points is putting pressure on iPhone sales.

The iPhone's dominance in Apple's revenue and profitability makes its sales performance a crucial factor for investors. Any slowdown in iPhone sales directly impacts the overall Apple Stock Forecast.

Concerns Regarding Future Product Innovation

Investor concerns about a perceived lack of groundbreaking innovation in recent product releases are also impacting the Apple Stock Price Decline.

- Analysis of recent product launches: Assessing the features and reception of recently launched products reveals whether they meet investor expectations for innovation.

- Comparison to competitor innovations: Comparing Apple's latest innovations to those of its competitors highlights its relative position in terms of technological advancement.

- Investor expectations for future product advancements: Investor sentiment is significantly influenced by their expectations for future product advancements. A perceived lack of innovation can dampen enthusiasm and lead to selling.

A perceived lack of innovation can negatively affect long-term growth and investor sentiment, contributing to a negative Apple Stock Price Decline.

Increased Competition in the Tech Sector

Increased competition from other tech giants is another factor fueling the Apple Stock Price Decline.

- Specific competitors and their strategies: Analyzing the strategies of key competitors like Samsung, Google, and others reveals the competitive pressures Apple faces.

- Market share comparisons: Monitoring Apple's market share in different segments provides insights into its competitive position.

- Competitive pricing pressures: The competitive landscape necessitates strategic pricing decisions that may impact profitability and ultimately, investor confidence.

Navigating this competitive landscape effectively is crucial for Apple's long-term success and its stock price.

Analyzing Market Sentiment and Investor Behavior

Understanding market sentiment and investor behavior is crucial for interpreting the Apple Stock Price Decline.

Analyst Ratings and Predictions

Leading financial analysts provide valuable insights into Apple's stock performance:

- Summary of key analyst ratings (buy, hold, sell): A consensus of analyst ratings provides a general picture of investor sentiment.

- Consensus price targets: Analyst price targets reflect their expectations for future stock price movements.

- Reasons behind their predictions: Understanding the rationale behind analyst predictions allows for a more comprehensive analysis.

Analyst reports significantly influence investor confidence and trading activity.

Investor Confidence and Trading Volume

Analyzing trends in investor sentiment and trading volume provides further insights:

- Data on trading volume: High trading volume often indicates increased investor interest and volatility.

- Analysis of short interest: High short interest can signal negative investor sentiment and potential for further price declines.

- Impact of news and events on investor behavior: Major news events and announcements can significantly influence investor behavior and trading activity.

Investor sentiment drives both short-term and long-term price movements. Understanding these dynamics is crucial for navigating the current Apple Stock Price Decline.

Conclusion

The pre-Q2 report decline in Apple's stock price is a multifaceted issue. While concerns regarding slowing iPhone sales growth, intensifying competition, and global economic uncertainty are valid, Apple's long-term prospects remain strong. Investors should carefully consider the upcoming Q2 report and its implications before making any investment decisions. Understanding the factors driving the Apple Stock Price Decline is crucial for navigating this period of uncertainty. Stay informed and continue analyzing the Apple Q2 Report and its impact on the Apple Stock Price Decline to make informed decisions about your portfolio.

