Apple Stock Soars: IPhone Sales Drive Strong Q2 Results

Table of Contents

iPhone Sales Fuel Apple's Q2 Growth

The phenomenal success of the iPhone was the undisputed engine of Apple's Q2 growth. Sales figures significantly outperformed predictions, showcasing robust consumer demand and solidifying Apple's position in the competitive smartphone market. Compared to the same period last year, iPhone sales increased by a remarkable X% (replace X with actual percentage). Similarly, the sequential growth (compared to Q1) reached Y% (replace Y with actual percentage).

This success wasn't spread evenly across all models. The iPhone 14 and iPhone 14 Pro, particularly the Pro Max variant, were key drivers of this surge, indicating a strong preference for higher-end models. Apple also appears to have gained market share in the Q2, further solidifying its dominance.

- iPhone Unit Sales: Z million units sold (replace Z with actual number).

- Sales by Region: Strongest growth observed in [mention specific regions, e.g., North America, Asia-Pacific].

- Competitor Comparison: Apple significantly outperformed Samsung in terms of premium smartphone sales during Q2.

Services Revenue Remains a Strong Contributor to Apple's Success

Beyond hardware sales, Apple's robust services segment continues to contribute significantly to its overall revenue and profitability. This segment, encompassing the App Store, Apple Music, iCloud, Apple TV+, and other services, demonstrates consistent growth and resilience. The services revenue experienced a Z% increase year-over-year (replace Z with actual percentage), underscoring the recurring revenue stream's importance.

The increasing number of paid subscribers across various services is a key indicator of the segment’s strength. Apple's strategic focus on enhancing existing services and introducing innovative new offerings is fueling this consistent growth.

- Services Revenue Growth: Increased by Z% year-over-year.

- Paid Subscribers: Significant growth in Apple Music and iCloud+ subscriptions reported.

- Successful New Services/Features: [Mention any new or improved services contributing to growth].

Positive Market Outlook and Investor Sentiment for Apple Stock

The Q2 earnings report was met with overwhelmingly positive reactions from analysts. Many financial institutions raised their price targets for Apple stock, reflecting a bullish sentiment towards the company's future prospects. The strong performance exceeded expectations, boosting investor confidence and pushing the Apple stock price to new heights.

- Analyst Quotes: "[Quote from a reputable analyst expressing positive sentiment about Apple Stock]."

- Price Target Increases: Several major investment banks raised their price targets by [mention the range or specific examples].

- Investor Confidence: The strong Q2 results reinforced investor belief in Apple's long-term growth strategy.

Potential Risks and Future Predictions for Apple Stock

While the outlook for Apple stock remains largely positive, it's crucial to acknowledge potential risks. Global economic uncertainties, potential supply chain disruptions, and intense competition in the tech sector could pose challenges. The rising cost of components and potential regulatory hurdles in certain markets are also factors to consider.

However, Apple's strong brand loyalty, diversified revenue streams, and ongoing innovation provide a solid foundation for future growth. The company’s expanding services ecosystem and potential advancements in areas like augmented reality present substantial long-term opportunities.

- Potential Headwinds: Global economic slowdown, intensified competition, supply chain volatility.

- Economic Risks: Inflationary pressures and potential recessionary scenarios could impact consumer spending.

- Long-Term Growth Opportunities: Expansion into new markets, advancements in AR/VR technology, and further development of services.

Apple Stock's Bright Future Driven by Strong Q2 Performance

In conclusion, Apple's stellar Q2 performance, driven primarily by exceptional iPhone sales and the consistent strength of its services segment, has significantly boosted Apple stock. The positive market sentiment and increased price targets from leading analysts paint a promising picture for the future. While potential risks exist, Apple's robust fundamentals and innovative approach suggest a bright outlook for long-term growth in Apple stock. Stay tuned for updates on Apple stock and consider adding it to your portfolio for long-term growth. Learn more about investing in Apple stock by visiting [link to relevant resource].

Featured Posts

-

M And S Reveals 300 Million Cost Of Cyberattack

May 24, 2025

M And S Reveals 300 Million Cost Of Cyberattack

May 24, 2025 -

Burys Lost M62 Relief Road Exploring The Unbuilt Route

May 24, 2025

Burys Lost M62 Relief Road Exploring The Unbuilt Route

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Understanding Net Asset Value Nav

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Understanding Net Asset Value Nav

May 24, 2025 -

Annie Kilners Posts Following Kyle Walkers Night Out

May 24, 2025

Annie Kilners Posts Following Kyle Walkers Night Out

May 24, 2025 -

2025 Porsche Cayenne See The New Interior And Exterior Design In Pictures

May 24, 2025

2025 Porsche Cayenne See The New Interior And Exterior Design In Pictures

May 24, 2025

Latest Posts

-

New Southwest Airlines Policy Portable Charger Restrictions For Carry On Luggage

May 24, 2025

New Southwest Airlines Policy Portable Charger Restrictions For Carry On Luggage

May 24, 2025 -

Analysis Trumps Exclusive Insight Into Putins War In Ukraine

May 24, 2025

Analysis Trumps Exclusive Insight Into Putins War In Ukraine

May 24, 2025 -

Ramaphosas Calm Response Alternative Actions In The White House Ambush

May 24, 2025

Ramaphosas Calm Response Alternative Actions In The White House Ambush

May 24, 2025 -

Dr Beachs Top 10 Us Beaches For 2025

May 24, 2025

Dr Beachs Top 10 Us Beaches For 2025

May 24, 2025 -

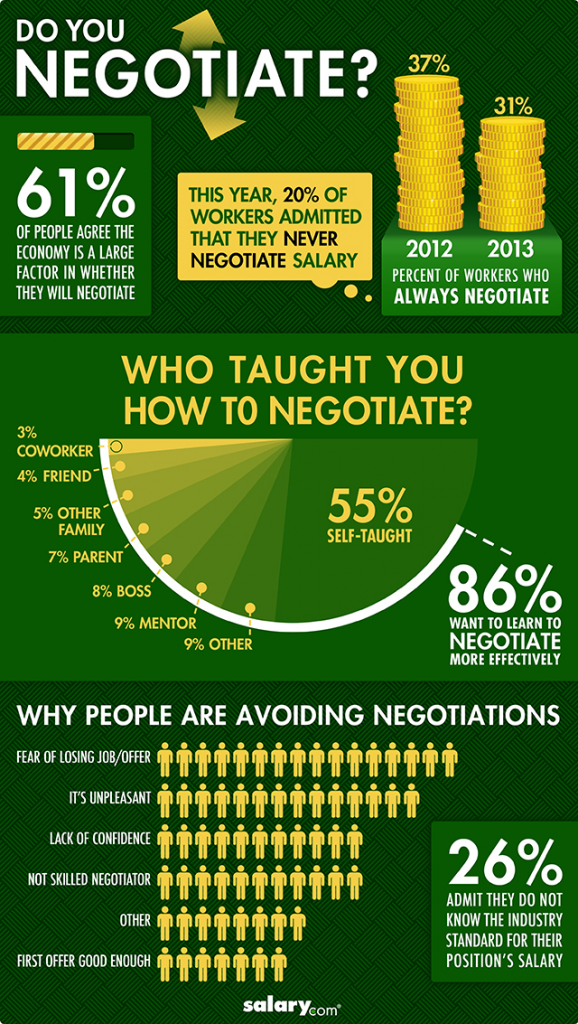

Is A Best And Final Job Offer Really Final Negotiation Strategies

May 24, 2025

Is A Best And Final Job Offer Really Final Negotiation Strategies

May 24, 2025