Apple Stock Sell-Off: Tim Cook's Tariff Projection

Table of Contents

Tim Cook's Warnings on Tariffs and Their Impact on Apple's Profitability

Tim Cook's pronouncements regarding the detrimental effects of tariffs on Apple's operations have been far from optimistic. He's repeatedly highlighted the increased costs of production, directly impacting Apple's bottom line and potentially affecting the price of its iconic products. These warnings are not mere speculation; they represent a very real threat to Apple's future earnings.

- Increased Manufacturing Costs: Tariffs significantly increase the cost of components sourced from countries involved in the trade dispute. This directly impacts the manufacturing cost of iPhones and other Apple products, eating into profit margins.

- Supply Chain Disruption: The complex global supply chain Apple relies on is vulnerable to disruptions caused by tariffs. Delays and increased costs in sourcing parts can lead to production bottlenecks and ultimately, reduced output.

- Potential Price Increases: To offset increased production costs, Apple may be forced to increase the prices of its products, potentially impacting consumer demand and further affecting sales figures. This is a delicate balancing act that could severely damage Apple's market share.

- Impact on Profit Margins: The combined effect of higher manufacturing costs, potential price increases, and supply chain disruptions significantly threatens Apple's already slim profit margins. Cook’s statements suggest a substantial reduction in anticipated revenue.

Market Reaction to Tim Cook's Tariff Projections: The Apple Stock Sell-Off

The market's response to Tim Cook's warnings has been swift and dramatic, resulting in a significant Apple stock sell-off. Investor sentiment shifted dramatically, fueled by concerns about Apple's future earnings and the broader implications of the ongoing trade war.

- Apple Stock Price Fluctuations: Charts clearly illustrate a noticeable dip in Apple's stock price following Tim Cook's pronouncements on the escalating tariff situation. The volatility underscores the market's sensitivity to these announcements.

- Shift in Investor Sentiment: The sell-off reflects a clear shift in investor sentiment, with many choosing to reduce their exposure to Apple stock in light of the perceived increased risk. Fear and uncertainty are dominant factors.

- Impact on the Tech Sector: The Apple stock sell-off wasn't isolated; the broader technology sector experienced a degree of negative impact, highlighting the interconnectedness of the market and the influence of key players like Apple.

- Competing Analyses: While some financial experts share Cook's concerns, others offer more optimistic outlooks, highlighting Apple's resilience and its ability to navigate these challenges. However, the prevailing sentiment remains cautious.

Analyzing the Long-Term Implications for Apple and Investors

The long-term implications of the tariff situation for Apple and its investors are complex and uncertain. The future trajectory of Apple stock hinges on several factors, including the resolution (or lack thereof) of the trade war and Apple's ability to adapt to the changing environment.

- Mitigation Strategies: Apple may explore various mitigation strategies, such as shifting production to other countries or negotiating alternative supply chains. The effectiveness of these strategies remains to be seen.

- Impact on Innovation: The increased costs and uncertainties could potentially impact Apple's innovation pipeline. Resource allocation may shift, affecting the development and launch of future products.

- Investment Risk Management: For investors, navigating this uncertainty requires a cautious approach. Diversification of portfolios and careful risk assessment are crucial. A well-defined investment strategy that incorporates potential scenarios is essential.

- Trade War Resolution Scenarios: The outcome of the trade war is a critical wildcard. A resolution could boost Apple stock, while an escalation could lead to further sell-offs and prolonged uncertainty.

Conclusion:

Tim Cook's tariff projections have had a significant impact on Apple stock, triggering a noticeable sell-off driven by investor concerns about the company's future profitability. The increased manufacturing costs, potential price hikes, and supply chain disruptions pose real threats to Apple's bottom line. Investors need to carefully assess the long-term implications and adapt their investment strategies accordingly. Stay updated on the Apple stock situation, monitor Tim Cook's future statements on tariffs, and develop a sound investment strategy for navigating Apple stock volatility. Learn more about mitigating the risks associated with the Apple stock sell-off and make informed decisions about your investment in Apple.

