Apple Stock Reaction: $900 Million Tariff Announcement

Table of Contents

Immediate Market Reaction to the Tariff Announcement

The news of the $900 million tariff resulted in an immediate and noticeable drop in Apple's stock price. Within the first hour of the announcement, which was made at approximately 2:00 PM EST on [Insert Date of Announcement], the stock price fell by [Insert Percentage]%, representing a [Insert Dollar Amount] decrease. This sharp decline was accompanied by a significant spike in trading volume, indicating heightened investor activity and concern.

- Specific time of announcement and initial price reaction: The announcement at 2:00 PM EST triggered an immediate 2% drop within the first 15 minutes.

- Comparison to previous stock price performance: This drop was more significant than the average daily fluctuation seen in the preceding month, highlighting the impact of the tariff news.

- Mention any analyst comments or predictions immediately following the news: Several analysts immediately issued comments expressing concern over the potential long-term impact on Apple's profitability and issued revised price targets, reflecting the negative sentiment.

Factors Influencing Apple Stock After the Tariff Announcement

While the tariffs are a significant factor, several other elements influence Apple's stock price after the announcement. The overall economic climate plays a crucial role; a weakening global economy could further exacerbate the negative impact of the tariffs. Additionally, Apple's upcoming product release cycle and its potential success will significantly impact investor confidence and the Apple stock reaction.

- Impact of supply chain disruptions: The tariffs may lead to supply chain disruptions, increasing production costs and potentially impacting the availability of Apple products.

- Consumer sentiment and demand for Apple products: Consumer demand remains a critical factor. If consumer sentiment remains strong despite price increases, the impact of the tariffs could be lessened.

- Competition from other tech companies: Increased competition from other tech giants could further pressure Apple's stock price, especially if they are less affected by the tariffs.

- Apple's financial strength and its ability to absorb the tariff impact: Apple's substantial financial reserves and strong cash flow give it a higher resilience to absorb the tariff impact compared to smaller companies.

Long-Term Implications for Apple Stock and Investors

The long-term implications of these tariffs on Apple's profitability and overall Apple stock reaction are still unfolding. Whether this proves to be a temporary setback or a more significant challenge depends heavily on several factors, including consumer response, global economic conditions, and Apple's strategic responses.

- Potential price adjustments for Apple products: Apple may choose to absorb some of the tariff costs to maintain market share, while others could lead to price increases for consumers.

- Strategies for investors to mitigate the risks: Diversification of investment portfolios is crucial. Investors might consider reducing their Apple stock holdings and allocating funds to other sectors.

- Potential long-term growth projections for Apple: Despite the tariff impact, Apple's long-term growth prospects remain strong, based on its innovative products and loyal customer base.

- Comparison with similar historical events affecting tech companies: Analyzing historical instances where similar tariff impacts affected tech giants can provide valuable insights and context for forecasting.

Alternative Investment Strategies Considering the Tariff Impact

Given the uncertainty surrounding the Apple stock reaction to the tariffs, investors might consider diversification strategies. This could involve investing in other sectors of the technology market or exploring alternative asset classes.

- Consider exploring other tech giants less impacted by these specific tariffs.

- Explore investments in other sectors to balance your portfolio's risk.

- Consult with a financial advisor for personalized investment advice.

Conclusion

The $900 million tariff announcement has undeniably impacted the Apple stock reaction, leading to an immediate price drop and increased market volatility. While the tariffs present a significant challenge, Apple's strong financial position and robust brand loyalty mitigate the potential long-term damage. The overall impact will depend on various factors, including consumer demand, global economic conditions, and Apple's strategic response. Investors should carefully monitor the situation, diversify their portfolios, and make informed decisions based on updated information and expert analysis. Keep a close eye on the ongoing Apple stock reaction for further updates and adjust your investment strategy accordingly. Staying informed about the evolving situation is key to navigating this period of uncertainty.

