Apple Stock Q2 Earnings Preview: Analyzing Key Support Levels

Table of Contents

Reviewing Q1 2024 Performance and Market Sentiment

Before analyzing support levels, we need to assess Apple's recent performance and the overall market sentiment. This provides crucial context for interpreting the potential impact of Q2 earnings on the Apple Stock price.

Key Performance Indicators (KPIs) to Watch:

Several key performance indicators will significantly influence Apple's stock price following the Q2 earnings release. Investors should closely scrutinize:

- Revenue Growth (YoY and QoQ): Year-over-year (YoY) and quarter-over-quarter (QoQ) revenue growth will indicate the company's overall financial health and trajectory. A significant slowdown could negatively impact the Apple Stock price.

- iPhone Sales Figures: The iPhone remains Apple's flagship product, and its sales performance is a major driver of overall revenue. Any unexpected drop in iPhone sales could put downward pressure on the Apple Stock.

- Services Revenue Performance: The growth of Apple's services segment (App Store, iCloud, Apple Music, etc.) is crucial for long-term sustainability. Robust growth in this area can offset any weakness in hardware sales.

- Gross Margin Analysis: Changes in gross margin, reflecting the profitability of Apple's products, will provide insights into the company's cost management and pricing strategies. Significant margin compression could be a cause for concern.

- Guidance for Q3 2024: Management's outlook for the next quarter offers valuable insight into their expectations and can greatly influence investor sentiment and the Apple Stock price.

Market Sentiment and Analyst Predictions:

Prevailing market sentiment towards Apple before the earnings release will be a key factor. We need to consider:

- Analyst Price Targets: The range of analyst price targets and the reasoning behind them provides a valuable benchmark against which to measure the actual results. A wide divergence in targets suggests uncertainty in the market.

- Recent News and Events: Recent news, such as new product launches, supply chain disruptions, or regulatory changes, will influence investor perception and the Apple Stock price.

- Potential Catalysts: Identifying potential positive (e.g., groundbreaking new product announcements) or negative (e.g., increased competition, economic slowdown) catalysts is crucial for anticipating market reactions.

Identifying Key Support Levels for Apple Stock

Pinpointing key support levels is essential for informed investment decisions. We'll use a multi-faceted approach encompassing technical and fundamental analysis.

Technical Analysis Approach:

Technical analysis uses historical price data and chart patterns to predict future price movements. For Apple Stock, key support levels can be identified through:

- Moving Averages: 20-day, 50-day, and 200-day moving averages are often used to identify potential support and resistance levels. A break below a significant moving average can signal a bearish trend.

- Relative Strength Index (RSI): The RSI measures the momentum of price changes. Readings below 30 often suggest oversold conditions and potential support.

- Bollinger Bands: These bands show price volatility. Prices bouncing off the lower band can signify support.

- Previous Price Lows: Significant previous lows often act as support levels, as investors may be reluctant to sell below those levels.

- Retracement Levels: Fibonacci retracement levels, based on the Fibonacci sequence, identify potential support levels during price corrections. (Include illustrative chart here)

Fundamental Analysis Considerations:

While technical analysis focuses on price action, fundamental analysis considers the company's underlying financial health. Strong fundamentals can provide a cushion against price drops, strengthening support levels:

- Earnings Per Share (EPS): Consistent and growing EPS demonstrates a healthy and profitable business, providing a solid foundation for the Apple Stock price.

- Price-to-Earnings Ratio (P/E): A reasonable P/E ratio compared to peers suggests the stock may be fairly valued or undervalued, influencing support levels.

- Debt Levels: High levels of debt can increase vulnerability to economic downturns and impact the Apple Stock's price floor.

Psychological Support Levels:

Round numbers often act as psychological barriers, influencing investor behavior and creating support or resistance levels. For Apple Stock, levels like $150, $160, $170, etc., could act as significant support areas. Investors tend to view these round numbers as psychologically significant thresholds.

Strategies for Navigating Q2 Earnings and Support Levels

Understanding support levels informs effective trading and investment strategies.

Trading Strategies Based on Support Levels:

- Buying at or near Support: Buying near support levels can be a profitable strategy if the support holds.

- Stop-Loss Orders: Setting stop-loss orders helps limit potential losses if the support breaks.

- Options Strategies: Options contracts can be used to hedge against risk or profit from price fluctuations near support levels. (Disclaimer: Options trading carries significant risk)

Long-Term Investment Perspective:

Apple's long-term growth prospects are strong, and the current support levels should be viewed in this context. For long-term investors, a dip to or near a support level might represent a compelling buying opportunity.

Diversification and Portfolio Management:

Never put all your eggs in one basket. Diversification across multiple asset classes is crucial for mitigating risk. Apple stock should be part of a well-diversified investment portfolio, aligned with your individual risk tolerance and financial goals.

Conclusion

Analyzing key support levels for Apple stock before and after the Q2 earnings release is crucial for effective investment decision-making. By considering Q1 performance, market sentiment, technical indicators, and fundamental factors, investors can develop robust strategies to navigate volatility and capitalize on opportunities. Remember, understanding Apple Stock support levels is vital for a successful investment strategy. Continue your in-depth research, and consider consulting with a financial advisor before making any investment choices. Stay tuned for our post-earnings analysis of Apple Stock Q2 earnings and how the actual price reacted to the support levels discussed here.