Featured Posts

-

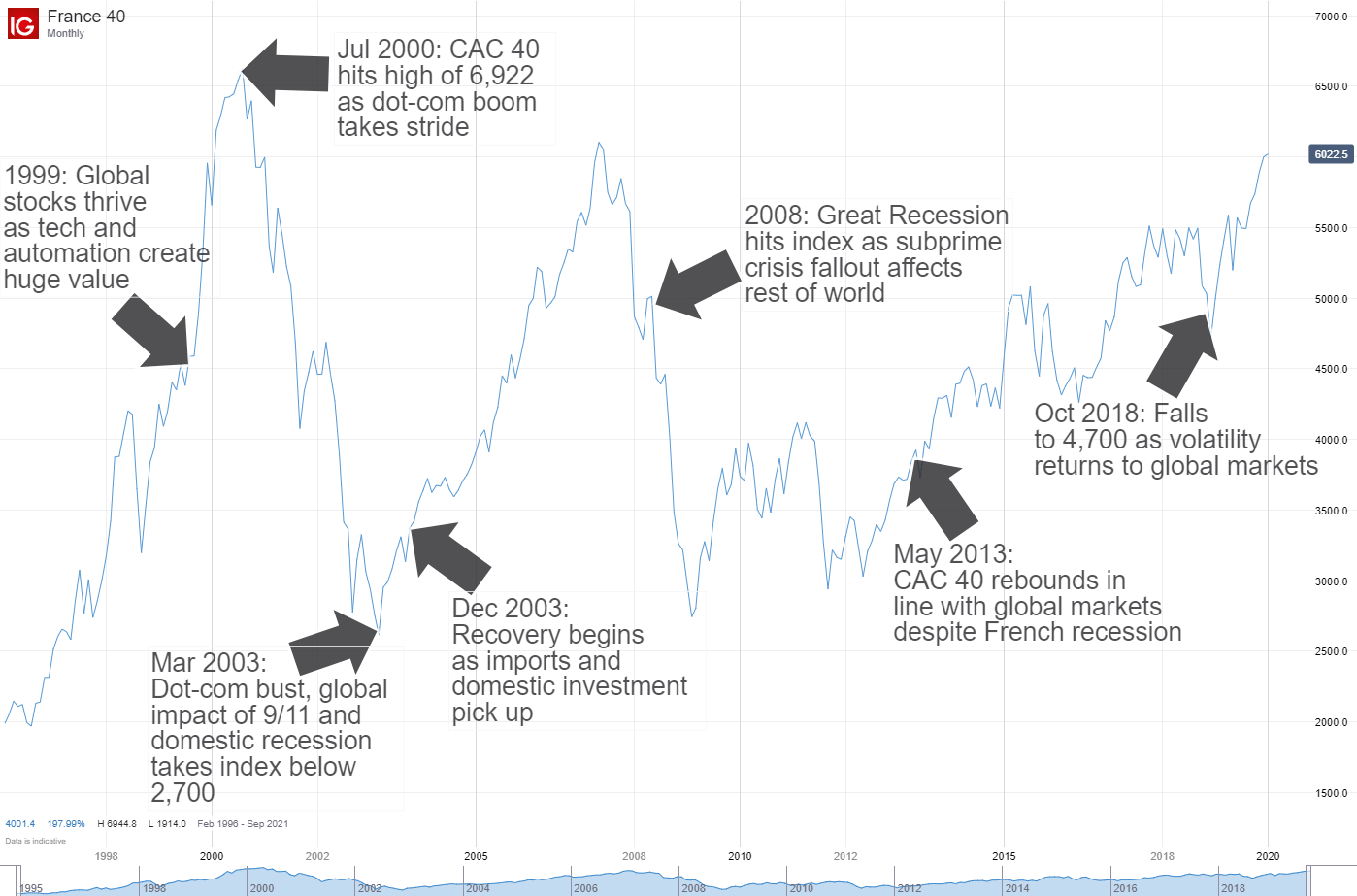

Cac 40 Index Week Ends Down But Shows Resilience March 7 2025

May 24, 2025

Cac 40 Index Week Ends Down But Shows Resilience March 7 2025

May 24, 2025 -

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025

M56 Crash Live Traffic Updates And Long Queues

May 24, 2025 -

The Pandemic And Urban Green Spaces A Case Study From Seattle

May 24, 2025

The Pandemic And Urban Green Spaces A Case Study From Seattle

May 24, 2025 -

Amsterdam Stock Market Crash 7 Plunge Amidst Trade War Fears