Featured Posts

-

Huge Diamond Ring Annie Kilners Public Display After Walker Spotting

May 24, 2025

Huge Diamond Ring Annie Kilners Public Display After Walker Spotting

May 24, 2025 -

West Hams Kyle Walker Peters Bid Transfer News And Analysis

May 24, 2025

West Hams Kyle Walker Peters Bid Transfer News And Analysis

May 24, 2025 -

Lewis Hamiltons Comments Draw Sharp Criticism From Ferrari

May 24, 2025

Lewis Hamiltons Comments Draw Sharp Criticism From Ferrari

May 24, 2025 -

Boosting Bangladeshs Presence In Europe A Collaborative Approach

May 24, 2025

Boosting Bangladeshs Presence In Europe A Collaborative Approach

May 24, 2025 -

Escape To The Countryside Top Locations And Considerations

May 24, 2025

Escape To The Countryside Top Locations And Considerations

May 24, 2025

Latest Posts

-

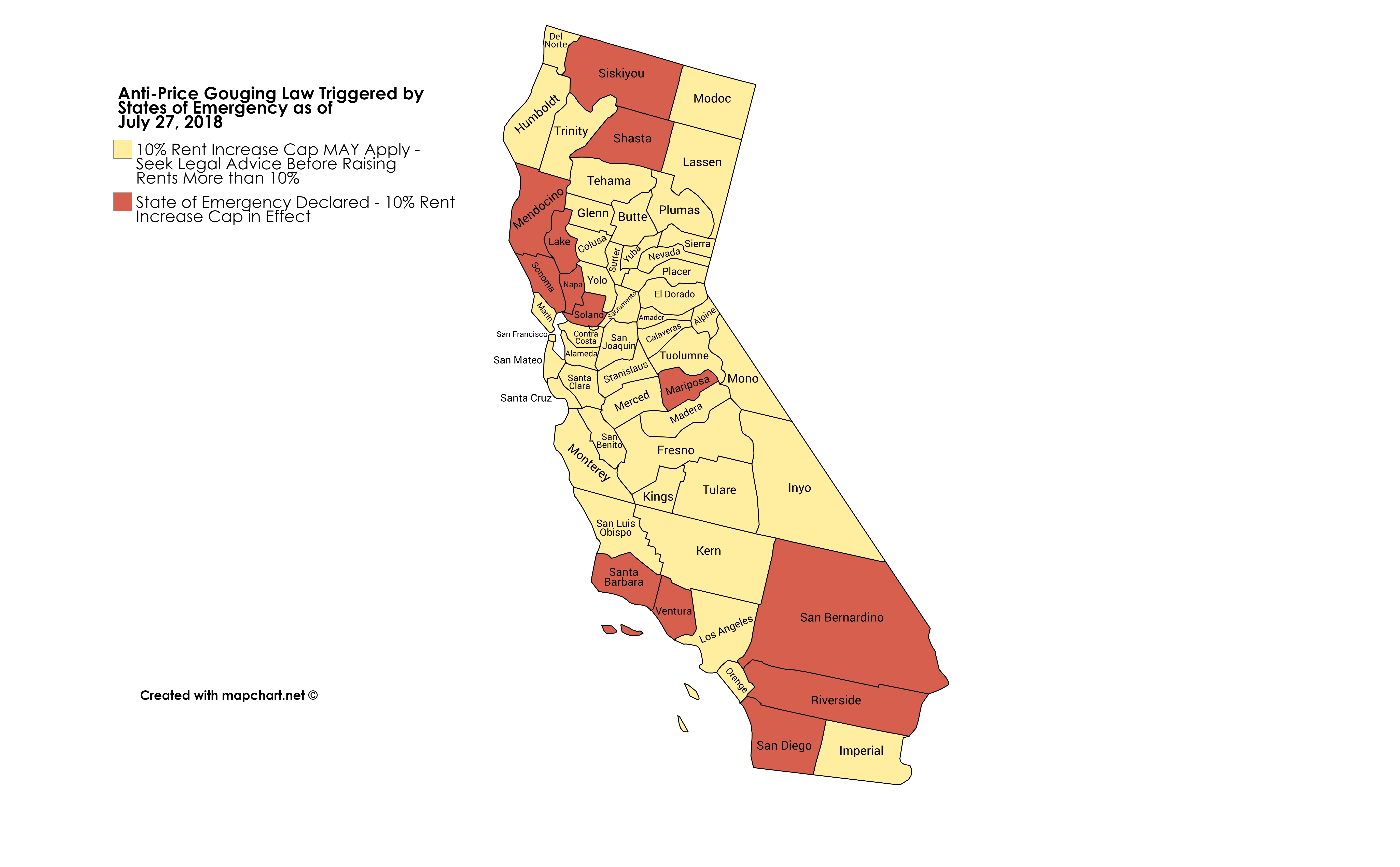

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025 -

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025 -

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025 -

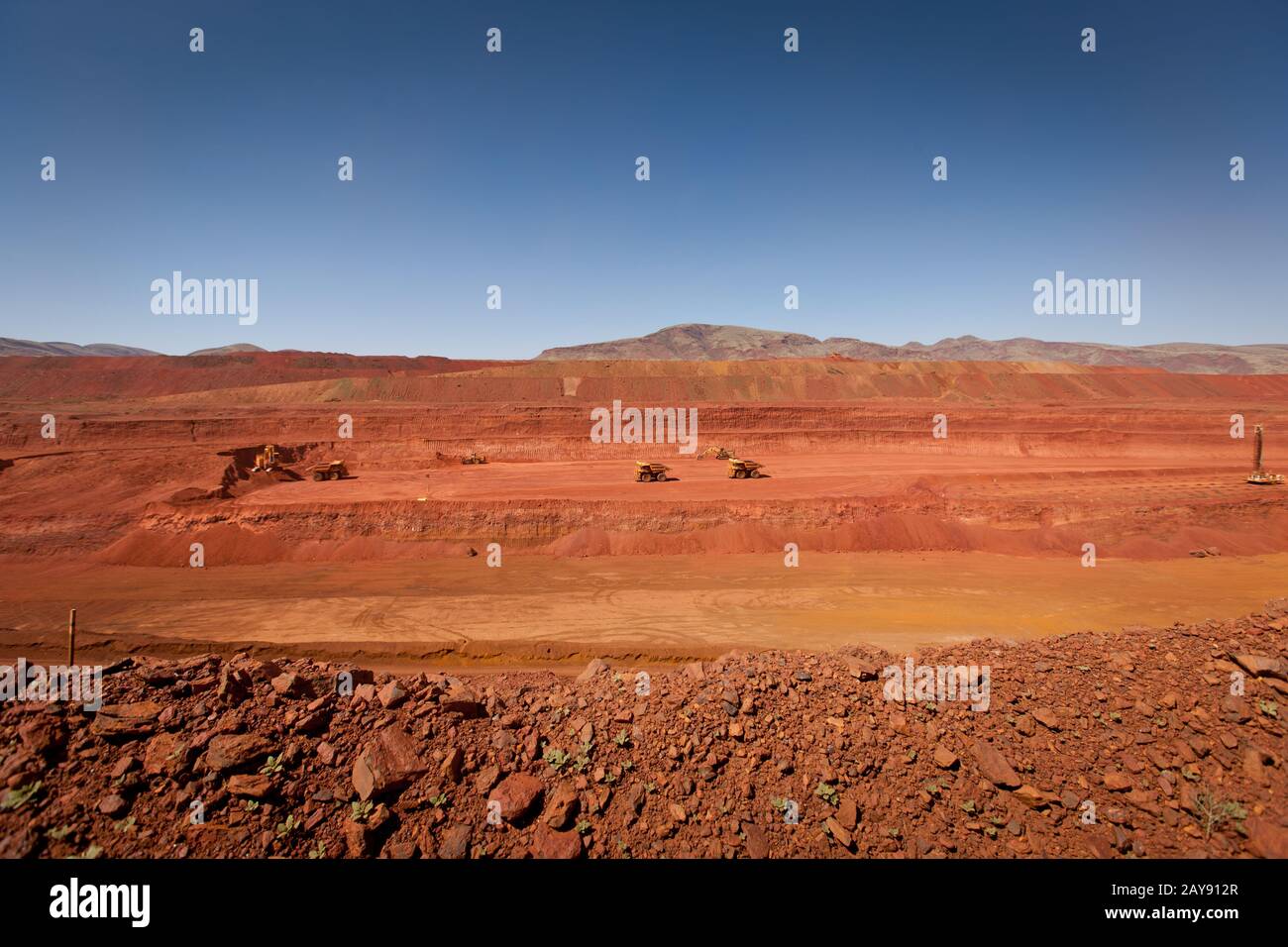

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025 -

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025