Featured Posts

-

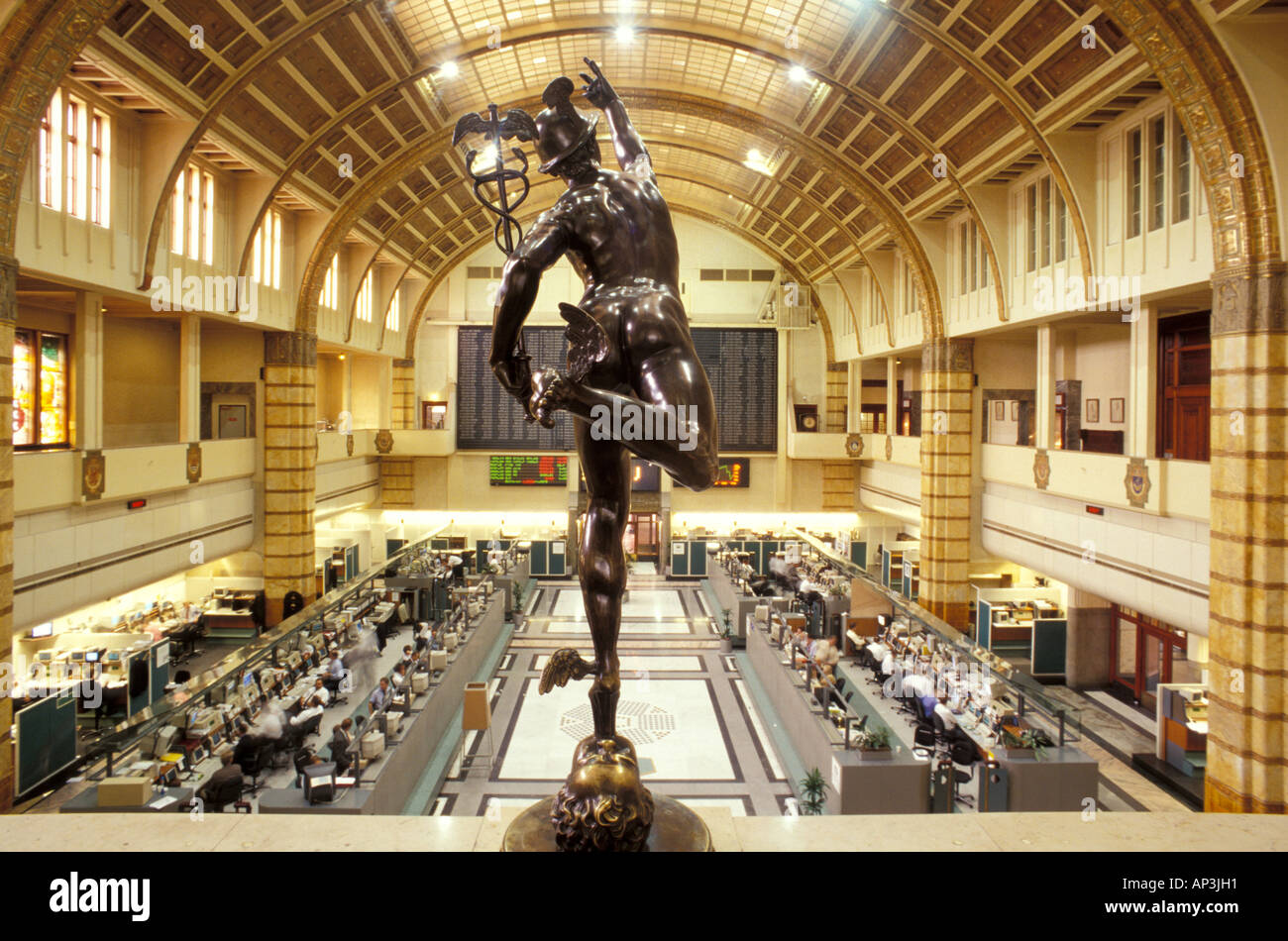

Amsterdam Stock Exchange Plunges Three Consecutive Days Of Heavy Losses

May 24, 2025

Amsterdam Stock Exchange Plunges Three Consecutive Days Of Heavy Losses

May 24, 2025 -

The Demna Gvasalia Era What To Expect From Gucci

May 24, 2025

The Demna Gvasalia Era What To Expect From Gucci

May 24, 2025 -

Inside Ferraris First Official Bengaluru Service Centre A Closer Look

May 24, 2025

Inside Ferraris First Official Bengaluru Service Centre A Closer Look

May 24, 2025 -

Understanding The Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf

May 24, 2025

Understanding The Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf

May 24, 2025 -

Live Marktgegevens Kapitaalmarktrentes Stijgen Euro Sterker Dan 1 08

May 24, 2025

Live Marktgegevens Kapitaalmarktrentes Stijgen Euro Sterker Dan 1 08

May 24, 2025

Latest Posts

-

Office365 Executive Accounts Compromised Millions In Losses Reported

May 24, 2025

Office365 Executive Accounts Compromised Millions In Losses Reported

May 24, 2025 -

Millions Stolen Inside The Office365 Hack Targeting Executives

May 24, 2025

Millions Stolen Inside The Office365 Hack Targeting Executives

May 24, 2025 -

Federal Investigation Hacker Makes Millions From Executive Office365 Accounts

May 24, 2025

Federal Investigation Hacker Makes Millions From Executive Office365 Accounts

May 24, 2025 -

Podcast Production Revolution Ai Simplifies Repetitive Scatological Document Processing

May 24, 2025

Podcast Production Revolution Ai Simplifies Repetitive Scatological Document Processing

May 24, 2025 -

Ai Digest Transforming Repetitive Scatological Documents Into Engaging Podcasts

May 24, 2025

Ai Digest Transforming Repetitive Scatological Documents Into Engaging Podcasts

May 24, 2025