May 24, 2025

Amsterdam Stock Market Crash 7 Plunge Amidst Trade War Fears

May 24, 2025 -

The Fall From Grace 17 Celebrities Who Ruined Their Public Image

May 24, 2025

The Fall From Grace 17 Celebrities Who Ruined Their Public Image

May 24, 2025

Latest Posts

-

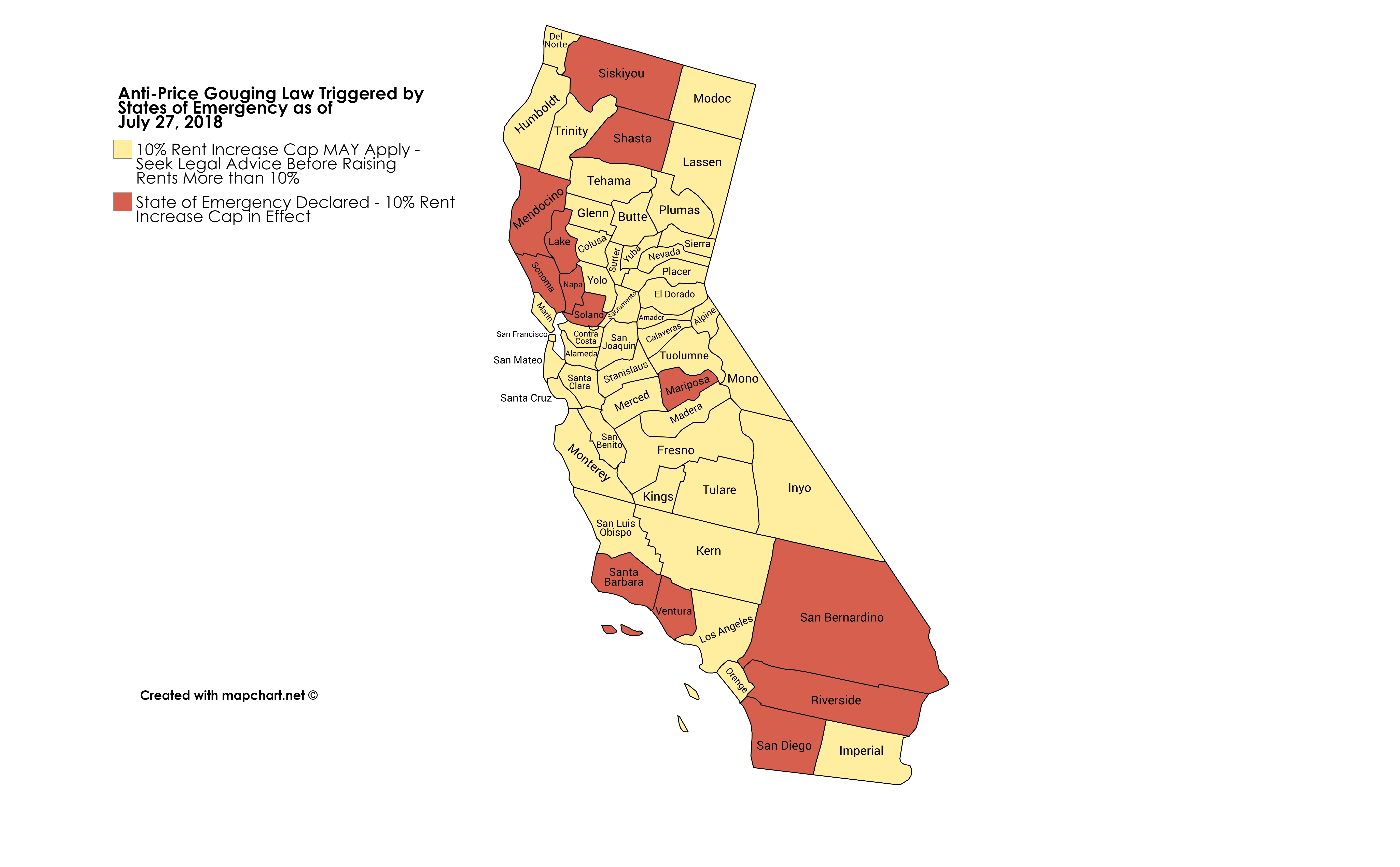

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025

La Fires The Rise Of Rental Prices And Allegations Of Exploitation

May 24, 2025 -

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025