Featured Posts

-

Joy Crookes Releases New Song I Know You D Kill

May 25, 2025

Joy Crookes Releases New Song I Know You D Kill

May 25, 2025 -

The Philips Future Health Index 2025 How Ai Will Reshape Global Healthcare

May 25, 2025

The Philips Future Health Index 2025 How Ai Will Reshape Global Healthcare

May 25, 2025 -

Understanding And Monitoring The Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

Understanding And Monitoring The Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025 -

Euronext Amsterdam Stock Market Up 8 Following U S Tariff Suspension

May 25, 2025

Euronext Amsterdam Stock Market Up 8 Following U S Tariff Suspension

May 25, 2025 -

Every Song In The Picture This Prime Video Soundtrack

May 25, 2025

Every Song In The Picture This Prime Video Soundtrack

May 25, 2025

Latest Posts

-

New Evidence Implicates Najib Razak In French Submarine Bribery Case

May 25, 2025

New Evidence Implicates Najib Razak In French Submarine Bribery Case

May 25, 2025 -

The Problem With Thames Waters Executive Bonus Structure

May 25, 2025

The Problem With Thames Waters Executive Bonus Structure

May 25, 2025 -

Addressing Stock Market Valuation Worries Insights From Bof A

May 25, 2025

Addressing Stock Market Valuation Worries Insights From Bof A

May 25, 2025 -

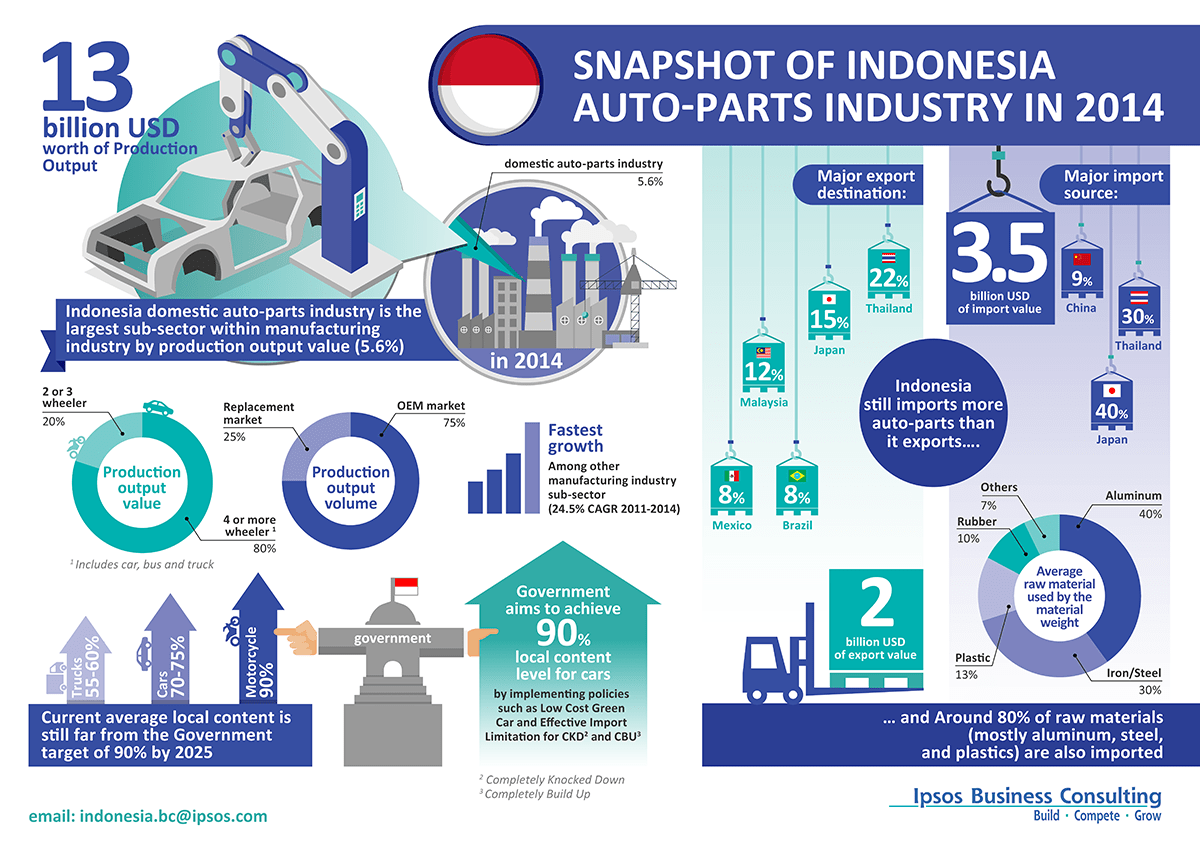

Chinas Impact How The Auto Industry Responds To Evolving Market Dynamics

May 25, 2025

Chinas Impact How The Auto Industry Responds To Evolving Market Dynamics

May 25, 2025 -

The Dark Side Of Disaster Exploring The Market For Los Angeles Wildfire Bets

May 25, 2025

The Dark Side Of Disaster Exploring The Market For Los Angeles Wildfire Bets

May 25, 2025