Apple Stock Suffers Setback: Cook Announces $900 Million Tariff Hit

Table of Contents

The $900 Million Tariff Hit: A Detailed Breakdown

The $900 million tariff represents a substantial increase in Apple's import costs, primarily stemming from tariffs imposed on goods manufactured in China. These tariffs specifically target several key Apple products, significantly impacting their production and ultimately, their price.

- iPhones: The flagship iPhone line is expected to bear a considerable portion of the tariff burden, leading to increased production costs.

- iPads: Similarly, iPad production costs are projected to rise, potentially impacting consumer prices and sales volumes.

- Macs: While perhaps less significantly affected than iPhones and iPads, Mac production also faces increased costs due to the tariffs on imported components.

- Apple Watch and AirPods: These products, while smaller revenue contributors compared to iPhones and Macs, also face increased import costs.

The percentage increase in import costs varies depending on the specific product and components, but estimates suggest a substantial rise, impacting Apple's already tight profit margins. This supply chain disruption is a major factor in the recent Apple stock price decline.

Impact on Apple's Financial Performance and Future Projections

The $900 million tariff hit will undoubtedly impact Apple's quarterly earnings, potentially leading to a decrease in profitability. Analysts predict a noticeable reduction in revenue, particularly in the coming quarters. The effect on Apple's future growth projections is also a major concern.

- Reduced Profitability: Higher production costs directly translate to lower profit margins, impacting the bottom line.

- Revised Forecasts: Apple may need to revise its earnings forecasts, potentially leading to further negative market reactions.

- Investor Sentiment: Negative investor sentiment following the tariff announcement is a primary driver of the recent Apple stock price decline.

The stock market reacted swiftly to the news, with a noticeable dip in Apple's stock price immediately following the announcement, reflecting the gravity of the situation for investors.

Tim Cook's Response and Apple's Strategic Mitigation Plans

In response to the tariff situation, Tim Cook acknowledged the significant challenges posed by the increased import costs. Apple is actively exploring several mitigation strategies to offset the negative impacts.

- Price Adjustments: While not explicitly stated, Apple may adjust pricing on some products to absorb some of the increased costs, although this carries the risk of impacting consumer demand.

- Supply Chain Diversification: Apple is likely accelerating its efforts to diversify its manufacturing base, potentially shifting some production away from China. This is a long-term strategy and will not provide immediate relief.

- Lobbying Efforts: Apple is likely engaging in lobbying efforts to influence trade policies and potentially lessen the impact of future tariffs.

The effectiveness of these mitigation strategies remains to be seen, and the ongoing trade war adds a layer of uncertainty to Apple's future planning.

Broader Market Implications and the Ongoing Trade War

The impact of the tariffs extends beyond Apple, affecting the entire tech industry. The ongoing US-China trade war creates significant uncertainty for businesses reliant on global supply chains. Other tech companies face similar challenges, highlighting the widespread impact of this trade conflict. Further escalation of the trade war could significantly exacerbate these problems, creating even greater economic uncertainty and impacting market volatility across the board.

Navigating the Apple Stock Setback and Future Outlook

The $900 million tariff hit represents a significant setback for Apple, impacting its financial performance and stock price. While Apple is actively implementing mitigation strategies, the ongoing trade war introduces considerable uncertainty. The future outlook for Apple stock remains somewhat clouded, dependent on the resolution of trade tensions and the effectiveness of Apple's strategic responses. To stay informed about further developments in Apple Stock and the broader implications of the ongoing trade disputes, continue to follow reputable financial news sources and conduct your own in-depth Apple stock analysis. Further reading on global trade and investment strategies can also provide valuable insights during this period of economic uncertainty. Understanding the complexities of global trade is crucial for navigating the challenges facing Apple Stock and similar investments.