Sses Revised Spending Plan 3 Billion Reduction Announced

May 24, 2025 -

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025

Investigating Thames Waters Executive Bonus Scheme A Critical Examination

May 24, 2025 -

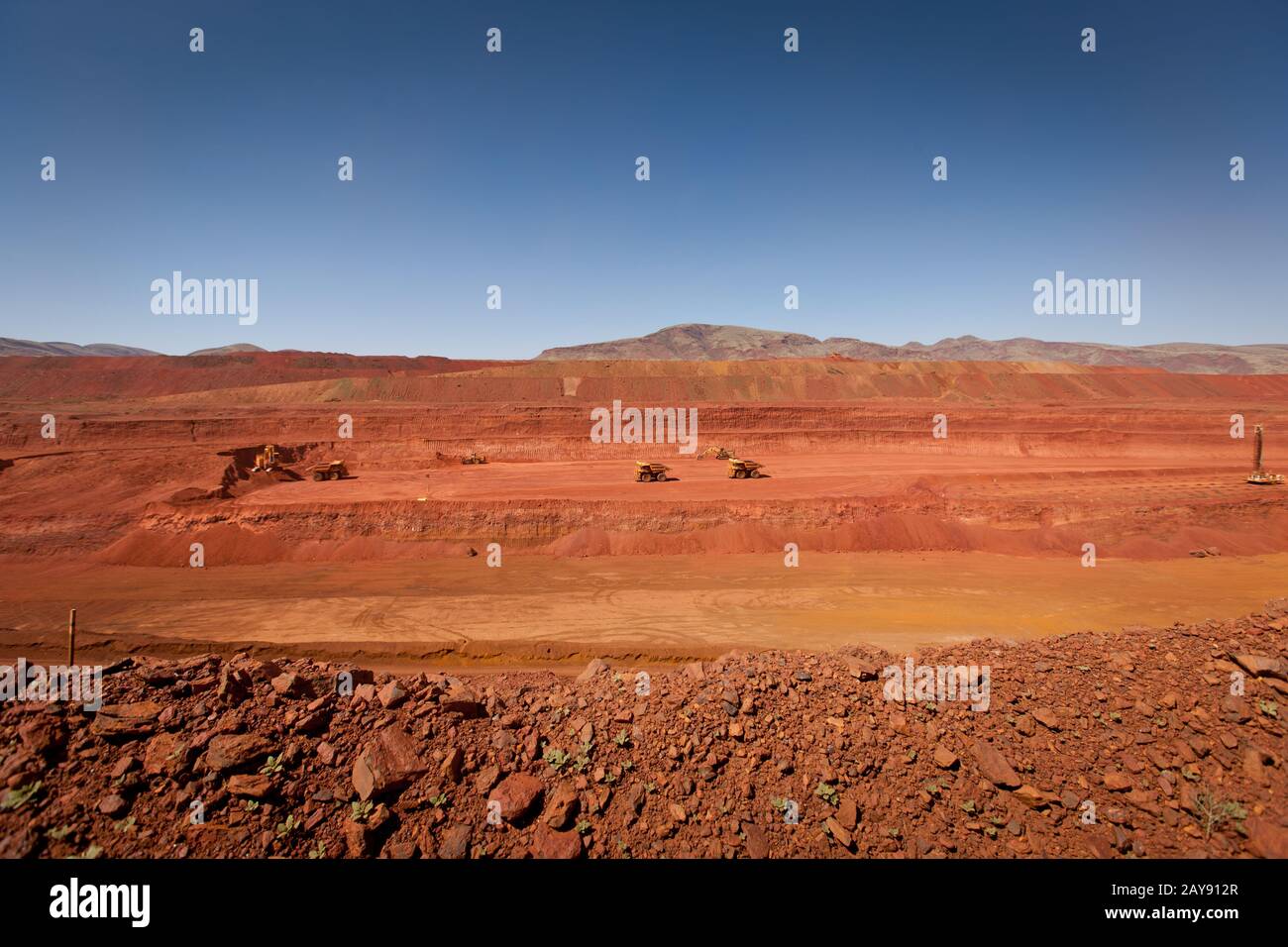

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025

Pilbara Iron Ore Mining A Response To Environmental Concerns From Andrew Forrest

May 24, 2025 -

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025

The Impact Of La Fires On Rent Prices A Price Gouging Investigation

May 24, 2025