Featured Posts

-

A Look At Nicki Chapmans Country Escape Her Chiswick Garden

May 24, 2025

A Look At Nicki Chapmans Country Escape Her Chiswick Garden

May 24, 2025 -

Is Sean Penn Me Too Blind His Defense Of Woody Allen Sparks Debate

May 24, 2025

Is Sean Penn Me Too Blind His Defense Of Woody Allen Sparks Debate

May 24, 2025 -

Amsterdam Exchange Down 2 Following Latest Trump Tariff Announcement

May 24, 2025

Amsterdam Exchange Down 2 Following Latest Trump Tariff Announcement

May 24, 2025 -

White House Cocaine Investigation The Secret Services Findings

May 24, 2025

White House Cocaine Investigation The Secret Services Findings

May 24, 2025 -

Escape To The Country Top Locations For A Countryside Getaway

May 24, 2025

Escape To The Country Top Locations For A Countryside Getaway

May 24, 2025

Latest Posts

-

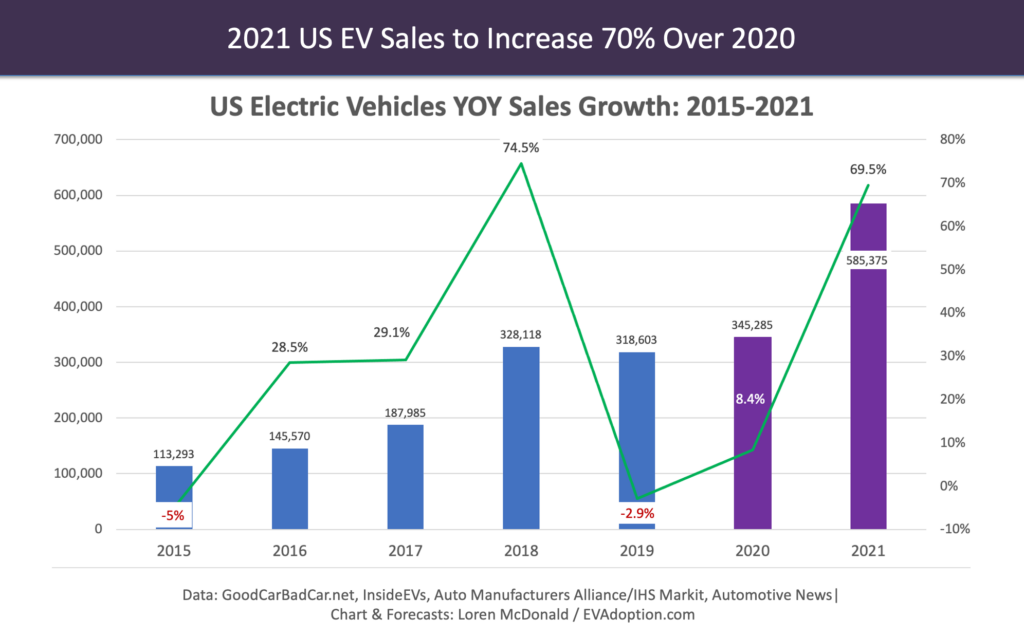

Ev Mandate Opposition Intensifies Car Dealers Renew Their Fight

May 24, 2025

Ev Mandate Opposition Intensifies Car Dealers Renew Their Fight

May 24, 2025 -

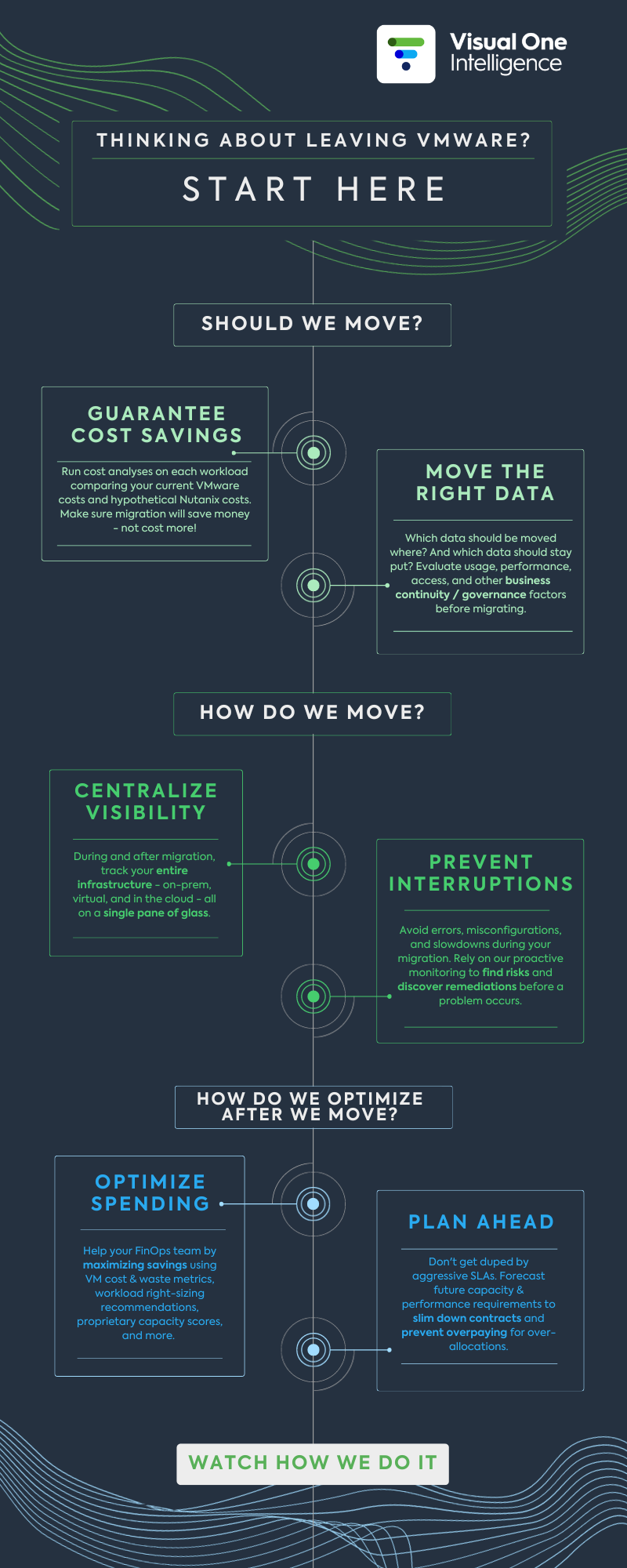

1 050 V Mware Price Increase At And Ts Outcry Against Broadcoms Acquisition

May 24, 2025

1 050 V Mware Price Increase At And Ts Outcry Against Broadcoms Acquisition

May 24, 2025 -

Investigation Reveals Prolonged Presence Of Toxic Chemicals Post Ohio Derailment

May 24, 2025

Investigation Reveals Prolonged Presence Of Toxic Chemicals Post Ohio Derailment

May 24, 2025 -

Resistance Grows Car Dealerships Renew Opposition To Ev Sales Mandates

May 24, 2025

Resistance Grows Car Dealerships Renew Opposition To Ev Sales Mandates

May 24, 2025 -

Ohio Train Disaster The Lingering Threat Of Toxic Chemicals In Buildings

May 24, 2025

Ohio Train Disaster The Lingering Threat Of Toxic Chemicals In Buildings

May 24, 2025